This three-part post was inspired by Ugo Bardi’s recent post concerning “Will Renewables Ever ReplaceFossils?” and recent discussions within Ugo’s discussion group on how is it that “Economists still don’t get it”? It integrates also numerous discussion and exchanges I have had with colleagues and business partners over the last three years.

Introduction

Since at least the end of 2014 there has been increasing confusions about oil prices, whether so-called “Peal Oil” has already happened, or will happen in the future and when, matters of EROI (or EROEI) values for current energy sources and for alternatives, climate change and the phantasmatic 2oC warming limit, and concerning the feasibility of shifting rapidly to renewables or sustainable sources of energy supply. Overall, it matters a great deal whether a reasonable time horizon to act is say 50 years, i.e. in the main the troubles that we are contemplating are taking place way past 2050, or if we are already in deep trouble and the timeframe to try and extricate ourselves is some 10 years. Answering this kind of question requires paying close attention to system boundary definitions and scrutinising all matters taken for granted.

It took over 50 years for climatologists to be heard and for politicians to reach the Paris Agreement re climate change (CC) at the close of the COP21, late last year. As you no doubt can gather from the title, I am of the view that we do not have 50 years to agonise about oil. In the three sections of this post I will first briefly take stock of where we are oil wise; I will then consider how this situation calls upon us to do our utter best to extricate ourselves from the current prevailing confusion and think straight about our predicament; and in the third part I will offer a few considerations concerning the near term, the next ten years – how to approach it, what cannot work and what may work, and the urgency to act, without delay.

Part 1 – Alice looking down the end of the barrel

In his recent post, Ugo contrasted the views of the Doomstead Diner‘s readers with that of energy experts regarding the feasibility of replacing fossil fuels within a reasonable timeframe. In my view, the Doomstead’s guests had a much better sense of the situation than the “experts” in Ugo’s survey. To be blunt, along current prevailing lines we are not going to make it. I am not just referring here to “business-as-usual” (BAU) parties holding for dear life onto fossil fuels and nukes. I also include all current efforts at implementing alternatives and combating CC. Here is why.

The energy cost of system replacement

What a great number of energy technology specialists miss are the challenges of whole system replacement – moving from fossil-based to 100% sustainable over a given period of time. Of course, the prior question concerns the necessity or otherwise of whole system replacement. For those of us who have already concluded that this is an urgent necessity, if only due to CC, no need to discuss this matter here. For those who maybe are not yet clear on this point, hopefully, the matter will become a lot clearer a few paragraphs down.

So coming back for now to whole system replacement, the first challenge most remain blind to is the huge energy cost of whole system replacement in terms of both the 1st principle of thermodynamics (i.e. how much net energy is required to develop and deploy a whole alternative system, while the old one has to be kept going and be progressively replaced) and also concerning the 2nd principle (i.e. the waste heat involved in the whole system substitution process). The implied issues are to figure out first how much total fossil primary energy is required by such a shift, in addition to what is required for ongoing BAU business and until such a time when any sustainable alternative has managed to become self-sustaining, and second to ascertain where this additional fossil energy may come from.

The end of the Oil Age is now

If we had a whole century ahead of us to transition, it would be comparatively easy. Unfortunately, we no longer have that leisure since the second key challenge is the remaining timeframe for whole system replacement. What most people miss is that the rapid end of the Oil Age began in 2012 and will be over within some 10 years. To the best of my knowledge, the most advanced material in this matter is the thermodynamic analysis of the oil industry taken as a whole system (OI) produced by The Hill’s Group (THG) over the last two years or so (http://www.thehillsgroup.org).

THG are seasoned US oil industry engineers led by B.W. Hill. I find its analysis elegant and rock hard. For example, one of its outputs concerns oil prices. Over a 56 year time period, its correlation factor with historical data is 0.995. In consequence, they began to warn in 2013 about the oil price crash that began late 2014 (see:http://www.thehillsgroup.org/depletion2_022.htm). In what follows I rely on THG’s report and my own work.

Three figures summarise the situation we are in rather well, in my view.

