Australia loudly boasts of its success as a multicultural society but this national narcissism hides huge deficiencies. The 2018 “Leading for Change” analysis shows that while Whites and non-Whites are 76% and 24%, respectively, of the population, they represent 94.9% and 5.1%, respectively of the senior leadership of Australian organizations and institutions. Australia is currently being rocked by huge scandals in the 4 Big Banks in which Whites and non-Whites average 89.7% and 10.3%, respectively, of Board members. Lack of cultural diversity evidently facilitates corporate malfeasance.

“Leading for Change. A blueprint for cultural diversity and inclusive leadership revisited” (2018) is authored by Dr Tim Soutphomassane (Race Discrimination Commissioner, Australian Human Rights Commission), Professor Greg Whitwell (Dean, the University of Sydney Business School), Kate Jordan (Chair, Professional and Business Services Taskforce, The Committee for Sydney) and Philipp Ivanov (Chief Executive Officer, Asia Society Australia) [1]. “Leading for Change” ( 2018) follows up on “Leading for Change” ( 2016) that revealed lack of cultural diversity in senior leadership positions in Australian business, politics, government and universities.

“Leading for Change” has a simple and important message that can well apply to many other societies: “We hope that this report challenges readers to think deeply about cultural diversity. Ultimately, we hope it will be used by leaders and organisations as a blueprint for action – because our national success and prosperity depends on us getting the most from our multicultural talents” (Preface, [1]).

The quantitative findings of a huge White versus non-White cultural diversity discrepancy in Australian leadership are summarized below

- “Leading for Change” considered 2,490 “leaders” of Australian organizations and institutions, specifically CEOs of ASX200 companies (Australian Stock Exchange top 200), Federal ministers, heads of Federal and State departments and vice chancellors of universities plus group executives of ASX 200 companies, elected members of the Federal Parliament, deputy heads of government departments and deputy vice chancellors of universities. It then classified these “leaders” by cultural background into British-origin (“Anglo-Celtic”) (58% of the Australian population but 75.9% of leaders), non-British European (“European’) (18% by population and 19.0% of leaders), Non-Indigenous non- European (“Non-European”) (21% by population but 4.7% of leaders) and Aboriginal and Torres Strait Islanders (“Indigenous”) (3% of population but 0.4% of leaders). Put crudely (after all, Aussies are famous for being “rough diamonds” and “calling a spade a spade” or “calling a spade a bloody shovel”), Whites represent 76% of the population but are 94.9% of the leaders, whereas the non-Whites represent 24% of the population but are only 5.1% of the leaders (pages 1 & 8, [1]).

- Analysis of 372 Chief Executives (CEs) classified them as Anglo-Celtic (58% of Australian population, 76.9% of CEs), European (18% of population, 20.1% of CEs), Non-European (21% of population, 2.7% of CEs) and Indigenous (3% of population, 0.3% of CEs) (pages 2 & 9, [1]).

- Analysis of 2,118 non-chief executive officers (non-CEO C-Suite executives or non-CEO C-level executives e.g. chief financial officer (CFO), chief operating officer (COO), and chief information officer (CIO)) classified them as Anglo-Celtic (58% of Australian population, 75.7 % of non-CEO leaders), European (18% of population, 18.9% of non-CEO leaders), Non-European (21% of population, 5.0% of non-CEO leaders) and Indigenous (3% of population, 0.4% of non-CEO leaders). Again, to put it crudely, Whites represent 76% of the population but are 94.6% of the non-CEO leaders, whereas the non-Whites represent 24% of the population but are only 5.4% of the non-CEO leaders (pages 1 and 11 [1]).

- Remembering that Anglo-Celtics are 58% of the Australian population, Europeans 18%, Non-Europeans 21%, Indigenous 3%, Whites 76% and Non-Whites 24%, the following summarizes leadership percentages for the following Australian CEOs and equivalent leaders:

(a) ASX 200 CEOs are 72.5% Anglo-Celtic, 23.5% European, 4.0% Non-European, and 0.0% Indigenous i.e. 96.0% White and 4.0% Non-White.

(b) Federal Ministers are 83.4% Anglo-Celtic, 13.3% European, 0.0% Non-European and 3.3% Indigenous i.e. 96.7% White and 3.3% Non-White.

(c) Federal & State Government Department Heads are 83.4% Anglo-Celtic, 13.3% European, 0.0% Non-European and 3.3% Indigenous i.e. 96.7% White and 3.3% Non-White.

