Transport Energy Futures: Long-Term Oil Supply Trends

And Projections (Australian Peak Oil Report)

By Dr David Gargett

22 January, 2012

Energy Bulletin

Suggested by an Australian reader who recommended the article that broke the story about this report:

This is a really important article published by the Daily Telegraph since it is the first widespread publicity for the fact that the Australian government has made a very comprehensive study of future oil supply (over 430 pages long!) including its own detailed analysis of data and their conclusions are closely consistent with the work of Prof. Kjell Aleklett of Sweden.

They predict a decline in oil supply within a few years. The scandal is that the government has, subsequently, tried to cover up the existence of the report. (After all, any open admission that oil decline is imminent would then require them to tell us what they are going to do about it.)

Interestingly, the report comes to many of the same conclusions about why the IEA's prognoses are inaccurate as Aleklett's "Peak of the Oil Age" paper. Most distressingly, the report was prepared in 2009 but its existence has only now gained widespread attention.

[The complete report is available online as a 474-page PDF.]

BITRE Report 117: Transport energy futures: long-term oil supply trends and projections

Foreword

In 2007 the Bureau of Infrastructure, Transport and Regional Economics (BITRE) commenced a project to look in a strategic way at possible alternative transport energy futures.

This was driven by a perceived need to address two key challenges to ‘business-as-usual’ for Australian and world transport: oil depletion and global warming.

To examine the oil depletion issue, it was necessary to assemble large amounts of data over long periods of time (centuries in a large number of cases). BITRE has had long experience with assembling lengthy datasets from multiple and sometimes conflicting data sources, and then analysing their dynamics. This is what has been done here, to examine the oil production prospects of over 40 countries/regions around the world, as a preliminary to delineating the scope of the oil depletion challenge.

Recognising that the issue of the timing of oil depletion is a highly controversial area, where information can be contested and where there is a range of views and

positions, comments are expressly invited on this report.

Future reports will examine 1) world oil demand/price relationships and 2) the kinds of responses to the twin challenges of oil depletion and global warming that may be possible in terms of alternative fuels and propulsion technologies.

This report has been compiled by Dr David Gargett.

Phil Potterton

Executive Director

Bureau of Infrastructure Transport, and Regional Economics

March 2009

Acknowledgements

This report would not have been possible without huge amounts of data published in graphical form by Colin Campbell and Jean Laherrere.

In addition, production data from the Energy Information Administration of the US Department of Energy has been utilised extensively.

Many other authors have provided specific items of data and are listed in the Data Sources section at the end of the report.

At a glance

The trends in discovery of oil can be used to project similar trends in the subsequent production of oil. Using a method developed here, forecasts of future oil/liquids production for 40 countries/regions around the world have been produced.

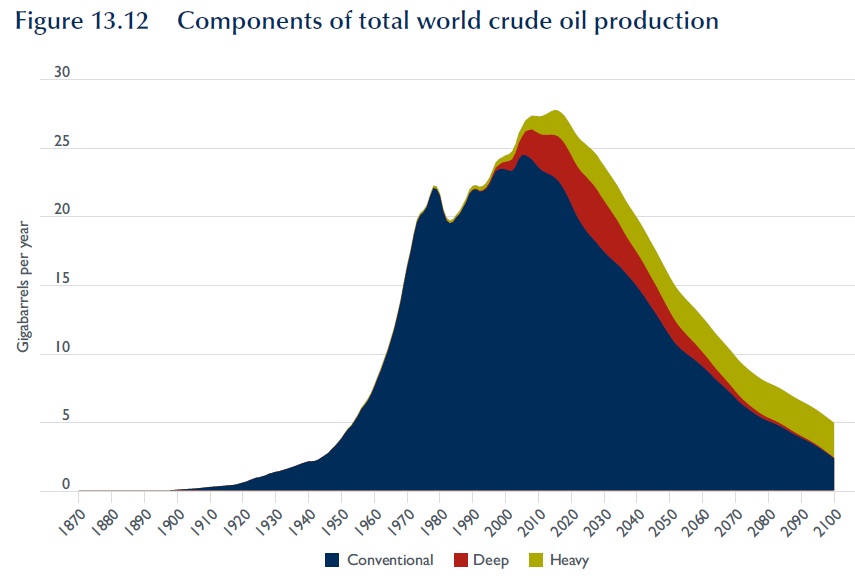

The oil production prospects of different countries and regions vary immensely. However, on balance, when an aggregation is done across the globe, it is predicted that world production of conventional oil is currently just past its highest point (conventional oil is oil pumped from wells on land or in water less than 500 metres deep). A predicted shallow decline in the short run should give way to a steeper decline after 2016.