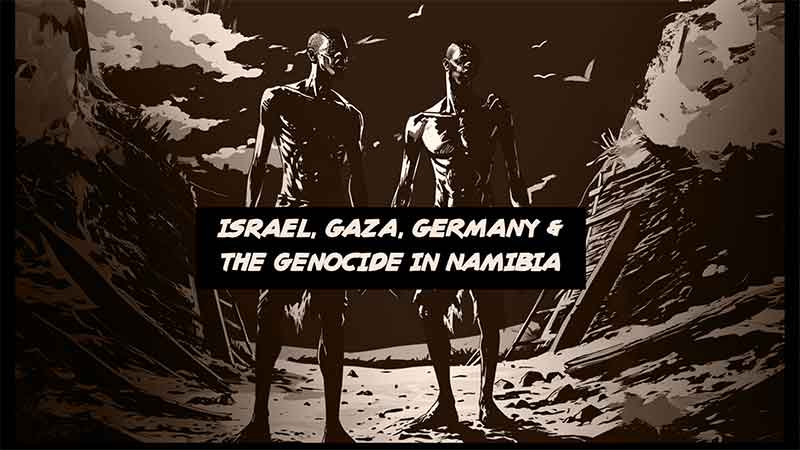

Figure 1 – End Game

For purely thermodynamic reasons net energy delivered to the globalised industrial world (GIW) per barrel by the oil industry (OI) is rapidly trending to zero. By net energy we mean here what the OI delivers to the GIW, essentially in the form of transport fuels, after the energy used by the OI for exploration, production, transport, refining and end products delivery have been deducted.

However, things break down well before reaching “ground zero”; i.e. within 10 years the OI as we know it will have disintegrated. Actually, a number of analysts from entities like Deloitte or Chatham House, reading financial tealeaves, are progressively reaching the same kind of conclusions.[1]

The Oil Age is finishing now, not in a slow, smooth, long slide down from “Peak Oil”, but in a rapid fizzling out of net energy. This is now combining with things like climate change and the global debt issues to generate what I call a“Perfect Storm” big enough to bring the GIW to its knees.

In an Alice world

At present, under the prevailing paradigm, there is no known way to exit from the Perfect Storm within the emerging time constraint (available time has shrunk by one order of magnitude, from 100 to 10 years). This is where I think thatDoomstead Diner’s readers are guessing right. Many readers are no doubt familiar with the so-called “Red Queen”effect illustrated in Figure 2 – to have to run fast to stay put, and even faster to be able to move forward. The OI is fully caught in it.

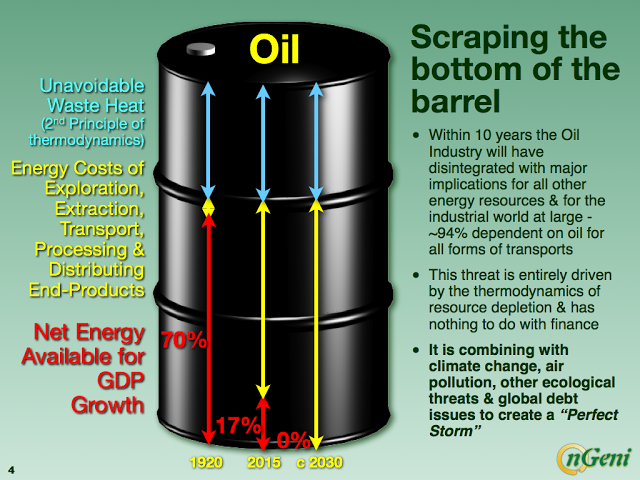

Figure 2 – Stuck on a one track to nowhere

The top part of Figure 2 highlights that, due to declining net energy per barrel, the OI has to keep running faster and faster (i.e. pumping oil) to keep supplying the GIW with the net energy it requires. What most people miss is that due to that same rapid decline of net energy/barrel towards nil, the OI can’t keep “running” for much more than a few years – e.g. B.W. Hill considers that within 10 years the number of petrol stations in the US will have shrunk by 75%…

What people also neglect, depicted in the bottom part of Figure 2, is what I call the inverse Red Queen effect (1/RQ). Building an alternative whole system takes energy that to a large extent initially has to come from the present fossil-fuelled system. If the shift takes place too rapidly, the net energy drain literally kills the existing BAU system.[2] The shorter the transition time the harder is the 1/RQ.

