Weather extremes can cause economic ripples along supply chains. If they occur at roughly the same time, the ripples start interacting and can amplify, even if they occur at completely different places around the world, a new study – “Ripple Resonance Amplifies Economic Welfare Loss from Weather Extremes” – by Kilian Kuhla, Sven Norman Willner, Christian Otto, Tobias Geiger and Anders Levermann (published on 27 October 2021, © 2021 The Author(s), published by IOP Publishing Ltd

Environmental Research Letters, Volume 16, Number 11, DOI: 10.1088/1748-9326/ac2932, iopscience.iop.org/article/10. … 088/1748-9326/ac2932) shows. The resulting economic losses are greater than the sum of the initial events, the researchers find in computer simulations of the global economic network. Rich economies are affected more strongly than poor ones, according to the calculations. Currently, weather extremes around the world are increasing due to greenhouse gas emissions from burning fossil fuels. If events happen simultaneously or in quick succession, even at different places on the planet, their economic repercussions can become much bigger than previously thought.

The study report said in its “Introduction” section: Climate change due to anthropogenic greenhouse gas emissions is likely to intensify both weather extremes and their impact on society. Disruptions by extreme weather events impact the health sector as well as the economy through perturbations of income, employment, economic growth, energy supply, and food security. In the aftermath of an extreme weather event, regions react in a variety of ways. Some might not manage to recover in between subsequent events others might even profit from disasters when the economy is build back more resilient or more efficient after the shock. On an inter-regional level, local production shocks induced by extreme events can, via price and demand fluctuations in the highly interconnected global trading network, result in losses or gains in production or consumption elsewhere in the world.

The short and long-term economic impact of each of individual disaster categories by themselves have been studied in regional case studies as well as on the individual regional or even at the global level. Additionally, events such as heat stress, fluvial floods, and tropical storms, can also overlap spatially as well as temporally, often referred to as compound events. This paper contributes to this literature, which so far mostly focuses on the natural science perspective or regards only local direct economic consequences. We here focus on how local and cross-regional economic repercussions of such events can interact due to trade and production supply linkages in a non-linear way either amplifying or mitigating the economic losses caused by the individual events. Additionally, disasters due to extreme weather events (e.g. flooding of factories) can lead not only to direct local (production) output losses, but also to indirect losses due to the propagation of losses in the global trade network causing economic ripple effects. Thus, the question arises of whether accounting for the interaction of these losses is important, and whether doing so amplifies or mitigates overall losses at a global level.

The study report’s “Results” section said:

Due to inertia in the climate system the different carbon emission scenarios yield temperature scenarios that are well within model uncertainty within the next two decades. Accordingly, we combine the individual years of the different scenarios into a full ensemble to improve statistics similar to previous publications. For that, we derive annual values of indirect losses from daily losses as computed by Acclimate. We then compare two situations. On the one hand, we use simulations with all three classes of weather extremes occurring together (i.e. consecutive disaster scenarios). The corresponding quantities, such as the consumption losses and production losses, are referred to as total quantities. On the other hand, we sum the results of three separate simulation classes with each having only one category of weather extremes. Their resulting quantities are denoted as aggregated. For direct losses, generally, the sum of the direct output losses of the three classes of weather extremes (aggregated direct losses) equals the losses of consecutively occurring disasters (total direct losses). Using an ensemble of projected weather extremes of three disaster categories, enables us to get a broad range of consecutive disaster events, spatially as well as temporally. Accordingly, in the ensemble we observe disasters of very different sizes and combinations.

It said:

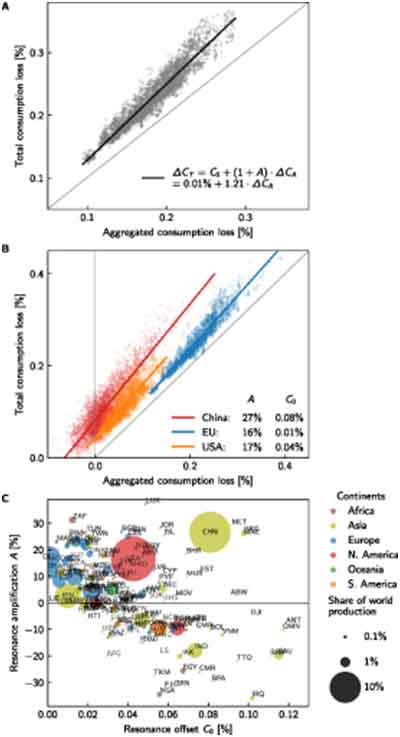

Figure 1: Global consumption losses are higher when impacts interact. Global annual consumption losses as they depend on annual direct output losses. For the total impact (red diamond) consumption losses are higher than for the aggregated sum of independent impacts (purple triangle) also for the same direct losses. This amplification is shown in figure 2. Each data point represents one year within the ensemble. Consumption and direct output losses are with respect to the baseline consumption and production, respectively. Credit: DOI: 10.1088/1748-9326/ac2932

Global welfare, measured as the sum of the final consumption of all regions, decreases in response to the direct losses in both cases, the aggregated as well as the total case (figure 1). The local production reductions are passed on via the supply network as supply and price shocks up to the final consumer. The latter usually just has the option to consume less, because of lack of supply or in response to increasing prices. Thus, price inflation of goods and services decreases consumption in the disasters aftermath.

