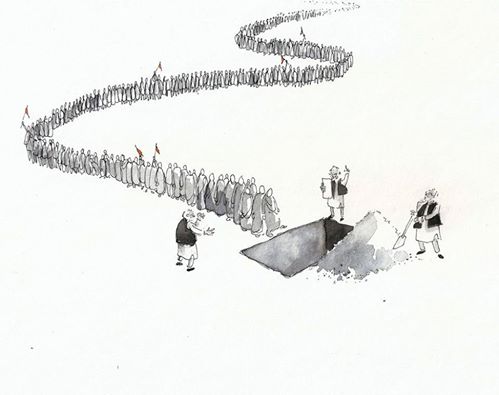

Demonestisation affected people. Things were said and written in ‘for ‘and ‘against’ of it. Prime Minister announced it, made a sensation and havoc among public and went to Japan. His picture sitting in bullet train, one of the fastest speed trains, was tweeted while his country persons were made peoples’ rail before bank’s ATMs, to experience one of the slowest move. One more fact is that till few years back, India is a country where almost 80% women are unbanked while Japan on the other hand has bank accounts of more than 90% women. In India, more than 80% women from total women employment are in unorganized workforce.

It is not that demonetization has no good in its pocket. It has virtues for sure, but the problem arose due to its sensation and unpreparedness. It also surfaced the truth of gap between metros and non metros citizens, educated and illiterate persons.

Was it a top Secret?

It is a question if the decision was a top secret. Few say that even cabinet ministers did not know about it and were not even allowed to leave hall when announcement was made by Prime Minister. It also raises suspicion that despite being an active finance ministry, decision was given by PM and not by FM. However, few news websites have been found reporting days ago from this announcement that currency note of Rs. 2000/- were about to come and that currency note of five hundred and one thousand will be demonetised and will not be legal tender. Newslinks said that it is shared by few ‘sources’ in RBI. Question comes here that if news papers knew about it and had hint about it through sources, how it can be believed that many others who may be ‘close’ to government or its sources, did not know about it.

Will it resolve fake Currency problem?

Yes, the move will definitely sideline fake currency as all such fake currency would be dead and invalid. This may be pointed as one of the key virtue of this decision but it cannot be guaranteed that replica of new currency would not come again. Initially, it was advertised (by non government sources) that new currency will have high security features, however later, Finance minister confirmed that only design has been changed and not security features. Change in security feature often equipped with higher cost in printing but may guarantee more secure services as it would be difficult to copy. No such features added in this case.

Infact, the Press notification of Finance Ministry reads about FICN (Fake Indian Currency Notes) as primary issue and this exercise of demonetization was actually focused on curbing terrorism as government believes that such funds were used in these activities. Black money elimination was secondary goal (it seems with wordings of press release).

As per study of estimation of the quantum of FICN in circulation, done by Indian Statistical Institute , Kolkata, it is said that at any point of time, fake currency of Rs. 400 crore flows in Indian market and that also mixed currency of various values. If we really see this amount in comparison to Indian economy, it is not even fraction. Also, even with simple logics, one can see that for two days working on holidays, banks paid on an average Rs. 1000/- per person to almost 10 lakhs employees all over India and this itself amounts Rs. 200 crore. Additional amounts spent on other resources utilised that will be almost equal.

Role of Pakistan, International view and practice

Leaders, specially of BJP claimed that through this move, they also attacked upon motives of Pakistan as it sends fake currency to India. A newspaper reported that how India investigated in recent years if the foreign companies who supplied papers for currency to India have also provided these papers to Pakistan. But the report of investigation team found no such evidence. Also, Pakistan itself has problems of fake currency in its country and it also developed a mobile app to let people aware about security features in its currency. Pakistan also blames ‘enemy countries’ for such circulation of fake currency and alleges that these currency have been used in anti national activities within the country. Though it cannnot be denied that Pakistan may have a role in circulation of such fake currency as many times such consignments have been raided and caught by security agencies of India.

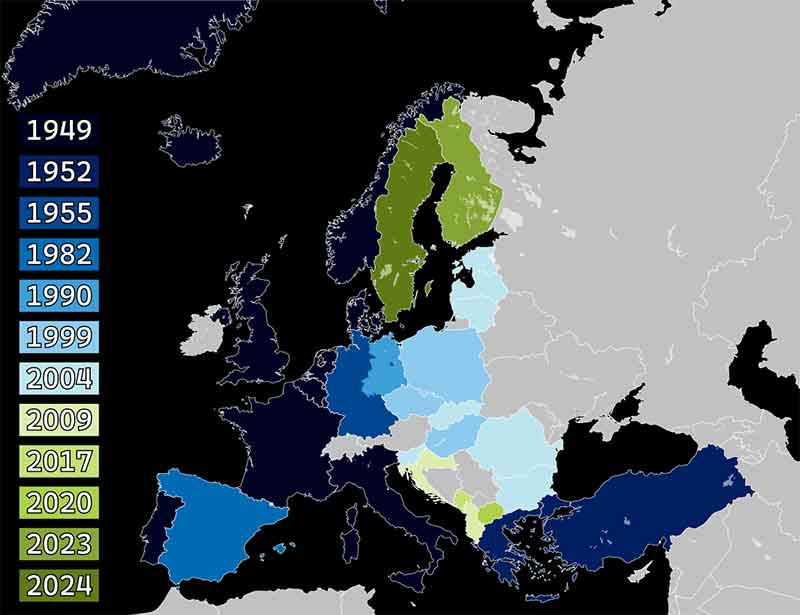

An international media viewed that this is why people of world trust more upon US dollars. USA has earlier demonetized one of its silver trade dollar, way back in 1876, but it re-monetised all currency and coins issued by US government later in 1965.

