Public Social Sector Expenditures: India vs Other Countries

Most developed countries have a very elaborate social security network for their citizens, including unemployment allowance, universal health coverage, free school education and free or cheap university education, old age pension, maternity benefits, disability benefits, family allowance such as child care allowance, allowances for those too poor to make a living, and much more. Governments spend substantial sums for providing these social services to their people. The average public expenditure on social services of the 34 countries of the OECD has been around 21% of GDP for the last many years, and for the EU–27 have been even higher at around 30% of GDP. In contrast, Government of India’s expenditure on social services (Centre and States combined) is less than 7% of GDP (see Chart 1).[1]

Since the per capita GDP of the developed countries is much more than India, so the per person social sector spending of the developed countries is many times more than that reflected by the above figures.

Chart 1: Social Sector Expenditure as % of GDP, 2022

Reduction in Welfare Spending During Modi Years

There are two important heads under which the government spends money on people:

- Subsidies: The most important subsidies given by the government as defined in its budget documents are food subsidy, fertiliser subsidy, and petroleum subsidy. (Note: the budget statement on subsidies also includes some other subsidies; we are excluding them from our discussion.)

- Budget outlay for social sector ministries that directly benefit the people.

As we have pointed out in a previous article in Janata Weekly, the Centre has been giving mind-boggling concessions to the country’s super rich and big corporate houses.[2] Consequently, the Centre’s revenues are low; the budget outlay over the last 4 years has increased by a CAGR of only 8%, which means it has only marginally increased in real terms; and the budget outlay as a percentage of GDP has actually fallen by more than 3 percentage points in the last 4 years (2020–21 A over 2024–25 BE).[3]

Within this stagnant budget outlay, the FM has made a huge increase in the Centre’s capital expenditure (capex) — for four successive years. Consequently, capital expenditure as a percentage of budget outlay has nearly doubled in just four years: from 12.1% in 2020–21 (Actuals), it has gone up to 23.3% in this year’s budget estimate. As we have shown in the previous article of this budget series published in Janata Weekly, capital expenditure is yet another way by which the Modi Government is transferring public funds to big corporate houses.[4]

To compensate for this increase in capex, the FM needs to reduce the budget spending on some other heads. The axe has fallen on public spending on the poor. As we see below, the FM has sharply reduced government spending on subsidies and the social sectors.

The Subsidy Bill

The Modi Government’s expenditures on subsidies on food, fertilisers and cooking gas are given in Table 1.

The pandemic (2020–21) saw a significant rise in the government’s subsidy bill, especially because of the huge increase in distribution of free foodgrains to the people badly affected by the unplanned lockdown. Since then, the subsidy bill of the Modi Government has sharply declined. The total expenditure on food, fertiliser and petroleum subsidies for 2024–25, even in nominal terms, is nearly half of that for 2020–21A (53%). As a percentage of budget outlay, the decline is steeper — by 60%. And as a percentage of GDP, the subsidy budget has come down by more than two-third (see Table 1)!

The cut in the subsidy bill has been so sharp that total subsidies as a proportion of the total budget outlay of the government is less than that for the pre-pandemic year 2019–20.

Table 1: Modi Govt’s Expenditure on Subsidies, 2019–20 to 2024–25 (Rs cr)

Reduction in Social Sector Expenditure

There is no standard definition of the ‘social sector’. The most popular definition is that given by the Centre for Policy Research (CPR), a leading private think tank of India.[5] The CPR website does not specifically mention which are the ministries that it has included in its definition, it only says: ‘social sector’ refers to education, rural development, health, water and sanitation, nutrition, social security and social justice, food security, urban poor welfare, tribal and minority affairs, employment, skill development, women and child welfare, and sports and culture.[6] The Economic Survey also gives a similar definition for social services, but again, it too does not specifically define how it has calculated the social sector expenditure of the government.[7] So, we have drawn up a list of ministries which can be considered to be social sector ministries; the total budget outlay of these social sector ministries is very close to the CPR definition for the Central government’s social sector expenditure.

