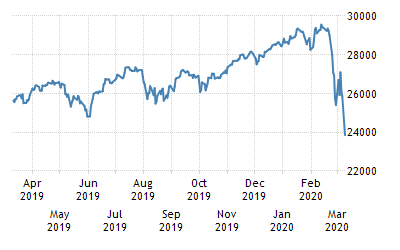

Stock markets are bearing the burden of oil slump and coronavirus fear. Stock markets across the world tumbled on Monday, and the fall in global oil prices after the OPEC+ deal collapsed. European markets fell by as much as 11.17 per cent during the course of the day’s trading.

Last week the Organization for Economic Cooperation and Development (OECD) said a severe outbreak of the coronavirus could see global growth down by 0.5 to 1.5 per cent.

Stocks cratered as markets closed on Monday, with the Dow down close to 7 percent in the largest single-day drop in NYSE history and the S&P and Nasdaq not far behind. Coronavirus, officially known as COVID-19, and a drop in oil prices are playing their role.

The Dow was down 7.8 percent at the close of trading on Monday, with the S&P and Nasdaq not far behind at -7.61 percent and -7.29 percent, respectively.

Plunging oil prices – the commodity lost 30 percent of its value overnight – and coronavirus-related panic took a big bite out of stock values, leading to one of the worst trading days since the 2008 crisis.

The U.S. was not alone in having its bottom drop out – markets around the world were feeling the sting, from Greece, hit the worst with a 13 percent drop to China, which got off comparatively easy at -3 percent.

However, China has been feeling the effects of the coronavirus panic for longer than anyone.

The epidemic has depressed demand for oil, leading to the price drop that triggered the day’s panic-selling – a vicious cycle that doesn’t seem likely to stop anytime soon.

The epidemic, which has hit most of the world’s economic hotspots, and OPEC meeting last week Vienna failed to reach an agreement to further cut production to shore up prices. The wider alliance, OPEC+, met in Vienna on March 7 to discuss a potential cut of another 1.5 million barrels per day (bpd) above an existing pact to reduce production by as much as 2.2 million bpd from the start of 2020. OPEC has had production cutting pacts since 2016 with its non-member allies led by Russia.

Russia objected to the production cut, instead holding out to maintain existing cuts, only for Saudi Arabia to offer its oil at an even deeper discount while suggesting it would increase production. The resulting price war triggered a massive tumble in value, sending the commodity down to levels not seen since the 1991 Gulf War.

While Russia has insisted it can weather the collapse, analysts have warned that both the Saudis, whose economy is almost entirely dependent on oil, and the U.S. shale industry, which pays considerably more to get the commodity out of the ground, are imperiled by continued low prices.

But the crash could be just a temporary setback. “Markets nearly always overreact in the short term,” said Peter C. Earle, a research fellow at the American Institute for Economic Research.

The expert said: “At present equity markets around the world are responding to uncertainty about the economic impact of the coronavirus. But while the Saudi move is likely to be bad for oil companies, oil is a major factor of production and lower prices actually constitute a very positive development for most other industries and consumers as well.”

Oil prices fell by more than 30 percent on Monday.

The value of April futures for WTI crude oil fell by 31.35 percent to $28.33 per barrel.

Oil prices bounced back slightly on Monday after registering a 30 percent drop on the news that Saudi Arabia was seeking to reclaim its share of the crude market after a pricing dispute with Russia.

Brent futures for March delivery climbed to $36.60 dollars per barrel, a decrease of 19 percent. West Texas Intermediate (WTI) futures for April slumped 20.13 percent to $32.97 per barrel.

Both crude benchmarks were reported to have crashed by more than 30 percent earlier in the day to four-year lows amid fears of an oil trade war between the two major producers who failed to agree deeper output cuts last week.

The Saudi Aramco’s stock prices fell by the maximum allowable 10 percent to 27 riyals ($7) at the opening of trading on Monday.

On Sunday, its shares traded below the original IPO price of 32 riyals for the first time since December, which was a 6.36 percent drop.

U.S. West Texas Intermediate (WTI) crude plummeted by more than 27 per cent, to $32.30 a barrel, after initially falling 33 per cent to $27.34 – its lowest since February 12, 2016.

