For a long time, a common assumption has been that the world will eventually “run out” of oil and other non-renewable resources. Instead, we seem to be running into surpluses and low prices. What is going on that was missed by M. King Hubbert, Harold Hotelling, and by the popular understanding of supply and demand?

The underlying assumption in these models is that scarcity would appear before the final cut off of consumption. Hubbert looked at the situation from a geologist’s point of view in the 1950s to 1980s, without an understanding of the extent to which geological availability could change with higher price and improved technology. Harold Hotelling’s work came out of the conservationist movement of 1890 to 1920, which was concerned about running out of non-renewable resources. Those using supply and demand models have equivalent concerns–too little fossil fuel supply relative to demand, especially when environmental considerations are included.

Virtually no one realizes that the economy is a self-organized networked system. There are many interconnections within the system. The real situation is that as prices rise, supply tends to rise as well, because new sources of production become available at the higher price. At the same time, demand tends to fall for a variety of reasons:

>> Lower affordability

>> Lower productivity growth

>> Falling relative wages of non-elite workers

The potential mismatch between amount of supply and demand is exacerbated by the oversized role that debt plays in determining the level of commodity prices. Because the oil problem is one of diminishing returns, adding debt becomes less and less profitable over time. There is a potential for a sharp decrease in debt from a combination of defaults and planned debt reductions, leading to very much lower oil prices, and severe problems for oil producers. Financial institutions tend to be badly affected as well. If a person looks at only past history, the situation looks secure, but it really is not.

Figure 1. By Merzperson at English Wikipedia – Transferred from en.wikipedia to Commons, Public Domain,https://commons.wikimedia.org/w/index.php?curid=2570936

Substitutes aren’t really helpful; they tend to be high-priced and dependent on the use of fossil fuels, including oil. They cannot possibly operate on their own. They add to the “oversupply at high prices” problem, but don’t really fix the need for low-priced supply.

Why supply tends to rise as prices rise

For any non-renewable commodity, there are a wide variety of resources that will “sort of” work as substitutes, if the price is high enough. If the price can be raised to a very high level, the funds available will encourage the development of more advanced (and expensive) technology.

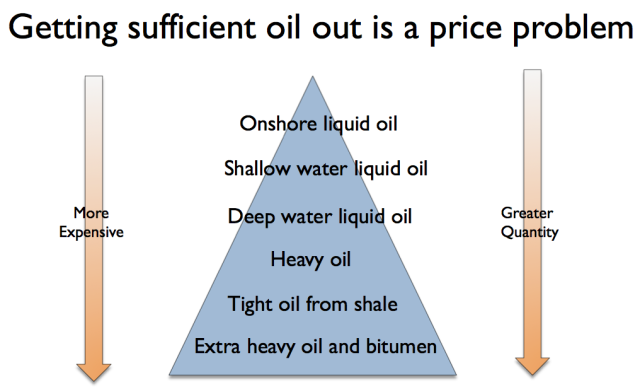

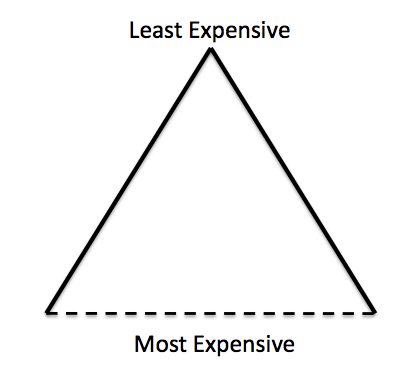

If it is possible to raise the price to a very high level, it is likely that a very large quantity of oil will be available. Figure 1 shows some of the types of oil available:

Getting sufficient oil out is a price problemI got my idea for Figure 2 from a natural gas resource triangle by Stephen Holditch.

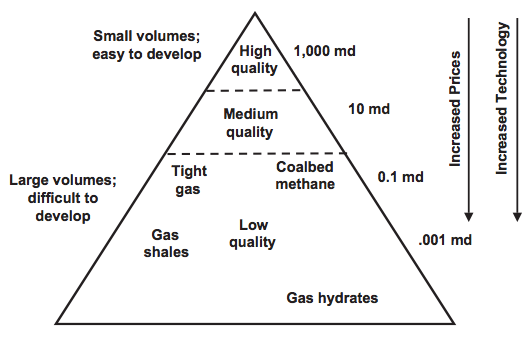

Figure 3. Stephen Holditch’s resource triangle for natural gas

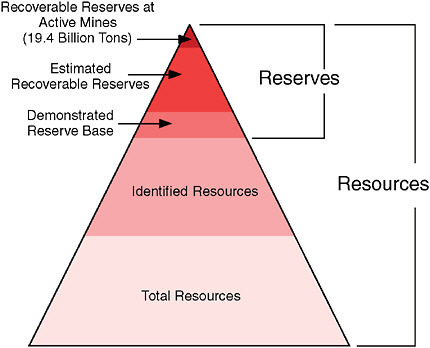

A similar resource triangle is available for coal (from National Academies Press; Coal Resource, Reserve, and Quality Assessments):