(d) University Vice-chancellors are 74.3% Anglo-Celtic, 23.1% European, 2.6% Non-European and 0.0%% Indigenous i.e. 97.4% White and 2.6% Non-White (page 10, {1]).

- The following summarizes leadership percentages for the following Australian non-Chief Executive senior leaders:

(a) ASX 200 non-CEO executives are 73.2% Anglo-Celtic, 21.0% European, 5.8% Non-European, and 0.0% Indigenous i.e. 94.2% White and 5.8% Non-White.

(b) Federal parliamentarians are 83.4% Anglo-Celtic, 13.3% European, 0.0% Non-European and 3.3% Indigenous i.e. 96.7% White and 3.3% Non-White.

(c) Federal & State Government Department Deputy Secretaries are 83.3% Anglo-Celtic, 12.5% European, 2.4% Non-European and 1.8% Indigenous i.e. 95.8% White and 4.2% Non-White.

(d) University Deputy Vice-chancellors are 74.3% Anglo-Celtic, 23.1% European, 2.6% Non-European and 0.0%% Indigenous i.e. 97.4% White and 2.6% Non-White (page 12, [1]).

The “Leading for Change” reports similar discrepancies in the US and UK: “According to McKinsey’s “Delivering through Diversity” report (2018), in the United Sates , black Americans comprise 10 per cent of graduates but only 4 per cent of senior executives, Hispanics and Latinos comprise 8 per cent of graduates but only 4 per cent of senior executives, and Asian Americans make up 7 per cent of graduates versus 5 per cent of executives. In the United Kingdom, 22 percent of university students identify as Black and Minority Ethnic, yet make up only 8 percent of British senior executives” (page 8, [1]).

“Leading for Change” rather politely opines: “The clear gap between European and non-European representation within senior leadership does point to a cultural dynamic not always publicly discussed” (page 13, [1] i.e., to be blunt, a “cultural dynamic” from tribal parochialism to racism. The report concedes that “Racial prejudice and discrimination remain problems in Australian society” (page 25, [1]) and that “Internal organisational power hierarchies often mirror those of the dominant societal values” (page 29, [1]).

The report gives examples of how the Leadership Council on Cultural Diversity, the Department of the Prime Minister and Cabinet, various Law firms, Deloitte, the Department of Foreign Affairs and Trade, the Commonwealth Bank of Australia, the law firm Clayton Utz, the Australia Broadcasting Corporation (the ABC, Australia’s equivalent of the UK BBC), the Australian Human Rights Commission and Sydney University Cultural Diversity and Leadership Fellowship, and the Special Broadcasting Service are variously addressing the problem of cultural diversity in organizations and institutions through in-house education, professional development, mentoring and data acquisition.

Of course there is a major concern in Western societies including Australia about the “glass ceiling” and female representation, and the “Leading for Change” report discusses the controversial issue of quotas versus targets to achieve fair representation in relation to women and cultural diversity . The report concludes with sensible suggestions for leadership on cultural diversity, data collection on cultural diversity and cultural change (mitigation of bias, unlocking talent through professional development and going beyond “cultural celebration” tokenism by cultivating “organisational resilience in negotiating cultural differences”). “Leading for Change” concludes that “There is one general area where efforts can be strengthened on cultural diversity. The experience of gender equality has demonstrated the power of having data and reporting on gender. If we are committing to deepening our success as a multicultural society, there must be consideration of official collection and reporting of comprehensive data on cultural diversity within Australian organisations and institutions” (page 31, [1]).

Toward the useful end of data collection , I have done a quick analysis of cultural diversity in Australia’s Federal Government-guaranteed 4 Big Banks, the Australia and New Zealand Banking Corporation (ANZ), the Commonwealth Bank of Australia (CBA), the National Australia Bank (NAB), and the Westpac Banking Corporation (Westpac), organizations now subject to the scrutiny of a Financial Services Royal Commission in 2018.

Remembering that Whites make up 76% of the Australian population, Non-Whites make up 24%, and Males and Females about 50% each, we can summarize the cultural diversity and female representation on the Boards of Australia’s 4 Big Banks as follows:

ANZ: 88.9% White, 11.1% Non-White, 66.7% Male, 33.3% Female.

CBA: 90% White, 10% Non-White, 60% Male, 40% Female.

NAB: 80% White, 20% Non-White, 70% Male, 30% Female.

Westpac: 100% White, 0% Non-White, 77.8% Male, 22.2% Female.

Average: 89.7% White, 10.3% Non-White, 68.6% Male, 31.4% Female.