However, deep water and non-conventional oil production are growing strongly, turning a slight decline into a plateau for total crude oil (non-conventional oil is heavy and viscose or indeed tar-like oil). Given the growth in deep and non-conventional balancing the shallow decline in conventional production, it is predicted that we have entered about 2006 onto a slightly upward slanting plateau in potential oil production that will last only to about 2016—eight years from now (2008). For the next eight years it is likely that world crude oil production will plateau in the face of continuing economic growth. After that, the modelling is forecasting what can be termed ‘the 2017 drop-off’. The outlook under a base case scenario is for a long decline in oil production to begin in 2017, which will stretch to the end of the century and beyond. Projected increases in deep water and non-conventional oil, which are ‘rate-constrained’ in ways that conventional oil is not, will not change this pattern.

Importantly, these forecasts assume that world oil production is not constrained in the near term by reduced demand arising from lower world economic growth. Depending on the length of time before a return to more normal levels of world economic growth and resulting higher demand for oil, the dropoff is likely to be delayed.

The outlook is not really changed much if a scenario of increased Middle East oil production is played out. The result of that scenario is that oil production continues its growth for longer and then falls far more precipitously. Arguably, this could be a worse scenario, as far as the world being able to cope comfortably with the transition. The possible effect of higher prices in bringing forward production would have a similar effect. Higher prices might also stimulate exploration but are no guarantee of significant further discovery.

Thus at some point beyond 2017 we must begin to cope with the longer-term task of replacing oil as a source of energy. Given the inertias inherent in energy systems and vehicle fleets, the transition will be necessarily challenging to most economies around the world.

Coping with the supply reductions will be compounded by the fact that shrinking oil supply will interact with measures to reduce greenhouse gas emissions in order to address climate change. While there are opportunities for joint solutions, there will also be conflicting demands. For example, two of the more obvious sources of alternative motive energy are coal-to-liquids and gas-to-liquids. Both of these would involve increased emissions.

Executive summary

The methodology used in this report is new and allows detailed patterns of future oil production to be forecast from past patterns in oil discovery, when the levels of the discovery data are adjusted to those indicated by past production data.

This adjustment of discovery data (usually upwards) results in higher assessments of possible future production than the so-called ‘peak oil’ analysts.

But it also results in lower forecasts than those from the ‘cornucopians’ as they may be called, who do not see the patterns of current production pointing to a plateau in oil production any time soon.

Using this paper’s methodology, forecasts of future oil production for 40 countries/regions around the world have been produced.

Production prospects of different countries and regions vary immensely.

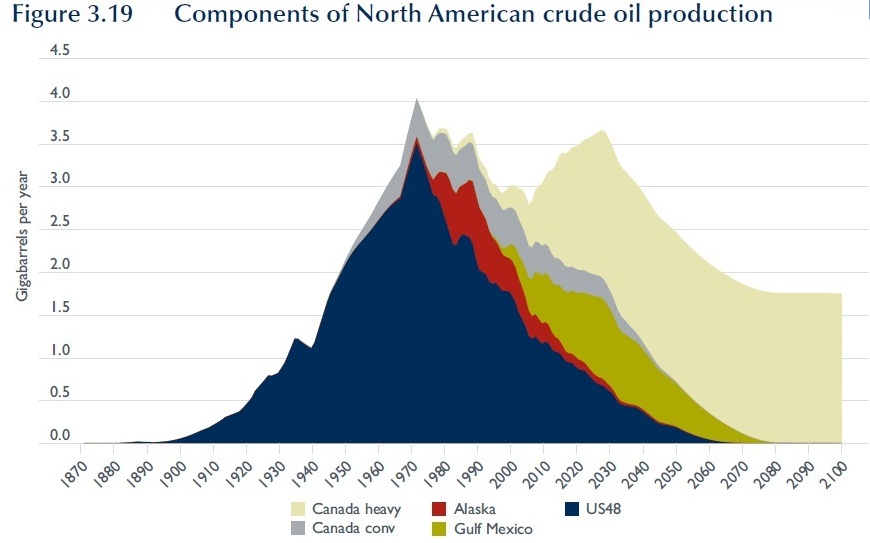

North American production is set to rebound to 2035 under the impetus of large increases in Canadian heavy and Gulf of Mexico deep water oils.