Figure 4. Coal resources in 1997, based on EIA data. Image from National Academies Press.

Because of the availability of an increasing amount of resources, we are likely to get more oil, natural gas, and coal, if prices rise. We associate high prices with scarcity; instead, high prices tend to make a larger quantity of energy product available.

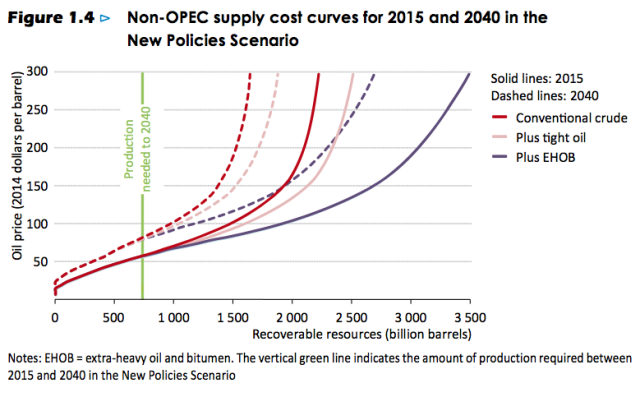

The International Energy Agency (IEA) has a different way of illustrating the likelihood of huge future oil supply, if prices can only rise high enough.

Figure 5. Figure 1.4 from International Energy Agency’s 2015 World Energy Outlook.

The implication of this chart is that the IEA believes that oil prices can rise to $300 per barrel, giving the world plenty of oil to extract for many years ahead.

Can consumers really afford very high-priced energy products?

In my view, the answer is “No!” If oil is high priced, then the many things made with oil will tend to be high priced as well. Wages don’t rise with oil prices; most of us remember this from the oil price run-up of 2003 to 2008.

Because of this affordability issue, the limit to oil production is really an invisible price limit, represented as a dotted line. We can’t know in advance where this is, so it is easy to assume that it doesn’t exist.

Figure 6. Resource triangle, with dotted line indicating uncertain financial cut-off.

The higher cost of extraction is equivalent to diminishing returns.

As we are forced to seek out ever more expensive to extract resources, the economy is in some sense becoming less and less efficient. We are devoting more of our human labor and other resources to extracting fossil fuels, and to extracting minerals from ever-lower quality ores. In some sense, we could just as well be putting these resources into a pit and burying them–they no longer help us grow the rest of the economy. Using resources in this way leaves fewer resources to “grow” the rest of the economy. As a result, we should expect economic contraction when the cost of oil extraction rises.

In fact, economic contraction seems to happen when oil prices rise, at least for oil importing countries. Economist James Hamilton has shown that 10 out of 11 post-World War II recessions were associated with oil price spikes. A 2004 IEA report says, “. . . a sustained $10 per barrel increase in oil prices from $25 to $35 would result in the OECD as a whole losing 0.4% of GDP in the first and second years of higher prices. Inflation would rise by half a percentage point and unemployment would also increase.”

Energy products play a critical role in the economy.

Economic activity is based on many kinds of physical changes. For example:

>> Using heat to transform materials from one form to another;

>> Using energy products to help move goods from one place to another;

>> Moving electrons in such a way that light is provided

>> Moving electrons in such a way that Internet transmission can be provided.

A human being, by himself, exerts only about 100 watts of power. A human being is also quite limited in what he can do; he can provide a little heat, but no light, for example. Energy products are very helpful for making capital goods such as buildings, machines, roads, electricity transmission lines, cars and trucks.