I estimate the limit growth rate for the alternative whole system at 7% growth per year.

In other words, current growth rates for solar and wind, well above 20% and in some cases over 60%, are not viable globally. However, the kind of growth rates, in the order of 35%, that are required for a very short transition under thePerfect Storm time frame are even less viable – if “we” stick to the prevailing paradigm, that is. As the last part ofFigure 2 suggests, there is a way out by focusing on current huge energy waste, but presently this is the road not taken.

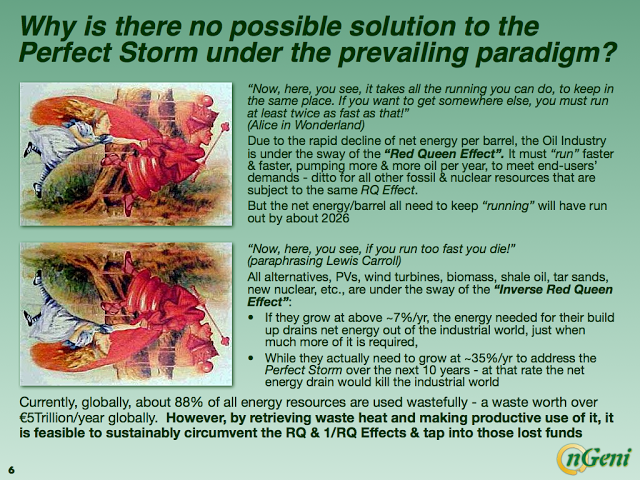

On the way to Olduvai

In my view, given that nearly everything within the GIW requires transport and that said transport is still about 94% dependent on oil-derived fuels, the rapid fizzling out of net energy from oil must be considered as the defining event of the 21st century – it governs the operation of all other energy sources, as well as that of the entire GIW. In this respect, the critical parameter to consider is not that absolute amount of oil mined (as even “peakoilers” do), such as Million barrels produced per year, but net energy from oil per head of global population, since when this gets too close to nil we must expect complete social breakdown, globally.

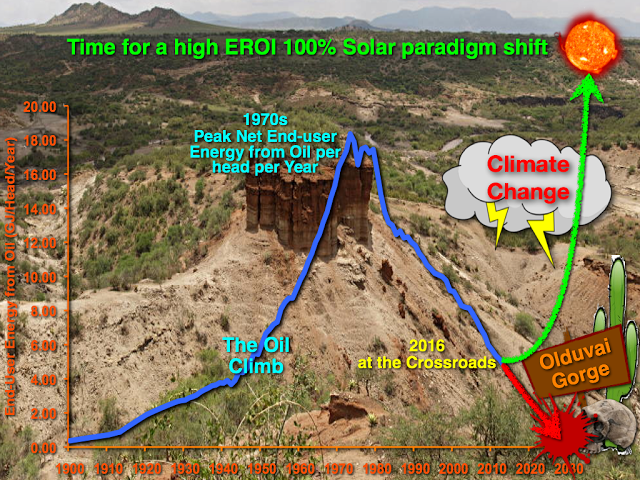

The overall picture, as depicted ion Figure 3, is that of the “Mother of all Senecas” (to use Ugo’s expression). It presents net energy from oil per head of global population.[3] The Olduvai Gorge as a backdrop is a wink to Dr. Richard Duncan’s scenario (he used barrels of oil equivalent which was a mistake) and to stress the dire consequences if we do reach the “bottom of the Gorge” – a kind of “postmodern hunter-gatherer” fate.