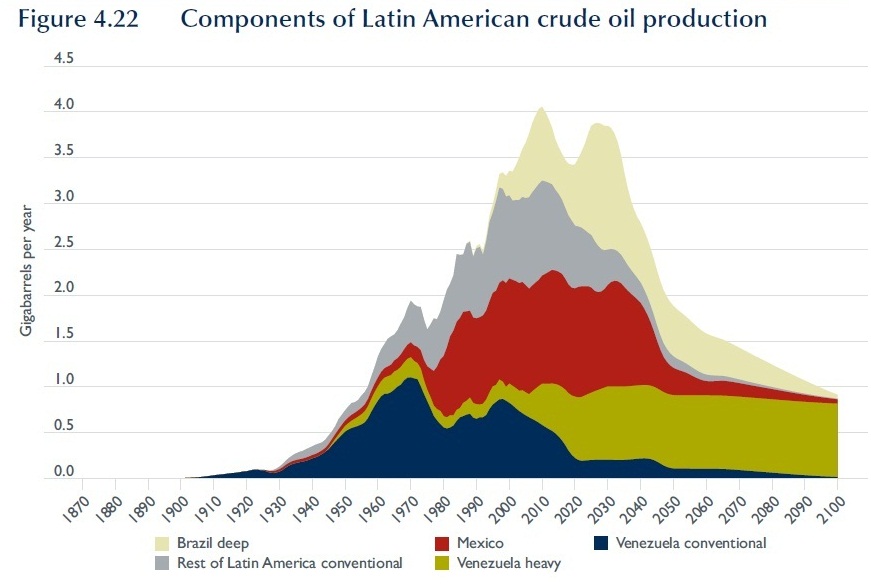

Latin American production is expected to have two peaks to 2035, after which production declines are predicted.

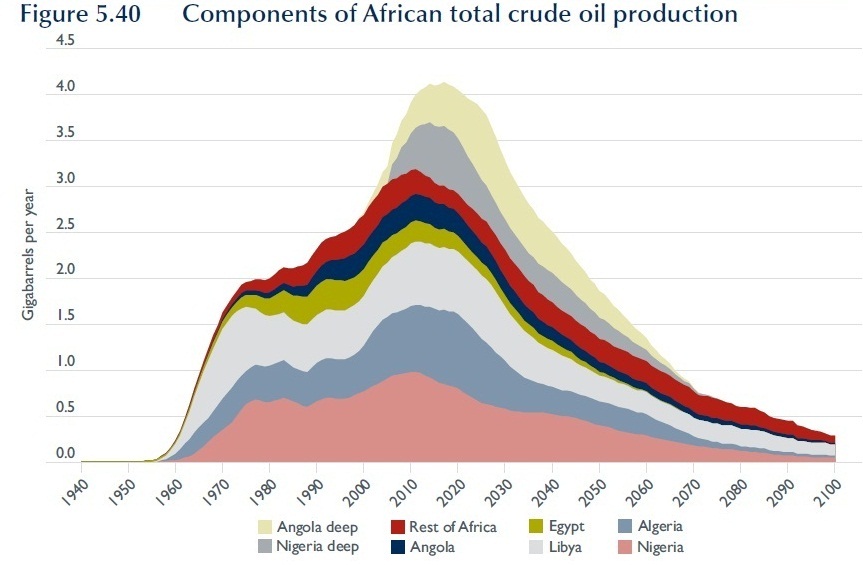

African production should continue to increase to 2020, thanks to large increases in deep water oil off-setting declines in conventional oil production.

