Western sanctions against Russia have accelerated the move away from the U.S. dollar worldwide, Stephen Jen, the CEO of London-based asset management company Eurizon, warned on Tuesday.

The dollar’s share in global reserves fell ten times faster last year than over the past two decades, Jen said, as cited by Bloomberg. The process began as some countries started to look for alternatives after seeing Russia’s assets frozen abroad and the country cut off from the global financial messaging system known as SWIFT, according to Jen.

Adjusting for “wild” exchange rate fluctuations last year, the U.S. dollar has lost roughly 11% of its market share since 2016 and double that amount since 2008, Jen and his Eurizon colleague Joana Freire wrote in a note.

“The dollar suffered a stunning collapse in 2022 its market share as a reserve currency, presumably due to its muscular use of sanctions,” the note reads. “Exceptional actions taken by the U.S. and its allies against Russia have startled large reserve-holding countries,” most of which are emerging economies, Jen and Freire explained.

The greenback now represents about 58% of total global reserves, down from 73% in 2001 when it was the “indisputable hegemonic reserve” the experts said.

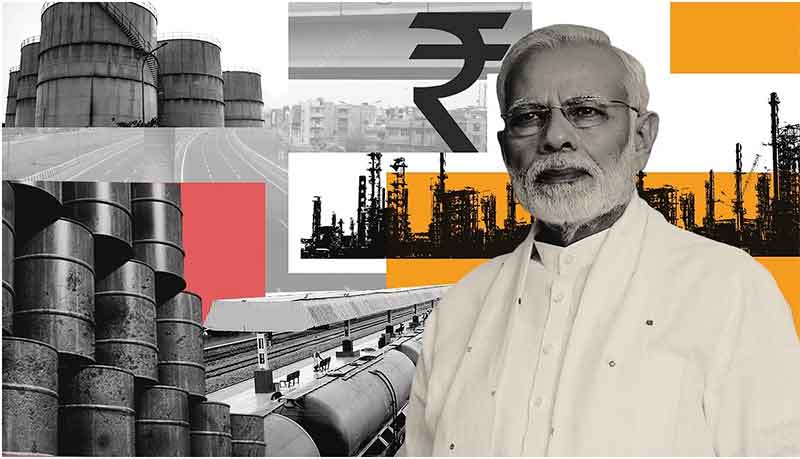

China and India are working to use their own currencies to settle international trade, while Russia started to accept payments for its exports from a number of countries in rubles and Chinese yuan.

Earlier this week, Brazilian President Luiz Inacio Lula da Silva called on developing nations to move away from the U.S. dollar in favor of their own currencies.

Following Lula’s comments, U.S. Secretary of the Treasury Janet Yellen admitted that the role of the U.S. dollar as the world reserve currency could diminish due to Washington using its leverage over the global financial system to pursue its geopolitical goals through sanctions.

Biden Is Willing To Damage U.S. Economy To Counter China, Says Yellen

Media reports including a report by Barron’s (April 20, 2023, https://www.barrons.com/articles/yellen-china-speech-xi-biden-4cde3450?siteid=yhoof2) said:

U.S. President Joe Biden will stop at nothing to protect the U.S. against security threats posed by China, even if the actions he must take damage his own nation’s economy, U.S. Treasury Secretary Janet Yellen has claimed.

“National security is of paramount importance in our relationship with China,” Yellen said on Wednesday in a speech in Washington. She gave the example of blocking China from obtaining certain technologies, adding, “We will not compromise on those concerns, even when they force trade-offs with our economic interests.”

Yellen accused China of “unfair” economic practices and of “taking a more confrontational posture” toward the U.S. and its allies in recent years. Washington has a “broad set of tools” to deal with security threats from China, she added, such as export controls and sanctions against entities that provide support to the People’s Liberation Army (PLA).

“The Treasury Department has sanctions authorities to address threats related to cybersecurity and China’s military-civil fusion,” Yellen said. “We also carefully review foreign investments in the United States for national security risks and take necessary actions to address any such risks. And we are considering a program to restrict certain U.S. outbound investments in specific sensitive technologies with significant national security implications.”

The Biden administration has already taken steps to block Chinese companies from securing advanced semiconductor technologies, such as restricting exports of chip-making equipment. Yellen insisted that Washington doesn’t take such actions to gain an economic advantage or to stifle China’s growth and modernization.

Yellen also scolded China for alleged human rights abuses and alleged “no limits” support for Russia amid the Ukraine crisis. She warned that consequences would be severe if China provided material support or helped Russia evade sanctions, and she added that the U.S. would use its “tools” to deter human rights abuses.

Beijing has balked at U.S. accusations, suggesting that Washington should “make more efforts in solving its own human rights problems.” Chinese leaders also have faulted Washington for a “Cold War mentality” in which Beijing is demonized as a security threat as Biden’s administration tries to contain its economic progress.

