For the life of me I cannot understand the reasoning behind demonetisation. I think the hidden underlying motivation is as that the only people India’s politicians are willing to attack are the poorest. Hindutva fascism is the system of turning the 90% into miserable wrecks through #demonetisation in order that the 1% super rich and the 9% who use their services and are employed by them, may continue their upper caste ways and persecute religious minorities who are poor and vulnerable.

I would be incredibly pleased if you could check out my note and see whether it makes sense for rescuing us 90% of Indians who have been plumeted into a demonetisation catastrophe by an incompetent and foolish Hindutva government.

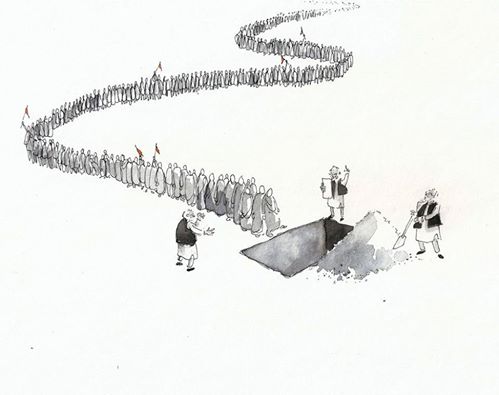

They cancelled all the 500 and 1000 Rs notes, which were 86% of the cash in circulation, and there are deaths every day as wages are not being paid, food not being bought, hospitals not reached and so on. 90% of Indians who in any case only had 14% of the wealth and whose wealth was predominantly their daily wages and some savings from the same now have just 3% of India’s total wealth, a survival catastrophe. I request readers to please read my article. Do my proposals make sense? We have planned to petition the Supreme Court of India to defend our Right to Livelihood and we can ask for a continuing mandamus to use these policies to create full unemployment, thus using this unbearable demonetisation crisis as a long overdue opportunity.

The aim of this paper is to point out to an incoming government in 2019 that a government can never run out of money and so there is no reason to collect the cash of the poor.

Instead if the corporate sector has five lakh worth of non performing assets and the mass of upper caste businessmen do not pay taxes, the government has to issue more money so that the debts of the defaulters can be restructured and managed, and secondly it has to employ more Tax officers to check electronic transfers of money and track the serial numbers of bank notes.

As far as the 90% of Indians who depend on the informal sector are concerned, life can not only go on but can go on better, if the government pays more people to do more things and thereby ensures the country enjoys full employment especially if the private sector is failing. The shady practices of the upper caste will seem only half as tragic if the rest of us can go on with our lifer and if we can prosper regardless of those shady dealings.

Demontisation is the violation of right to livelihood under Article 21 and must be reversed. The government can by definition, afford to restructure the debts of private firms, create full employment, provide social welfare and build infrastructure. All it has to do is persuade people to use its currency; it does this by saying the person needs this money because it has to pay taxes with it at the end of the year.

Thus the government can and must not only restructure defaulters’ debts but more importantly provide full employment and all the other things mandated by the constitution in the directive principles of public policy. The only thing that constrains a government in its monetary policy is that it may run out of resources to buy. That point has not been reached in India where there is a huge untapped wealth of labour to purchase, and huge untapped volume of carbon dioxide in the atmosphere to draw down through labour in agriculture and forestry, let alone of course habitats to create for wildlife and food to grow for the growing population. Indeed the need to collect taxes is also somewhat of a red herring. If a company has failed it has already failed, if a cash or electronic transaction is untraceable it is already untraceable. The government will for the sake of its own accounts want to mention in its balance sheet that so much wealth has been created; that it has these huge liabilities. That will automatically show that these assets exist, and in a way the illegal economy will be legal from one day to the next. It will allow the government to move forward creating yet more liabilities, this time in the form of money and in the form of spending that really matters: social welfare and 100% employment.

At present the Union is the sovereign because monetary policy, that is to say, the legal tender, currency and coinage, are under the seventh schedule. If needed a two third majority in Parliament can also provide the opportunity to amend the constitution to give this power to the Districts that would then be more manageable smaller countries.

