That is the title of a Report by business-standard.com, April 29, 2020.

While the country is drowned in reports about Covid-19, this news did not so much attract the attention of people. We celebrate the World Press Freedom Day with a report on this issue.

The Indian media, known for its sensationalism did not somehow highlight it, nor gave it the coverage it deserved. Like so many events, Covid-19 came to the rescue of the government, in covering up the information. RTI helped in this case, but media minimized the damage to the Modi regime, as much as it could.

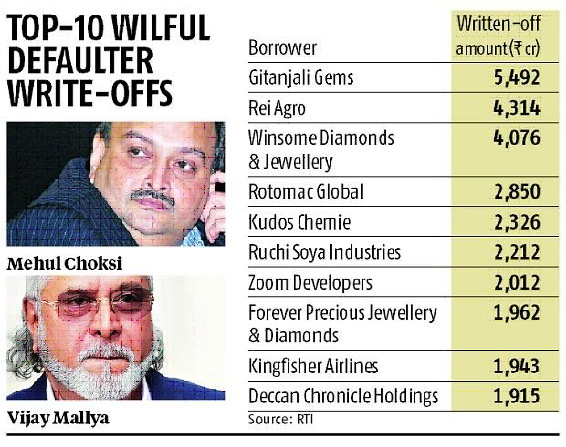

Indian banks have written off Rs 68,607 crore of debt of top 50 willful defaulters till September 30, 2019, said the Reserve Bank of India (RBI) in response to a petition filed under the Right to Information (RTI) Act. The list of top 10 is given at the end of this report.

The RTI query was filed by Saket Gokhale (photo below), an activist, on March 19 this year, and he received the list on April 24. It lists defaulters till September 30 last year, which means either the RBI did not update the list, or further willful defaults above Rs. 5 crore did not happen in this period to update.

The activist was seeking “details of the 50 top wilful defaulters and their current loan status till February 16.”

The RBI said the amount (Rs 68,607 crore) comprises outstanding and the amounts technically/prudentially written off till September 30, 2019.

The RBI reply thus lists defaulters till September 30 last year, which means either the RBI did not update the list, or further willful defaults above Rs 5 crore did not happen in this period to update, reported business-standard.com.

“The apex bank also declined to provide the relevant information on overseas borrowers citing a Supreme Court judgement of December 16, 2015,” Gokhale told IANS.

“I filed this RTI because Finance Minister Nirmala Sitharaman and Minister of State for Finance Anurag Thakur had refused to reply to this starred question asked in the Parliament by Congress MP Rahul Gandhi in the last Budget Session on February 16,” Gokhale told IANS.

Disclosing what the government didn”t reveal, the RBI”s Central Public Information Officer Abhay Kumar provided the replies on April 24, with several startling revelations in the ”diamond-studded list”, said Gokhale :

Six among the 50 top wilful defaulters are connected with the glittering diamond and/or gold jewellery industries, reported IANS. This sector is mostly concentrated in Gujarat, the home state of PM Modi and Home Minister Amit Shah, it may be noted.

Topping the list is Choksi”s scam-hit company, Gitanjali Gems Limited, which owed Rs.5,492 crore, besides other group companies, Gili India Ltd and Nakshatra Brands Ltd, which had taken loans of Rs 1,447 crore and Rs 1,109 crore, respectively. Thus this Group’s amount adds up to Rs 8048 cr.

Choksi is currently a citizen of Antigua & Barbados Isles, while his nephew and another absconder diamond trader Nirav Modi is in London.

Jatin Mehta’s Winsome Diamonds & Jewellery was owing Rs 4,076 crore. Harish R. Mehta’s Ahmedabad-based Forever Precious Jewellery & Diamonds Pvt. Ltd. owed Rs.,1962 crore.

Baba Ramdev is also on the list who owes Rs 2,212 crores. Absconder liquor baron Vijay Mallya’s dead Kingfisher Airlines Ltd. is also on the list owing Rs 1,943 crore.

