The United States has steadily escalated its regime change operation in Venezuela, seeking to remove Venezuelan president Nicolas Maduro by means of a coup d’état driven by crippling economic sanctions tantamount to a state of war and the continuous threat of outright US military intervention.

The aim is to install the US puppet, Juan Guaidó, who in December traveledto the United States to discuss the operation with the Trump Administration.

Guaidó, an operative of Voluntad Popular, a right-wing party funded by the USAID and National Endowment for Democracy (NED) has bipartisan support from Democrats and the Republicans. He been presented in the media as a kind of freedom fighter and champion of democracy against Maduro, a dictator and force of evil. As Secretary of State Mike Pompeo stated in a speech last Saturday, warning other governments at the United Nations, “Either you stand with the forces of freedom, or you’re in league with Maduro and his mayhem.”

Beneath Washington’s tired and hypocritical invocation of “freedom” and “democracy” lies the real motives for a coup that could quickly spiral into civil war and armed intervention.

Venezuela has the largest proven oil reserves of any country in the world—several billion barrels more than Saudi Arabia. This valuable prize is not simply a source of profit, but a critical geopolitical piece in the growing conflict between the US and China—especially in light of growing fears that the oil markets could soon tighten.

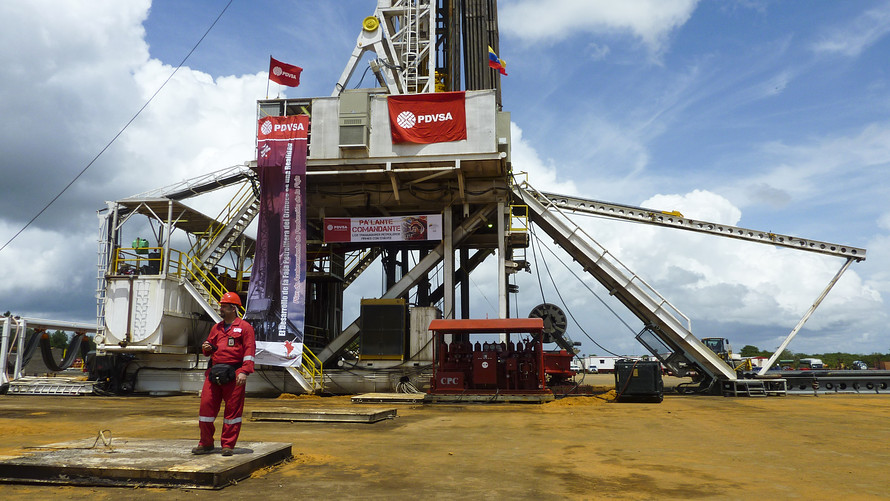

On Monday, the Trump Administration tried to stop the flow of oil revenues to the Maduro government by halting all US payments to the state-owned oil company, Petróleos de Venezuela (PDVSA). Venezuela sends 41 percent of its oil exports to the US and is heavily reliant on this trade for its revenue.

Washington’s aims were nakedly expressed by National Security Adviser John Bolton who told Fox News on Monday that, with a successful coup, “It will make a big difference to the United States economically if we could have American oil companies really invest in and produce the oil capabilities in Venezuela.”

For that to happen would require the reversal of Venezuela’s nationalization of its oil industry, which took place more than four decades ago—long before the advent of Maduro or his predecessor, Hugo Chávez—and the transformation of the country into an open semi-colony of US imperialism and Big Oil.

The latest US bid to strangle the flow of Venezuelan oil revenue—described by some economic analysts as the “nuclear option”—follows several years of collapse in the Venezuelan oil industry. Crude production fell from almost 3 million barrels per day (mb/d) to 1.5 mb/d late last year—with some predicting it will plummet to 800,000 b/d this year.

Venezuela’s extra-heavy crude oil, located in the Orinoco Belt, while voluminous, is extremely expensive to produce. Similar to Canada’s tar sands, it can only be profitably produced at a relatively low rate of extraction. In order to turn extra heavy oil, or tar sands, into usable crude, Venezuela must import a large volume of light oil from the United States to blend with its crude in an energy-intensive refining process.

These underlying geophysical realities complicate and intensify the economic crisis facing the national-bourgeois regime of Maduro. Like Chavez before him, Maduro relies on these oil revenues for the limited social-programs that has allowed his regime to falsely posture as the proponent of “Bolivarian Socialism,” while guaranteeing the property and profits of both domestic and foreign capital.