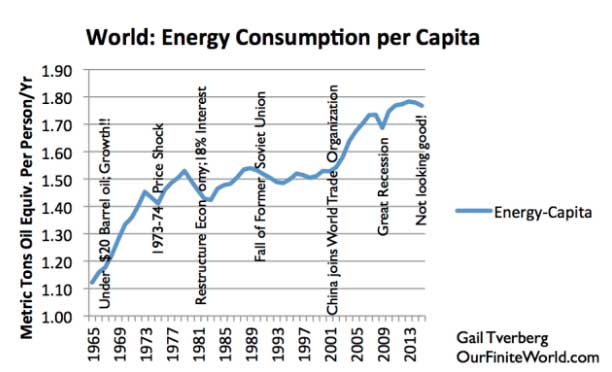

We can think of energy products, and capital goods made using energy products, as ways of leveraging human energy. If per capita energy consumption increases over time, leveraging of human labor can grow. As a result, humans can become ever more productive–think of new and better machines to help humans do their work. Dips in this leveraging tend to correspond to economic contraction (Figure 7).

Figure 7. World energy consumption per capita, based on BP Statistical Review of World Energy 2105 data.

Year 2015 estimate and notes by G. Tverberg.

To have a growing economy, wages of non-elite workers need to be growing.

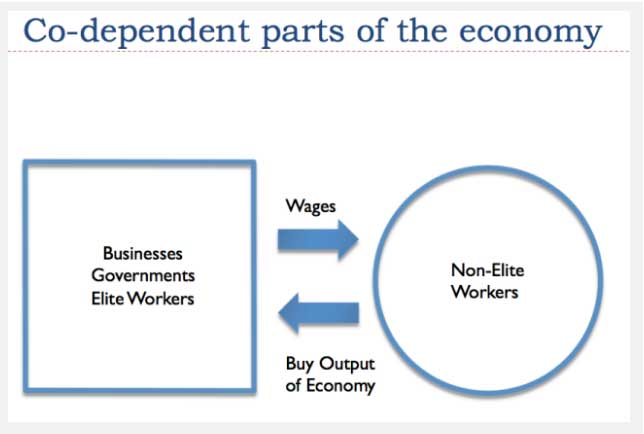

Our economy is in a sense a “circular economy,” in which non-elite workers (less educated, non-managerial workers) play a pivotal role because they are both producers of goods and potential consumers of the output of the economy. Because there are so many non-elite workers, their demand for homes, cars, and electronic goods plays a critical role in maintaining the total demand of the economy.

Figure 8. Representation of two major parts of the economy by author.

If the wages of these non-elite workers are growing, thanks to increased productivity, the economy as a whole can grow. If the wages of these workers are shrinking or are flat (in inflation-adjusted terms), the economy is in trouble. The recycling process cannot work very well.

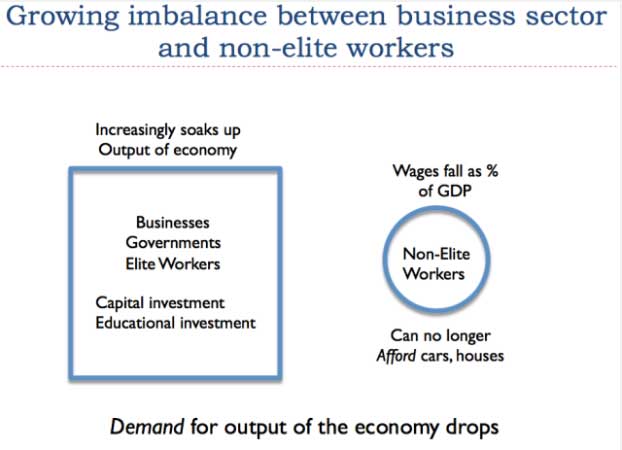

If there is not enough economic growth–often caused by not enough growth in energy consumption to leverage human labor–then we tend to get a growing imbalance between the sector on the left with businesses, governments, and elite workers, and the sector on the right, with non-elite workers. Part of this wage imbalance comes from sending jobs to low-wage countries. As jobs are shifted to low-wage countries, the workers of the world increasingly cannot afford the goods that they and other workers are producing.

Figure 9. Representation by author of imbalance that occurs.

If the wages of non-elite workers are not rising sufficiently, rising debt can be used to hide this problem for a while. The way this is done is by allowing workers to buy goods at ever-lower interest rates, over ever-longer time periods. This strategy has an endpoint, which we seem to be close to reaching.

Debt is a key factor in creating an economy that operates using energy.

A generally overlooked problem of our current system is the fact that we do not receive the benefit of energy products until well after they are used. This is especially the case for energy used to make capital investments, such as buildings, roads, machines, and vehicles. Even education and health care represent energy investments that have benefits long after the investment is made.

