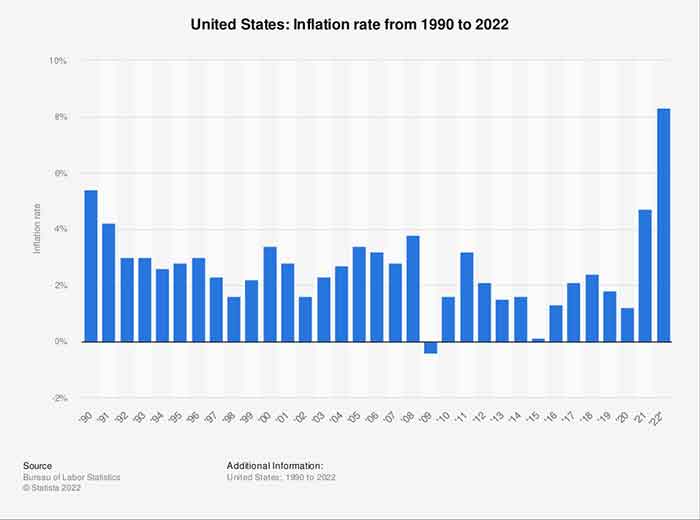

High inflation in Germany and Eurozone is making impact, with possibility of further impacting.

Inflation in Germany saw year-on-year growth of 10.9% in September, up from 8.8% recorded in the previous month, official data released on Thursday by the Federal Statistical Office (Destatis) shows.

The readings came in higher than the market expectation of 9.4%, and marked a record high since the creation of the euro in 1999.

Soaring food and energy prices reportedly had a considerable impact on the high inflation rate.

“Energy prices were 43% higher in September 2022 than in September 2021,” the agency said in a press release. “There was also an above-average rise in food prices by 18.7% from the same month of the previous year.”

On Thursday, the German government agreed a €200 billion ($194 billion) package to “cushion rising costs and the most severe consequences for consumers and businesses.” Under the plan, which will be financed with new borrowing, Berlin will introduce an emergency price brake on gas and electricity. It will also scrap a planned gas levy on consumers to avoid further price increases.

The detailed information, along with final data on the level of inflation in September, will be published by Destatis on October 13.

German Producer Prices Hit All-time High

Germany’s producer prices rose sharply in August from a year earlier, driven by higher energy costs, and posted the biggest increase ever recorded, the Destatis reported on Tuesday.

Data shows that prices were up 7.9% in August, well above analysts’ expectations. They soared 45.8% from a year earlier. That followed a 37.2% jump in July and a 32.7% rise in June.

According to Destatis, energy prices surged 139.0% over the last 12 months. The price of electricity was up 174.9% year-on-year. The producer price index (PPI) excluding energy rose 14% on the year.

Significant price increases were also recorded by metals, which gained 19.9% from August, Destatis said.

Researchers have been warning lately that Germany is headed for a recession. According to last week’s report from the Kiel Institute, the country’s GDP is expected to decline by 0.7% next year. Analysts previously predicted a 3.3% growth for the German economy in 2023.

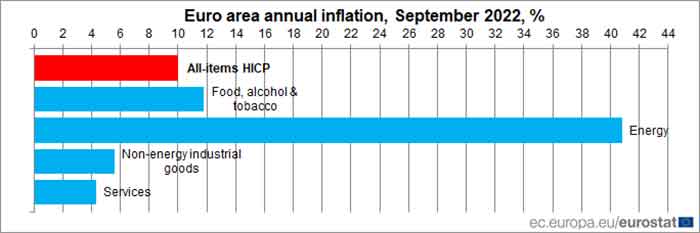

Eurozone Records First Ever Double-digit Inflation

Consumer prices in the Eurozone saw massive year-on-year growth of 10% in September, marking a new record high that increases pressure on the European Central Bank (ECB) to aggressively tighten monetary policy.

Inflation across the euro area increased from August’s 9.1% print, data from Eurostat showed on Friday, beating the median forecast of 9.7%, and marking the fifth straight month of price growth outpacing analysts’ forecasts.