Russian companies listed on the London Stock Exchange (LSE) took a hit on Monday with Lukoil and Rosneft shares plunging by over 20 per cent, stock exchange data showed.

The cost of Rosneft’s and Lukoil’s global depository receipts (GDR) plummeted by 21.43 and 22.13 per cent to $4.53 and $62.98 respectively, while Novatek’s shares dropped by 19.96 per cent to $111.5.

Gazprom and Gasprom Neft shares decreased by 17 and 16.88 per cent to $4.55 and $22.9 respectively.

Nornikel’s shares fell by 10.81 per cent to $28.89, while Severstal suffered a 7.91 per cent loss in its shares’ cost that reduced to $10.94.

Steel manufacturer, NLMK Group, saw its shares fall by 14.49 per cent to $14.93.

In the banking sector, VTB’s and Sberbank’s stocks plunged by 11.93 and 18.01 per cent to $105 and $10.61 respectively. Shares of TCS Group Holding that includes Tinkoff Bank decreased by 17.18 per cent to $14.08.

GDR of AFK Sistema dropped by 15.31 per cent to $3.65 and that of Magnit reduced by 16.77 per cent to $8.35.

U.S. stocks tumbled more than 7 percent on Monday, with the key Dow index falling more than 1,800 points, reacting to the tumble in global markets after oil prices collapsed in the aftermath of an expected Saudi-Russian price war.

The steep plunge triggered a halt to trading for 15 minutes.

Major European stock exchange indexes plummeted on Monday due.

FTSE 100, a benchmark for the UK’s largest companies, plummeted 7.69 per cent to 5,965.77 points after Shell and BP saw their shares fall.

French CAC 40 dived 8.39 per cent to 4,707.91 points, while Germany’s DAX lost 7.94 per cent, landing on 10,631.63 points.

Italy’s stock market index FTSE MIB was hit the hardest, posting an 11.17 per cent loss and plunging to 18,475.91 points, its biggest fall since the 2008 financial crisis.

Stock markets in the Asia Pacific also recorded tremendous losses.

Fears of the Covid-19 epidemic sparking a recession in Australia witnessed the share market closing at 7.4 per cent down.

In Japan, the Nikkei fell more than 5 per cent, Hong Kong’s Hang Sen lost 3.9 per cent, and a drop of just slightly over 3 per cent was registered at the Shanghai stock exchange.

Japan’s benchmark closed down 5.1 per cent, while Australia’s lost 7.3 per cent and the Shanghai market in China was off 3 per cent.

Buenos Aires stock exchange opens with a 9% decline.

The Sao Paulo B3 stock exchange has halted trading after the main Ibovespa index lost 10.02% at the opening of the session, falling to 88,178 points. Brazil’s Petrobras oil company was the biggest loser with its shares down by 24.8%.

Egypt’s EGX 30 was staying at about 10,978 points, while EGX 100 was at about 1,167 points with a 5.70 percent slump.

The U.S. urges ship captains to take photos of any illegal ship-to-ship transfers of sanctioned oil, Deputy Assistant Secretary of State David Peyman said Monday.

“We are convinced that the lack of consensus among OPEC countries and non-member states is an unexpected event that has negative implications for the cooperation of both parties,” said a representative of the ministry Kasra Nouri.

Iran believes that in order to maintain balance in the oil market, supply needs to be reduced, which in turn means that negotiations to achieve mutual understanding on this issue will sooner or later be necessary, Nouri added.

“The Russian oil industry maintains a high-quality resource portfolio and sufficient financial strength to remain competitive at any predicted price level, as well as maintain its market share,” said Russian energy minister Alexander Novak.

He added that Russia proposed the prolongation of the OPEC+ deal to the second quarter, however OPEC members opted to increase output and fight for market share.

Novak, who spoke with Prime Minister Mikhail Mishustin at a cabinet meeting, said the Russian oil industry had enough liquidity to outlast any drop in prices and preserve its market share.

White House Advisers plan to present Trump with list of measures to boost economy amid Coronavirus fears, said a reports.

U.S. President Trump is expected to meet with Treasury Secretary Steven Mnuchin and other advisers to contemplate an action plan in the face of the coronavirus outbreak, a source in the administration told Reuters.

Trump blames Riyadh, Moscow and “the Fake News” for the market slump.