Here’s the list of fugitive economic offenders who are residing abroad, according to thenews21.com : Pushpesh Baid, Ashish Jobanputra, Vijay Mallya, Sunny Kalra, Sanjay Kalra, SK Kalra, Aarti Kalra, Varsha Kalra, Jatin Mehta, Umesh Parekh, Kamlesh Parekh, Nilesh Parekh, Eklavya Garg, Vinay Mittal, Nirav Modi, Neeshal Modi, Mehul Choksi.

“I asked a straight question in Parliament – state the names of the 50 top bank loan defaulters in the country. The finance minister refused to answer the question. Now the RBI has given the names of Nirav Modi, Mehul Choksi and many of BJP’s ‘friends’ in the list of bank frauds. That is why this truth was held back from Parliament,” Rahul Gandhi said in a tweet in Hindi.

“A majority of them have defaulted prominent nationalist banks over the past several years and many of them are either absconding or facing action by various probe agencies and some are under litigation,” Gokhale said.

No industry however is sacrosanct as the top 50 willful defaulters are spread across various sectors of the economy including IT, infrastructure, power, gold-diamond jewellery, pharma, etc.

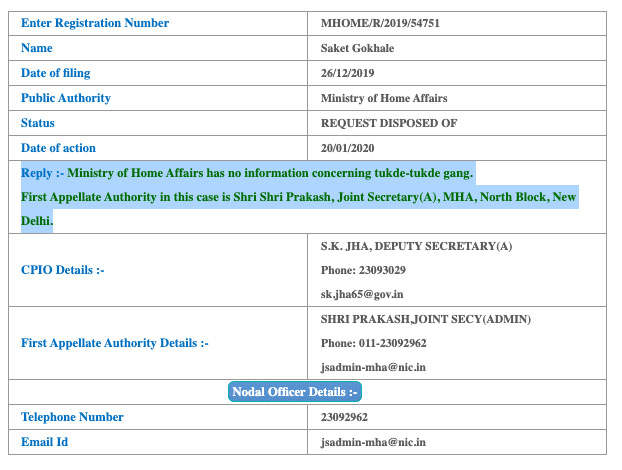

‘Tukde Tukde Gang’ :

It was the same activist, it may be recalled, who had asked, on December 26 , 2019, about the ‘Tukde Tukde Gang’.In a reply, dated January 20, 2020, The Ministry of Home Affairs (MHA) said that it has “no information” concerning the ‘Tukde Tukde Gang’ — a term that has been used a number of times by PM Narendra Modi and Home Minister Amit Shah to attack opponents.

In his RTI application, Saket Gokhle said Home Minister “Amit Shah addressed a public event in New Delhi, and in his address said, ‘The Tukde Tukde Gang of Delhi needs to be taught a lesson and punished’.” Gokhle’s RTI asked for details of the ‘Tukde Tukde Gang’. The home ministry, in its reply to Saket Gokhle’s RTI application, said, “Ministry of Home Affairs has no information concerning tukde-tukde gang.”

Like Amit Shah who stuck to the epithet ‘Tukde Tukde Gang’, despite RTI reply above, Finance Minister Nirmala Sitharaman stuck to the policy of the Govt., and took shelter under a technical explanation, which the Govt should have given in parliament, but avoided.

business-standard.com reported her argument:

Stung by the Opposition’s attack on the issue, Nirmala Sitharaman said that the Modi government was cleaning up the financial system, going after wilful defaulters, and accused the Congress of ‘sensationalising’ and being ‘brazen’ in misleading people on the subject.

“Congress and Rahul Gandhi should introspect why they fail to play a constructive role in cleaning up the system. Neither while in power, nor while in the opposition has the Congress shown any commitment or inclination to stop corruption and cronyism,” Sitharaman tweeted late on April 28 Tuesday night.

“Rahul Gandhi and Randeep Surjewala (Congress spokesperson) have attempted to mislead people in a brazen manner. Today’s attempt of Congress leaders is to mislead on wilful defaulters, bad loans & write-offs,” Sitharaman said.

Both are adept in the blame game, people by now realized. They play their due roles depending on who is in power at the given time.

