In India, the government does not pay income tax as it is the entity responsible for collecting taxes from individuals and businesses. Instead, the government uses the income tax collected to fund public services and pay government obligations. Individuals and entities that earn income are subject to income tax, which is collected by the Income Tax Department for the central government, which is later apportioned among the State governments as well.

As per Income Tax Act, 1961, an income tax assessee is a person by whom any tax or any other sum of money is payable. It does not include any organisation or least alone a government. Interestingly, Government of Telangana is paying income tax of its Ministers. It is not known for how long this practice has been going on and if it extends to all the Ministers and senior civil service officers. Income tax authorities are probably not aware of this practice. Income tax paid on a behalf of an individual is taken into account, and not who paid it. Thus, the onus of such payment responsibility falls on the Telangana government. Income tax is a tax on a person’s income – salaries or otherwise.

Usually all salaried employees, private or public, pay income tax from their own account. However, it is unusual for government to pay income tax of Ministers in Telangana. Government issued a GO. Rt.No.55, 7th March, 2025, by Industries and Commerce Department, which says “Payment of Income Tax by the State Government on behalf of Sri.Duddilla Sridhar Babu, Hon’ble Minister for ITE&C, I&C, Legislative Affairs, Telangana State for the Financial Year 2024-2025 (Assessment Year 2025-2026) – Sanction of expenditure towards Income Tax for an amount of Rs.1,38,061/- (Rupees One lakh Thirty Eight thousand and Sixty One only) – Orders – Issued.” Apparently, this is not limited to Congress government.

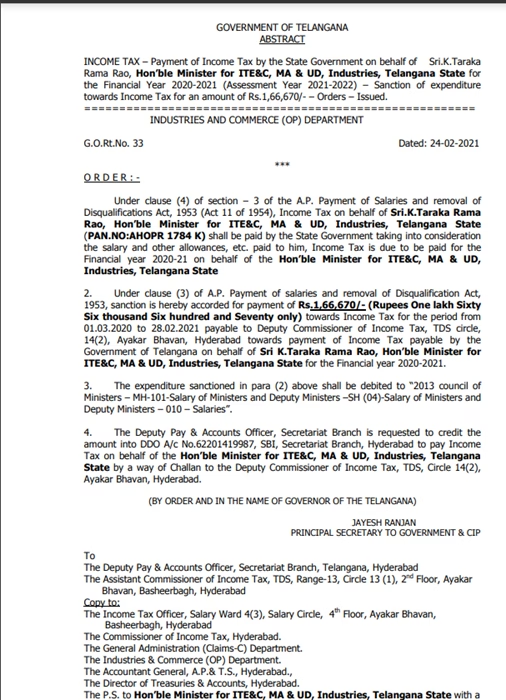

In 2021, Government issued a GO.Rt.No.33, 24th February, 2021, by Industries and Commerce Department, which said “Payment of Income Tax by the State Government on behalf of Sri.K.Taraka Rama Rao, Hon’ble Minister for ITE&C, MA & UD, Industries, Telangana State for the Financial Year 2020-2021 (Assessment Year 2021-2022) – Sanction of expenditure towards Income Tax for an amount of Rs.1,66,670/- – Orders – Issued.” We are not sure for how many years this has been going on, and how much amount in total was paid towards the income tax of the Ministers.

There is huge variation in these payments, for unknown reasons. While in 2021-22, income tax paid on behalf of the Minister was Rs.1,66,670, it was a mere Rs.24,946/- in 2020-21. A scrutiny of the both the assessments should inform us about the reasons for such huge variation. As per GO.Rt.No.33, 10th March, 2020, by Industries and Commerce Department, “Payment of Income Tax by the State Government on behalf of Sri.K.Taraka Rama Rao, Hon’ble Minister for ITE&C, MA & UD, Industries, Telangana State for the Financial Year 2019-20 (Assessment Year 2020-2021) – Sanction of expenditure towards Income Tax for an amount of Rs.24,946/- – Orders – Issued.” How did the assessment raise multiple times? There is this difference between what was paid to one Minister is not the same as well, simply because the salary assumedly has not decreased. In 2021-22, the Minister with Industries and Commerce portfolio was paid Rs.1,66,670/-, but the same Minister was paid in Rs.1,38,061/- only in 2024-2025. These two different individuals, as Ministers, should be receiving same salary, even if there is some variation in perks. Thus, the income tax on the salary has to be similar, if not equal, every year. It cannot keep changing every year.

Most income tax paid is changing most probably due to the inclusion ‘income from other sources’. Assessment for the Minister’s position might be changing if any other income is also added to the fixed salary. Ofcourse, one can argue that the income, including perks, might be self-defined and has variation. In such a case, where other income is also assessed, and paid for, Government of Telangana is paying tax on the individual’s income. On the other hand, the Ministers after they are sworn in cannot hold or have income of profits, atleast on paper. If so, what explains the variation in income tax paid every year? As per the GO, the expenditure sanctioned shall be debited to “2013 council of Ministers – MH-101-Salary of Ministers and Deputy Ministers –SH (04)-Salary of Ministers and Deputy Ministers – 010 – Salaries”. This means income tax of all the Ministers are being paid by the government. It would be interesting to see how much total amount this comes to. Remarkably, the budget document does not mention allocation for income tax. Total salary of Ministers as allocated in 2025-26 budget is Rs.10.17 crores. There is no mention of income tax in the disaggregated allocation either. This allocation is also rising – in 2014-15, the allocation was a mere Rs.3.93 crores.

In India, both employers and employees have roles in the payment of income tax. Employers are responsible for withholding and remitting income taxes from their employees’ gross monthly earnings, as is characterised as Tax Deduction at Source (TDS). These payments on behalf of Ministers are clearly mentioned as income tax, and paid in March, at the end of every financial year. It is not mentioned as TDS. In any case, income tax payment has to be from the individual income, and not from the government. This income tax, being paid by the government, on behalf of Ministers and officers should also constitute salary or perks. Can income tax payment be considered as perk by the Income Tax Department?

Also, these payments by the Government of Telangana are not limited to paying the tax. Payments for assessment of the income tax, filing IT returns are being made to a single private agency, across all Ministries and Departments. When income tax payment is online, and there are standard formats for income tax filing and assessment, for government employee salaries, payments to a single agency for this service is inappropriate and not necessary.

Dr Narasimha Reddy Donthi, Public Policy and Public Interest Campaign