The departments and ministries that we have included in the list of social sector ministries are:

- Department of Health and Family Welfare

- Department of Food and Public Distribution

- Ministry of Ayush

- Ministry of Education

- Ministry of Jalshakti

- Ministry of Labour and Employment

- Ministry of Social Justice

- Ministry of Women and Child Development

- Ministry of Culture

- Ministry of Youth Affairs and Sports

- Ministry of Housing and Urban Affairs

- Ministry of Skill Development and Entrepreneurship

- Ministry of Tribal Affairs

- Ministry of Minority Affairs

- Ministry of Rural Development

- Ministry of Environment, Forests and Climate Change

Adding up the outlay for all the above ministries / departments, the Central government’s total social sector expenditure is given in Table 2.

{A note on our estimation of Centre’s social sector expenditures:

Our estimates for total social sector expenditure for the financial years 2019–20 to 2024–25 closely match the calculation of the CPR — see Table 3.[8] We do not have the Modi Government’s estimate of its social sector expenditure; the Economic Survey gives data on total social sector expenditure of the Centre and States combined. The RBI publication State Finances: A Study of Budgets 2023 gives social sector expenditure of the States, but its definition of social sectors and the definition given in the Economic Survey are different, so the two data sets are not comparable, or else we could have deduced the Centre’s social sector expenditure from these two sets of data.}

Table 2: Modi Government’s Social Sector Expenditure, 2019–20 to 2024–25*(Rs cr)

| 2019–20 A | 2020–21 A | 2022–23 A | 2023–24 RE | 2024–25 BE | |

| Total Social Sector Exp. (1) | 5,24,957 | 10,45,797 | 8,48,310 | 8,43,666 | 8,63,713 |

| (1) as % of Budget Outlay | 19.54 | 29.80 | 20.23 | 18.79 | 18.12 |

| (1) as % of GDP | 2.61 | 5.28 | 3.15 | 2.87 | 2.64 |

* This is based on our definition of the Government’s social sector expenditure.

Table 3: Our Calculation vs. CPR Calculation of India’s Social Sector Expenditure

| 2019–20 A | 2020–21 A | 2022–23 A | 2023–24 RE | 2024–25 BE | |

| Total Social Sector Exp. as % of Budget Outlay – Our Estimate | 19.54 | 29.80 | 20.23 | 18.79 | 18.12 |

| Total Social Sector Exp. as % of Budget Outlay – CPR Estimate | 20 | 30 | 24 | 19 | 18 |

As can be seen from Table 2, the Modi Government’s expenditure on social services has significantly reduced every year since 2020–21, even in nominal terms. The estimated social sector expenditure for 2024–25 is less than that for 2020–21 by nearly 20%! But this figure does not reflect the true extent of the cut made by the Modi Government in its social sector outlay. As a share of the total budget expenditure, the social sector budget outlay for 2024–25 is less than that for 2020–21 by as much as 40%; and as a percentage of the GDP, it has exactly halved! CPR data too makes the same estimate (for social sector expenditure as percentage of budget outlay).

Violation of Federalism: Reduction in Central Transfers to States

Another way in which the Modi Government has sought to compensate for its massive subsidies to the rich is by reducing its transfers to the States, in violation of the country’s federal structure.

The Constitution grants the Union government more revenue raising powers while the States are tasked to undertake most of the development and welfare-related responsibilities. Consequently, the Centre collects the bulk of the revenues in the country, the States do not have many sources of revenue. This has got further skewed after the imposition of GST, that has further restricted the sources of revenues of the States. Presently, including the Centre’s borrowings, of the total revenues of the Centre and States, the Centre collects around 70%, and the States the remaining 30%; the States’ share has fallen to below 30% in recent years.[9] On the other hand, of the total expenditures of the Centre and State governments, the States spend more than 55% (this came down to around 51% during the Corona pandemic, but has been rising since).[10]

This allocation of revenue raising powers and expenditure responsibilities results in an imbalance, and so the Constitution has made a provision for the setting up of a Financial Commission to determine the sharing of revenues between the Centre and the States. Successive Finance Commissions (FC) have attempted to reduce this imbalance by increasing the States’ share in Central taxes. The 14th FC recommended that the share of States in gross tax revenue of the Centre be 42% (for the period 2015–20), while the 15th FC marginally lowered this to 41% (for the period 2021–26). (The adjustment of 1% is to provide for the newly formed union territories of Jammu and Kashmir, and Ladakh from the resources of the Centre.)