The technical answer for the cover up is as follows:

The write-offs are technical or prudential in nature, which means the banks have made 100 per cent provisions against the loans. However, this doesn’t mean the banks have given up the right to recover the loans. It also doesn’t mean that banks have written off the entire loan, as some loans have been taken against security, which either can be or already has been recovered.

As and when they recover the money, it directly adds up to banks’ profits, and the provisions also come down by that extent (business-standard.com).

RBI maintains records of loans above Rs 5 crore given by banks, both fund and non-fund based, in its Central Repository of Information on Large Credits (CRILC) database. If any entity defaults, the RBI captures it.

The definition of a willful default is lengthy and conditional, but it simply points to a default by anyone who has the means to pay but won’t.

Gitanjali Gems, owned by Mehul Choksi, was a darling of the stock markets. Soon after the Nirav Modi scam came out in the open, the Central Bureau of Investigation (CBI) found that Choksi and Modi used the same tactics to defraud banks. Choksi, Modi’s maternal uncle, used to open letters of credit in the name of foreign suppliers.

The duo were helped by a few Punjab National Bank employees. Both Modi and Choksi showed fake transactions among various offshore entities and took Indian banks for a ride. The CBI and Enforcement Directorate filed a chargesheet against Choksi and other top officials of Gitanjali Gems.

The List of top 10 is as below:

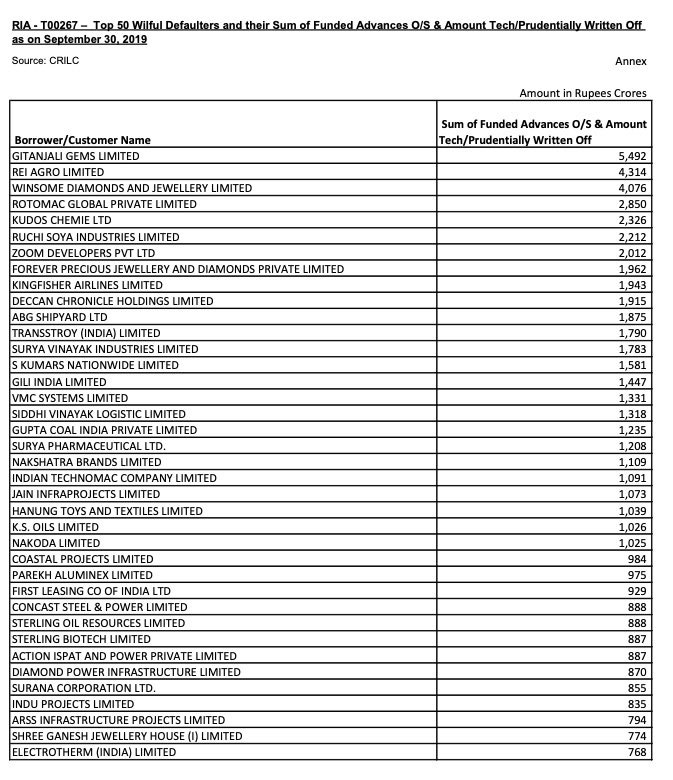

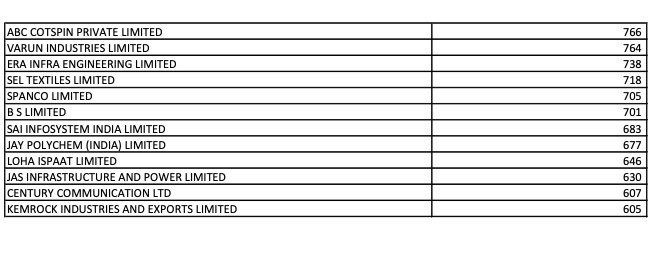

The Report on RBI’s list of wilful defaulters contained Top 10. Even the smaller but big enough defaulters should not be missed to be recorded. Hence this more detailed list, given as an Annexure by RBI.

Out of 50 listed below, there are seven companies in the Rs 2,000 crore plus segment; 18 companies in the Rs 1,000 crore plus segment. Another 25 companies fall in the sub-1K crore category with outstandings ranging from Rs 605 crore to Rs 984 crore, either individually or as group.

SIGN UP FOR COUNTERCURRENTS DAILY NEWS LETTER