Rich White males still rule Australia – it is still a Boy’s Club up there. Australia used to be ruled by rich White Protestants but thence with increasing Catholic involvement came to be ruled by the 21st century by Prosperous Anglo-Celtic Men (Pacmen [2]. Out of the 38 Board members of the 4 Big Banks, 4 (10.5%) are Asian, 7 (18.4%) of non-British European origin, 27 (71.1%) of Anglo-Celtic origin and 0.0% of Indigenous origin.

In the 2008 Global Financial Crisis the Rudd Labor Government intervened to guarantee the 4 Big Banks as well as embarking on massive, nation-wide building works to stimulate the economy. The Big 4 Banks were regarded as “too big to fail”. However subsequently whistleblowers and damaged clients began exposing bank malpractices, a trickle of revelations that has become a flood. The Australian 4 Big Banks and other financial institutions are presently the subject of a Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry (aka the Financial Services Royal Commission or the Banking Royal Commission) that every week is exposing outrageous malfeasances including unethical and illegal misconduct by the Financial Sector. The Australian Liberal Party-National Party Coalition Government, that is in the pocket of Big Business in Corporatocracy Australia, resolutely resisted Opposition calls for such a Royal Commission for 2 years – they finally gave way because the National Party represents farmers, many of whom have suffered at the hands of the financial sector. However in giving way, the neoliberal Coalition Government limited the Royal Commission to 1 year, a target that is now increasingly seen as woefully inadequate.

The Australian Financial Review reported after just several months of the Royal Commission that: “The end result is that shareholders this year – including dividends – have lost 8.6 per cent in Westpac, 8.2 per cent in CBA, 6.6 per cent in ANZ, and 2.1 per cent in NAB. That compares to a flat total return from the ASX 200 [Australian Stock Exchange top 200] index (which is itself weighed down by the banking stock losses)” [3].

Paul Soos comments: “Deregulation has helped parts of the financial industry to be captured by fraudsters. Faked pay slips, forged documents and cash-stuffed envelopes used as bribes to secure loans are just some of the examples of dodgy practices exposed so far by the banking royal commission… There is evidence to suggest regular and widespread criminality has been committed by industry since the 1980s” [4].

The lives of thousands of people have been wrecked by corrupt practices of the financial sector. The Royal Commission has revealed banking staff or brokers corruptly achieving excessive loans that ultimately could not be serviced; financial advisers giving damaging advice that benefited the adviser while ruining the clients; bribery and forgery to secure loans; billing of clients, including dead clients, for advice that was not given (“fee for non-service”) ; deception of government financial regulators; installing systems potentially enabling criminal or terrorist money laundering and permitting 54,000 transactions violating money laundering laws; and a shocking financial services culture of executives looking the other way and ignoring advice from subordinates and whistle blowers. Just this week CBA has confessed that it has “lost” the financial records of 20 million accounts, statements containing customers’ names, addresses, account numbers and transaction details from 2000 to 2016 – and worse still, did not inform the customers [5]. The banking regulator, The Australian Prudential Regulation Authority (APRA), has just released a report damning the CBA for a “widespread sense of complacency” and “lack of accountability” that has led to multiple regulatory breaches [6].

The core of the problem is dishonesty and capitalist greed – financial institution staff and brokers discarded ethical duty of care for their clients in their financial advice and deals in favour of maximizing profits, dividends to shareholders and personal gain through bonuses and promotion. One is reminded of John Perkin’s “Confessions of an Economic Hit Man” in which he describes a system of massively fraudulent advice to poor nations but sadly comments that while he went into this massive corporate criminality with his eyes open, today commerce and business studies students are taught at university that the prime obligation or fiduciary duty is to the shareholder and not to their clients or to truth [7].

Ethicist Professor Peter Singer has argued that the flaw in socialist idealism is human greed. However that criticism misses the point that while strong, socially-selected behavioural memes (e.g. “love thy neighbour as thyself”) and consequent societal laws can mitigate individual greed, rapacious greed is the core imperative of the presently dominant economic ideology of neoliberalism (economic rationalism). Neoliberalism advocates maximal freedom for the smart and advantaged to exploit the human and natural resources of the world for private profit, whereas social humanism (socialism, democratic socialism, eco-socialism, the welfare state) aims to maximize happiness, dignity and opportunity for everyone via evolving intra-national and international social contracts [8, 9].

