To

Smt Nirmala Sitharaman

Union Finance Minister

Dear Smt Sitharaman,

I refer to my letter dated January 15, 2022 on the imprudence of listing LIC in the stock market and the misleading valuation approach adopted by the government (https://www.moneylife.in/article/lic-ipo-gross-underestimated-valuation-put-it-on-hold-says-eas-sarma/66146.html).

As the single largest social security provider in the country for the economically weaker sections, the social value of the LIC cannot be left to be determined by stock market investors driven exclusively by their profit-motive. The Finance Ministry’s assumption that disinvestment of LIC’s equity will bring additional fiscal resources is fallacious, as those that invest indirectly in LIC’s equity access the same pool of savings in the economy as the government. The government can raise the same amounts through borrowing on more advantageous terms, without having to allow the stock market pressures to force the LIC to alter its role as a social security provider. By and large, these arguments hold good to disinvestment of any CPSE.

In one of my earlier letters addressed to you on 20-11-2021 on disinvestment of Central Electronics Ltd. (CEL) [https://countercurrents.org/2021/11/the-sale-of-cel-is-not-justifiable/], I had cautioned the government that the CEL was being undersold, that too, to a small private company which could not have nurtured the kind of innovative technology development activity that the CEL was engaged in, and that such a thoughtless disinvestment would result in frittering away a three-decade long effort of the CPSE in contributing to the strategic sectors of the economy. CEL’s land holding of 50 acres in Sahibabad near Delhi alone should be valued at more than Rs 500 Crores, whereas the government had finalised the sale for a paltry sum of Rs 210 Crores. If the other properties of the CEL including its buildings and equipment were to be priced at their replacement value and the enormous value of its technically competent employees were also to be considered, in addition to the R&D investments made by the CEL over the decades and its brand value etc., CEL’s value for the nation would be far more, raising serious questions of propriety about the disinvestment process itself.

As it was to be expected, more unsavoury aspects of CEL’s disinvestment seem to be emerging now, forcing the government to put the sale on hold, a situation that would have caused considerable discomfort to your Ministry. Instead of learning lessons from it, the government seems to be hiding behind a departmental investigation, which raises more questions than providing answers.

The summary and the sweeping manner in which the Dept of Public Enterprises (DPE) had announced the government’s new Central Public Sector Enterprises (CPSE) disinvestment policy vide DPE/3(1)l2o2l’DD dated 17-12-2021 in the name of “Atmanirbhar Bharat” implied that the government was in an undue haste to dismantle almost the entire edifice of the public sector enterprises built assiduously by its predecessors over several decades for valid and compelling reasons. To cite Atmanirbhar Bharat as the rationale for disinvesting the CPSEs is misleading, as the CPSEs were created in the first instance under Articles 12 and 19(6)(ii) of the Constitution to promote the country’s self-reliance through technology development and act as an instrument of the government in discharging its welfare obligations under the Directive Principles of the Constitution. Since CPSE disinvestment policy would directly hurt self-reliance, it makes a mockery of Atmanirbhar Bharat, as demonstrated by the CEL debacle. Closing down the CPSEs will shrink the space for SC/ST/OBC reservations provided in Article 16 and the other welfare obligations listed out in the Directive Principles, rendering disinvestment prima facie illegal.

In arriving at the value of the CPSEs, the Dept of Investment and Public Asset Management (DIPAM) is evidently following the methodology suggested by the Disinvestment Commission in the nineties, which left the valuation of the intangible assets such as R&D to be left to the bidding process itself and the appetite of the stock market investors. Indian stock markets are still far too shallow for a realistic asset value to emerge. This is bound to result in gross undervaluation of valuable public assets. Moreover, in the specific case of the CPSEs, their value for the society is far more important.

Realising the crucial importance of R&D investments for technology development aimed at promoting self-reliance, the government issued guidelines on R&D investments to be made by the CPSEs, vide DPE No. 3(9)/2010-DPE(MOU) dated 23-9-2011. Para 1.8 of this notification provided that, for MOU rating of the CPSEs, R&D investment would be given a weightage of 5% out of the 50% earmarked for non-financial parameters and the minimum R&D investment to be made as a proportion of the Profit after Tax (PAT) would be 1% for Maha- & Navratna CPSEs and 0.5% for the Miniratna CPSEs. This prompted the CPSEs to ramp up their R&D effort. For example, the CPSEs as a group invested Rs 15,383 Crores on R&D during 2017-20 alone, a considerable amount to be spent in three years, by any standard. The outcome of this has got reflected in the enhanced effort towards indigenisation of technology and acquisition of intellectual property rights by the CPSEs.