The Modi Government accepted both these recommendations. But it has resorted to a simple trick to deny the States their rightful share in Central revenues. As mentioned above, as per the Finance Commission recommendations, presently the States are supposed to receive 41% of the ‘Divisible Pool’ of Centre’s tax revenues, defined as total tax revenue of the Centre minus the expenditure incurred for collecting taxes. But there is a loophole in this, which enables the Centre to transfer a lesser portion as taxes. The loophole is, that taxes collected by the Centre in the form of cesses and surcharges are not included in the ‘Divisible Pool’ and therefore are not shared with the States. The Modi Government is blithely exploiting this ambiguity.

- Divisible Pool of Centre’s revenues = [Gross Tax Revenue of Centre – Cesses and Surcharges – Expenses incurred for collecting taxes]

- States’ Share of Centre’s Tax Revenues = Divisible Pool of Centre’s Revenues x 41/100

The Centre has been collecting more and more of its taxes as surcharges and cesses, to reduce its transfers to the States. During the first 7 years of the Modi Government, the share of cesses and surcharges in the gross tax revenue of the Centre (excluding the GST compensation cess which is exclusively given to the States) actually doubled, from 9.3% in 2014–15 to 19.9% in 2020–21. After that, their share declined, but still remains at a high of 14.6% in last year’s RE and 14.1% in this year’s BE (Chart 2).[11]

Chart 2: Cesses and Surcharges as % of Gross Tax Revenue of Centre,

2014–15 to 2024–25

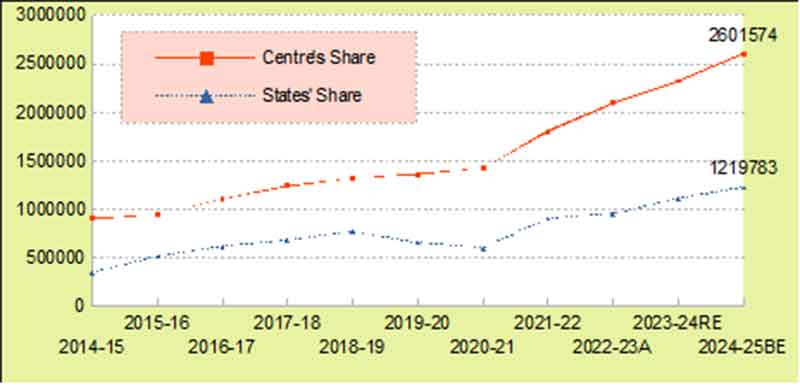

With the shrinking of the divisible pool, the share of the Centre’s gross tax revenue (GTR) going to the States has stagnated, while the Centre’s kitty has continued to rise. This can be seen from Chart 3.[12] Note that even during the pandemic years, 2019–20 and 2020–21, when the GTR took a hit, the States’ share of GTR recorded a steep fall of 15% and 19% respectively, but the Centre’s revenues continued to rise because the Centre beefed up its revenues by hiking cesses and surcharges, which are not shareable with the States.

