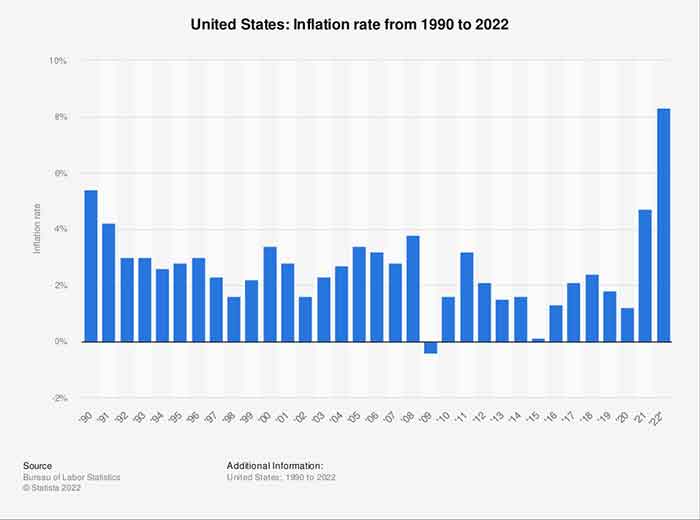

The U.S. consumer price index (CPI) rose 0.4% last month after gaining 0.1% in August, the U.S. Labor Department said in its report. In the 12 months through September, the CPI increased 8.2% after rising 8.3% in August.

The White House noted that inflation over the last three months has averaged 2%, at an annualized rate. That is down from 11% in the prior quarter.

A Reuters report said:

U.S. President Joe Biden said the CPI report released on Thursday shows some progress in the fight against higher prices but there is more work to do, according to a statement issued by the White House.

“But even with this progress, prices are still too high. Fighting the global inflation that is affecting countries around the world and working families here at home is my top priority,” Biden said in statement.

The latest inflation report ensures that Biden and his Democratic Party will head into the critical midterm elections in November facing lingering questions on how they managed soaring prices of food, fuel and an array of other consumer products.

Biden once again said fighting inflation is his top priority after spending much of the past two years trying — with modest success — to curtail price surges.

Pain For Many Households

Other media reports said:

The annual U.S. inflation rate was little changed in September causing pain for many households.

High prices for food, shelter and medical care sent the consumer price index for September up by 0.4% compared to August’s 0.1%, according to data from the Bureau of Labor Statistics released Thursday morning.

Markets opened lower following the news, with investors attempting to gauge how the Federal Reserve will respond.

Inflation remains at the top of Americans’ minds going into the last quarter of a year that has seen across-the-board volatility in food, gasoline and energy prices.

Stubborn Inflation

An NBC News report said:

While the Biden administration has sought to address the issue through measures like the Inflation Reduction Act, the provisions contained in that law are set to take effect over a period of 10 years, and at least two separate models predict its actual impact on inflation would be statistically insignificant.

So the burden of bridling a stubborn inflation rate sits at the doorstep of the Federal Reserve. The central bank has already increased its benchmark rate five times this year — which included three consecutive 0.75% hikes — in order to make borrowing and spending money more expensive in order to cool off consumer demand.

At its most recent Federal Open Markets Committee meeting, Fed officials largely agreed that it was better to aggressively raise interest rates now in order to avoid economic pain down the road.

Housing Market

The housing market has seen the most immediate impact of the Fed’s rate-raising scheme. At nearly 7%, mortgage rates are now at their highest levels in close to two decades, which has slowed home price growth in its tracks, and in some cities caused prices to fall.

Comerica Bank chief economist Bill Adams told NBC News that house prices and rents are likely to decline throughout the United States in the coming months.

What remains to be seen, he said, is whether other key costs, especially food, will also come down. Bringing those expenses lower may be out of the federal government’s hands, he said.

“There is definitely still a Russia-Ukraine effect keeping food prices elevated,” he said. “Commodities futures prices for grain have been high since the start of the Russian invasion.”

Food And Higher Energy Costs

Food costs also reflect higher energy costs, he said, and while gas price declines in September likely affected the headline inflation reading, Adams notes pump prices have already begun to climb back up amid higher demand. Additionally, OPEC+ announced last week it would cut oil production by 2 million barrels per day, which sent crude oil prices to nearly $98 Friday.

