The current turmoil in financial markets was set off by the Trump administration’s threat to impose tariffs on an additional $300 billion worth of Chinese goods and its decision to label China a “currency manipulator,” following Beijing’s move to allow the renminbi to fall. The extreme volatility has prompted questions about the stability of the global financial system.

But the latest round in the US-China conflict was only the catalyst for the emergence of these issues. Under conditions where the world economy is clearly on a recessionary trend—the euro zone is slowing and the UK economy contracted in the second quarter—the deeper question now coming to the surface is how long central banks can continue to pump money into the financial system without setting off a systemic crisis?

Having cut interest rates to record lows in response to the global financial crisis of 2008, the world’s major central banks have reversed their policy of trying to “normalise” monetary policy and are moving to provide further stimulus.

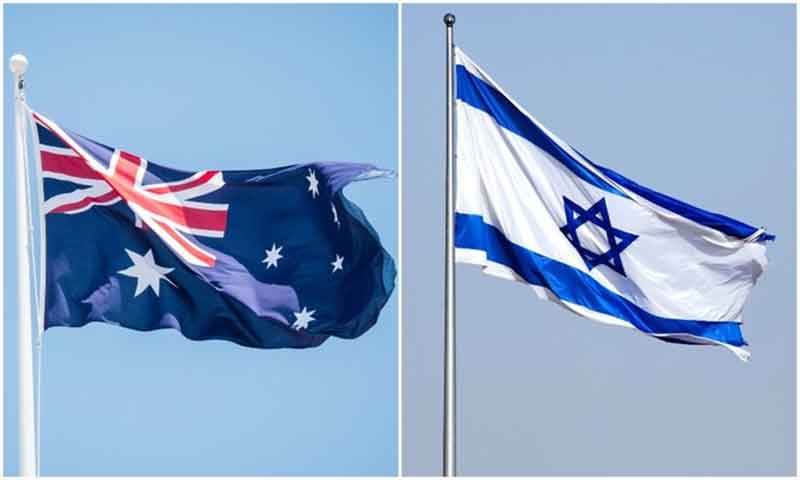

The US Fed cut interest rates last month and is set to do so again in September, with the prospect that more cuts may follow. The European Central Bank has signalled it is looking to further ease monetary policy at its meeting next September, and the central banks of Australia, New Zealand, India and Thailand have already moved and cut their rates.

The results so far have created a historically unprecedented situation in bond markets. It is estimated that some $15 trillion worth of government bonds are trading at negative yields, meaning an investor who purchased the bond and held it to maturity would make a loss.

This phenomenon may spread still further. Over the weekend, the Wall Street Journal published a lead article with the headline “Investors Ponder Negative Bond Yields in the US.” It quoted one financial analyst who noted that if you had raised the prospect of negative rates 10 years ago you would have been “laughed out of the room,” but now “people are getting on board the negative-rate idea very quickly.”

The fall in long-term interest rates is essentially a vote of no confidence in the prospects for global growth, as investors seek safe havens for the cash that has been injected into the system. If there were opportunities for profitable investments in the real economy, money would move in that direction. Instead it is being pushed into financial assets.

In the market for equities, this leads to higher stock prices. It also brings higher bond prices, pushing down their yield, since the two factors move in the opposite direction.

In an expression of the growing concern, the Journal article cited another analyst who said he was “perplexed” over yield levels and it was as if “Armageddon is being priced in.”

Across the Atlantic, similar concerns have been voiced in the pages of the Financial Times. As a column by Rana Foroohar noted, the market volatility was “ostensibly triggered by the US-China conflict turning into a full-blown currency war.”

But, she continued, at its heart it was about the “inability of the Federal Reserve to convince us that the July rate cut was merely ‘insurance’ to protect against a future downturn,” when, “as any number of indicators now show… the global downturn has already begun.”

However, stock markets have in general continued to rise. But this is not an indication of health, as stocks are rated at their most expensive levels in more than a century. “I don’t think it’s a question of whether we’ll see a crash—the question is why we haven’t seen one yet,” she wrote.

There were “plenty of worried market participants,” as evidenced by the record levels of negative-yielding bonds around the world. When many are prepared to pay for the “security” of losing a little bit of money as a hedge against losing a lot, “you know there’s something deeply wrong in the world.”

The article pointed out that the Fed’s decade-long Plan A—“blanket the economy with money, and hope for normalisation”—had failed, and there was no Plan B. It cited recent comments by well known analyst Dave Rosenberg of Gluskin Sheff that “the private sector in the US is choking on so much debt that lowering the cost of credit… won’t cause much of a demand reaction.”

The Fed was now “pushing on a string”—a term first coined in the 1930s to describe the central bank’s inability to create additional growth in the real economy by means of an easier monetary policy.

“It didn’t work then, and it won’t work now,” Foroohar wrote. “You cannot solve the problems of debt with more debt. And central bankers… can’t create real growth; they can only move money around. At some point, the markets, and the real economy must converge.”

Such a “convergence” will not only result in a crash in financial markets. It threatens to go beyond what took place in 2008. This is because central bank policies of the last decade, involving the injection of tens of trillions of dollars into financial markets, have called into question the stability of the international monetary system itself.

This is seen in the increased demand for gold as the ultimate basis of value in the global capitalist economy.

For the past four decades and more, it has been asserted that the analysis made by Marx in Capital that the monetary system had to be based, in the final analysis, on a commodity that embodied real value, resulting from the expenditure of human labour, was null and void.

This claim was based on the development of an international monetary system based on fiat currencies, backed by the power of the state, in the period following US President Nixon’s removal of the gold backing from the US dollar in August 1971.

But now there is an increasing lack of confidence in the stability of this system, reflected in the growing demand for gold, much of it resulting from purchases by central banks, which has lifted its price above $1,500 per ounce—the highest level in six years.

Earlier this month, the Financial Times reported that data released by the World Gold Council showed that central banks, led by Poland, China and Russia, had made the “largest acquisition of the precious metal on record by public institutions in the first half of a year.”

“The pattern advances on last year’s activity in which central banks hoovered up more gold than at any time since the end of the gold standard… in 1971,” it said.

The push into gold is also reflected in financial markets, as investors move into exchange traded commodity funds (ETFs), with gold-based ETFs playing a leading role as a hedge against growing financial uncertainty. While this does not involve the direct possession of gold, it is another indication of the trend of developments.

Marx once explained that the laws of capitalist economy do not operate openly and transparently. They can be hidden for long periods of time, but eventually they assert themselves in the same way as the law of gravity when a house crashes down about our ears.

These laws, expressed in economic data, have an essential social content. That is, they express the relations between classes—above all between the working class and the bourgeoisie, now dominated by a financial oligarchy.

The course of the financial crisis will no doubt take many unpredictable twists and turns. But one thing is certain: every step will bring an increased response from the ruling financial elites as they attempt to restore value to their mountain of fictitious assets, created through the press of a computer button or the operation of an algorithm, by intensifying the attacks on the working class, going far beyond those initiated in response to the crisis of a decade ago.

Originally published in WSWS.org

SIGN UP FOR COUNTERCURRENTS DAILY NEWS LETTER