It is difficult to change human nature. Polya’s 3 Laws of Economics that mirror the 3 Laws of Thermodynamics of science, are (1) Price minus COP (Cost of Production) equals profit; (2) Deception about COP strives to a maximum; and (3) No work, price or profit on a dead planet (the 3 Laws of Thermodynamics state that (1) the energy of a closed system remains constant , (2) entropy or disorder and lack of information content tend to a maximum, and (3) zero motion at zero degrees Kelvin) [10]. However decent, humane people mitigate the tendency to deception and moral disorder by a sense of obligation to one’s fellow human beings.

Thus in decently conducted business “the customer is always right” and in financial services the advisers must always exercise duty of care to their clients and properly discharge their legal obligations to regulatory agencies. However, according to the Australian Financial Review “AMP [a major investment company] may have been unlawfully deducting service fees from customer accounts since 2009, but it was its attitude to dealing with the regulator that has got the company in the most trouble. Evidence before the royal commission showed AMP misled the corporate regulator 20 times, including by portraying its “fee for no service” problem as a process error rather than deliberate decisions and mischaracterising findings from an external audit by PwC [a top auditing company]” [11]. Analysis of the AMP Board reveals that it is 87.5% White, 12.5% Non-White, 62.5% Male and 37.5% Female, this being similar to the average for the 4 Big Banks but at variance with the Australian population which is 76% White, 24% Non-White, 50% Male and 50% Female.

The “Leading for Change” report provides some salutary statistics showing that Australia’s Non-White minority is considerably under-represented in corporate, government and academic leadership. The same pattern is evident in the 4 Big Banks and in AMP, one of Australia’s leading investment companies. Increasing female representation has made big inroads into Australian leadership but the average for the leadership of the 4 Big Banks is 89.7% White, 10.3% Non-White, 68.6% Male, and 31.4% Female as compared to the Australian population that is 76% White, 24% Non-White, 50% Male and 50% Female. The “Leading for Change” report sensibly argues for more data to impel change in this area, and crucially observes that “our national success and prosperity depends on us getting the most from our multicultural talents”. However there is a serious and perverting downside to this restricted, mutually-reinforcing, “rich White” organisational and institutional culture.

It is apparent from the shocking finding of the currently running Financial Services Royal Commission that the predominantly “rich White” composition of the leadership of Australia’s financial institutions has contributed to manifold and appalling malfeasances through a culture of collective complacency and high self-regard coupled with Mainstream Australia’s entrenched “look-the-other-way” culture. These attitudes are not confined to the financial sector. Thus the “rich White”-led , corporatist Australian universities resolutely ignore censorship and self-censorship that violates the core academic ethos [2] and are resolutely committed to exploitative, fee-based university education and ignore the reality that 25 countries have free university education – all societies and nations need to have a complement of expert scholars and scientists for variety of economic, health, national security and national prestige reasons but it is grossly unfair to make impoverished 20-year olds pay for it. Further, reading-based off-campus education can be achieved at 1% of the cost of on-campus education (which is increasingly off-campus in practice) [2, 12-17].

It is not just banks, fund managers, and universities – the whole of Mainstream Australia is afflicted with this “look-the-other-way” culture that is compounded by lack of cultural diversity in organisational and institutional leadership, and lack of effective free speech for educated, informed and humane Australian intellectuals. Thus, for example, a “look-the-other-way”, “aren’t-we-nice”, and narcissistic Australia loudly proclaims its noble sporting values but lies by omission over horrendous Australian crimes from child abuse to genocide. Australia has rightly reacted with shock and indignation to cricket ball tampering involving at least one quarter of the Australian cricket team – it is simply not cricket and is cheating that impinges on the national image. However US lackey, pro-Apartheid, neoliberal Mainstream Australia largely or effectively ignores a catalogue of 190 realities that indelibly stain the national reputation including endemic child abuse, endemic violence against women, horrendous preventable deaths, ongoing Aboriginal Genocide, ongoing Aboriginal Ethnocide and disproportionate complicity in US wars, Israeli Apartheid, the Palestinian Genocide, the Muslim Genocide, the Global Avoidable Mortality Holocaust, ecocide, speciescide and a worsening Climate Genocide [18].