To cite specific examples, RINL which has come under the disinvestment anvil had won 6 patents during 2020-21 alone. HLL Lifecare, which is being disinvested has got its first Indian patent awarded during June 2020 and has currently three international patents awarded, out of the 8 patents filed. BEML, a defence sector CPSE to be disinvested, has supplied India’s biggest 750 HP Bulldozer to CIL which was designed and developed by in-house R&D. No other than the Prime Minister himself unveiled BEML supplied Unmanned Train Operation system and indigenously developed Bogie Run Test Machine. Till date, BEML has filed 20 patents out of which six have been registered.

CEL, which has been subject to mindless disinvestment as referred above, was set up specifically to indigenise technologies developed by the national laboratories and the R&D institutions in the country, which objective it has realised admirably. It is a pioneer in the field of solar photovoltaics; it caters to the defence sector and the railways. For the latter, it has developed Single Section Digital Axle Counters (SSDAC), High Availability SSDAC (HA-SSDAC), Multi-section Digital Axle Counter (MSDAC) and Block Proving by Axle Counter (BPAC) using Universal Fail Safe Block Interface (UFSBI), in line with the global standards.

The disinvestment conditions make no mention of the prior experience of the bidders nor do they require any expertise on the part of the bidders to be able to bid for such technologically strong CPSEs. Many of them seek the land, the buildings etc of the CPSEs more than their R&D capital. In other words, the disinvestment process will render all these R&D investments of the CPSEs infructuous. The DPE’s TOR for disinvestment valuers makes no mention whatsoever of the need to value these investments, which was amply demonstrated by the way the CEL had been undervalued at Rs 196 Crores in all!

Had the DPE/DIPAM sought the considered views of the heads of the CSIR and the Dept of Science & Technology before preparing its note for the Cabinet, those departments would have expressed their concerns to enable the Cabinet to take a collective view. Apparently, the procedures prescribed in the Business Transaction Rules of the Cabinet Secretariat were violated. An impartial investigation alone can bring these facts to light.

In any case, apart from their R&D investments, CPSEs are far more important entities than ordinary market commodities that can be traded across the counter in a casual manner. They are arms of the government in terms of Article 12 and they are as much a part of the welfare State envisaged in the Directive Principles as the government itself is. Their value cannot be determined summarily in terms of their profitability. Their socio-economic benefits are far more important than the financial profits they earn. The government as their owner cannot be replaced by private undertakings.

In short, CPSE disinvestment is inherently flawed and illegal and it should be done away with immediately. Instead, the government should make efforts to strengthen their management so as to enable them to discharge their Constitutional obligations more effectively for benefiting the society at large.

I request you to place these concerns before the Union Cabinet, with the advice that all CPSE disinvestment exercises should be put on hold pending a careful consideration of the legal and the socio-economic implications involved. Otherwise, I am afraid that many CEL-like cases will emerge, eroding the credibility of governance.

Since the CPSE assets belong to the nation, disinvesting them without a wider discussion will constitute a breach of the public trust.

Regards,

Yours sincerely,

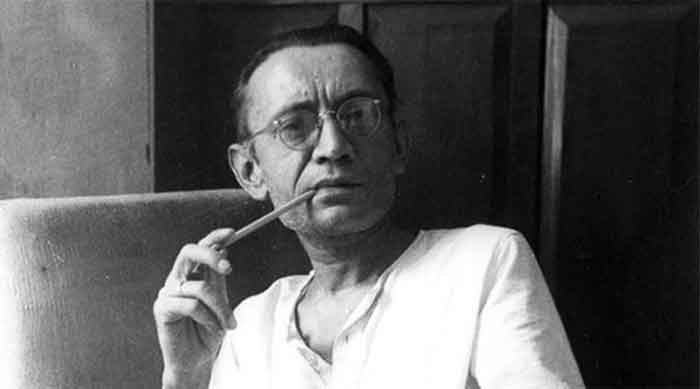

E A S Sarma

Former Secretary to Government of India

Visakhapatnam