The reason debt (and close substitutes) are needed is because it is necessary to bring forward hoped-for future benefits of energy products to the current period if workers are to be paid. In addition, the use of debt makes it possible to pay for consumer products such as automobiles and houses over a period of years. It also allows factories and other capital goods to be financed over the period they provide their benefits. (See my post Debt: The Key Factor Connecting Energy and the Economy.)

When debt is used to move forward hoped-for future benefits to the present, oil prices can be higher, as can be the prices of other commodities. In fact, the price of assets in general can be higher. With the higher price of oil, it is possible for businesses to use the hoped-for future benefits of oil to pay current workers. This system works, as long as the price set by this system doesn’t exceed the actual benefit to the economy of the added energy.

The amount of benefits that oil products provide to the economy is determined by their physical characteristics–for example, how far oil can make a truck move. These benefits can increase a bit over time, with rising efficiency, but in general, physics sets an upper bound to this increase. Thus, the value of oil and other energy products cannot rise without limit.

Using hoped-for benefits to set oil prices is likely to lead to oil prices that overshoot their maximum sustainable level, and then fall back.

A debt-based system of setting oil prices is different from what most of us would have considered possible. If wages of non-elite workers had been growing fast enough (Figure 9), increasing debt would not even be needed, because the whole system could grow thanks to the increased buying power of the many non-elite workers. These workers could buy new houses and cars, have more meat in their diet, and travel on international vacations, adding to demand for oil and other energy products, thereby keeping prices up.

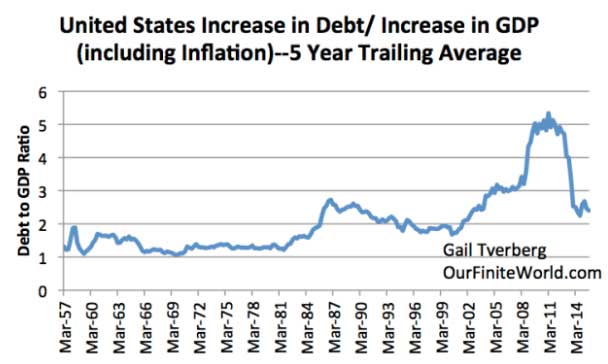

As wages of non-elite workers fall behind, an increasing amount of debt is needed. For the US, the ratio of the increase in debt to the increase in GDP (including the rise in inflation) is as shown in Figure 10:

Figure 10. United States increase in debt over five-year period, divided by increase in GDP (with inflation!) in that five-year period. GDP from Bureau of Economic Analysis; debt is non-financial debt, from BIS compilation for all countries.

Thus, the increase in debt has never been less than the corresponding increase in GDP over five-year periods, even when oil prices were low prior to 1970. In general, the pattern would suggest that the higher the oil price, the higher the increase in debt needs to be to generate one dollar of GDP. This is to be expected, if economic growth depends on Btus of energy, and higher prices lead to the need for more debt to cover the purchase of necessary Btus of energy.

We are reaching a head-on collision between (1) the rising cost of energy production and (2) the falling ability of non-elite workers to pay for this high-priced energy.

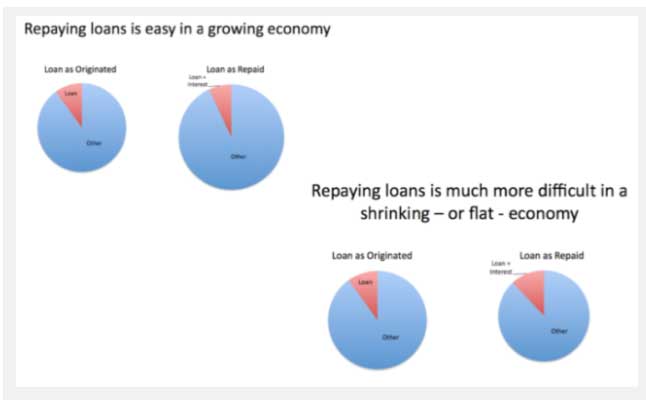

The head on collision we are reaching is what causes the potential instability referred to at the beginning of this article, as illustrated in Figure 1. Of course, such a collision has the potential to cause debt defaults, as it becomes impossible to repay debt with interest.

Figure 11. Repaying loans is easy in a growing economy, but much more difficult in a shrinking economy.