Chart 3: Distribution of Gross Tax Revenue Between Centre and States,

2014–15 to 2023–24 (Rs cr)

Consequently, the actual share of the States in the gross tax revenue of the Centre has never reached the mandated level of 41–42%. After reaching a peak of 36.6% in 2018–19, States’ share has fallen to 32.1% in 2023–24 RE and 31.8% in 2024–25 BE. The gap between the share recommended by the FC and the actual devolution is a huge 9 percentage points.[13]

Let us calculate the revenue losses of the States for 2023–24, due to this undemocratic behaviour of the Centre, which goes against the federal spirit of the Constitution:

- For 2024–25, total gross tax revenue = Rs 38.31 lakh crore

- 41% of this = Rs 15.71 lakh crore

- Actual share of States in gross central tax revenue (as per this year’s Union Budget documents) = Rs 12.2 lakh crore

The States are going to lose Rs 3.51 lakh crore in revenue this year due to the Centre resorting to collecting revenue through cesses and surcharges instead of taxes. This means that the States are going to suffer a loss of 24% in their share of Central tax revenue in FY 2024–25 as mandated by the FC!

Even constitutional institutions such as the RBI and the CAG have adversely commented on this denial to the States of their rightful share of Central tax revenues. In 2019, the Reserve Bank of India (RBI) had noted that levying cesses and surcharges neutralises the increase in tax devolution recommended by successive Finance Commissions. Both the 14th and the 15th Finance Commissions also disapproved of the increasing tendency of the Centre to collect revenues through cesses.[14]

With the Centre resorting to tricks to reduce the tax transfers to the States, they are being pushed into a corner, and are forced to approach the Centre for special funding. This gives the Centre the power to play favourites, and penalise those States which oppose it politically — affecting the federal structure of the country. This is precisely what the Modi Government is doing.

Impact on Social Sector Spending of States

We have mentioned above that of the total total revenues of all kinds collected by the Centre and States (including Centre’s borrowings), the Centre collects roughly 70%, and the States’ own revenue is 30%.

In contrast, the major part of the social sector expenditure in India is done by the States — around 70 to 80%.[15]

The total Central transfers to the States has fluctuated between 42 to 48% of their total revenues (excluding their borrowings) during the Modi years. The States spend around 52–58% of their revenues (excluding borrowings) on the social sectors.[16] So, if the Centre financially squeezes the States by reducing its transfers to them, then their social sector spending is obviously going to get hit.

This, plus the low Centre spending on the social sectors, is what is responsible for the abysmally low total social sector expenditure of the Government of India (Centre + States combined). It is just around 7% of GDP (as admitted by the Economic Survey 2022–23). This figure is one-third of the average for the OECD countries, and one-fourth of the social sector spending of the EU–27!

Social Sector Expenditure and Employment

We have pointed out above that within its stagnant budgetary outlay, the Modi Government has hugely increased its capital expenditure, and to compensate for this, has reduced its social sector expenditures. This is an important reason for India’s terrible employment crisis. Let us explain.

It is well established economics that rupee for rupee, social sector expenditure is more employment generating than public capital expenditure. (Furthermore, in a situation where the country is facing such a terrible unemployment and poverty crisis, social sector expenditure directly benefits the working people. In the face of lack of demand due to poverty and unemployment, capex is not going to lead to increase in private investment as we have argued in a previous article [17]; but increase in expenditure on social services puts purchasing power in the hands of people, and so pushes the private sector to invest in creating productive capacity, thereby leading to employment generation.) Not only that, much of the capital expenditure only goes towards boosting imports of capital goods, rather than strengthening domestic production. This further reduces the employment generation that should have taken place with increase in capex.

Even within the capitalist framework, there is a huge potential for creating public sector jobs in India in the social sectors. To understand this, let us compare public employment in India with that in the developed countries. The Modi Government has been claiming that it is working hard to transform India into a developed country. While it is true that the developed countries — from Germany, France and the United Kingdom to the USA — are all undoubtedly free market economies or capitalist economies, our readers would be surprised to know that the number of people in public employment as a percentage of the total population in the developed countries is as much as 7 to 14 times that of India (Table 4)! The reason why public sector employment in these countries is so high is because governments in these countries spend huge sums to provide social services to their people. In contrast, as we have discussed above, the Indian Government’s social sector expenditures are very low.