Oil has been in use for thousands of year, in limited fashion at locations where it seeped naturally or where small well could be dug out by hand. Oil sands began to be mined industrially in 1745 at Merkwiller-Pechelbronn in north east France (the birthplace of Schlumberger). From such very modest beginnings to a peak in the early 1970s, the climb took over 220 years. The fall back to nil will have taken about 50 years.

The amazing economic growth in the three post WWII decades was actually fuelled by a 321% growth in net energy/head. The peak of 18GJ/head in around 1973, was actually in the order of some 40GJ/head for those who actually has access to oil at the time, i.e. the industrialised fraction of the global population.

Figure 3 – The “Mother of all Senecas”

In 2012 the OI began to use more energy per barrel in its own processes (from oil exploration to transport fuel deliveries at the petrol stations) than what it delivers net to the GIW. We are now down below 4GJ/head and dropping fast.

This is what is now actually driving the oil prices: since 2014, through millions of trade transactions (functioning as the“invisible hand” of the markets), the reality is progressively filtering that the GIW can only afford oil prices in proportion to the amount of GDP growth that can be generated by a rapidly shrinking net energy delivered per barrel, which is no longer much. Soon it will be nil. So oil prices are actually on a downtrend towards nil.

To cope, the OI has been cannibalising itself since 2012. This trend is accelerating but cannot continue for very long. Even mainstream analysts have begun to recognise that the OI is no longer replenishing its reserves. We have entered fire-sale times (as shown by the recent announcements by Saudi Arabia (whose main field, Ghawar, is probably over 90% depleted) to sell part of Aramco and make a rapid shift out of a near 100% dependence on oil and towards “solar”.

Given what Figure 1 to 3 depict, it should be obvious that resuming growth along BAU lines is no longer doable, that addressing CC as envisaged at the COP21 in Paris last year is not doable either, and that incurring ever more debt that can never be reimbursed is no longer a solution, not even short-term.

Time to “pull up” and this requires a paradigm change capable of avoiding both the RQ and 1/RQ constraints. After some 45 years of research, my colleagues and I think this is still doable. Short of this, no, we are not going to make it, in terms of replacing fossil resources with renewable ones within the remaining timeframe, or in terms of the GIW’s survival.

Dr Louis Arnoux is a scientist, engineer, and entrepreneur committed to the development of sustainable ways of living and doing business. His profile is available on Google+ at: https://plus.google.com/u/0/115895160299982053493/about/p/pub

Next:

Part 2 – Enquiring into the appropriateness of the question

Part 3 – Standing slightly past the edge of the cliff

[1] See for example, Stevens, Paul, 2016, International Oil Companies: The Death of the Old Business Model, Energy, Research Paper, Energy, Environment and Resources, Chatham House; England, John W., 2016, Short of capital? Risk of underinvestment in oil and gas is amplified by competing cash priorities, Deloitte Center for Energy Solutions, Deloitte LLP. The Bank of England recently commented: “The embattled crude oil and natural gas industry worldwide has slashed capital spending to a point below the minimum required levels to replace reserves — replacement of proved reserves in the past constituted about 80 percent of the industry’s spending; however, the industry has slashed its capital spending by a total of about 50 percent in 2015 and 2016. According to Deloitte’s new study {referred to above], this underinvestment will quickly deplete the future availability of reserves and production.”

[2] This effect is also referred to as “cannibalising”. See for example, J. M. Pearce, 2009, Optimising Greenhouse Gas Mitigation Strategies to Suppress Energy Cannibalism, 2nd Climate Change Technology Conference, May 12-15, Hamilton, Ontario, Canada. However, in the oil industry and more generally the mining industry, cannibalism usually refers to what companies do when there are reaching the end of exploitable reserves and cut down on maintenance, sell assets at a discount or acquires some from companies gone bankrupt, in order to try and survive a bit longer. Presently there is much asset disposal going on in the Shale Oil and Gas patches, ditto among majors, Lukoil, BP, Shell, Chevron, etc…. Between spending cuts and assets disposal amounts involved are in the $1 to $2 trillions.

[3] This graph is based on THG’s net energy data, BP oil production data and UN demographic data.

This article was first published by Cassandra’s Legacy