The ideology of governments under capitalism is that the governments are perpetually constrained by lack of money and only taxes paid by citizens will provide the money the government requires to provide government services. It is shown in detail in Part II of this article that this argument is false.

A second misapprehension is circulating that also needs to be laid to rest.

Apparently there is in some circles a movement called debt-free money. This movement has to be educated to drop its demands and instead join the movement demanding full employment.

The modern money theory in a nutshell is that governments spend units of account into existence, and as they do so they have created I Owe Yous, IOUs. Money is always an IOU. In the balance sheet of the Reserve Bank when the RBI spends money that money is a liability, i.e. debt. It is on the liability side of the issuer and asset side of the holder. If what one wants is zero interest on government liabilities that is easy to arrange. A simple new instruction from Parliament to its creature the RBI and one can have Zero Interest Rates forever. L.Randall Wray explains what money is. “Imagine a cloakroom that issues “debt-free” cloakroom tokens. These look just like the normal token issued by a cloakroom, but they are not debts. You can return them to the cloakroom, but you don’t get a coat. The cloakroom attendant refuses to recognize the tokens as debt. They are your assets, but not cloakroom debts. What is a “debt-free” cloakroom token? It is a piece of plastic, a piece of cardboard, a piece of paper. It is “wealth-based”, not “debt-based”. Its value is determined by the value of the plastic, cardboard, or paper. Imagine a sovereign that issues “debt-free” coins. They look like normal coins, but when you take them back to the exchequer, your taxes are not paid. The exchequer does not recognize them as a debt—as a promise to redeem yourself in tax payment–but rather as a bit of base metal. Why would you want the debt-free cloakroom token? Why would you want the debt-free coin? Only for its wealth-value (whatever that might be). It is not money. As Modern Money Theory says, “taxes drive money”. If you cannot use the sovereign’s token to pay your taxes, it is nothing but a piece of paper, hazelwood stick, or metal. If you cannot redeem the token for your coat, or for the taxes you owe, why would you want it? In fact those movements calling for debt-free money really want a record of a transaction. What are notes or electronic entries? They are records of indebtedness—debts that can be redeemed in payments of debts owed to the issuers.”

The discussion is important in relation to the demonetisation done by the Modi government. The RBI goes into debt to me when he issues me the note or an electronic credit and when I pay the note or transfer back because I owe a tax the debt is redeemed.

It is stupefying what Narendra Modi and the BJP government did when they cancelled the old 500 and 1000 Rs notes without replacing them. They required the RBI to unilaterally cancel the IOU it had issued to me, telling me in effect that it no longer wants me to redeem the debt. It has in effect done the opposite of what it intended. It had intended to ask us to have confidence in it and pay back the IOUs the RBI and the Government together had issued to us; but instead it has made us question what we need to RBI’s IOUs for at all. Today people are sending around watsapp messages warning pepple to withdraw their money from their accounts. This would be a complicated development if we all use some other IOUs: Dinars from Qatar, or some other tokens all together, created locally, or Swiss Franks.

Unless the Government of India quickly creates a vast stock of new reserve money and distributes it to all Indians, the economy will cease to exist for the 90% whose 86% of money has been demonetised, let alone for the 1% who cannot be bothered with the Rupee anymore and take their money abroad.

The question about interest rates is of secondary importance. We can easily stop paying interest on bank reserves, and the RBI can stop issuing bonds. That is fine. The important thing is let us all understand that the sovereign government’s debt is the non-government’s asset. The RBI’s liability is our wealth, we being households and businesses. The outstanding debt of the Government of India is (identically) our (nongovernment) net financial (Rupee) wealth. It can be zero interest if we want it to be. It can also be cancelled out of circulation, or taxed.

