Major Reports Point To Oil Supply Turmoil And Price Volatility

By Matthew Wild

24 August, 2010

Peak Generation

Major energy reports published this year are pointing to a significant rise in the price of oil due to supply constraints sometime over the next three years – the only disagreement is how soon.

So far 2010 has seen three international reports considering the future of oil production, demand and prices. These were published by high profile groups that command widespread respect – in turn, a collection of UK industrialists, the US military and a joint effort between Europe’s most recognized insurance company and a politically connected think-tank.

Largely ignored by the media, and considered separately online as they came out, it is interesting to do a compare-and-contrast between documents produced for widely different audiences on each side of the Atlantic.

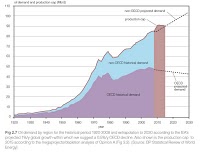

In early February a group calling itself the UK Industry Taskforce on Peak Oil & Energy Security presented The Oil Crunch: a Wake-up Call for the UK Economy, an “independent, business-minded” view of a coming decline in oil production. Representing six UK companies – Arup, Foster + Partners, Scottish and Southern Energy, Solarcentury, Stagecoach Group and Virgin – the group called for immediate government action to help overcome potential economic turmoil relating to oil demand versus production (see graphic, left, from the report).

In early February a group calling itself the UK Industry Taskforce on Peak Oil & Energy Security presented The Oil Crunch: a Wake-up Call for the UK Economy, an “independent, business-minded” view of a coming decline in oil production. Representing six UK companies – Arup, Foster + Partners, Scottish and Southern Energy, Solarcentury, Stagecoach Group and Virgin – the group called for immediate government action to help overcome potential economic turmoil relating to oil demand versus production (see graphic, left, from the report).

The report begins with a clear definition of peak oil, before suggesting that “global supply rates are currently at, or near, their peak and cannot rise significantly above 92 million barrels per day.” Or, in more detail:

There are now serious concerns that the free flow of relatively low cost oil, which has underpinned OECD countries economic growth since 1945, may not be sustainable for very much longer. . . low-cost (under $25/b) oil supplies effectively ended in early 2005 and are unlikely to return. The actual global supply of oil is now expected to be limited to 91-92Mb/d (million barrels per day) of capacity that will be in place by end 2010/early 2011. Global capacity will then remain in the 91-92Mb/d range until 2015 from which time depletion will more than offset capacity growth from then onwards. . .

The next major supply constraint, along with spiking oil prices, will not occur until recession-hit demand grows to the point that it removes the current excess oil stocks and the large spare capacity held by OPEC. However, once these are removed, possibly as early as 2012/2013 and no later than 2014/2015, oil prices are likely to spike, imperilling economic growth and causing economic dislocation.

It makes some interesting observations about demand destruction arguments that suggest prices above $120 per barrel kills the market and brings oil down again. Nowadays world economic development is “systematically different from the past,” it suggests, with the growth coming from developing countries whose “economic systems are currently evolving in a climate of higher oil prices and therefore might be relatively immune to it.”

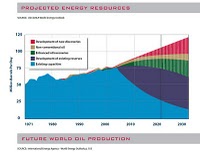

Later in February the United States Joint Forces Command published The Joint Operating Environment 2010 as an “intellectual foundation upon which we will construct the concepts to guide our future force development.” Essentially, it sets out to consider likely “future trends and disruptions” that will affect the US military over the next 25 years. This list includes a series of global issues familiar to readers of any liberal-minded publication: demographics, globalization, US debt, the global recession, water shortages, food supply, climate change and dwindling oil supplies (graphic, left).

Later in February the United States Joint Forces Command published The Joint Operating Environment 2010 as an “intellectual foundation upon which we will construct the concepts to guide our future force development.” Essentially, it sets out to consider likely “future trends and disruptions” that will affect the US military over the next 25 years. This list includes a series of global issues familiar to readers of any liberal-minded publication: demographics, globalization, US debt, the global recession, water shortages, food supply, climate change and dwindling oil supplies (graphic, left).

It points to a chronically unstable world. Massive population growth across the Middle East and Sub-Saharan Africa may lead to significant potential for “revolution or war, including civil war,” alongside rising tensions over dwindling resources as basic as water and food both between nations and different groups within individual countries. The authors may have an interest in saying this, but it will involve a great deal of work for the US military – the report considers its role in combat, policing and aid delivery. But the Joint Operating Environment is also clear that the burgeoning US debt suggests military spending cuts may be coming: “Interest payments, when combined with the growth of Social Security and healthcare, will crowd out spending for everything else the government does, including national defense.” The point is that the military will most likely have to do more with less.

Although stating that global energy production would have to rise by 1.3 per cent each year to maintain the economic growth required to hold things together, the Joint Operating Environment contains the term peak oil precisely once. (It appears as a heading, over an item that discusses likely coming energy shortages, but not from a peak oil perspective.) The report clearly states the main concern is underinvestment in the oil industry at a time of increasing global demand. Its view is:

Assuming the most optimistic scenario for improved petroleum production through enhanced recovery means, the development of non-conventional oils (such as oil shales or tar sands) and new discoveries, petroleum production will be hard pressed to meet the expected future demand of 118 million barrels per day.

A severe energy crunch is inevitable without a massive expansion of production and refining capacity.

While it is difficult to predict precisely what economic, political, and strategic effects such a shortfall might produce, it surely would reduce the prospects for growth in both the developing and developed worlds. Such an economic slowdown would exacerbate other unresolved tensions, push fragile and failing states further down the path toward collapse, and perhaps have serious economic impact on both China and India. At best, it would lead to periods of harsh economic adjustment. . .