Turchin and Nefedov in the academic book Secular Cycles analyzed eight agricultural economies that eventually collapsed. The problem that these economies encountered was exactly the same one we are now encountering: falling wages of non-elite workers at the same time that the cost of producing energy products (food, at that time) was rising. Rising costs were often an end result of too many people for the arable land. A workaround could be found, such as building irrigation or adding a larger army to conquer a neighboring land, but it would add costs.

As the problems of these economies progressed, debt defaults became more of a problem. Governments found it hard to collect enough taxes, because so many of the workers were increasingly impoverished. Often, workers became sufficiently weakened by an inadequate diet that they became vulnerable to epidemics. Governments often collapsed.

In the economies analyzed by Turchin and Nefedov, food prices temporarily spiked, but it is not clear that this was the final outcome, given the inability of workers to pay the high prices. Debt defaults would tend to further reduce ability to pay. Thus, it would not be surprising if prices ended up low (from lack of demand), rather than high. We know that ancient Babylon is an example of one economy that collapsed. Revelation 18:11-13 seems to describe the situation after Babylon’s collapse as one of lack of demand.

11 “The merchants of the earth will weep and mourn over her because no one buys their cargoes anymore— 12 cargoes of gold, silver, precious stones and pearls; fine linen, purple, silk and scarlet cloth; every sort of citron wood, and articles of every kind made of ivory, costly wood, bronze, iron and marble; 13 cargoes of cinnamon and spice, of incense, myrrh and frankincense, of wine and olive oil, of fine flour and wheat; cattle and sheep; horses and carriages; and human beings sold as slaves.

Other parts of the oil limits story that researchers have missed

As I have previously mentioned, most researchers begin with the view that soon there will be a problem with energy scarcity. The real issue that tends to bring the system down is related, but it is fairly different. It is the fact that as we use energy, the system necessarily generates entropy. This entropy takes the form of rising debt and increased pollution. It is these entropy-related issues, rather than a shortage of energy products per se, that tends to bring the system down. See my post, Our economic growth system is reaching limits in a strange way.

We could, in theory, fix our problems by adding infinite debt at the same time that wages of non-elite workers tend toward zero. We could then use this additional debt to fight pollution problems and pay all of the workers. All of us know that this solution would not work in the real world, however.

The two-sided economy I have described in Figures 8 and 9 is one part of our problem. There is a popular saying, “We pay each other’s wages.” Unfortunately, paying each other’s wages does not work well, if the wage level of elite workers differs too much from the wage level of the non-elite workers. A worker making $7.50 per hour in a part-time job is not going to be able to pay the wages of a surgeon making $300,000 per year, no matter how an insurance policy is designed to spread costs evenly. A worker in India or Africa will not be able to afford goods made by human workers in the United States, because of wage differences.

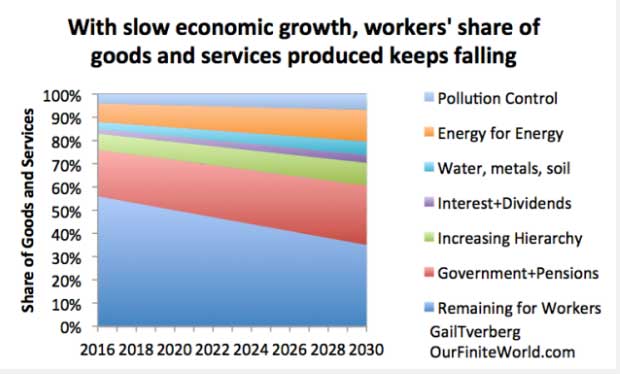

Governments can try to fix the problem of non-elite workers getting too small a share of the output of the system, but this is not easy to do. The real problem is that the system as a whole is not producing enough goods and services. This happens because the high cost of energy extraction (plus related issues–pollution control; need for more education for workers; need for ever-larger government and more elite workers) is removing too many resources from the system. The result is that the economy as a whole tends to grow ever more slowly. The quantity of goods and services produced by the economy does not rise very rapidly. When there are not enough goods produced in total, non-elite workers tend to find that their allocation has been reduced.

If governments attempt to add debt to fix the problems with the system, the addition of debt tends to raise asset prices on the left side of Figures 8 and 9. Unfortunately, the additional debt usually has little impact on the wages of non-elite workers (that is, the right hand part of the system).