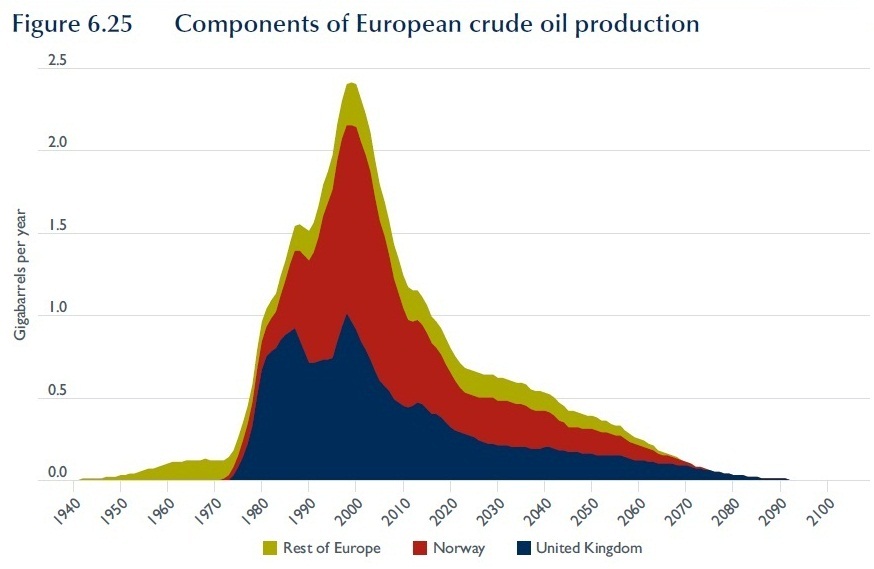

European oil production should continue to decline steeply.

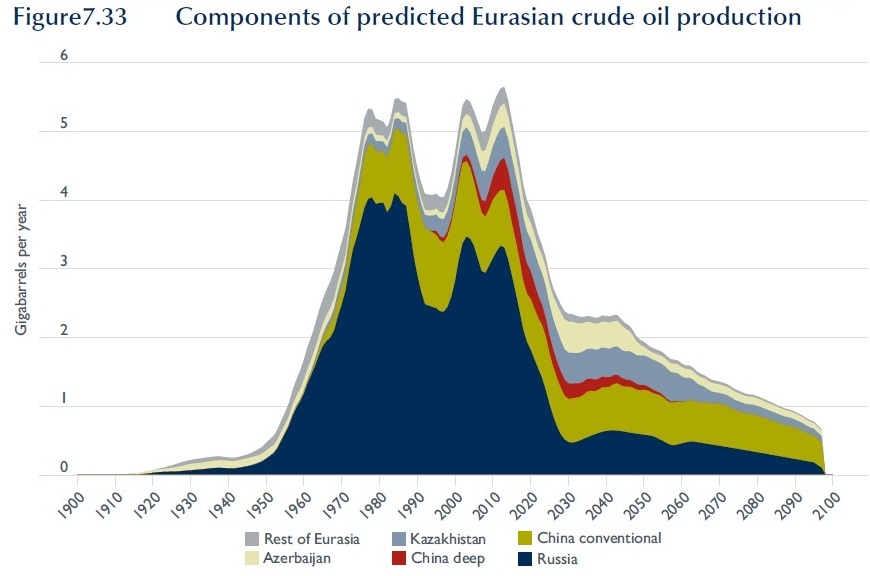

Eurasian production is set to fluctuate to about 2016, after which time a sharp decline should set in.

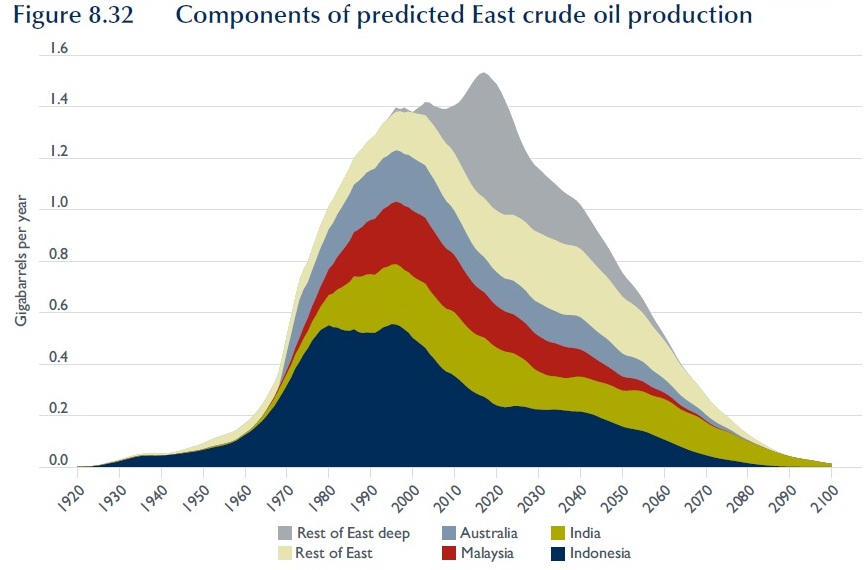

The East region should have increases in production to 2025, thanks to an expansion of deep water production.