Figure 2: Economic ripple resonance—consumption losses of consecutive disasters are increased in comparison to losses of aggregated single disasters. (A), (B) Annual consumption losses for the total impact over those for the aggregated sum of independent impacts, globally ((A), grey dots) as well as for China, EU, and the USA ((B), colored dots). Each data point represents one year within the ensemble. Losses are relative to the (unperturbed) baseline consumption. The solid lines depict the resonance analysis with resonance amplification factor A and resonance offset C0. (C) Resonance amplification factor and offset per country. The area of each circle represents the country’s share of the world production, its color depicts the geographic region. A few extreme outliers (of economically small countries) are not in the visual range.

Globally, we observe an economic ripple resonance of extreme weather events. We define this resonance as the amplification of regional and global economic disruptions that result from the interaction of the economic repercussions of individual event impacts. Here, total annual consumption losses are larger than the aggregated losses from single disaster scenarios for the whole simulated ensemble (figures 1 and 2(A)). Specifically, the resonance leads to both an additional consumption losses that is independent of the level of direct losses (the resonance offset C0), and a linear amplification of consumption losses with increasing direct losses (the resonance amplification factor A). Consequently, losses from consecutive disasters are always larger than the sum of their individual scenarios, and this difference grows with the size of direct losses, e.g. for stronger disruptive events.

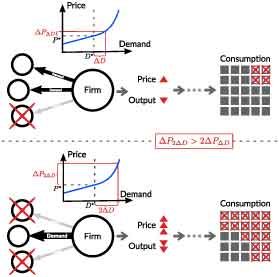

Figure 3: Non-linear price increase due to increasing demand—consumption response to ripple resonance. Upper panel: due to a supplier outage, a firm shifts its demand to other suppliers (of the same commodity/service). Consequent prices () grow non-linearly with increasing demand () due to extra costs for additional production, potentially reducing the firm’s output. This price increase and supply shortage propagates through the supply network and leads to fewer consumption goods and services for a higher price for the consumer. Lower panel: if more suppliers fail, the fewer remaining suppliers face more demand (), which increases the price enormously (). In fact, a price change due to a doubling of the demand change is greater than twice the price change due to a demand change (). A firm therefore produces less but that for a significantly higher price. At the end of the supply chain, the high expenditure for less goods and services result in a drastic reduction in consumption.

The global enhancement of welfare losses via economic ripple resonance can be explained by non-linear price inflation due to rising demand (figure 3). If a firm increases its demand to some of its suppliers due to supply shortages elsewhere, the price increases non-linearly due to additional production costs. These higher prices and output losses are likely to be passed down the supply chain to the consumer, who has a lower consumption amount for a higher price. If other suppliers fail, due to economic repercussions of different weather extremes, these price deviations may interfere and the resulting declines in consumption can be intensified. Hence spatial and temporal consecutive disasters can amplify indirect consumer losses. It is important to note that individual extreme weather events are not responsible for the ripple resonance. Rather, the overlap of economic repercussions caused by several extreme events resonate and thus trigger the enhancement and amplification of consumption losses.

“Ripple resonance, as we call it, might become key in assessing economic climate impacts especially in the future,” says Kilian Kuhla from the Potsdam Institute for Climate Impact Research, first author of a new study — Ripple resonance amplifies economic welfare loss from weather extremes. “The effect of weather extremes in our globalized economy yield losses in some regions that face supply shortages and gains in others that see increased demand and thereby higher prices. But when extremes overlap economic losses in the entire global supply network are on average 20 percent higher. This is what we see in our simulations of heat stress events, river floodings, and tropical cyclones; and it is a most worrying insight.”

Generally, extreme weather leading to, for example, the flooding of a factory does lead not only to direct local output losses. It is known that the economic shocks also propagate in the global trade network. Now the researchers find that these propagated effects do not just add up but can in fact amplify each other. The researchers modelled the response of the global network, calculating 1.8 Million economic relations between more than 7000 regional economic sectors.

Richer economies are hit harder

While not all countries suffer from the ripple resonance effect, most countries which are economically relevant do. Specifically China, due to its prominent position in the world economy, shows an above-average effect of more than 27% of extra losses when extreme events overlap compared to when they hit independently from each other.

“The phenomenon of economic ripple resonance means that two separate incidents send shock waves through the world economy, and those waves build up — like a tidal wave,” says Anders Levermann department head at Potsdam Institute and scientist at Columbia University in New York, who led the author team. “Supply shortages increase the demand and that increases the prices. Firms have to pay more for their production goods. In most cases, this will get passed down to the consumer. Since weather extremes happen abruptly, there’s no smooth adaptation of capacities and prices at least for a short period of time. If other suppliers fail, due to economic repercussions of another weather extreme elsewhere, the interfering price shocks are intensified.”

Overlap makes total losses larger than the sum of two events’ damages

“If something gets rare, it gets expensive, and if it gets rare worldwide it gets very expensive — clearly, that’s not new,” says Levermann. “The new thing is the overlap. So far, people mostly looked at the local damage or at most the economic repercussions of one disaster at a time. Now we find that a second disaster happening at about the same time, even if it’s in a different corner of the world, can lead to higher worldwide economic losses.”

This holds true not just for simultaneous but also for consecutive disasters, if the economic effects of the different disasters overlap. “By allowing climate change run wild, we add climate-induced economic losses on top of everything else. If we do not rapidly reduce greenhouse gases, this will cost us — even more than we’ve expected so far.”