And this “rich White”-led reality suppression is not just about looking the other way – it is also about “softening conversations” and “respectful conversations” so that public commentators rendered “visible” by One Percenter-dominated Mainstream media preserve their “visibility” by , for example, being anti-war lite, climate lite, Apartheid lite and activism lite. In the neoliberal War on Humanity and War on Terra, there are the Bad Guys (the neoliberals, One Percenters, Super Rich, US Alliance military, warmongers, moronic Trumpists, fascists, neo-Nazis, religious right, and genocidal Zionists) versus the Good Guys (the anti-war, anti-nuclear, anti-Apartheid, anti-discrimination, and pro-environment social humanists). However the Good Guys have been severely compromised by many activists who are insufficiently activist (i.e. activism lite ) by being climate lite, socialism lite, anti-Apartheid lite, and anti-war lite in order to preserve their precious “rich White”-conferred “visibility” [19].

Finally, cultural diversity is not just about ethnicity – it is also about gender and socio-economic status. One can semi-mischievously note that the Australian “ Leadership Council on Cultural Diversity” listed in “Leading for Change” (page 17, [1]) is 75% White, 25% Non-White, 75% Male and 25% Female. A powerful example of a very useful kind of cultural diversity is the inclusion of worker representatives on the boards of German corporations, as so effectively portrayed by Mike Moore in his movie “Where To Invade Next” [20, 21]. The “Leading for Change” report has done Australia a great service by providing data on lack of cultural diversity in the leadership of Australian organizations and institutions, and by suggesting ways of addressing this in the national interest. Wake up, Australia!

References.

[1]. Tim Soutphomassane, Greg Whitwell, Kate Jordan and Philipp Ivanov, “Leading for Change. A blueprint for cultural diversity and inclusive leadership revisited”, 2018.

[2]. Gideon Polya, “Current academic censorship and self-censorship in Australian universities”, Free University Education: https://sites.google.com/site/freeuniversityeducation/academic-censorship .

[3]. Patrick Commins, “Brokers unruffled by Banking Royal Commission”, Sydney Morning Herald, 2 May 2018: http://www.afr.com/markets/brokers-unruffled-by-banking-royal-commission-20180502-h0zjns .

[4]. Philip Soos, “Banking inquiry has already exposed shocking corruption – but it needs more time”, Guardian, 22 March 2018: https://www.theguardian.com/australia-news/commentisfree/2018/mar/22/banking-inquiry-has-already-exposed-shocking-corruption-but-it-needs-more-time .

[5]. Jane Norman, “Commonwealth Bank admits it lost the details of almost 20 million accounts, didn’t tell customers”, ABC News, 3 April 2018: http://www.abc.net.au/news/2018-05-02/commonwealth-bank-confirms-loss-financial-records-20m-customers/9720928 .

[6]. Peter Ryan, “APRA launches scathing criticism of Commonwealth Bank, Scott Morrison puts boards on notice”, ABC News, 1 May 2018: http://www.abc.net.au/news/2018-05-01/cba-forced-to-put-aside-a-billion-dollars-extra-by-apra/9713646 .

[7]. John Perkins, “Confessions of an Economic Hit Man”, Berrett-Koehler Publishers, 2004.

[8]. Brian Ellis, “Social Humanism. A New Metaphysics”, Routledge , UK , 2012.

[9]. Gideon Polya, “Book Review: “Social Humanism. A New Metaphysics” By Brian Ellis – Last Chance To Save Planet”, Countercurrents, 19 August, 2012: https://www.countercurrents.org/polya190812.htm .

[10]. Gideon Polya, “Polya’s 3 Laws Of Economics Expose Deadly, Dishonest And Terminal Neoliberal Capitalism”, Countercurrents, 17 October, 2015: https://www.countercurrents.org/polya171015.htm .

[11]. Misa Han, “Banking Royal Commission: AMP’s misleading of ASIC explained”, Australian Financial Review, 30 April 2018: http://www.afr.com/business/banking-and-finance/banking-royal-commission-amps-misleading-of-asic-explained-20180430-h0zfy9 .

[12]. Gideon Polya, “Crisis in our universities”, Australian Broadcasting Corporation (ABC) Radio National, Ockham’s Razor, 19 August 2001: http://www.abc.net.au/radionational/programs/ockhamsrazor/crisis-in-our-universities/3490214#transcript .

[13]. “Free University Education”: https://sites.google.com/site/freeuniversityeducation/home .

[14]. Gideon Polya, “50 reasons for free university education as we bequeath the young a dying-planet/”, Countercurrents, 19 March 2017: https://countercurrents.org/2017/03/19/50-reasons-for-free-university-education-as-we-bequeath-the-young-a-dying-planet/ .

[15]. Gideon Polya, “Free University Education Via Accredited Remote Learning – All Education Should Be Free For All”, Countercurrents, 31 January, 2015: https://countercurrents.org/polya310116.htm .

