Characterizations of the Tax Cuts and Jobs Act have followed agendas – its opponents maintaining it is a bill for the wealthy, and its supporters arguing that the bill fairly satisfies all economic levels.

A previous article, Failure of Trump Tax Cuts, analyzed the effects of the Tax cuts on the economy and showed that tax cuts do not pay for themselves; they do not generate additional revenue that compensate for the loss of government receipts.This article analyzes tax cut effects on individual wage earners. Four scenarios, representative of the tax paying public in years 2107 and 2018, are presented.

- Single tax payer using standard deduction,

- Single tax payer using itemizeddeduction of $16,000,

- Married taxpayer, two children, filing separately and using standard deduction, and

- Married taxpayer, two children, filing separately, and using itemized deduction of $16,000.

Effects on wage earners are not the sole means for evaluating the worth of tax bills; other factors will be considered.

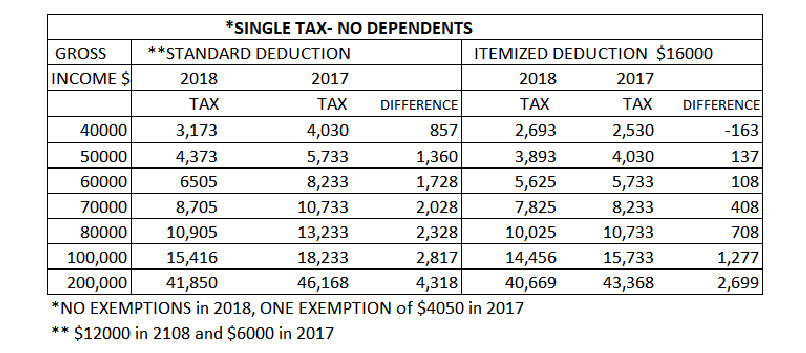

The results for single taxpayers, using the standard deduction, are shown on the left in the following table.

In 2017, this type of taxpayer added a deduction from a $4050 exemption to the standard deduction of $6000. In 2018, the standarddeduction was raised to $12,000, but no exemptions were allowed.

The singletaxpayer in 2018, using the standard deduction, had a $1950 advantage in taxable income compared to the single 2107 taxpayer. Because the tax rates were also lowered in 2018, a single taxpayer of equivalent gross income gained another advantage and paid less tax than in 2017.

Which earning group did the reduced taxes most benefit?

By absolute figures, the higher the earnings, the greater is the benefit. However, a more accepted manner for examining the figures is by proportion. By these criteria, the lower waged earners received the greatest benefit — 21% for low wage earner, 18% for high wage earner, and 9.3% for ultra-high wage earners.

The results for single taxpayers, using itemized deduction of $16,000 deduction, are shown on the right of the table.

In this case, the 2017 wage earner had an advantage. In addition to the $16,000 itemized deduction, the 2017 wage earner received a single exemption of $4050 applied to the deductions. The lower tax rates in 2018 offset this advantage, but insufficiently; none of the single taxpayers received much benefit, and the lowest wage earners actually paid slightly more taxes.

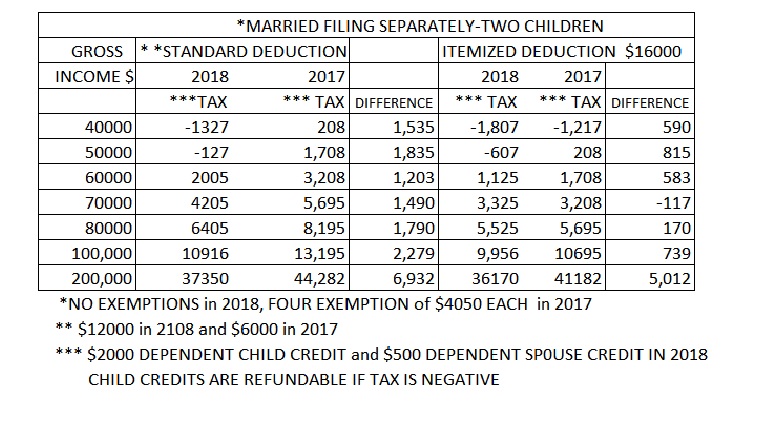

The results for the married taxpayer, using standard deduction, are shown on the left in the next table.

In 2017, this type of taxpayer was able, from four $4050 exemptions, to add a deductionof $16,200to the standard deduction of $6000. In 2018, no exemptions were allowed, even for married families.Offsetting this disadvantage were the child and spouse credits. In 2017, each dependentchild, created a $1000 tax credit, directly off the bottom line of the tax statement. In 2018, each dependent child created a $2000 tax credit and a $500 tax credit was allowed for the spouse. In 2018, the child tax credits are refundable (not the spouse credit), which means a negative tax, up to $1400, is refundable.

The higher tax credits in 2018 enabled all of these types of married taxpayers ($4500 tax credits) to reduce their taxes in 2018. Note that the difference in taxes between the 2018 single taxpayer using the standard deduction and the married taxpayer using the standard deduction is exactly $45000. In this scenario, the absolute tax gain was almost equal between all wage earners, except the ultra-high wage earners. Proportionately, the lower wage earners received the most benefits.