Production in the Middle East outside the Gulf region should rise somewhat to about 2025, after which production declines should set in.

[See original document for graph]

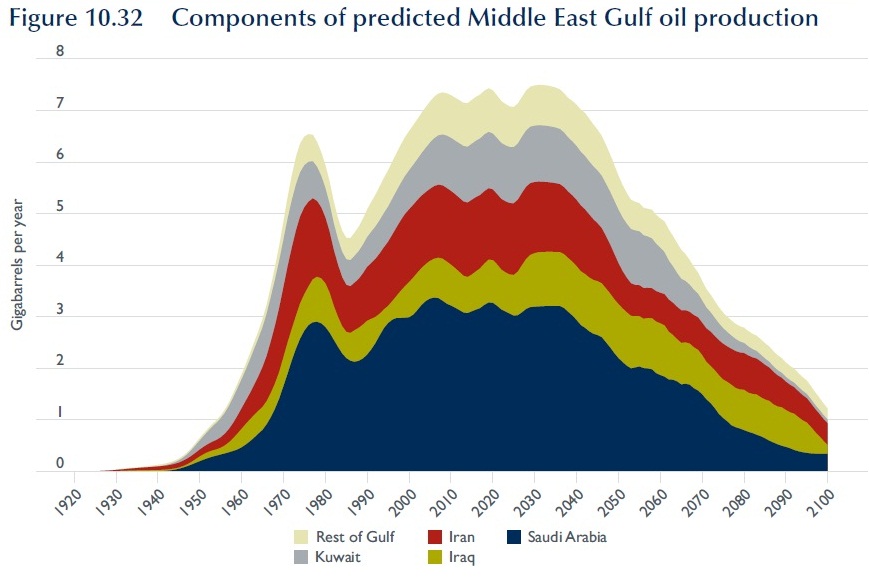

Middle East Gulf production, under a business-as-usual outlook, should maintain current production levels to 2040, after which time declines should set in.

The oil production prospects of different countries and regions vary immensely.

However, on balance, when an aggregation is done across the globe, it is predicted that world production of conventional oil is currently just past its highest point conventional oil is oil pumped from wells on land or in water less than 500 metres deep). A predicted shallow decline in the short run should give way to a steeper decline after 2016. However, deep water and non-conventional oil production are growing strongly, turning a slight decline into a plateau for total crude oil (nonconventional oil is heavy and viscose, as in the Venezuelan deposits, or indeed tar-like, as in the Canadian tar sands).

Given the growth in deep and non-conventional balancing the shallow decline in conventional production, it is predicted that that we have entered about 2006 onto a plateau in potential world crude oil production that will last only to about 2016—eight years from now (2008). For the next eight years it is likely that potential world crude oil production will plateau (very little rise) in the face of continuing economic growth.

After that, the modelling is forecasting what can be termed ‘the 2017 drop-off’. The outlook under a base case scenario is for a long decline in oil production to begin in 2017, which will stretch to the end of the century and beyond. Importantly, these forecasts assume that world oil production is not itself constrained by lower demand arising from low economic growth. Depending on the length of time to return to more normal levels of world economic growth and resulting higher demand for oil, the ‘drop off’ is likely to be delayed.

Projected increases in deep water and non-conventional oil will not change this pattern, after the decline in conventional oil starts in earnest. This is because the production of non-conventional oil is constrained in two ways that conventional oil production is not.

Firstly, non-conventional oil is essentially ‘manufactured’ oil, and the manufacturing process is often ‘rate constrained’ due to limitations on the rate of utilisation of input resources, e.g. energy, water, capital, skills, et cetera.

Secondly, the production processes for non-conventional oil use energy to get energy. As such, their energy profitability is much less than conventional oil sources.

The world outlook for total crude oil production (conventional plus deep and non-conventional) is not really changed much if a scenario of increased Middle East oil production is played out. The result of that scenario is that oil production continues its growth for longer and then falls far more precipitously. Arguably, this could be a worse scenario, as far as the world being able to cope comfortably with the transition.

