To

Shri Shaktikant Das

Governor

RBI

Dear Shri Das,

RBI must have seen the disturbing report of the credit research agency, CreditSights, on highly over-leveraged expansion programme undertaken by the Adani Group in India and abroad (https://www.reuters.com/world/india/indias-adani-group-deeply-overleveraged-creditsights-says-2022-08-23/)

The credit research agency is reported to have pointed out, “The conglomerate’s debt-funded growth plans could spiral ‘into a massive debt trap’ and culminate in distress or default of its companies and the broader Indian economy in a ‘worst-case scenario‘”.

I am not sure as to what extent this report represents the actual financial status of the Adani Group, which I am sure that the RBI will look into with a sense of urgency.

The following concerns arise in this connection.

- The Adani group’s combined borrowings jumped 40.5% to about Rs 2.21 lakh crore in the financial year 2021-22. It had stood at Rs 1.57 lakh crore in the previous financial year (https://www.news18.com/news/business/adani-groups-debt-up-40-to-rs-2-21-lakh-crore-in-fy22-adani-enterprises-sees-highest-rise-5370031.html). From a financial stability point of view, this is highly significant.

- According to a news report (https://www.financialexpress.com/industry/sbi-to-refinance-adanis-loans-through-525/73493/), the SBI had, sometime ago, agreed to refinance R5,000 crore of loans to Adani Power subsidiaries — Adani Power Maharashtra (APML) and Adani Power Rajasthan (APRL), using the so-called “5/25 scheme”, which is nothing but condoning the borrower’s failure to repay and providing a further debt facility to cover the liability, a highly imprudent practice generously adopted by the PSU banks, by way of a special largesse for big business houses, whereas lakhs of indebted farmers in India, in the absence of a similar facility, are forced to commit suicides! Loan waivers to farmers are insensitively called “revdis or freebies“, whereas such toxic concessions given to corporate houses are treated admiringly as a measure for promoting “ease of business“!

- The fact that the PSU banks are providing such debt restructuring concessions to the corporate houses, apparently endorsed by the RBI, points to both the RBI and the PSU banks becoming willing parties to over-leveraged debt, as it is now being reported in the case of the Adani Group. Often, it is such overleveraged debt in the case of a private entity that turns into an NPA. Should not the RBI feel concerned?

- There were reports of the SBI considering a similar debt facility covering more than Rs 5,000 Crores (it could be more) for the Adani Group for its Carmichael Coal Mining Project in Queensland province in Australia, a project that has raised global concerns.

- This is not the first time that questions have been raised about the Adani Group’s over-leveraged operations. I refer in this connection to one earlier article in 2019 (https://scroll.in/article/923201/from-2014-to-2019-how-the-adani-group-funded-its-expansion). I wonder how the RBI has responded to that report during the last 4 years, which is long enough for anyone to wake up and act.

- In recent times, there has been an over-aggressive expansion in the Adani Group’s operations. The Group has acquired dominance in ports, airports, power, coal, renewables, cement, aluminium, more recently 5G spectrum and even the media. Perhaps, more debt capital than equity has driven such forays, a fact that should cause concern to the RBI.

- More worrisome is the fact of big business houses taking control of the media, which could adversely impact our democracy. In my view, from the point of view of safeguarding independent press and media, the Central government to whom I am marking a copy of this letter, should also act immediately.

- To cite one recent example of how this group is aggressively entering new areas, the Adani Group in collaboration with another private company, Greenko, has signed MOUs for around 20,000 MW of pumped storage projects across more than 6 States, all through highly non-transparent means. Some of the locations chosen for the projects are such that they involve a violation of the special laws applicable to the Scheduled Areas, such as the PESA and the FRA. The investments required for this may exceed Rs 1 lakh crores, most of it perhaps expected from the PSU banks and others like the PFC. By no stretch of imagination, this is an insignificant amount!

- With a gentle pressure exerted at the highest level in India, the group has already made its entry in Sri Lanka in a port project and a renewable project, which have raised concerns in the island country, a matter that the Indian diplomats should worry about.

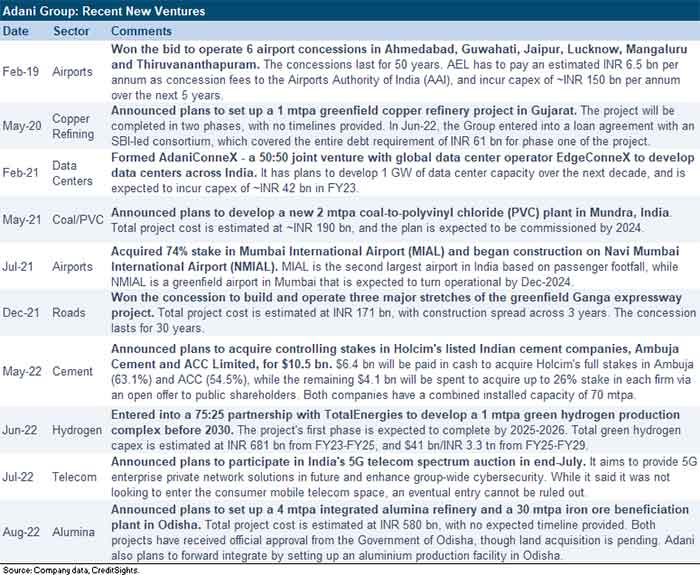

- The new areas into which the group seems to have forayed are many as shown below (a table downloaded from the CreditSights report):

Considering that the bulk of this debt will have to come from the PSU banks, which are owned by the Government of India and the public at large, it raises serious concerns of public interest. The RBI has the statutory responsibility of regulating the operations of the banks in order to safeguard the interests of the depositors and the equity holders under the Banking Regulation Act.

Against this background, in view of the reports on the over-leveraged operations of the Adani Group, I request the RBI to get a comprehensive assessment conducted on the risks it might pose to the banking system and its stability.

There may be other corporate businesses in India which are similarly taking advantage of political patronage to run their operations and expanding into new areas based on excessively leveraged debt, which poses risks to the PSU banks and the overall financial stability at the macro level. It is time that the RBI gets alert and acts, before it is too late.

It is the PSU banks that provide funds for corporate houses, who in turn are the beneficiaries of the large scale, indiscriminate programmes undertaken by the government to disinvest the CPSEs and their valuable assets. One should not be surprised if the PSU banks themselves slip into the hands of the corporate houses very soon, if the Ministry of Finance’s plans to privatise them materialise!

I feel that the RBI should lose no time in addressing these concerns.

Regards,

Yours sincerely,

E A S Sarma

Former Secretary to Govt of India

Visakhapatnam