Inflation is still being driven by spiraling food and energy costs. Energy prices, which surged at an annual rate of 41% in September, were the main contributor to the soaring inflation in the 19 countries that use the euro. Meanwhile, prices for unprocessed food rose 13%.

Excluding volatile food and energy prices, inflation still soared to 6.1% from 5.5% in August, while an even narrower measure that also excludes alcohol and tobacco rose to 4.8% from 4.3%.

Estonia, Lithuania, and Latvia all registered inflation rates above 22%. The figure for the Netherlands came in at 17.1%, up from below 14% in August. Slovakia’s 13.6% reading also put it in the group of those with higher than average price growth.

Earlier this week, Germany reported year-on-year growth of 10.9% in September, up from 8.8% recorded in the previous month. Soaring food and energy prices were also the culprits in the rise.

The concerning inflation readings are adding to the urgency for more rate hikes, even after the aggressive moves made by the ECB in July and September. After today’s inflation print, calls will likely grow louder for another large move at the ECB’s next scheduled meeting on October 27.

Investors now see the 0.75% deposit rate rising to around 2% by the end of the year, then to around 3% next spring before leveling off.

Eurozone Economic Growth May Drop To Zero, Warns ECB

Eurozone economic growth has slumped and could soon wind down to zero, the ECB vice president said on Monday.

“We are seeing that in the third and fourth quarters there is a significant slowdown and we may find ourselves with growth rates close to zero,” Luis de Guindos said at a conference, according to Reuters.

Economic output has been suffering due to soaring energy costs and the loss of Russian natural gas, which has raised the risk of energy rationing during the upcoming heating season. Elevated energy prices propelled euro area annual inflation to 9.1% in August, and are expected to drive it up to 9.6% this month, a record high for the region.

The ECB raised interest rates earlier this month by an unprecedented 75 basis points, mere weeks after a 50 basis-point move in order to fight inflation. The regulator said more rate hikes are coming, with analysts expecting another rate move in October, with more increases at every meeting through next spring.

De Guindos did not disclose how aggressive these upcoming moves will be, noting only that they will be “data-dependent” and stressing that inflationary pressures have significantly increased in recent months.

Last week, the official said the ECB will need to continue taking steps to battle inflation, as the economic slowdown is not enough to curb consumer prices.

“Markets believe that the slowdown of the economy would reduce inflation by itself. Actually, this is not right. Monetary policy has to make a contribution,” he said last week.

EU Approves Emergency Measures To Curb Prices

EU energy ministers on Friday approved their first package of emergency measures in response to the deepening energy crisis in the bloc driven by skyrocketing prices.

The package, negotiated in less than a month, includes mandatory power savings, a cap on excess market revenues and a levy to capture surplus corporate profits.

The plan prescribes a mandatory 5% target during peak hours, when gas plays a bigger role in price setting, and a voluntary 10% reduction in overall electricity demand.

It also suggests a cap on the excess revenue made by power plants that do not use gas to produce electricity, such as solar, wind, nuclear, hydropower and lignite. The cap will be uniform and set at €180 per megawatt-hour. All revenue that exceeds the threshold will be collected by governments.

The ministers have also approved a so-called ‘solidarity mechanism’ to partially capture the surplus profits made by fossil fuel companies. Authorities will be able to introduce a 33% levy on the profits made by those companies in the 2022 fiscal year in case the profits represent a 20% increase compared to the average seen in the last three years.

The extra funds will reportedly be re-directed to households and companies under financial stress in the form of subsidies, reduced tariffs or income support.

The Czech Republic’s minister for industry and trade, Jozef Sikela, told reporters ahead of the meeting that while the package is a decisive step, further action is needed. “We must not stop here. We are in an energy war with Russia. The winter is coming. We need to act now. Now means now,” Sikela was quoted as saying by Euronews.

His French counterpart, Agnes Pannier-Runacher, echoed the call, stating “Let me be very clear: We will have to go faster, much further and make other proposals.”

The EU’s emergency package comes as inflation in the Eurozone hit double digits for the first time in the history of the single currency.