The impact of the Covid pandemic on Indian companies has not been uniform across all sectors. In fact, the pandemic had come as a boon to some sectors and a bane to others.

Despite some initial blips, companies in the healthcare sector and e-commerce companies have gained the most out of the pandemic period.

On the other hand, companies in hospitality, travel and tourism, aviation, automobile, and real estate sectors have incurred huge losses. While some have more or less recovered, others are yet to reach the pre-pandemic levels of performance.

Let us first focus on healthcare industry which was closely related to the pandemic management.

Pandemic impact on the healthcare industry

The difference between 5 lakhs and 50 lakhs is mind-blowingly huge, especially when the numbers refer to the count of people who died in the pandemic. The WHO says that the pandemic toll in India was around 5 million. The Indian government adamantly insists that the number was no more than one-tenth of the WHO figure.

At the height of the pandemic, the government remained bankrupt even as thousands of unidentified and unclaimed bodies simply floated down the Ganges and other rivers. There was no system to even ascertain whether those who met with unnatural and premature deaths in more than 6 lakh remote villages in India died due to Covid infection. There was no arrangement of testing and hospitalization for the sick villagers was unthinkable. Even those who could get admitted to the private hospitals and afford treatment there could get no bed even if they somehow managed to find transportation. Rural India was haplessly resigned to its fate. There was no governance, and no health infrastructure that could function in a pandemic.

At the height of the pandemic, the government remained bankrupt even as thousands of unidentified and unclaimed bodies simply floated down the Ganges and other rivers. There was no system to even ascertain whether those who met with unnatural and premature deaths in more than 6 lakh remote villages in India died due to Covid infection. There was no arrangement of testing and hospitalization for the sick villagers was unthinkable. Even those who could get admitted to the private hospitals and afford treatment there could get no bed even if they somehow managed to find transportation. Rural India was haplessly resigned to its fate. There was no governance, and no health infrastructure that could function in a pandemic.

Such a devastating pandemic should have served as an eyeopener for any sensitive government. After recovering from the second wave, the government should have worked on a war-footing to beef up the health infrastructure. The pandemic exposed how grossly inadequate India’s abysmally low public health expenditure at 1.3% of the GDP was for building up a minimal life-saving health infrastructure in times of crisis.

This ruling party had promised doubling of allocation for health. But, except for doubling allocation in one-budget of 2021—22, and that too to meet the vaccination exigency, the health sector allocation in the next union budget showed no appreciable increase. Some States like Gujarat and Chhattisgarh even reduced their health budgets in absolute terms.

If anything, the pandemic’s impact on the healthcare sector only proved that given the state of health infrastructure in India, a catastrophic health event like Covid-19 pandemic could kill hundreds of thousands and push millions below the poverty line. A large-sample survey by the Azim Premji University established beyond any doubt that that the pandemic had pushed 230 million below poverty.

But then there are always segments which take advantage of any crisis. While lakhs of small-scale healthcare institutions ceased to provide any healthcare service during the peak pandemic season, even for routine illnesses, profits of some big corporate hospitals and health insurance majors were booming.

Corporate Hospitals

The government hospitals did not have minimum oxygen supply and essential Covid-19 medicines. Small private hospitals and nursing homes had to shut down during the lockdown and even for a long period after it was lifted. Health workers from the public sector were the largest contingent of frontline workers and they had to make huge sacrifices while fighting the pandemic.

However, the trend in market capitalization of most of the top ten listed hospitals shows a big jump during the two peak Covid-19 years. Ironically, the market capitalization of most of these same companies had come down in the two years before the pandemic.

Market capitalization of five of the top 10 corporate hospitals before and after Covid-19

| Name of the Listed Hospital | Market Capitalization as on | ||

| 21 August 2016 | 21 August 2018 | On 4 May 2022 | |

| Apollo | Rs.19146 Cr | Rs.16,450 Cr | Rs.23,483 Cr |

| Fortis Healthcare Ltd. | Rs.8430 Cr | Rs.7760 | Rs.11,800 Cr. |

| Narayana Hrudayalaya Ltd. | Rs.6405 Cr | Rs.4992 Cr | Rs.7,703 Cr |

| Dr.Lal Pathlabs Ltd. | Rs.7799 Cr | Rs.8666 Cr | Rs. 14,762 Cr.

|

| Max India | Rs.4055 Cr | Rs.2459 Cr | Rs.1848 Cr |

Source: For 2016 & 2018 Economic Times, 26 August 2018 and for 2022 moneycontol.com.

E-Commerce Industry

Pandemic boosts online shopping

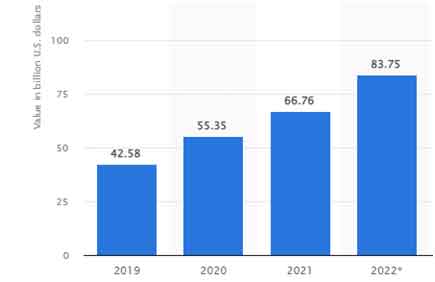

After corporate hospitals, e-commerce was the second important industrial sector that gained most from the pandemic. As direct physical shopping became virtually impossible during the lockdowns, online sales in India got a tremendous boost. Even after the lockdowns were lifted, many preferred to shift to online shopping due to safety considerations.

E-commerce Sales Growth in India

Source: Statista

Employment as delivery personnel for e-commerce companies expanded in lakhs which was a record. But these workers had to work in very hazardous conditions without much social security cover and the pandemic took a huge toll of lives among them. But they were not recognized as “frontline workers” and hence did not get Rs.50 lakh compensation that other frontline workers received.

