Modi government has recently doled out 1.45 lakh crore gift to the corporate houses[i]. For the last five years, the corporates in India in connivance with the Modi government, has been accruing financial burden to the country leaving behind the majority of the poor people to be future slaves. The Modi Government is doling out tax payers` money to the corporate houses and in return his Bhartiya Janata Party (BJP) is getting huge political funding. ADR analysis revealed that corporates donated 93% or Rs 915.596 Crores (9.16 billion) to BJP in FY 2016-17 and 2017-18[ii]these figures shows that as of today the BJP is the richest party in India.The political and corporate corruption under the Modi Government increased manifold. This corruption has further suffocated the welfare schemes and reinforced oppression & exploitation of the poor people of India.

Business and politics go hand in hand in India. The majority of the politicians are running businesses therefore they have complete grip on the government funds available under various schemes. As T. N. Ninan, a prominent editor noted:

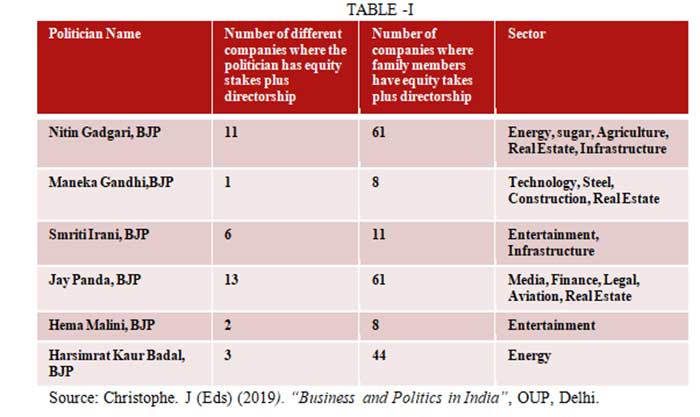

Rajeev Chandrasekhar, BJP Rajya Sabha MP, who ran a telecom business before selling out to become an investor (including in the media) told James Crabtree of the Financial Times: “We have a completely unique phenomenon in India, which I call political entrepreneurship, that has taken roots in the last five to six years…They (the politicians) are saying: “we do not want briefcases full of cash and Swiss bank accounts and all that any more. We want to own businesses ourselves. We want equity stakes[iii].The Table- I illustrates the involvement of the BJP Members of Parliament & their family members in money generating businesses in India.

The BJP Members of Parliament and their family members own number of companies, equity shares plus Directorship[iv].

The data in Table-I shows that rich BJP Ministers or their political allies have already entered into money generating businesses in India. With their entry into the money generating businesses two things are crystal clear that (1) they will not allow the poor people to lay hands on the government funds; (2) government policies will be formulated in the larger interest of the corporate houses of which they themselves are the members.

We can also safely conclude that the BJP Members of Parliaments have no inclination towards education sector. They know it very well that an educated person will certainly revolt and demand for his or her rights as enshrined in the constitution of India. It is, therefore, most of the BJP Members of Parliaments are not into the business of education. Their empty speeches from the public platforms for the education of poor people is nothing but a sham. They know that the money does not lies in educating the underprivileged, marginalized children but in real estate, construction, energy so & so on. On the other side, in such types of businesses there are plenty of chances to smuggle out money to different countries in collaboration with multinational companies. The rich Brahmins of India have devised new strategy to evade tax through religious trusts. Recently, Income Tax Department has raided 40 premises of religious trusts and other entities that preach about “oneness philosophy” and run wellness centers and found Rs 5 billion undisclosed income and links to investments in tax havens[v].

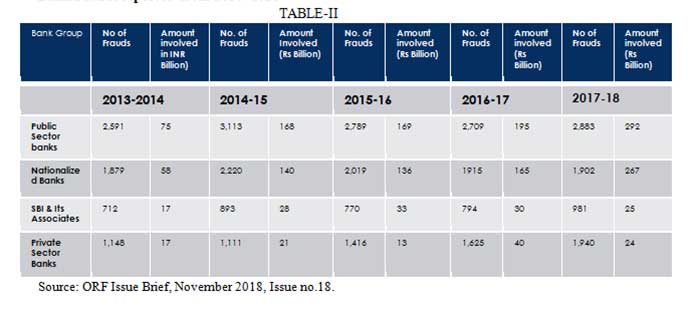

During Atal Bihari Vajpayee BJP government, the disinvestment drive was shot in the arm. The purpose behind disinvestment was to control the wealth of the country. Under economic freedom, the BJP and its Members of Parliaments have captured all central as well state financial resources. The BJP leaders and Members of Parliament have tight grip on money generating industries in India, it is, therefore, Indian millionaire, billionaire in the Forbes list is increasing day by day from the BJP kitty. Who are these millionaire, billionaires? How their wealth is increasing year by year despite the larger sections of the Indian people are struggling to meet both ends. There is a longlist of such BJP Members of Parliaments and their family members whose income rose from 2014 to 2018 under Modi. Modi proudly says in the public meetings that ‘neither I will eat, nor will I let others to eat’. But the data shows the real picture of the Modi government. There is a great difference between speech and action. Bank defaulters are increasing day by day under the thump of the Modi government. The Table-II illustrates how corporate houses in the name of development under the thump of Modi Government are squeezing public money from the nationalized and private banks.

Bank Frauds reported from 2014- 2018

As per the Table –II, under the Modi government, bank frauds in public sector banks increased from Rs. 75 billion to Rs. 292 billion which is approximately 289 percent increase in total. In private sector banks it increased from Rs. 17 billion to Rs. 24 billion which is approximately 41 percent. This shows that frauds in the public sector banks are much higher. This plunder of public money shows that the Modi government is in favor of the corporate houses.