The conclusion of a drop-off is also true regardless of the path of world oil prices. Higher prices encourage exploration, which is a necessary condition for discovery. Higher prices mean more wells are drilled, but there are diminishing returns. Even a 50 per cent increase in historical drilling will only mean that the discovery of some of the remaining conventional oil might be brought forward slightly. Given the lags, this will not materially alter the forecast path of production. Higher prices might also bring forward a small proportion of production, but experience in the U.S has shown that this effect will probably be small. The main constraints on production are geological in nature.

Thus beyond 2017 we must begin to cope with the longer-term task of replacing oil as a source of energy.

Given the inertias inherent in energy systems and vehicle fleets, the transition will be challenging to most economies around the world.

If the prognosis for plateau and then decline of conventional petroleum liquids is accepted, the question arises as to how the world will cope with the prospect of one of its major and convenient energy sources being progressively withdrawn.

There are really three options:

1. Oil is replaced with other (equally rich and abundant) energy sources (opening the whole debate about alternative fuel sources, e.g. gas-to-liquids, coal-to-liquids, electricity, hydrogen).

2. Improved energy efficiency results in energy use per unit of GDP declining markedly to match the shortfall.

3. GDP declines to match the shortfall.

The first option opens the whole debate about alternative fuel sources. For example, coal-to-liquids and gas-to-liquids production in Australia and worldwide is set to begin in earnest at about the same time as forseen here for the beginning of the decline in conventional petroleum liquids (about 2017). How much of the constant annual decline in production foreseen can be replaced by continually ramping up production from ‘fungible’ fossil fuels? What about the greenhouse gas implications? If electric vehicles begin to make inroads, what are the the infrastructure requirements and lags, and what about the greenhouse gas implications of the elctricity generation energy sources—coal or renewables?

The second option leads to consideration of necessary infrastructure changes to supply and support new energy-saving technologies, and the lags involved in this. Again, greenhouse gas issues are important.

Alternatives under options 1 and 2 will be the subject of a future BITRE report.

However, it would seem that, given the magnitude of the potential supply reductions, many adaptations in many areas will be required—the so-called ‘wedges’ approach (Lovins et al 2004, Hirsch et al 2005).

It should be noted that this report concentrates on the long-run potential supply of conventional petroleum liquids. In order to understand the dynamics of the oil market, not only potential supply, but also demand and price need to be considered. In the short run, the effects of the global economic slow down are likely to mean that lower demand, not limits on potential supply, will be the limiting factor for oil production. Thus lower GDP growth will be running the show in the short run, and the associated lower oil prices wil in fact make it harder to progress options 1 and 2 to deal with the long-run trends. World oil demand/price dynamics are the subject of a second future BITRE report.

In conclusion, this paper indicates that although the oil production prospects of different countries and regions vary immensely, the prospects for potential world conventional liquids production can be summarised as ‘flattish to slightly up for another eight years or longer (depending on the duration of the global economic slowdown) and then down’. In this short run, the effects of the global economic slowdown are likely to mean that curtailed demand, not potential supply, will be limiting factor on oil production. But, given the magnitude of the downturn foreseen for the rest of the century, and given the inertia inherent in our energy systems and transport vehicle fleets, the challenge for global transport will remain.

[The complete report is available online as a 474-page PDF.]

© Commonwealth of Australia, 2009

ISSN 1440-9569

ISBN 978–1–921260–31–5

March 2009/INFRASTRUCTURE 08294

This publication is available in hard copy or PDF format from the Bureau of Infrastructure, Transport and Regional Economics website at www.bitre.gov.au — if you require part or all of this publication in a different format, please contact BITRE.

An appropriate citation for this report is:

Bureau of Infrastructure, Transport and Regional Economics (BITRE), 2009, Transport energy futures: long-term oil supply trends and projections, Report 117, Canberra ACT.

Editorial Notes

The complete report is available on a French website (Manicore) run by Jean-Marc Jancovici as a 474-page PDF.

It does not seem to be posted on the website of the Australian Bureau of Infrastructure, Transport and Regional Economics where it presumably belongs.

Comments are not moderated. Please be responsible and civil in your postings and stay within the topic discussed in the article too. If you find inappropriate comments, just Flag (Report) them and they will move into moderation que.