If this is understood why did the Narendra Modi government not issue more money quickly when there was a crisis of non-performing assets in the nationalised banks? The only explanation is that the wrong ideology of money has taken hold in the minds of the middle class including the Aam Admi Party, the most vociferous opponents of corruption, who refused to countenance the government sorting out the debts of the private corporate defaulters by in effect buying up the debts and liquidating them or using any of its other powers of sovereign money issuance. In other words, the ideology of anti-corruption and anti-nepotism and anti-illegality poisoned the minds of the anti-corruption campaigners and instead of them coming up with a solution namely using the government powers to solve the problem ,it keeps driving the government in the direction of deepening the crisis because it will not “allow” the Government to liquidate the debt of the corporations. Instead it has forced the government to impose a liqudity crisis on the only functioning sector of the economy, the households and informal businesses.

This irrational fear of government insolvency, and its obverse, government debt, does not come from just any where. It comes from capitalism that has as its main goal the creation of money by private banks for profit. Capitalism has no interest what so ever in helping government create full employment or do any other of its jobs, such as govern or manage the debt crises of its companies. All capitalists want is for government to give private banks powers to create money and maintain the police in order to keep the workers from rebelling.

It is this ideology that constrains our government spending; we cannot spend enough to get the economy growing because under this ideology the outstanding stock of Government of India debt prevents Parliament from allocating more funding.

The mistaken understanding that pushed us into this crisis, and it is an understanding that Dr Manmohan Singh and the Aam Admi party and the BJP Party and probably Dr Urjit Patel, share, is that they believe that government first receives taxes, or asks banks for loans, and then it spends. Then when the private sector is in trouble with 5 lakh crore Rupees non-performing assets they want to avoid sending the government to banks to borrow bank money, for which banks charge interest. But that is a wrong notion. Government cannot spend “bank money”; it can only write checks on its deposit account at the Reserve Bank of India.

When Government of India spends it is spending Reserve Bank of India reserves. Reserve Bank of India reserves are the liability of the Reserve Bank of India —which is a branch of government. So obviously the Government HAS to bail out the private NON Performing Assets, there is no other way, because the Government is the only issuer of the money. The fact that many of the companies are in trouble because they borrowed in foreign exchange and cannot service foreign exchange debts without defaulting on their Rupee debts is also to be taken into consideration. But all the Government of India can do if it thinks the danger of money flowing out to service foreign debt is big is to impose exchange controls.

Finally to satisfy the anti-corruption public like Aam Admi party and others, the only way the bankrupt debtors can be punished is for the individuals responsible for the economic disasters of collapsed and bankrupt companies to be sent to jail. The company and the individuals cannot be made to pay money it does not have, but of course the enforcement agencies can try and recover the remaining assets lodged in real estate and so on. They can take over Antilia and the rest of the asset in so far as they are traceable.

This raises the biggest question of all. In India it appears to be the case that the assets of the rich private corporations have come to be treated the same way as assets of the Public Sector Undertakings. These corporations are perceived to be employers, providers of electricity and the coal and the gas, chemical fertilisers flowing to the villages, in short, they are too big to fail because the entire urban city life will collapse. They also cannot be renationalised, according to this logic, because they are all companies that emerged out of the privatisation of public assets at the time of liberalisation in the late 1980s and onwards.

All this is foolish.

The actions we need to take with relation to the demonetisation disaster are

To immediately issue to every single Indian the amount of Rupees that they ask for and that they say they need.

Secondly, to let the country know that there is a new taxation regime for everyone whether farmer or private corporation or anyone else, and that regime is: a percentage of the money held by the person at the end of the year is taxable, and the percentage of tax depends on how much money they are holding at the end of the year. Upto 20 lakhs is tax free. Upto 1 crore is at 40%. Above 1 crore is at 90%. This is the same for companies and individuals. At the beginning of the next year if individuals and companies need money they can come and get some from the bank again, free, no interest, no repayment. At the end of the year it will be taxed again.

Thirdly, land cannot be bought and sold. All land belongs to the Gram sabha and Town wards, for use by local people who pay rent. The right to rent the particular property is inheritable.