The Sectors that went Bust

Hospitality Industry

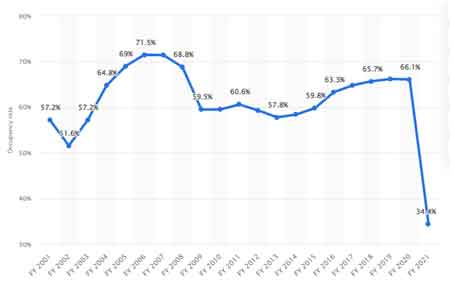

According to the Federation of Hotel & Restaurant Associations of India (FHRAI), 25 to 30 per cent of establishments in the organised sector comprising around 60,000 hotels and 5 lakh restaurants had shut shop in 2020 and another 15 per cent could follow suit if there is no support from the government to revive the sector.

Source: Economic Times, 30 April 2020.

Occupancy Rate of Hotel Industry in India 2001—2021

Source: IBEF

Civil Aviation

High disposable income in the hands of the middle class and business travel sustained the steady growth of civil aviation in the pre-pandemic days. Both took a hit during the pandemic and the airlines industry was almost grounded in 2020, from which it is yet to take off despite reasonable recovery in the overall economic activity.

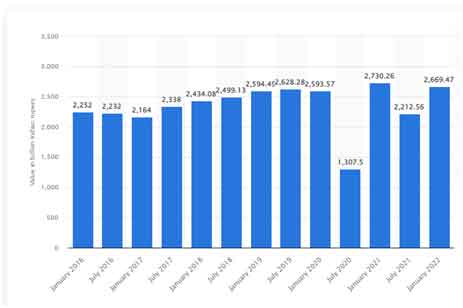

Construction Industry

Since it is the second major employment generator in India after agriculture, the macro-economic significance of the construction sector needs no emphasis. If this industry which used to grow at an average rate of nearly 5% in the pre-pandemic years, slumps by nearly 50% that can only be described as massive destruction. Construction activity was disallowed during the lockdowns. The work could not resume after unlocking as a large chunk of migrant workers did not report for work again.

Construction Industry Growth in India

Source: Statista

Automobile Industry

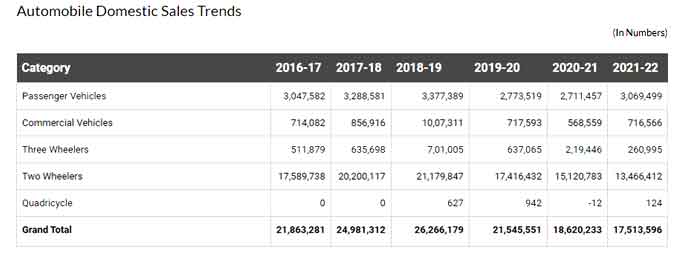

It is well known that the automobile sector took the maximum hit during the 2019—20 economic slowdown. The lockdown disruptions in 2020 and 2021 second wave and the demand contraction far outweighed the stimulus offered through the Production-Linked Incentive (PLI) scheme in delaying the recovery process.

The PLI scheme financial incentives of up to 18% of the incremental sales value over the base year was launched for the auto sector from 23 September 2021. Even as per the official estimates of the government, the PLI scheme for the automobile industry would lead to fresh investments of Rs.42,500 crore, incremental production of Rs.2.3 lakh crore and create 7.5 lakh additional employment over six years. But two years of the pandemic had already swallowed 3.45 lakh automobile sector jobs in a single pandemic year of 2020 as per a report in Economic Times on 24 January 2021. A Business Today report on 16 December 2020 said that the auto industry in India lost Rs.2300 crore per day after the lockdown was declared in March 2020.

Disruptions in public transport and Covid safety considerations also forced many people to buy personal two-wheelers and even cars. The monthly vehicle sales figure was almost zero during April 2020. However, there was a late revival in the fiscal year after the lockdowns were lifted but the recovery was so feeble that except for Tata Motors other auto units could not reach pre-pandemic levels.

Source: https://www.siam.in/statistics.aspx?mpgid=8&pgidtrail=14

Textile and Apparel Industry

Textile sector accounts for 2% of India’s GDP and around 13% of export earnings as per data from the rating agency KPMG. India is the second largest manufacturing hub in the global textile landscape and fourth largest apparel exporter. Indian textile and apparel sector comprises sub-segments like organized sector spinning and weaving mills, garment and hosiery units in the SME sector, and powerlooms and handlooms in the informal sector and so on. All these sectors, put together, account for 45 million workers.

In the last two years it was a double whammy for the Indian cotton spinning mills sector. First the market contraction due to Covid-19 dented domestic sales. Subsequently, in 2021, 80% increase in cotton prices has also eroded the margins of the spinning mills and even garment units and powerlooms-handlooms. The pandemic precipitated a continuing crisis so much so that nearly 1700 spinning mills in Tamil Nadu had shut down production in the last week of May 2022 and the impasse continues in the first week of June. Textile sector is a good example for how the pandemic paved the foundation for deepening of other crises like market contraction, inflation, rupee volatility etc.

However, the pandemic and the domestic textile crisis did not affect textile exports. India recorded its highest ever textiles and apparel exports tally at $44.4 billion in the 2021-22. This was a 41 percent increase over the figure for 2020-21 fiscal, and a 25 percent rise over the year before that as per a government press release.

Surface Transportation Industries Bounce Back

The impact of the pandemic on surface transport sectors appears to be somewhat paradoxical. The recovery in GST e-way bill volumes, railway freight traffic, diesel consumption, petrol consumption, and cargo traffic at major ports—all show a picture of robust growth. But vehicle registrations—especially, commercial vehicles—are still in the negative range. This otherwise robust picture doesn’t tally with the overall scenario of low and halting recovery in growth in several key sectors of the economy. May be, this contrast hints at the fact that these parameters are not the real indicators of the health of the economy.

B.Sivaraman is a researcher based in Allahabad, Uttar Pradesh