Table 4: Public Sector Employment as % of Total Population [18]

| Sweden | 14.47 |

| France | 8.81 |

| UK | 7.77 |

| USA | 7.17 |

| India | 1.20 |

The USA has one of the lowest levels of public sector employment among the developed countries — 7.17% of its population is employed in public sector jobs. This ratio for India is just 1.20%. Even if India were to increase its social sector expenditure to bring public employment in the country to half that of the USA, India’s public employment would increase to 48 million.[19] India’s public sector employment is around 17 million at present.[20] This means the creation of an additional 3.1 crore jobs in the social sectors!

Since the Centre collects the bulk of the revenues in the country, the responsibility for increasing social sector spending lies mainly with the Centre. If the Centre increased its social sector spending, and also increased its transfers to the States, so as to double the country’s total social sector spending from the 8% of GDP at present to 15% (not a very large sum; the social sector spending of the OECD countries is 21% of GDP, and their per capita social sector spending is several times more than India), that would:

- lead to a huge improvement in social services and result in a huge leap in the living standards of the entire people, including the most marginalised sections;

- lead to the creation of crores of jobs in the public sector, and at least an equal number of jobs in the private sector because of the multiplier effect — thus resolving the country’s terrible unemployment crisis.

Is it possible for the Centre to increase its revenues and increase the total social sector expenditure of the country to 15% of GDP?

Subscribe to Our Newsletter

Get the latest CounterCurrents updates delivered straight to your inbox.

As per the Economic Survey 2022–23, the total social sector expenditure of the Centre and States for 2022–23 BE was Rs 21.32 lakh crore, which was 8.3% of the GDP. For this to increase to 15% of the GDP would require the total social sector expenditure to go up to Rs 38.53 lakh crore. Since the Centre has much greater flexibility in increasing revenues, let us assume that the Centre takes the entire responsibility for the required increase in revenues (of Rs 17.21 lakh crore). That may appear to be huge, and impossible, but is actually very doable. A study by a team of economists led by Thomas Piketty and Lucas Chancel at the World Inequality Lab in Paris on the extent of inequality in India (we have given its conclusions in Part 1 of this article series [21]) estimates that levying a 3 to 5% wealth tax and a 45 to 55% inheritance tax on those with net wealth above Rs 10 crore {these are the top 0.04% of the adult population (~ 370,000 adults), who currently hold over a quarter of the total wealth in the country} would generate a huge 6.08% of the GDP in revenues in 2022–23, amounting to Rs 16.4 lakh crore.[22]

We discuss our proposals in a later article in this series.

Notes

1. Source for OECD: “Social Spending”, https://data.oecd.org, accessed on 16 May 2023; for EU: Government Expenditure on Social Protection, https://ec.europa.eu; for India: Economic Survey, 2021–22 and 2022–23. EU–27 figure includes general government expenditure on education, health and social protection (this includes sickness and disability, unemployment, old age, housing, etc). While the 2022–23 Economic Survey projects the social sector spending to be 8.2% and 8.3% for 2021–22 RE and 2022–23 BE respectively, the fact is, the Modi Government has been exaggerating its expenditure in the Budget Estimates and Revised Estimates; based on the experience of past years, this figure should turn out to be around 7% when the actual figures come out in 2025.

2. Neeraj Jain, “Modi’s Only Guarantee Which Is Not a Jumla: Allow Adani–Ambani to Loot the Country”, Janata Weekly, 26 May 2024, https://janataweekly.org.

3. Neeraj Jain, “Analysis of Budget 2024–25, Part 1: Declining Budget Outlay”, Janata Weekly, 9 June 2024, https://janataweekly.org.

4. See: Neeraj Jain, “Analysis of Budget 2024, Part 2: The Real Reason Behind Increase in Capital Expenditure”, Janata Weekly, 16 June 2024, https://janataweekly.org.

5. Centre of Policy Research is one of the national social science research institutes recognized by the Indian Council of Social Science Research (ICSSR).

6. For CPR’s definition of social sectors, see: “The Evolution of India’s Welfare System from 2008–2023: A Lookback”, Accountability Initiative, https://cprindia.org.