Fourthly all production consumption and distribution of commercial energy shall be illegal except for the electricity used by the financial sector. For all production, consumption and distribution in the household sector and the business sector only manual labour will henceforth be permitted. This point is due to the imperative of mitigating climate change.

So let us repeat why this is all perfectly workable. The government sells bonds to banks. Banks that buy bonds must use Reserve Bank of India reserves to purchase them; the Reserve Bank of India debits bank reserves and credits the Finance Ministry deposit at the Reserve Bank of India. If the banks lend on at zero interest that is fine, they can also grant the money. At the beginning of the following year they can replenish their funds. The Finance Ministry spends Reserve Bank of India money, the liability of the Reserve Bank of India. As the Reserve Bank of India is a branch of government, it is the government’s own IOU that the Finance Ministry is spending.

The only way the Finance Ministry can spend is by writing a check on its account at its Reserve Bank of India, its central bank. All Finance Ministry spending takes the form of spending central bank IOUs. It is always “debt-financed” spending, using government debt. Telling the Finance Ministry to stop selling bonds (which is what AAP and other anti-corruption people are telling the Government to do) is stupid for reasons explained above, and also, to answer those confused “debt-free” movement people, there is no reason on earth why we should stop the government from going into debt. That is what money is.

Sovereign government spends first, then it taxes, or sells bonds. If we target zero interest and stop issuing bonds that promise interest above zero, we will have interest free money in circulation if that is what we want. It does not really matter as no one is earning profits from charging interest. The wages of bankers are coming from their service charges to customers. They will not have much need to charge exporbitantly because at the end of the year excess money is heavily taxed.

The currency spent by government and accumulated as net financial assets by all the households and businesses will be liabilities of the Reserve Bank of India (Notes and Reserves and coins). Government will be in debt. And it can choose not to pay interest. To do this Parliament amends the Reserve Bank of India 1934 Act, dictating that the RBI will keep the discount rate and RBI funds rate target at zero. It simultaneously mandates that the RBI will allow zero rate overdrafts by the Finance Ministry on its deposit account up to an amount to allow the Finance Ministry to spend budgeted funds.

The Finance Ministry’s spending is funds already budgeted by the elected representatives as per the draft items one to four above and as per the directive principles of the constitution and the Constitutional fundamental rights and duties; and signed by the head of the administrative branch of government. Overdrafts are normal banking procedure. The Government of India will run an overdraft at the RBI: His spending is already checked by the budget. His signature on his debt creates what is without question the most highly esteemed “note” in India, a government bond. It is accepted all over the globe. His banker—the RBI—also ought to accept it.

This system will achieve the required amount of Rupees circulating in the form of electronic money and coins and notes, without depriving the informal economy of its money of account in whatever form. The RBI will not have to send trainloads of cash to every bank and cooperative bank and rural bank let alone ATM in the country. At the same time the 90% of the Indian economy that is informal whether in coins or notes or reserves or savings will be properly managed to ensure full employment and social welfare, housing and forestry, amongst other things, as listed in the directive principles and established as fundamental rights. If there isn’t a bank in a village it has to be established immediately. The state governments and the PRIs must be empowered to undertake all these jobs.

The argument of this paper is thus that a government can never run out of money. It can rather, by definition, afford to provide full employment and all the other things mandated by the constitution in the directive principles of public policy. Demonetisation is a catastrophic move and must be overturned and replaced with the policies to provide full employment as suggested in this draft note.

The directive principles under the Indian Constitution are: a social order for the promotion of welfare of the people, equal justice and free legal aid, organisation of village panchayats, right to work, to education and to public assistance in certain cases, provision for just and humane conditions of work and maternity relief, living wage, etc., for workers, participation of workers in management of industries, uniform civil code for the citizens, provision for free and compulsory education for children, promotion of educational and economic interests of Scheduled Castes, Scheduled Tribes and other weaker sections, duty of the State to raise the level of nutrition and the standard of living and to improve public health, organisation of agriculture and animal husbandry, protection and improvement of environment and safeguarding of forests and wild life, protection of monuments and places and objects of national importance, separation of judiciary from executive, promotion of international peace and security and in overarching for the right to life and right to livelihood guaranteed under Article 21 in conjunction with article 14 and 19.

