Pradhan Mantri Jan Dhan Yojna (PMJDY) was launched in August 2014 by the Prime Minister Narendra Modi with the aim of providing banking facilities to the poor and to increase financial inclusion in the country. It aimed to open at least one basic banking account for every household and provide access to financial services such as savings and deposit accounts, remittance, credit, insurance, pension, etc. at affordable rates.

PMJDY) comes under Bank Deposit Accounts (BSBDAs) or no-frills zero balance account. It is a kind of saving account which does not impose service charges because the services offered by this account is quite limited as compared to the Regular Saving Bank Accounts which offers various banking services.

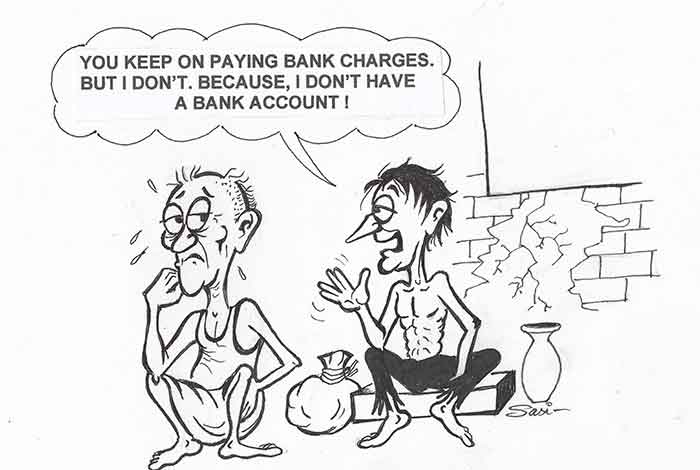

With the announcement of this scheme, government has encouraged and insisted large number of people to open their account with Jan Dhan because it doesn’t require maintaining minimum monthly average balance. Beneficiaries were also encouraged to use their nearby ATM’s, RuPay debit card and mobile banking facilities as much as possible. Therefore to avoid giving charges for minimum balance, many people (especially from economically weaker section) opened their accounts under Jan Dhan scheme with zero balance facility.

Till April 2020, total number of accounts opened under PMJDY scheme was 38.12 crores and over 29 crore account holders have been issued RuPay Debit Cards. Now when such large numbers of people started using Jan Dhan accounts then banks begun converting them into Regular Saving Bank Accounts. Along with other certain limits of availing banking services under this account, RBI has also fixed the number of withdrawals to four a month. This has also become an advantage for the banks because as soon as the customers exceed the limit of four withdrawals in a month and go for the fifth debit, they immediately covert their Jan Dhan accounts into the Normal Savings accounts. This conversion is getting done without informing or consenting customers. Till now vast number of Jan Dhan/BSBDA accounts have been converted into Regular Saving Account. According to a data, just 4 big Public Sector Banks, i.e. SBI, PNB, Bank of Maharashtra and UCO Bank have converted 3,380,861 Jan Dhan accounts into Regular Savings Accounts.

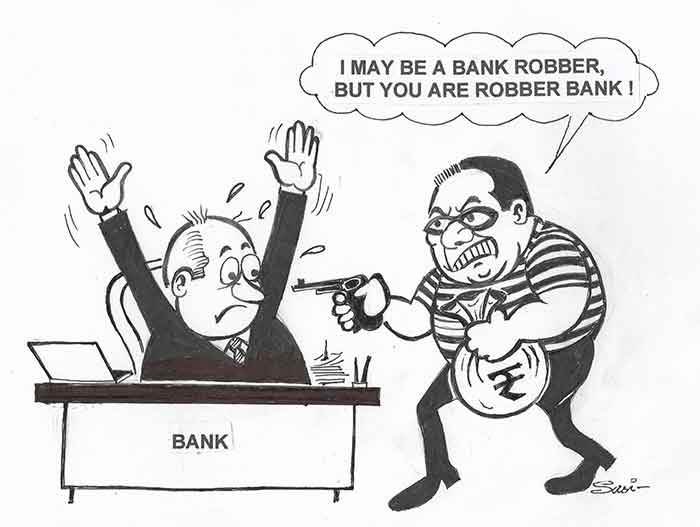

The main reason behind all these conversion is that the Regular Saving Accounts are subjected to levy numerous fees and charges on all banking services like charges for maintaining minimum balance, cash deposit/withdrawal, SMS alerts, balance inquiry, KYC related changes, debit card issuance/re issuance/replacement etc. So it gives a great opportunity for banks to impose bank charges and extract money even from their accounts too. Most of the customers are not even aware with all these several kinds of service charges being imposed on them.

Hence, all this pattern and designing of banking system which first encourages customers to open their accounts with zero balance, use debit cards, ATM machines, etc. and then convert it into normal saving accounts without even informing them shows that banks only want to penalize and impose service charges on poor and common customers in every possible ways. The very purpose of bringing such schemes like Jan Dhan Yojna becomes completely worthless by such unfair practices and charges. So the RBI must take action and stop converting such Jan Dhan/BSBDA’s account into Regular Savings or other accounts.

Through ‘No Bank Charges’ Campaign, we demand that RBI, Ministry of Finance and Banks must remove all the charges from such account holders. They must remove the restrictions from the number of cash withdrawal or deposit in a month because these are very basic services which must be offered to the customers for free of cost, they must not be charged for withdrawing or depositing their own money.

Send emails to your Bank, Reserve Bank of India and Finance Minister from www.fanindia.net demanding the removal of bank charges.

Join ‘No Bank Charges’ campaign

For more information, please visit www.fanindia.net

SIGN UP FOR COUNTERCURRENTS DAILY NEWSLETTER