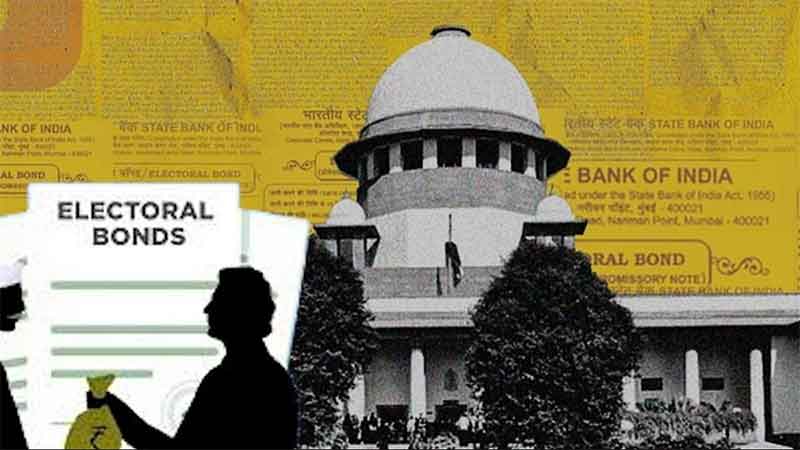

Nothing happening in the country right now seems to surprise us any more, so few people took any notice of a statement made recently by Injeti Srinivas, the Union Secretary of Corporate Affairs. Speaking on the sidelines of a CII event on 25 February, Srinivas defended a judgement, recorded by the National Company Law Appellate Tribunal (NCLAT) in the IL&FS case, which some journalists thought was beyond the NCLAT’s remit. Srinivas’ response was enough to disarm all sceptics. He said the decision was made ‘in national interest’. In other words, that it was beyond all question. The journalists, naturally, did not venture beyond that point: for who would like to be seen as anti-national, especially after Pulwama/Balakot?

The context was this: on 22nd February, 2019, the NCLAT, in course of a hearing in the IL&FS imbroglio, had forbidden IL&FS’ lenders from classifying the company’s loan accounts as NPAs, no matter that they were NPAs. Now, banking supervision is formally part of the RBI’s brief, and it is the central bank that has hitherto taken a call on whether a lending bank’s classification of a borrower’s account was correct or not. Fact is, the NCLAT now abrogated to itself that privilege ‘in national interest’. The RBI didn’t seem to mind, because for nearly a month it did not join issue with the tribunal on this. Now, of course, the central bank has issued a rejoinder – a weak one, though – only to be advised by the NCLAT ‘not to make this a prestige issue’. A sterner rebuke of the RBI is hard to imagine, but it is possible –indeed, probable – that governor Shaktikanta Das would wake up to the exigencies of national interest and allow the NCLAT to do what it deemed fit.

This episode is symptomatic of the disease afflicting our banking system today. Nobody seems to be sure of their responsibilities, or of the limits to their jurisdiction. While the NCLAT was stepping into uncharted territory, the RBI was busy shepherding 5 commercial banks out of its own Prompt Corrective Action (PCA) regime though none of these banks appeared to have earned the reprieve. Bank of India, Bank of Maharashtra, Oriental Bank of Commerce, Allahabad Bank and Corporation Bank were clearly not out of the woods yet – their recent record of profitability and management of NPAs gave precious little scope for optimism – but the RBI decided that it was time to set them free from PCA restrictions. These banks were of course unhappy with these restrictions – they were feeling hamstrung, for obvious reasons – but Government of India was unhappier, and made no secret of its displeasure. When push came to shove, Urjit Patel resigned as RBI governor, making way for a more obliging ex-bureaucrat who had earned his spurs as an establishment loyalist in course of the demonetisation (mis)adventure when he was Union Secretary of Economic Affairs. The new governor did not disappoint the government, though the RBI had to think up an extraordinary piece of sophistry to justify the withdrawal of the PCA restrictions from these 5 banks. But clearly the RBI was acting ‘in national interest’, so the irony of the central bank undoing its own regulatory intervention in the functioning of ailing banks was hardly noticed. Least of all by the ‘nationalistic-minded’ media. With elections just round the corner, the government expects the banks to unthrottle their loan lines to industry, thus pushing up sagging growth numbers. (Whether this will result, a few years down the line, in a repeat of the disaster-recovery cycle for these banks is anybody’s guess, though.) Of course, to make it possible, the government had to pump aggregate fresh capital of the order of Rs 361 billion into these 5 banks’ balance sheets. If anyone was watching, they would have known that, during the 2018-19 fiscal, the government has already secured from the RBI a dividend of Rs 680 billion (an all-time record). In other words, a significant portion of the bounty received from the central bank was used to eventually undermine a regime that the same central bank had put in place itself.

