by Ashish Kumar Singh & Akash Singh

According to a NITI Aayog recent report titled ‘India’s Booming Gig and Platform Economy’ India’s gig workforce, estimated to be at 77 lakh in 2020-21. It is expected to go up to 2.35 crore by 2029-30. Gig worker are defined by Niti Aayog as those engaged in livelihoods outside the traditional employer-employee arrangement. Gig workers can be broadly classified into platform and non-platform-based workers. Platform workers are those whose work is based on online software apps or digital platforms such as Ola and Uber. Non-platform gig workers are generally casual wage workers and own account workers in the conventional sectors, working part-time or full time. A gig economy is a free market system that provides short term contracts to independent workers.

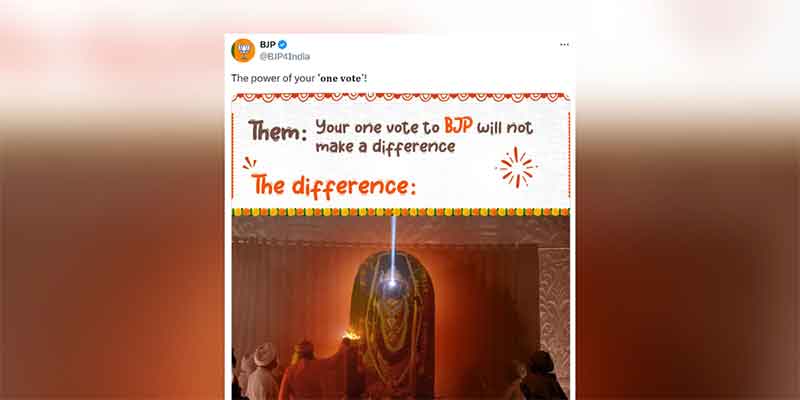

From the perspective of companies, hiring such workers is more beneficial as they do not have any political or union connections with regards to their jobs, making them nearly unaffected by any political movement. The formation of workers’ union has been important as it gives them collective voice and bargaining power. India has seen what trade unions are capable of. Therefore, it is not surprising that instead of hiring employees, companies would prefer contractors.

Another notable feature of the capital markets are that they provide too little or conditional capital to entrepreneurs forcing them to finance themselves and bear the risk of failures. Low entry barriers as well as flexible working hours are the characteristics of gig economy that provide insurance against entrepreneurship related income volatility.

In the post-Covid era, the Russia-Ukraine conflict has emerged as a challenge for several economies around the world. Inflation is increasing and the currencies are getting weaker. Low growth also causes unemployment. Gig economy, hence, becomes more lucrative due to its ability to provide some kind of paid work.

Since gig workers are mostly contractors or sub-contractors, there is no social security available to them from the employers.

Covid-19 has shows that many such workers had paid huge price in the absence of any safety net. Due to this new client-service provider relationship between the traditional humane features of employer-employee relationship vanishes, with no scope for compassion in the cases gig workers do not perform well. The commoditization of work means gig workers are vulnerable to fluctuation in demand. The absence of social security makes things worse for the gig workers.

With most gig jobs worker are paid by the project or task. The problem is that worker may not have control over how many tasks they would be able to complete in a day or a week. If worker is not logging to service for any day due to family or even for his car or bike servicing for that day he will not get any single rupee. The tasks are assigned based on the algorithms of the apps/online platforms. It gives an option to the customers to rate the workers. High rating results in more work and low may mean lesser or no work.

Today most of the platforms has introduce the tipping amount for delivery or service provider worker and customer can opt for this to give tip for delivery person or driver. The tipping amount is credited to worker with their weekly or monthly payment schedule. Irony is that these companies are holding the tipping amount in its account and utilize for other activity till the worker payment cycle is complete. It is released to them without any interest generated during the holding period.

Suppose any company has 1000 gig worker for delivery and out of these at least 700 delivery person get tip amount of 10 rupee per person per delivery and a person is doing average 3 delivery in a day with tipping amount. Then this company will receive INR 21000 approx. This amount adds as an incentive receivable by worker as per company ledger but they are utilizing this amount for other activity and make cash till the worker payment cycle. This amount is also not earned money by company so it get tax exemption but ultimate holder and user of this amount is company till worker’s payment cycle is complete. We can also see a similar trend with the wallet based service provider companies.

What is needed today is a policy framework to minimize the risk factors of the gig worker and government must work on bringing a uniform contract model for such workers. Most of such workers are not literate and even they do not know English but they sign the contract of gig employment with company in English. There is a need to regulate this and bring this contract in many local languages so that workers can understand the conditions of their contract and move forward accordingly.

The major potential problem is that gig workers are not in tune with the legal definition of employees. Every state has its own definition, but it mainly depends upon the degree of control that the company has over the worker. It is difficult for an individual worker to afford the cost of legal proceedings. This makes gig workers more vulnerable to settlement, even when they have a good legal claim.

The NITI Aayog report also emphasizes the corpus fund for any unclaimed economic situation which leads to job loss of the gig workers.A platform, in order to support auto-rickshaw, cab, and taxi drivers to mitigate the effects of the Covid-19 lockdown on their income, created a corpus of INR 20 Cr, called the “Drive the Driver Fund.” Measures such as offering a social security cover out of a corpus fund can help support gig workers and other self-employed individuals associated with the sector in case of contingencies.

There is also a need to offer mandatory coverage to platform workers under the centrally sponsored schemes such as Pradhan Mantri Jan Arogya Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana and Pradhan Mantri Suraksha Bima Yojana.

Suggestions by NITI Aayog include paid sick leave, health access and insurance year-round, occupational disease and work accident insurance, retirement/pension plans and other contingency benefits, as well as supporting businesses and entrepreneurs that are associated with platforms. For supporting these businesses and entrepreneurs, it suggests extending interest-free business advances and delayed payback periods to protect gig workers, self-employed persons and small businesses that are associated with platforms.

For the government, civil society, businesses and non-profits, Niti Aayog suggested universal coverage of platform workers through the Code on Social Security. It also recommended that skill gaps be bridged by carrying out assessments periodically and partnering with platform businesses for onboarding skilled women and persons with disabilities. It also suggests making aggregate data public to enable decision-making.

These companies also have enormous data of consumer associated with them and we all know how trading of data has become a new earning model for such companies. Government should prevent data trafficking and ensure that privacy of consumers is not violated.

(Ashish Kumar Singh is a doctoral candidate of political science at the NRU-HSE, Moscow. Akash Singh is a business development professional in polymer and chemical sector and has worked in Oman & Qatar.)