According to Panagariya, Indian economist, government choose to give subsidies on the consumption of specific items such as food, fertilizers, electricity, water, and high education. Often these subsidies are hijacked by the rich consumers. He further writes that default rates are extremely high[vi]. The subsidies funds meant for the poor people are usurped by the middlemen and touts despite digitalization of the system.Poor people especially in the villages of India cannot operate technical systems hence they always seek the help of those who are well –versed with the functioning of computers & internet. The idea of Corporate Social Responsibility has become a tool for the corporate houses under the Modi Government to avoid tax. Schedule VII refer to the activities which may be included by the companies in their CSR activities related to eradicating poverty, promoting education, promoting gender equality, and ensuring environmental sustainability, training to promote rural sports. According to the 2013 Act[vii], the companies require to spend 2 percent towards CSR. India`s CSR reporting Survey 2018 published by KPMG, shows that 33 companies have spent less than the prescribed CSR amount towards CSR. The percentage of amount spent by the telecom sector of the prescribed amount has significantly decreased from 50 percent in 2106-17 to 19 percent in 2017-18(CSR spends of INR49.16 crore, while the prescribed amount is INR 254.64 crore)[viii]The majority of the big corporate houses are manipulating CSR funds to their financial advantages.

From 2014 to 2018, under the Modi incompetence, political & corporate corruption have increased manifold. As of today, the Modi Government`s total Public debt increased by 4%. The total public debt (including liabilities under the ‘Public account’) of the Government as per provisional data, increased to Rs 78, 79,601 crore in 2019 from Rs 75,79,036[ix].The Modi government has nurtured the corporate houses with financial concessions & privileges resulting into unfettered capitalism.The role & duty of the government is to curb the monopolies but the Modi government has been reinforcing the monopolies since its inception which is quite dangerous to the people of India. The Modi government in connivance of corporate houses privatized the Indian railways therefore making it more difficult for the common man to travel across India.

In the prevailing circumstances, members belonging to the poor sections of the society should not expect much in terms of welfare from the bankrupt, myopic, totteringModi Government when Modi and his government Ministers, bureaucrats own the money generating businesses.The CEOs of the corporate houses are well connected and to know how to extract public funds for their own & family advancement. The lion share will always be usurped by the corporate houses in connivance with the Ministers, bureaucrats and politicians. The working middle class people will feel the pinch in the coming years. They should be mentally prepared for the worse to follow. While enriching corporates in India, the government is likely to discontinuing disbursement of medical bills, pension payments.

The financial condition of the Government is so bad that in the coming days all flagship schemes launched by Modi in 2014 will die sooner or later due to mismanagement of funds.The degree of colossal damage being caused by the Modi Government while strengthening hands of the capitalist class is unimaginable. Even Modi followers, blind in their loyalty, have shut their eyes permanently to stultification of the country.

On the one hand, the irony is that poverty-stricken & underfed people in India have neither education nor physical & economic energy to annihilate economic domination of the rapaciousness corporate houses. On the other hand, it is shameful to note that the so –called rich & educated retired flunkey, subservient socially privileged & economically sound economists, bureaucrats are awfully busy in licking the boots of the Modi government in search of plum government posts.For the sake of the country, the educated class of India, must leave behind their selfish interests and come forward to take the lead.

Dr. Rahul Kumar holds a PhD inSociology from the Department of Centre for the Study of Social Systems, Jawaharlal Nehru University, Delhi. India. He is a visiting freelance faculty and teaches sociology courses to the undergraduate college students. He is an independent researcher and senior media columnist. His research & writing interest extend to macro social, economic, political & international affairs. He is working currently with the “The Asian Independent UK” newspaper as a Bureau Chief (Asian Region). His book on “Elderly Punjabis in Indian Diaspora” traces trajectories of Elderly Punjabi migration to U.K. He is a member of the Editorial Committee of Global Research Forum for Diaspora and Transnationalism (GRFDT) New Delhi. India. The views expressed by the author in this article are personal and do not necessarily reflect the official policy of the paper.

REFERENCES

[i]https://www.newsclick.in/Corporate-Tax-Concession-Modi-Government-Joblessness-Economic-Slowdown.

[ii]ADR Report – Analysis of donations from corporates & business houses to National Parties, FY 2016-17 & 2017-18, https://adrindia.org/content/analysis-donations-corporates-business-houses-national-parties-fy-2016-17-2017-18.

[iii] Christophe Jaffrelot, Kohli Atul, & Murali Kanta. (2019)(Eds).Business and Politics in India, Oxford University Press. New Delhi. p.

[iv] Ibid.

[v]https://gulfnews.com/world/asia/india/india-income-tax-raids-on-religious-trusts-reveal-rs5-billion-black-money-1.1571406232903.

[vi] Panagariya, Arvind. (2019). Free Trade & Prosperity: How Openness Helps Developing Countries Grow Richer & Combat Poverty, Oxford University Press.p.141.

[vii]The 2013 Act requires that every company with net worth of500 crore or more, or turnover of1,000 crore or more or a net profit of 5 crore or more during any financial year will constitute a CSR committee.

[viii] India`s CSR reporting survey 2018, available at https://assets.kpmg/content/dam/kpmg/in/pdf/2019/01/India_CSR_Reporting_Survey_2018.pdf

[ix]. PHD Chamber, 2019 Quarterly Report.

SIGN UP FOR COUNTERCURRENTS DAILY NEWS LETTER