In developing countries, first time India demonetized in 1946 (under British rule) but later remonetised and then demonetized in 1978 before this year. As Indian currency has convertibility in neighboring countries, hence there is damage to trust in currency, specially in Sri Lanka, Nepal and Bhutan.

Is it biggest attack upon black money?

Data says that only 6% of black money is in cash forms. Also, it is already advertised that major amount of black money is in Swiss banks. This announcement tried to advertise itself without considering these factors. The real fact is that government, despite all its promises, has not even made public names of top black money holders who have high deposits in Swiss bank accounts. Most of the within country black money holders may be officials and politicians who already have sufficient assistance to convert their black in to white through various available mediums. There is no tracking upon gold accumulation and declaration, wealth accumulation and property investments of such persons. Many may have hidden partnerships with real estate and other booming groups.

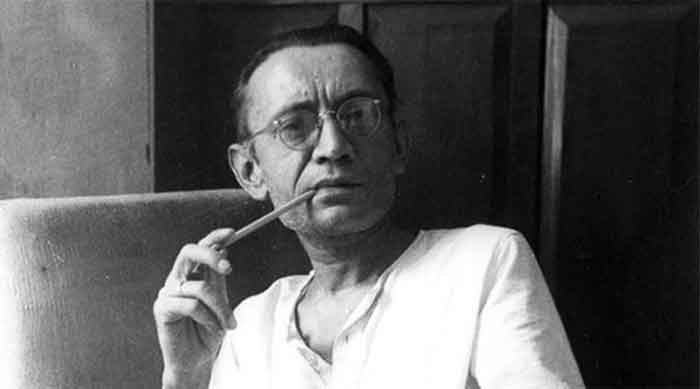

Even while talking about demonetization in 1978, former RBI governor I G patel in his book Glimpses of Indian Economic Policy stated that idea that black money is held in suitcases is naive and there will be little useful effects on reducing corruption or black economy.

Is it for the first time in History?

It is not that such actions were taken first time. History says that in Independent India, in the year 1978, such demonetization had happened. We can see that probably that too could not destroy black money much. We see R K lakshman cartoon of 1978 where he has shown a big tiger as black money with small part of its long tail under grip and written as demonetisation.

Also, social media has witnessed a viral video where in the year 2005, the then government was to take decision on change in currency notes, but BJP had opposed the move strongly on the points of inconvenience to common people and that it will not bring good fraction of black money.

Was Banking system prepared?

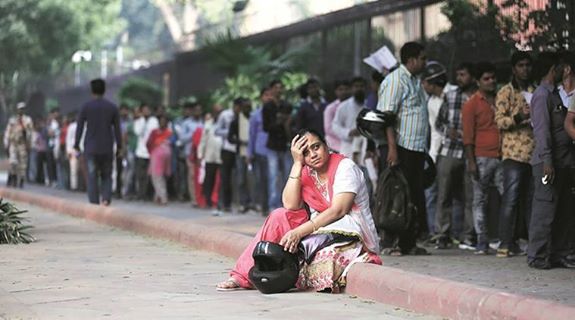

Fact is that no preparedness is visible. Banks have been compelled to open even on public holidays. ATM booths were not working properly and long queue can be seen. With the sudden announcement, even currency of Rs. 100 went on shortage in market. Reports came of conflicts, loot, lathicharge as a result of chaos. Small currency has been made black through its sale on higher value.

One of the most astonishing fact is that even ATM machines do not have required slot for providing Rs. 2000/- note and slots are being arranged to make ATMs compatible for new currency. Note share of small currency in market is very low. Only hundred rupee currency can be withdrawn from ATMs and due to long queue, frequent loading would be required and that also within the available limits.

As per census 2011, number of households having access to banking 58.7% . Presently, Jan Dhan Yojna advertised that now India has 210 million bank accounts (that is almost equal to number of households in India) but it is also doubted that many of these accounts have duplicacy as many persons have multiple bank accounts and therefore still there is good percentage of people who do not have bank accounts.

For monitoring of accounts that had more than Rs. 2.5 lakhs per day deposit, government has not sent any detailed instructions to banks. It is very much possible that banks are monitoring just savings bank accounts while huge deposit may be done in even loan accounts that have no eye upon.

Who is facing what?

People who are salaried and living in metros often get their salaries credited in their bank accounts and use e-transfers, credit cards and e-wallets. Most of them even regularly avail facility of e-wallet payments for daily items like buying milk, curd, ice creams, movie tickets, food etc. Second requirement to spend money comes for transportation where either they get filled fuel tanks through card swap or they avail e-cab services. Such a lifestyle makes them immune to any such announcement as they themselves have not been made bound to face crisis. They stand apart, outside the periphery of common person. Former Dy Governor of RBI Mr. K C Chakrabarty said in 2012 only 13% population had debit cards and 2% credit cards. This figure would have been increased now, but not far.

On the other hand, as most of them are those who talk politics without having even knowledge of it and who decide nation’s fate without actually participating in its building, and therefore, they sometimes praise such actions without any feeling of sufferings of others. Non metro persons do not have much facilities of such kind and they are facing sufferings. Reports shows how even deaths happened due to denial by hospitals for the reason of not having valid currency with patient. People even saying that they are buying milk for two times instead of three times for their kids due to the problems of currency. We must care that Over half of India’s total employed are working poor as per International Poverty Line and majority of Indians still live in rural India with high illiteracy, less digitalization and average banking reach (if not low).

We hope this decision of government even if would not be much fruitful for people or even economy, may be useful one as a learning experience for future governments. If it brings some good, it would be weighed with sufferings it provided. Till now, the only suffering surfaced is of people, who are in queue even in night of November.

Ravi Nitesh is freelance writer and activist

Twitter: /ravinitesh, Email: [email protected]

Views expressed are personal