Venezuela, like many other oil-producing countries suffers from over reliance on the commodity. When a country relies heavily on a valuable export-oriented resource, the influx of foreign currency can lead to general inflation and prioritize investment in that extractive resource over all other sections of the economy. This inevitably leads to the slowing down of other sections of the economy, especially industry and manufacturing, unless radical measures are taken to halt the process.

Venezuela has experienced several spiraling economic crises due to this process, as far back as the 1920’s. This time, the insufficient capital of the Venezuelan regime and the volatile price of oil has prevented the government from making the necessary and costly investments in its heavy-oil fields to keep production stable.

The prospect of a protracted regime-change operation leading to the temporary withdrawal of Venezuelan crude from global oil markets does not bother the United States and its allies because US crude oil production, along with the steady growth of tight-oil and shale gas, will make up for any shortfall. However, Venezuela’s reserves are still seen as critical for the long-term economic and geopolitical stability of the United States for two reasons.

The first is that Venezuela has recently undertaken plans to intensify its collaboration with the Chinese state and Chinese oil companies. Venezuela owes around $20 billion to China—making the country one of its largest creditors—and it has already paid $40 billion of another loan back to China using oil exports as the method of payment. Chinese petroleum companies have taken large shares in various ventures in Venezuela as well with the intention of halting the downward spiral of the industry and sending oil back to China.

China’s oil production amounts to 3.5 mb/d and does not begin to meet its nearly 15 mb/d in consumption of petroleum. Unlike the United States, China has no significant shale formations. This lack of oil has pressured the Chinese ruling class to desperately seek oil abroad. On the other side, the United States understands that strategically holding—either through alliance or direct ownership—the world’s major oil fields would cripple the Chinese economy in the event of conflict. Thus, oil rich countries like Venezuela and Gadaffi’s Libya, both of which entertained Chinese and Russian oil investment, are seen by the US as major targets.

A second reason why Venezuela’s oil is of particular importance is that, though it is expensive, it could help meet an expected supply-demand gap that will emerge later this decade. The International Energy Agency believes that the world needs to spend at least $640 billion every year to keep production at adequate levels; however, spending in the industry is well below that, at $430 billion.

Currently, hydraulic fracturing, or fracking, in the United States has been able to supply markets —however, even if there is a significant economic recession in the coming years, new oil, like Venezuela’s, needs heavy investments to fill the gap. Should the US-backed coup succeed, companies like Exxon, which have historically controlled Venezuela’s oil, would be brought back in to invest and control the resource.

There is nothing new about the United States’ desire to control the flow of Venezuelan oil. Prior to nationalization in the 1970s, various Western companies dominated Venezuela’s oil wealth. Beginning with Royal Dutch Shell (an Anglo-Dutch venture) in the early part of the 20th century and ending with the antecedents of modern-day Exxon Mobil (Standard Oil, Exxon, and Mobil) prior to nationalization, Venezuela’s oil has long been dominated by foreign capital.

In the early 1970’s, Venezuela was a close ally of the United States in Latin America. In 1976, under the presidency of Carlos Andrés Pérez, the country’s oil was officially nationalized and Petróleos de Venezuela (PDVSA) was created as the state oil company. Venezuela’s oil nationalization gave much more generous terms to Western oil relative to other OPEC members.

In the late 1980s and early 1990s, a second major economic downturn occurred, again bound up with the economy’s over-reliance on oil and the resultant economic woes. It was out of this economic crisis, and the mass popular revolt against austerity measures known as the Caracazo, that former Venezuelan president Hugo Chavez first emerged as a national figure, leading an abortive coup in 1992 and being elected as president in 1998.

Chavez pursued social reforms that improved the standard of living, at first, of a section of the working class—largely funded by oil revenues. However, Chavez, a bourgeois nationalist, did not in any way represent the working class or advance its struggle for control over production and society. On the contrary, he spoke for a layer of businessmen who thought their situation could be improved by achieving greater independence from foreign capital while using oil revenues to ease class tensions.

In the end, as in the economic crisis of the 1990s, the global forces of capital acting on a national economy dependent on an extractive resource disturbed a very temporary equilibrium. In the years leading to Chavez’s death in 2013, the economic situation deteriorated, and the Venezuelan regime found itself confronting an increasingly hostile and disillusioned working class.

US imperialism is now seeking to exploit this crisis for its own purposes. Under the phony banners of “freedom” and “democracy” it is seeking to carry through a naked imperialist intervention that would install a dictatorship dedicated to suppressing the working class and assuring the unfettered control of the Venezuelan economy by Big Oil and Wall Street.

Originally published by WSWS.org