The European Commission strives to comprehensively address the strong impact of coronavirus on the European Union’s economy, Commission President Ursula von der Leyen said on Monday.

“The spread of the virus has a vast impact on people’s lives, but it also has a vast impact on our economy. We are looking into everything that we can do to help to address the impacts on the economy,” von der Leyen said at a press conference.

She said a “strong coordination” was ongoing between the commission and Europe’s leaders, as well as European institutions, to address this topic in a “coordinated and coherent way.”

Commissioner for International Partnerships Jutta Urpilainen, in turn, said during a joint press conference with EU High Representative for Foreign Affairs and Security Policy Josep Borrell that the Union would “try to support [its] partners in Africa in order to strengthen their health care system and health security,” when asked about the coronavirus spread in Africa. She said that of the 300 million euros ($342 million) that the commission had issued in extra financial support two weeks ago, “part … is going to Africa.”

A week ago, the Organization for Economic Co-operation and Development (OECD) predicted a slowdown of the global GDP growth to as little as 1.5 percent in 2020 if the spread of novel coronavirus intensifies. Even if the spread worldwide is contained, the OECD forecast the global GDP to not grow beyond 2.4 percent, which is 0.5 percentage points lower than previous estimates.

The global demand for crude oil can be expected to recover after a sharp drop amid price fluctuations in the second half of 2020, the International Energy Agency said in a report on Monday.

“For the first time since 2009, demand is expected to fall year-on-year, by 90,000 barrels per day,” the report read, citing the spread of coronavirus beyond China. “We assume that oil demand returns to close to normal in 2H20.”

Depending on how the virus spread proceeds worldwide, the watchdog has outlined its expectations under two possible scenarios.

“Our pessimistic low case assumes that countries already affected by the virus recover more slowly while the epidemic spreads further in Europe, Asia, and beyond,” it said in the report, adding that “In this pessimistic case, global oil demand could decline by 730,000 barrels per day in 2020.”

Conversely, if the epidemic’s impact is successfully mitigated, the IAE expects global oil demand to grow by 480,000 barrels per day.

The overall forecast for the year is for oil demand to be 99.90 million barrels per day, with the annual forecast, thus, lowered by close to a million barrels per day.

As for Russia, the IAE maintained its forecast for hydrocarbon gas liquids production in 2020 at 11.59 million barrels per day, despite the Saudi-led OPEC’s failure to agree on deeper production cuts.

The growth rate will amount to 0.01 million barrels per day, according to the report.

Algeria has been negotiating oil prices stabilisation with its partners since Friday and considers it necessary to adopt urgent measures to deal with the current situation on the market, Energy Minister Mohamed Arkab said on Monday.

Arkab said that a similar situation had taken place in 2014, when oil was sold for $20 per barrel. The situation was solved by adopting the 2016 agreement in Algeria.

Iraq is holding talks with interested countries on a new oil deal to stop falling prices and stabilize the market in the wake of oil producers’ failure to agree on deeper production cuts, Oil Ministry spokesperson Asim Jihad said on Monday.

According to the spokesperson, it is currently unreasonable to supply additional volumes of oil to the world market, as this will lead to a further drop in prices, which will “cause significant harm, especially to producing countries.”

New York Fed to increase cash injections into financial markets by up to $150 bln daily.

The boost “should help support smooth functioning of funding markets as market participants implement business resiliency plans in response to the coronavirus,” the New York Fed said in a statement.

Goldman Sachs predicts oil price collapse to $20 a barrel.

The dollar index against a basket of currencies was down 0.4 per cent.

Peter Cardillo, chief market economist at Spartan Capital Securities in New York was quoted by Reuters as saying: “This is basically panic selling created by the sharp drop in oil prices. There is a lot of fear in the market and if the price of oil continues to move lower, it is an indication that a global recession is not far away. We see that with gold, Treasury yields collapsing and the dollar as well. We’re not that far from entering into bear market territory another sign of economic decay.”

Neil Wilson, the chief market analyst at the trading platform Markets.com, was quoted by The Guardian as saying:

“This will be remembered as Black Monday. If you thought it couldn’t get any worse than the last fortnight, think again.”

SIGN UP FOR COUNTERCURRENTS DAILY NEWS LETTER