Of course, the RBI has quite a few other thorny issues on its hands right now. Last year, GOI persuaded LIC of India to step in as the majority stake-holder in trouble-ridden IDBI Bank. (How difficult things had turned for IDBI bank can be gauged from the fact that its gross NPA ratio had crossed 32%: which means every third rupee the bank had lent was clearly irrecoverable.) The deal was touted as a win-win scenario for both LIC and IDBI Bank, though the LIC’s retail clients wondered how sponsoring a sick bank could bolster the prospects of a fairly well-managed insurance outfit. Both GOI and LIC claimed that the bank’s branch network would come in handy for the marketing of LIC’s quite popular insurance products. This supposed synergy is not beyond doubt: some of the public sector banks that have been aggressive in the area of selling insurance have repeatedly attracted adverse scrutiny of regulators in recent years. Conflicts of interest, insufficient disclosures, even cases of deliberate mis-selling have been cited time and again, and the Central Vigilance Commission (CVC) has been obliged to step in to try and rein in overenthusiastic forays into insurance by commercial banks. But GOI had made up its mind and the LIC or its clients had few options. The insurer acquired the majority stake of 51% by January this year (by investing an additional Rs 200 billion in the bank’s equity), apparently obviating the need for GOI to have to bother about recapitalising IDBI Bank in the short and medium terms. Now, IDBI Bank happens to be one of the PCA banks and its early exit from the PCA framework looks very unlikely: it has been steadily losing money ( in fact its losses have been escalating at a quite fast clip: in the December, 2018 quarter, it posted a loss of Rs 42 billion, which was nearly three-times as high as the year-ago quarterly loss of Rs 15 billion) and in the December, 2018 quarter also, its gross NPAs stood at a staggering 30%. That does not stop either the bank or GOI from grandly announcing that IDBI will be unshackled from PCA restrictions by September, 2019. Even as all this was playing out, the RBI on 14th March, 2019 declared that since GOI is no longer the majority owner of IDBI, the bank will henceforth not be treated as a public sector bank. What happens as a result of this startling re-categorisation is that the regulatory framework for IDBI Bank changes with immediate effect: the RBI’s audit of the bank’s books will follow a different –many would say a more relaxed – architecture; the statutory external audit will be of a relatively limited scope; and, perhaps most importantly, the bank will go out of the ambit of the CVC, because private banks are not on the CVC’s watch-list. For a bank that can be said to have been in the eye of a storm for some years now, this leap of faith is quite extraordinary. (What is perhaps most note-worthy is the fact that, together, LIC and GOI still own over 97% of the bank’s equity.) But again this has failed to generate any serious commentator interest – maybe because all this is being done ‘in national interest’.

The story does not end here, however. Even as LIC becomes the arbiter of IDBI Bank’s destiny, the Insurance Regulatory and Development Authority of India (IRDAI), the country’s apex insurance regulator, seems intent on queering the pitch somewhat. IRDAI has now said that it has sought from LIC its definitive plans for reducing its stake in IDBI Bank ‘in line with the applicable ceiling of 15% of the investee bank’s equity’. So, after LIC was prompted by GOI to acquire controlling majority stake in the bank, it is now enjoined upon by the insurance regulator that it needs to dilute its stake ‘in a time-bound manner’. This, despite the fact that the IRDAI approved the original proposal of LIC picking up the 51% stake in the bank’s equity! The delightful irony of the mess-up does, however, appear to have been lost on the business media completely.

The irony is even greater in one other aspect of the banking story right now. Since mounting NPAs are widely recognised as the bane of the Indian banking industry, it will be worth our while to take a look at what was believed to be the magic bullet for this humongous problem – the Insolvency and Bankruptcy Code (IBC). By simplifying the process of sending failed and errant borrowers into bankruptcy, IBC was proclaimed, t the time of its enactment in 2016, to be the real game-changer. Now that it has been operative for close to three years now, has IBC changed the game for Indian banks? A recent example will be instructive. For the debt-ridden textile major Alok Industries Limited (AIL), the NCLT, Ahmedabad, recently put its seal of approval on a resolution deal that has gladdened the cockles of many hearts — particularly those of the successful bidders for AIL’s business: Reliance Industries Limited (RIL) and JM Financial Asset Reconstruction Co Limited (JMF ARC). AIL owed its lending banks an aggregate amount of Rs 295 billion, and, after a fairly long-drawn-out process of negotiations, the banks have now settled for a total payment of –hold your breath! –Rs 40 billion. Effectively this mean that the lenders are set to receive a little over 13% of what AIL owed them: in financial journalese, this translates into a ‘haircut’ of 87%. ( For retail or non-institutional borrowers, this ‘haircut’ would have been described in less edifying terms as a ‘loan waiver’.) Along the way, even the IBC Code itself had to be amended to make this path-breaking resolution possible. In terms of the original provisions of the IBC, a minimum of 75% of the lenders was required to approve a resolution plan for it to be valid. To break the AIL stalemate where 75% lender agreement seemed unachievable, however, this provision had to be relaxed and now the assent of 66% of the lenders is adequate to the requirements of an IBC resolution. For the record, 72% of the lenders had finally come around to the recognition that this was the best deal they could hope for. Will it be completely off the mark to suppose that here also the resolution problems were in the end ironed out ‘in national interest’? (The fact that AIL’s original promoters, who had run the business to the ground, got out of their liabilities with barely a scratch on either their reputation or their personal wealth, appears at first glance to make a mockery of the IBC dispensation. But considerations of ‘national interest’ help us see things in perspective.) And let us remember that in the books of these banks, the aggregate liability of AIL will be written down to Rs 40 billion: in other words, these banks will have cleansed their loan books to the extent of Rs 245 billion (295 minus 40), or reduced their NPAs by an equivalent amount. And that reduction in NPAs – funded by the banks’ own capital rather than by the borrowing company – will be counted eventually as a loan recovery. Purely by itself, this episode shines the light on the dark alley in which the Indian banking industry finds itself today.

Anjan Basu worked for over three decades for one of India’s largest commercial banks. He can be reached at [email protected]