Had DIPAM conducted due diligence on bidders’ background, it would have avoided causing embarrassment to the government in Pawan Hans disinvestment

To

Smt Nirmala Sitharaman

Union Finance Minister

Dear Smt Sitharaman,

Referring to disposal of scrap in different government departments, the Union Minister for Personnel, Shri Jitendra Singh had proudly announced on October, 25, 2022 that “Over Rs. 254 Crore has been earned so far from disposal of scrap (from different government offices), ….during a short period of three weeks of the ongoing Special Swachhta campaign” (https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1870837).

I wonder whether he was aware, while saying those words, that your Ministry had earlier persuaded the Union Cabinet to sell 100% government equity of Central Electronics Ltd. (CEL) for only Rs 210 Crores and 51% government equity of Pawanhans for only Rs 211 Crores, suggesting that your government had no hesitation in disposing of its strategic ownership of each of these highly precious CPSEs for prices less than the one that the scrap in the government’s offices could fetch. As a result of a widespread public outcry against these decisions, the Centre was forced to put on hold both these decisions, to its utter embarrassment.

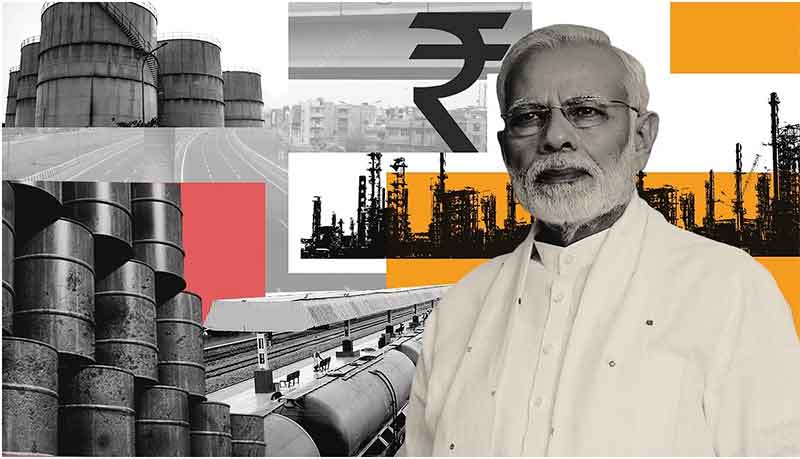

The ongoing policy of indiscriminate disinvestment of the CPSEs amounts to a distress sale of valuable public assets in a buyers’ market. What disturbs me most is that your Ministry should refuse to learn lessons from the sordid manner in which it had to abort the sale of these two CPSEs. To justify CPSE privatisation on the ground that it would bring additional fiscal resources is in itself a flawed argument, as private companies buying the CPSEs mostly raise funds from the same domestic pool of savings in the economy from which the government could as well borrow on more advantageous terms.

Compounding this is the fact that Department of Investment and Public Asset Management (DIPAM) has designed the disinvestment format in such a way that it necessarily results in underselling the CPSEs. It leads to handing over the CPSEs to nondescript companies incapable of carrying forward their strategic activities. It also provides scope for the control of disinvested CPSEs slipping into the hands of groups who raise funds from tainted sources.,

For example, when a particular CPSE is proposed for disinvestment, the other CPSEs competent to take it over are prohibited from bidding, which in turn severely limits competition, resulting in underselling the CPSE to be privatised. The eligibility criteria stipulated in the disinvestment format are so open-ended that private companies not even remotely connected with the activities of the CPSE are allowed to bid, which will force the CPSE to move away from its core activity. The eligibility criteria do not impose any restriction on the bidder’s antecedents nor on the source from which the bidder would raise resources for buying the CPSE, which could result in the disinvestment proceeds being raised from a tainted source and the CPSE itself slipping into the hands of a buyer of questionable background.

In addition, the manner in which the CEL and Pawanhans were proposed to be sold also showed that neither DIPAM nor the Transaction Advisor in either case had chosen to exercise due diligence on their own in the matter of vetting the antecedents of the bidders. It is unfortunate that questions had to be raised against the selection of the bidders in either case by the employees of the two CPSEs and the civil society at large.

In the specific case of Pawanhans, it was the CPSE’s employees, the media and the civil society that raised questions about the successful bidder not fulfilling the eligibility criteria. They also raised concerns about the questionable background of one of the members of the consortium that successfully bid for the CPSE.

One prudent way for the government to disinvest its own equity in Pawanhans would have been to sell its share to ONGC to enable the latter to have 100% control over Pawanhans and utilise its services for its offshore activities. Another alternative would be for the government and ONGC to hand over Pawanhans to HAL. It is inexplicable that the government should consider disinvesting its 51% share in Pawanhans for a paltry sum of Rs 211 to a third party with unknown antecedents.

An important concern that prompted the government to put privatisation of Pawanhans on hold was that there was an adverse order passed by the National Company Law Board (NCLT) against Almas Global Opportunity Fund (AGOF), one of the three members of the consortium finally selected as the successful bidder

(https://indianexpress.com/article/business/aviation/nclt-ruling-in-way-so-govt-takes-another-look-at-sale-of-pawan-hans-7920927/). There were also other concerns raised against the three bidders, including AGOF’s questionable involvement in overseas operations in Zimbabwe. It is not clear whether the government is ascertaining the genuineness of the concerns against AGOF’s overseas activities. The government seems to have conveniently chosen to remain silent on the latter, giving an impression that NCLT’s order alone had come in the way.

AGOF has since referred to a more recent order of the NCLT that seemed to have cleared the way, to press its claim for taking over Pawanhans (https://economictimes.indiatimes.com/news/india/nclat-order-in-favour-of-us-says-pawan-hans-bid-winner/articleshow/95069179.cms). Your Ministry should inform the public whether, in view of the latest NCLT order referred, Pawanhans will be handed over to AGOF along with its other two consortium members, or whether the government will get the other concerns against AGOF investigated thoroughly before moving forward.

The other concerns against the selection of AGOF arise primarily from a comprehensive investigation report published by the Sentry, a well regarded overseas investigative and policy organization (https://thesentry.org/reports/shadows-shell-games/?gclid=CjwKCAjw79iaBhAJEiwAPYwoCMy8-y4QbWvSx5Z0Xxfk4BjiEeYU-yprZ-DnlhHiImRI1nyBX5FYuRoC0wwQAvD_BwE). The report refers to the involvement of AGOF in certain activities of a questionable nature in Zimbabwe. It is desirable that your Ministry examines the allegations contained in the Sentry’s report with a view to ascertain the veracity of the same and make sure that disinvestment of Pawanhans does not result in the CPSE being handed over to a private group with questionable links to overseas activities.

While it will be prudent for the government to strengthen the governance of the CPSEs so as to promote the overall public interest, rather than privatise them, DIPAM should consider allowing mergers and reorganisation of the existing CPSEs as an alternate way to promote efficiency of utilisation of public assets and services. It will be futile for the government to undersell the CPSEs to private groups not capable of carrying forward the CPSEs’ activities or hand them over to groups with dubious antecedents.

Against this background, I hope that your Ministry will immediately put on hold the larger exercise of disinvestment of the CPSEs and the plans to monetise their assets. In the case of the two aborted exercises of disinvestment of CEL and Pawanhans, your Ministry should order an independent investigation to ascertain the lapses that have resulted in an inappropriate selection of bidders and, as a result, caused embarrassment for the government.

Regards,

Yours sincerely,

E A S Sarma

Former Secretary to Government of India

Visakhapatnam