The results for married taxpayers, using an itemized deduction of $16,000, are shown on the right of the table. In this case, by itemizing deductions, just as for the single taxpayers, the 2018 married taxpayers lost the $6000 advantage they had compared to the 2017 taxpayers. The combination of loss of this advantage, together with the difference in tax credits and tax tables for the two tax years, made erratic differences between taxpayers from the two years. Generally, the absolute advantage for the 2018 taxpayer was small, even going negative for middle-income wage earners.

For this scenario, only the ultra-high wage earners managed to maintain a distinct advantage in the 2018 tax year. The low wage earners had a decent advantage, but the $1400 limitation in the tax credits limited the advantage.

Other Considerations

The analysis uncovers the inutility of the standard tax deduction, which only moves the income down the tax schedule. As an example, a single wage earner of $40,000 in 2018 who uses the $12,000 standard deduction pays the same tax as a wage earner of $38,000 in the same tax schedule that has no standard deduction. For those who itemize deductions, subtracting $12,000 from their deduction steers taxpayers to itemize deductions only when they have more than $12,000 in deductions. Similar reasoning applies to the exemption; it also only shifts the tax table by the exemption, which every single taxpayer has, by the exemption amount. Having a standard deduction and an exemption make it seem that the Internal Revenue Department is being considerate of taxpayers, but all these considerations do is raise the level at which it is beneficial to itemize deductions. Is it not simpler and preferable to have neither a standard deduction nor exemptions and modify the tax table to more equitably distribute taxes?

Married taxpayers with children, who also have no exemptions in 2018, have a $500 tax credit for the spouse and a $2000 tax credit for each child. Regardless of the taxable income, all taxpayers receive the same credit. Is this fair or logical? Should the lower income groups, in which the care of a dependent child is a greater percentage of available income and, therefore, a greater financial burden, receive more benefit? Tax credits are a correct approach, but shouldn’t they be inversely proportional to the income? As an example, a wage earner with dependent children, could receive a tax credit by the formula

N X K/I = TC

where N= number of dependents, K = Tax Credit for one dependent, I = income, and TC = Total tax credits.

As an example, if N=2, K= 80 (expressed in 000), and I = 40 (expressed in 000), then

TC = 4 or $4000.

If I = $100,000, then TC = $1600.

Although the Tax Cuts and Jobs Actmanaged to save all 2018 wage earners somethingin their taxes, the savings begs another question, “Were the benefits sufficient to warrant the Tax act?” Entering into the discussion is that the reduced taxesincreased the federal deficit. Regarding the entire situation from a total perspective, we have the increased deficit essentially financing the tax cuts. Wage earners received a temporary loan from the government, which should be repaid one day by increased taxes. Should be, but not definitely – the deficit monotonically increases with no regard of ever reducing it.

The tax cuts could have been used to re-distribute the wealth – heavy tax cuts for low wage earners and no tax cuts for ultra-high wage earners. Why give those earning $200,000 another $5000 and low wage earners only another $1500? Shouldn’t it be the other way? Better yet, why not make tax cuts, budget neutral, and have low wage earners receive sizable tax cuts and ultra-high wage earners pay more taxes to compensate for the revenue lost to the government planners..

Going further, why has the administration bothered to spend huge dollars for preparing, legislating, and managing new income tax policies that gave $6000 to people who already had after tax income of $160,000, and served to increase the federal deficit and support their largesse? Why did it not keep the same tax legislation and use the costs incurred for the new tax legislation together with the monetary benefits that occurred with the new legislation and use the total revenue to assist the least advantaged citizens of the American economy?

Conclusions

(1) The Tax Cuts and Jobs Actmainly favored those using the standard deduction.

(2) From a proportional saving perspective, lower wage earners gained mostly from the Act

(3) The fact that the Act was not budget neutral, and increased the deficit, its effectiveness is definitely judgmental.

(4) A more meaningful and fair Tax Cuts and Jobs Act gives more decisive benefits to all low wage earners and serves to redistribute the wealth.

(5) Reappraisal of the income tax should have included a reappraisal of the worth of the standard deduction.

(6) The tax credits gave equal weight to all income levels, which does not seem fair or logical.

(7) The most debatable feature of theTax Cuts and Jobs Actis that it assumes that the function of income taxes is to regulate consumer purchasing power rather than provide adequate revenue for government programs.

Americans for Tax Reform and Grover Norquist take note: There is no evidence that income tax cuts pay for themselves or stimulate the economy. Until poverty is eliminated, tax cuts are meaningless if they only give more funds to those who already have adequate means to live.

Dan Lieberman is the editor of Alternative Insight, a monthly web based newsletter. His website articles have appeared in online journals throughout the world. Many have served as teaching resources in several universities and several have become Internet classics, each attracting thousands of readers annually. Dan can be reached at [email protected]