[16]. Gideon Polya, “Accredited Remote Learning (ARL) (Distance Learning, DL) to maximize Deep Learning”, Free University Education: https://sites.google.com/site/freeuniversityeducation/accredited-remote-learning .

[17]. Gideon Polya, “Review of Global Distance Learning (DL) systems”, Free University Education: https://sites.google.com/site/freeuniversityeducation/distance-learning .

[18]. Gideon Polya, “Australia Shocked By Cricket Ball Tampering But Ignores Horrendous Australian Crimes From Child Abuse To Genocide”, Countercurrents, 24 April 2018: https://countercurrents.org/2018/04/24/australia-shocked-by-cricket-ball-tampering-but-ignores-horrendous-australian-crimes-from-child-abuse-to-genocide/ .

[19]. Gideon Polya, “Planetary salvation compromised by activism lite, climate lite, anti-Apartheid lite & anti-war lite weakness”, Countercurrents, 15 November 15, 2017: https://countercurrents.org/2017/11/15/planetary-salvation-compromised-by-activism-lite-climate-lite-anti-apartheid-lite-anti-war-lite-weakness/ .

[20]. “Where to invade next”, Wikipedia: https://en.wikipedia.org/wiki/Where_to_Invade_Next .

[21]. Gideon Polya, “Movie Review: “Where To Invade Next” By Michael Moore – Hammer, Chisel, Down For Social Humanism”, Countercurrents, 23 April, 2016: https://www.countercurrents.org/polya230416.htm .

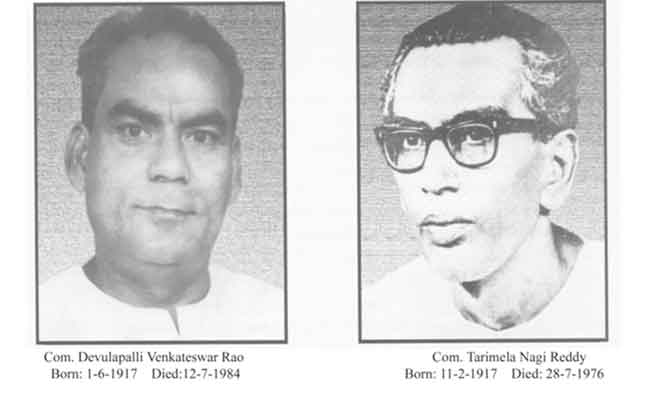

Dr Gideon Polya taught science students at a major Australian university for 4 decades. He published some 130 works in a 5 decade scientific career, most recently a huge pharmacological reference text “Biochemical Targets of Plant Bioactive Compounds” (CRC Press/Taylor & Francis, New York & London , 2003). He has published “Body Count. Global avoidable mortality since 1950” (G.M. Polya, Melbourne, 2007: http://globalbodycount.blogspot.com/ ); see also his contributions “Australian complicity in Iraq mass mortality” in “Lies, Deep Fries & Statistics” (edited by Robyn Williams, ABC Books, Sydney, 2007: http://www.abc.net.au/radionational/programs/ockhamsrazor/australian-complicity-in-iraq-mass-mortality/3369002#transcript

) and “Ongoing Palestinian Genocide” in “The Plight of the Palestinians (edited by William Cook, Palgrave Macmillan, London, 2010: http://mwcnews.net/focus/analysis/4047-the-plight-of-the-palestinians.html ). He has published a revised and updated 2008 version of his 1998 book “Jane Austen and the Black Hole of British History” (see: http://janeaustenand.blogspot.com/ ) as biofuel-, globalization- and climate-driven global food price increases threaten a greater famine catastrophe than the man-made famine in British-ruled India that killed 6-7 million Indians in the “forgotten” World War 2 Bengal Famine (see recent BBC broadcast involving Dr Polya, Economics Nobel Laureate Professor Amartya Sen and others: http://www.open.edu/openlearn/history-the-arts/history/social-economic-history/listen-the-bengal-famine ; Gideon Polya: https://sites.google.com/site/drgideonpolya/home ; Gideon Polya Writing: https://sites.google.com/site/gideonpolyawriting/ ; Gideon Polya, Wikipedia: https://en.wikipedia.org/wiki/Gideon_Polya ) . When words fail one can say it in pictures – for images of Gideon Polya’s huge paintings for the Planet, Peace, Mother and Child see: http://sites.google.com/site/artforpeaceplanetmotherchild/ and http://www.flickr.com/photos/gideonpolya/ .