Pressure On Wages

Finally, an apparent shortage of workers has continued to put upward pressure on wages, Adams noted. Last month, the unemployment rate hit 3.5%, tying the pre-pandemic low and suggesting most people who want to find work are able to do so while also commanding higher wages.

“Food price inflation is going to stay a problem in U.S. for next couple of months,” Adams said. “Wage growth in the U.S. is considerably faster than it was pre-pandemic, especially in lower paying occupations like food services.”

Darker Mood

A Market Watch report — ‘The mood has turned darker’: Desperate to outrun inflation, people are making big (and easy) changes to their habits. You can too. (https://www.marketwatch.com/story/the-mood-has-turned-darker-desperate-to-outrun-inflation-people-are-making-big-and-easy-changes-to-their-habits-you-can-too-11665666332?siteid=yhoof2, Oct. 13, 2022) — said:

Rattled by the rise in the cost of living in recent months, millions of people have been taking action to conserve their cash.

Americans are trying to cope with inflation, and they are changing their behavior as a result.

Stubbornly high inflation rates in recent months and several interest rate hikes by the U.S. Federal Reserve are impacting consumer behavior. That is according to company earnings reports, market-data analytics and consumer surveys.

Inflation is clinging to a four-decade high.

The cost of living increased 0.4% from August to September. But the “core” numbers that strip away volatile food and energy costs rose 0.6% month to month when Wall Street forecasters were expecting a 0.4% rise.

Rattled by the rise in the cost of living in recent months, millions of people have already been taking action to conserve their cash, according to recent McKinsey & Co. report that explored the ways people are trading down.

“Whether it is at gas pumps or in grocery stores, people across the U.S. have been feeling a pinch in their pocketbooks this summer,” it said. “Inflation is the highest it has been in decades, and consumers are worried and jittery.”

With inflation at a 40-year high, McKinsey said, “The mood has turned darker. Thirty percent of our respondents say they are feeling pessimistic, and that we may be headed toward one of the worst recessions we’ve ever seen.”

Inflation has become a stark — if bleak — reality for some people, especially when shopping for food — like this California woman who told MarketWatch that she buys less vegetables, or freezes them to get more bang for her buck.

Once consumers have made up their minds that inflation is a problem, and it is here to stay, they are less likely than economists to change their minds, said Carlo Pizzinelli, an economist at the International Monetary Fund’s research department.

Consumers’ Changing Behavior

The report said:

- Three quarters of consumers said they were engaging in some sort of deal-seeking: 60% were adjusting the quantity of what they were buying. That means either opting for large amounts at lower unit prices or smaller amounts.

- 44% of people told McKinseythey were delaying purchases on non-essential items. Lower-income shoppers tended to single out certain groceries, home improvement, footwear and apparel as the items bound for a pause.

- More than one-third (37%) of McKinsey’s respondents said they were switching retailers for lower prices or discounts.They are also eyeing lower prices from generic brandsand using ‘buy now pay later’ programs, McKinsey noted.

- Three quarters of consumers are taking a dim view of discretionary spending, according to a separate survey carried out last September by Numerator, a consumer markets and analytics firm.

Many people already know where they are planning to cut back — starting with dining out, travel, electronics, plus toys and games — as they are learning to live with feelings of insecurity that rising prices bring.

Gold Slides

Another Reuters report said:

Gold prices dropped more than 1% on Thursday to a two-week low after data showing higher-than-expected U.S. inflation numbers in September cemented market expectations the Federal Reserve will stick to its policy of aggressive interest rate hikes.

Spot gold dropped 1.5% to $1,647.80 per ounce by 1319 GMT. U.S. gold futures lost 1.4% to $1,6544.50.

Spot silver dropped 2.7% to $18.54 per ounce, platinum fell 2.3% to $859.83, and palladium dipped 3.7% to $2,056.42.

The data “portends that the Fed is going to need to be more aggressive in fighting these inflationary pressures by raising interest rates at a faster pace” and hence, gold is under pressure, said David Meger, director of metals trading at High Ridge Futures.

Following the data, the dollar jumped, weighing on greenback-priced gold.

The market’s sharp reaction was seen as predictable.