“Containment and suppression will not make America great again, nor will it stop China from moving towards national rejuvenation,” Chinese Foreign Minister Qin Gang told reporters last month.

Yellen admitted earlier this week that Washington’s use of its leverage over the global financial system to sanction other countries could diminish the role of the US dollar as the world’s reserve currency. Asked about “weaponization” of the U.S. currency, she told CNN that such tactics “could undermine the hegemony of the dollar.”

Treasury Secretary Janet Yellen is set to confirm what investors have increasingly feared: The U.S. is viewing its relationship with China through a national security lens — and that may come with some economic costs.

Yellen’s speech takes a hawkish tone.

Yellen’s comments were delivered in a set-piece speech on U.S.-China economic relations at Johns Hopkins University’s School of Advanced International Studies.

Yellen did manage to strike a delicate balance between national security and economic concerns, hitting all the familiar talking points from defending U.S. national interests and supporting human rights, to an openness for greater economic cooperation. She reiterated the primacy of national security in economic affairs, and stated that proposals to limit specific U.S. foreign investment in China were being considered.

The high point of her speech to potentially reignite better relations came when she said the goal was “not to use these tools to gain competitive economic advantage.”

Yellen’s speech also lacked any concrete new initiatives. She had no new vision of a future in which countries with such wildly divergent worldviews could find a way toward compromise. And her emphasis on limiting only a narrow range of economic activity on national security grounds, chip technology for example, is unlikely to be viewed as less offensive than restricting a range of trade and investment.

Yellen said she plans to travel to China “at the appropriate time,” without offering details.

U.S. Debt Default A Matter Of Time, Says Musk

Tesla and Twitter chief executive Elon Musk, who has been calling for U.S. government spending reductions, said on Wednesday that a debt default was just a question of time.

“Given federal expenditure, it is a matter of when, not if, we default,” Musk wrote responding to a Twitter post by the White House that the Republican plan may be to default on U.S. debt.

Earlier this week, US House of Representatives Speaker Kevin McCarthy warned in a speech at the New York Stock Exchange that the U.S. debt is unsustainable and poses a threat to the nation. He said that Republicans would not allow the country to default on its debt, taking a jab at President Biden for refusing to negotiate on cost-cutting measures.

McCarthy added that the House of Representatives would soon vote on a bill to raise the debt ceiling through 2023.

U.S. President Joe Biden urged the Republicans to first release their proposed budget, with the White House stressing it would not negotiate the debt ceiling until the GOP releases its counterproposal to the administration’s budget plan, which was put out in March.

In January, the U.S. Treasury Department notified Congress of the start of “extraordinary measures” until June 5 in order to continue paying the government’s obligations as the US has reached its $31.4 trillion debt limit. Treasury Secretary Janet Yellen then called on lawmakers to “act promptly” to increase borrowing limits in order to avoid a default.

EU Done With Russia Sanctions, Say Officials

The European Union has exhausted its options for further economic restrictions against Russia, the Financial Times (FT) reported on Thursday, citing EU officials.

The bloc has so far adopted ten rounds of sanctions in response to the Ukraine conflict and is currently working on an eleventh package of punitive measures against Moscow. Meetings between the European Commission and member state officials to informally discuss new actions will start on Friday, FT wrote.

Officials working on further sanctions told the outlet that they are likely to be limited to expanding the list of individuals subject to asset freezes and travel bans, as well as steps to scale up existing measures by closing loopholes.

Most officials reportedly admitted that those parts of the Russian economy that were left unsanctioned are parts that one or more EU member states “cannot live without,” and thus measures targeting them would be vetoed.

“We are done,” one of the officials told FT, adding: “If we do more sanctions, there will be more exemptions than measures.”

New restrictions could reportedly target Russia’s nuclear fuel and services exports, but those would be opposed by some member-states, such as France, Hungary, and others.

Sweeping EU sanctions have targeted various sectors of the Russian economy as well as individuals and entities.

According to FT, almost 1,500 people and more than 200 entities are currently subject to asset freezes and travel bans. The report indicated that the bloc’s restrictive measures have banned bilateral trade flows worth more than €135 billion ($148 billion), including energy imports from Russia, as well as exports of technology, machinery, and electronic goods. Some €21.5 billion worth of assets belonging to sanctioned individuals and entities has been frozen, alongside €300 billion of Russian central bank reserves.

Many economists and politicians, however, have argued that the embargos harm the West more than Moscow.

Hungarian President Viktor Orban has repeatedly called for “the failed policy of Brussels” to be changed, noting that the sanctions “did not fulfill the hopes were pinned on them,” while Europe is “slowly bleeding.”

Meanwhile, Russian President Vladimir Putin has likened the bloc’s attempts to cut itself off from Russian fossil fuels to economic “suicide.”