By 2012, surplus oil production capacity could entirely disappear, and as early as 2015, the shortfall in output could reach nearly 10 MBD.

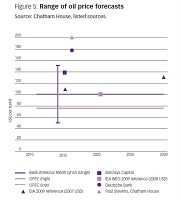

In June, insurers Lloyds (which reported 3.9 billion UK pound profits in 2009) teamed up with Chatham House (a think tank with a history of working closely with the UK parliament) to produce Sustainable Energy Security: Strategic Risks and Opportunities for Business. This examines energy issues – availability, cost and political climate change initiatives – from a business perspective. (See chart of various oil future price estimates, left, taken from the report.)

In June, insurers Lloyds (which reported 3.9 billion UK pound profits in 2009) teamed up with Chatham House (a think tank with a history of working closely with the UK parliament) to produce Sustainable Energy Security: Strategic Risks and Opportunities for Business. This examines energy issues – availability, cost and political climate change initiatives – from a business perspective. (See chart of various oil future price estimates, left, taken from the report.)

It sugars the pill with a consideration of opportunities to proactive leaders who are first to “transition to a low carbon economy,” but also states that “failure to do so could be catastrophic.” Underlying this is the stark message that “the bad times have not yet hit.” The world faces “dramatic changes” as it has “entered a period of deep uncertainty in how we will source energy for power, heat and mobility, and how much we will pay for it.”

Once again the term peak oil is largely absent, occurring three times in a densely written 44 page document. Although it gets a fair hearing, with a study quoted that suggests “there is a significant risk of a peak before 2020,” the report suggests the world faces more immediate concerns relating to oilfield investment not keeping pace with rising demand:

Even before we reach peak oil, we could witness an oil supply crunch because of increased Asian demand. Major new investment in energy takes 10-15 years from the initial investment to the first production, and to date we have not seen the amount of new projects that would supply the projected increase in demand.

While the report itself does not enter into speculation about exactly when all this could come about, it does present the following quote – you aren’t meant to miss it as it’s in a vivid purple colour a couple of point sizes larger than surrounding text – from Professor Paul Stevens, senior research fellow for Chatham House: “A supply crunch appears likely around 2013…given recent price experience, a spike in excess of $200 per barrel is not infeasible.”

Sustainable Energy Security provides an overview of the world’s declining hydrocarbon and nuclear “extractive energy sources.” It presents an overview of the whole energy debate: growing domestic oil use producing nations, increasing demand from the developing world, geopolitical considerations, questions over the availability of coal and gas for transition fuels, and the inherent problems associated with output from deepwater, oil sands and shale gas sources. (More here.) Findings include:

Modern society has been built on the back of access to relatively cheap, combustible, carbon-based energy sources. Three factors render that model outdated: surging energy consumption in emerging economies, multiple constraints on conventional fuel production and international recognition that continuing to release carbon dioxide into the atmosphere will cause climate chaos.

Energy markets will continue to be volatile as traditional mechanisms for balancing supply and price lose their power. International oil prices are likely to rise in the short to mid-term due to the costs of producing additional barrels from difficult environments, such as deep offshore fields and tar sands. An oil supply crunch in the medium term is likely to be due to a combination of insufficient investment in upstream oil and efficiency over the last two decades and rebounding demand following the global recession. This would create a price spike prompting drastic national measures to cut oil dependency.

So, three quite different reports, independently written for different audiences on either side of the Atlantic – and all with very similar views of energy supply over the next few years.

The Oil Crunch is a more typical peak oil report, calling for political action to mitigate a coming plateau in global oil production; The Joint Operating Environment, written by the military for its own leaders, states a “severe energy crunch is inevitable” because of oil industry underinvestment even though the world has large reserves; Sustainable Energy Security also states projected demand for oil is greater than our ability to bring it to market.

Only the first of these is a peak oil report – the others do not outright dispute the peak concept, but suggest a variety of issues are more urgent, from supply disruption due to warfare to a technical inability to get sufficient oil to consumers. Terms such as “energy crunch” or “supply crunch” may at first appear to be a conscious decision to gain political acceptance through the use of more neutral language, but this less specific terminology allows a more wide-ranging view of energy supply.

Anyway, the terminology is of less interest than the suggested timelines for resource disruption:

The Oil Crunch: The world will experience peak oil at 91-92 million barrels per day “by end 2010/early 2011. Global capacity will then remain in the 91-92Mb/d range until 2015 from which time depletion will more than offset capacity growth. . .”

The Joint Operating Environment: “By 2012, surplus oil production capacity could entirely disappear, and as early as 2015, the shortfall in output could reach nearly 10 MBD.”

Sustainable Energy Security: “A supply crunch appears likely around 2013…given recent price experience, a spike in excess of $200 per barrel is not infeasible.”

Taken together, then, these reports suggest the world will be entering into a period of turmoil due to oil supply issues as early as the beginning of 2011 or as late as 2013. This will be marked by a time of rising oil prices, simply due to demand. By 2015 oil output will be in decline and the world will collectively have to make structural changes, or else face outright economic decline, because less oil will be coming to the market at any price.

(For comparison, the IEA’s latest Oil Market Report, published August 11, predicts global demand reaching 86.6 million barrels per day in 2010, and then 87.9 million barrels per day in 2011, assuming a continuing global economic recovery. As I’ve written previously, this will overtake the all-time high of 86.9 million barrels per day established in 2008 before the global economic downturn. I’ve also looked at the views of economists writing online recently, suggesting “we are in a lot of trouble in energy in the United States and around the world by about 2012-2015.”)