At present the Union is the sovereign because monetary policy, that is the legal tender, currency and coinage, are under the seventh schedule. If needed, however, a two third majority in Parliament can also provide the opportunity to amend the constitution to give this power to the Districts that would be smaller countries and more manageable.

Basically Modern Money Theory shows that there is no solvency risk for a government that issues its own currency. It can’t go bankrupt. It’s not possible for it to run out. You cannot spend more than tax revenue and go bust, because you can always issue more currency. But you can put your own constraints: so in (the US there is debt limit, no other country has this, the US has had it since 1913. But the debt limit has always been raised as needed, so it was a constraint that was never constraining. But sometimes there is a pressure like a political pressure recently by Republicans to try to enforce policy change. You can impose a debt limit constraint and force the government to default on its promise to pay on bonds, or social security, that is a self imposed constraint. In fact Congress can just get rid of the debt limit all together, because it is stupid.) (In India the Fiscal Reserve and Budgetary Management Act is a similar constraint that should be abolished) . There is no reason why the government cannot continue to spend simply by issuing more currency. The government debt is nothing other than private sector savings. If you have your own currency, you can always afford to spend more, so you can always afford full employment. The policy implication of modern money theory is thus that you can afford full employment and all the other things mentioned in the directive policies. There may be inflation but you cannot run out of money.

To draw the implications for India today 25th November 2016, it appears that really India escaped the 2008 financial crisis, but, the globalised corporations domiciled in India did not, and it is the fact that they are thus not contributing to surpluses and savings but rather are in permanent deficit and not coming out of it that is the crisis: and because of a fundamental misunderstanding of the power of money creation by the Sovereign (due to the FMBRA imposed by the world bank and Manmohan Singh and Ex RBI Governor Ranjan and present RBI Governor Urjit Patel and present Finance Minister Arun Jaitley) the crisis is having to be managed by the only sector that is in surplus namely the households; but this idea that dumping the problem on the households is the only solution is because the sovereign is not going into the required additional deficit to cure the problem, which is actually its duty, and which would get the private firms out if the crisis or let them go bankrupt in an orderly manner, with government deficit spending catching all the unemployment of the bankrupt global private sector AND at the same time creating full employment for all.

In other words the government does not understand that it can issue credit to millions of household and state government and other accounts to create demand and create work and create the money that will later come back in tax, to replace the failed global corporations, but it is in any case not the tax that is financing government spending but the money that the government has created in order for the households and small firms to be able to pay tax.

The strength of India is its people not it’s corporations but day by day that strength is getting annihilated by the demonetisation crisis.

This in short is the draft note towards a plan for 2019, to be read in conjunction with the need to do carbon sequestration (Ref2) through MGRNEGA and forest rights (Ref3). The note will be continuously improved and modified as it is discussed and suggestions are contributed.

Anandi Sharan is an environmental historian and writer based at Bangalore. She is a Board member of the global environmental platform CBD Alliance and has been articulating the global South’s concerns on climate change. She can be reached at [email protected]

Ref1: Randall Wray: a money system must guarantee full employment – that is its primary role. L. Randall Wray – Modern Money Theory: Intellectual Origins and Policy Implications. MMT: https://www.youtube.com/watch?v=-KRi9nF8BiA

Ref2: Mainstream, VOL LI, No 1, December 22, 2012 [Annual 2012]

The Role of Sequestration in Reversing Anthropogenic Climate Change

Thursday 3 January 2013, by Anandi Sharan

Ref3: Natural Resources Forum 40 (2016) 103–111 DOI: 10.1111/1477-8947.12103, A framework for reforming India’s forest biodiversity management regime, by S. Faizi and M. Ravichandran

Ref4: http://www.nakedcapitalism.com/2015/12/randy-wray-debt-free-money-and-banana-republics.html