Governments have talked about minimum income programs to raise incomes of those who are not elite workers. Whether or not this approach can work depends on many things–how much additional debt can be added to the system; whether this debt will actually raise the total amount of goods and services produced; how tolerant those in the left-hand side of Figures 8 and 9 are of losing their share of goods and services; the impact on relative currency levels.

Research involving Energy Returned on Energy Investment (EROEI) ratios for fossil fuels is a frequently used approach for evaluating prospective energy substitutes, such as wind turbines and solar panels. Unfortunately, this ratio only tells part of the story. The real problem is declining return on human labor for the system as a whole–that is, falling inflation adjusted wages of non-elite workers. This could also be described as falling EROEI–falling return on human labor. Declining human labor EROEI represents the same problem that fish swimming upstream have, when pursuit of food starts requiring so much energy that further upstream trips are no longer worthwhile.

Falling fossil fuel EROEI is a contributor to falling EROEI with respect to human labor, but there are other contributors as well (Figure 12). (My list is probably not exhaustive.)

Figure 12. Authors’ depiction of changes to workers share of output of economy,

as costs keep rising for other portions of the economy.

If our problem is a shortage of fossil fuels, fossil fuel EROEI analysis is ideal for determining how to best leverage our small remaining fossil fuel supply. For each type of fossil fuel evaluated, the fossil fuel EROEI calculation determines the amount of energy output from a given quantity of fossil fuel inputs. If a decision is made to focus primarily on the energy products with the highest EROEI ratios, then our existing fossil fuel supply can be used as sparingly as possible.

If our problem isn’t really a shortage of fossil fuels, EROEI is much less helpful. In fact, the EROEI calculation strips out the timing over which the energy return is made, even though this may vary greatly. The delay (and thus needed amount of debt) is likely to be greatest for those energy products where large front-end capital expenditures are required. Nuclear would tend to be a problem in this regard; so would wind and solar.

To evaluate the extent to which a given energy product tends to raise debt levels, a better approach might be to look at debt levels directly. Another measure might be to compare the required system-wide capital expenditures for a particular purpose, for example, to provide sufficient non-intermittent electricity for the state of California over a period of say, 50 years, using different electricity generation scenarios.

Our academic system of inquiry, with its peer reviewed literature system, has let us down.

Our peer reviewed academic system is not telling this story. Part of the problem is that this is a difficult story. It has taken me most of the last ten years to figure it out.

Part of the problem with our academic system seems to be excessive reliance on past analyses. Once one direction has been set, it is hard to change. Another part of the problem is that the focus of each researcher tends to be quite narrow. The result can be that it is hard to “see the forest for the trees.”

Furthermore, politicians and academic publishers tend to “push” results in the direction of a desired outcome. Grant money goes to researchers who follow the government-preferred fields of inquiry; publishers prefer books that are not too alarming to students.

I am coming at this issue from “out in left field.” I don’t have a Ph.D., although I am a Fellow of the Casualty Actuarial Society, which many would consider similar. I also have an M. S. in Mathematics. I do not work in a university setting. I do not have a strong background in subjects a person might expect, such as geology, economic theory, or physics. I do have a fair amount of practical experience with financial modeling from my actuarial background, however.

My approach is very different from that of most researchers. I come to the problem from the point of view of how a finite world might be expected to operate. I write most of my articles on the Internet, where I get the benefit of comments from readers. Many of these commenters point me in the direction of articles or books I should read, or raise additional issues I should consider.

Over the years, I have become acquainted with many researchers in related fields. These people have generally reached out to me–invited me to speak at their conferences, or corresponded with me about issues they considered important. As a result of this collaboration, I have been able to put together a more complete story than others.

I have stayed away from publishers and funding sources that might try to influence what I say. I have not been taking donations, and do not run ads on my website. The story is one that needs to be told, but it easily gets distorted if the person telling the story is influenced by what will generate the largest donations, or the most grant money.

Gail E. Tverberg graduated from St. Olaf College in Northfield, Minnesota in 1968 with a B.S. in Mathematics. She received a M.S. in Mathematics from the University of Illinois, Chicago in 1970. Ms. Tverberg is a Fellow of the Casualty Actuarial Society and a Member of the American Academy of Actuaries. Ms. Tverberg began writing articles on finite world issues in early 2006. Since March 1, 2007, Ms. Tverberg has been working for Tverberg Actuarial Services on finite world issues. Her blog ishttp://ourfiniteworld.com

This article was first published in Ourfiniteworld.com