7. For the Economic Survey’s definition of social sectors, see for instance: Economic Survey, 2022–23, Government of India, p. 147.

8. “Budget FY 2024–25 (Interim): The Last Decade of Social Spending”, Accountability Initiative, CPR, https://accountabilityindia.in.

9. Our calculation. Calculated by us using data given here: figures for Centre’s expenditure and Centre’s transfers to States — taken from ‘Budget at a Glance’, Union Budget, various years; data for States’ own revenues taken from: State Finances: A Study of Budgets 2023, available at https://www.rbi.org.in. We have excluded States’ borrowing in this calculation.

10. Our calculation. We have taken the total expenditure of the States from: State Finances: A Study of Budgets 2023, available at https://www.rbi.org.in. For Centre, we have deducted Centre’s transfer to States from its expenditure figures.

11. Source for Chart 2: Walking the Tightrope: An Analysis of Union Budget 2023–24, CBGA, Delhi, 2023, https://www.cbgaindia.org; and Of Monies and Matters: An Analysis of Interim Union Budget 2024–25, CBGA, Delhi, 2024, https://www.cbgaindia.org. Similar figures given in: “Finances of the Central Government (2019–20 to 2024–25)”, PRS India, https://prsindia.org. Note that GST cess is not included in above figure, as it is meant for the specific purpose of sharing with States.

12. Source for Chart 4: Union budget documents, various years.

13. Our calculation. See also: “Finances of the Central Government (2019–20 to 2024–25)”, PRS India, https://prsindia.org.

14. “Centre’s Cess Cleverness Is Taxing States”, 22 February 2024, https://www.deccanherald.com.

15. Resource Sharing between Centre and States and Allocation across States: Some Issues in Balancing Equity and Efficiency, Institute of Economic Growth, July 2019, https://fincomindia.nic.in — this document gives the States’ share at around 80%.

16. Our calculation, based on figures for revenues and social expenditures of States given in State Finances: A Study of Budgets 2023, available at https://www.rbi.org.in.

17. Neeraj Jain, “Analysis of Budget 2024, Part 2: The Real Reason Behind Increase in Capital Expenditure”, op. cit.

18. Calculation done by us. For developed countries, public sector employment data taken from: “Employment in General Government”, given in OECD Government at a Glance, 2019, https://www.oecd-ilibrary.org; total employment figures taken from OECD Labour Force Statistics 2019, https://read.oecd-ilibrary.org; population figures taken from: Population data – OECD Statistics, https://stats.oecd.org. All figures for 2017. Public sector employment figure for India taken from: R. Nagaraj, “Public Sector Employment: What has Changed?”, 2014, http://www.igidr.ac.in. The Modi Government has stopped releasing public sector employment figures; we assume that public sector employment in India is the same as it was in 2012, though it has fallen considerably since then. Population figure for India for 2017 taken from: Population, Total – India, https://data.worldbank.org.

19. Total population in 2017 was around 1339 million. 1339 x 7.17/100 x0.5 = 48.

20. R. Nagaraj, op. cit.

21. Neeraj Jain, “Analysis of Budget 2024–25, Part 1: Declining Budget Outlay”, op. cit.

22. Nitin Kumar Bharti, Lucas Chancel, Thomas Piketty, and Anmol Somanchi, “Towards Tax Justice & Wealth Redistribution in India: Proposals Based on Latest Inequality Estimates”,

World Inequality Lab, May 2024, https://wid.world. See also: Nitin Kumar Bharti et al., “Towards Tax Justice and Wealth Redistribution in India”, 21 May 2024, https://www.theindiaforum.in.

………………………………………………………………………………………….

Neeraj Jain is a social–political activist with an activist group called Lokayat in Pune, and is also the Associate Editor of ‘Janata Weekly’, a weekly print magazine and blog published from Mumbai. He is the author of several books, including ‘Globalisation or Recolonisation?’, ‘Nuclear Energy: Technology from Hell’, and ‘Education Under Globalisation: Burial of the Constitutional Dream’.