- INTRODUCTION

With usual high hope and promise, the Davos annual ritual is on the stage. But, the promise and hope appear false.

The World Economic Forum (WEF) Switzerland meeting beginning from January 21 has become one of the voices of the world capitalist system as it considers itself “the foremost creative force for engaging the world’s top leaders […] to shape global, regional and industry agendas […].” But, with capitalism as the dominating force in the world, what can be shaped other than destruction of lives on this planet? Shall the Davos elites question capitalism?

The meet and the WEF’s Global Risk Report are two of the significant weather-meters to gauge the weather the system is bumping into. Many capitans of the capitalist system express their perception about the situation they are facing – “the most pressing issues on the global agenda”. These are actually the fear and the uncertainty the system is failing to get rid of. The participants include the world’s top politicians, academics, and business and NGO leaders.

The 2020 meeting theme is “Stakeholders for a Cohesive and Sustainable World”. Its cherished commitment is “to improve the state of the world”. A capitalist world system can never be cohesive and sustainable and it can’t improve the world as the system breeds incoherence and chaos. The system itself is the evidence.

- THE HOPELESS CONDITION

The Davos Report – Global Risks Report 2020 (GRR 2020) – fails to hide the hopeless condition the world capitalist system is experiencing. The report’s “The Fraying Fundamentals” chapter cites the facts:

Stagnation

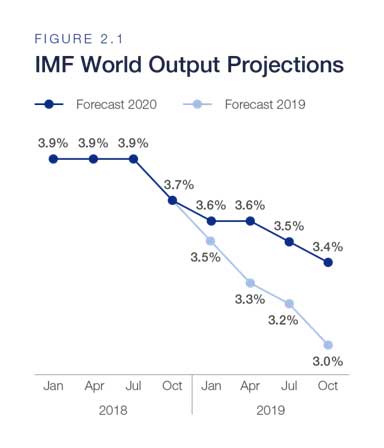

Downward pressure on the global economy from macroeconomic fragilities and financial inequality continued to intensify in 2019. The global economy is at increasing risk of stagnation. Tense geo-economic and geopolitical landscape, and domestic challenges have exacerbated uncertainty. There’s, according to the IMF-speak, “synchronized slowdown” – weakened growth among the world’s economies. A gradual deceleration was already underway. The slowdown of the world economy has further materialized. By the third quarter of 2019, six of the world’s largest seven economies (Japan is the exception), which together represent more than half of global production, had decelerated. The outlook is also precarious for other G20 economies. Most of these economies are growing at a rate below 2%. There’s risk of a prolonged slowdown of the world economy. The IMF has lowered its last five estimates of world output for 2019 and expected a growth rate of 3.0% – a sharp decline from 3.6% in 2018 and the slowest since the 1.7% contraction in 2009. For 2020, the IMF had also downgraded its forecast from 3.7% to 3.4% [The figure 2.1].

Source: IMF, 2018 and 2019, World Economic Outlooks and quarterly updates, cited in the GRR 2020

Slowing trade

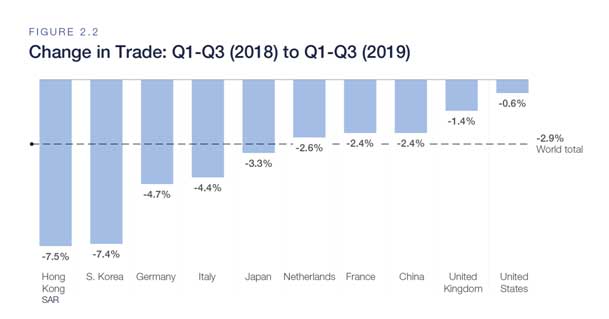

“Nationalist” policies are challenging low trade barriers, fiscal prudence and strong global investment. Rising trade barriers, lower investment and high debt are straining economies around the world. Global trade is slowing down. World Trade Organization (WTO) data for the first three quarters of 2019 show that total world merchandise trade decreased 2.9% from the previous year. It decreased in the world’s top ten traders. [The figure 2.2] Reduced trade volumes are largely the result of what the WTO has called “historically high levels of trade restrictions”. Turning trade to a weapon of rivalry may persist.

Source: WEF estimates from WTO data, https://data.wto.org/, accessed on January 8, 2020, cited in the GRR 2020

Decreased FDI

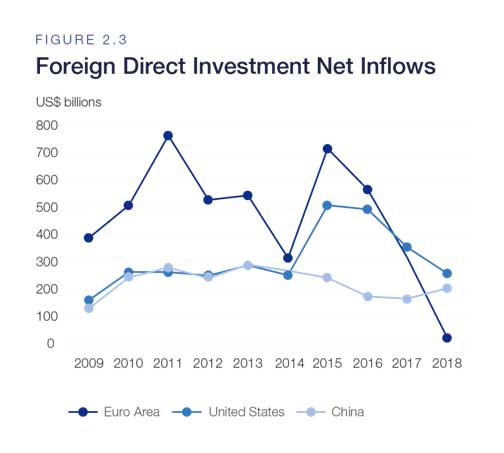

Globally, investment has been affected by low expected returns, uncertainty about economic policy in major economies, and ongoing and emerging geopolitical tensions. Foreign Direct Investment (FDI) remains lower than it was before the 2008-’09 crisis. It has decreased for the last three years. In 2018, net FDI inflows were down 38% compared to 2017, and less than half of the level, they were in 2015. The sharpest decline has been in the euro area [the figure 2.3], where less appealing yields, lower production and uncertainty surrounding Brexit have led net FDI inflows to the region to fall to a record low since the euro was adopted in 1999.

Source: World Bank OpenData, “Foreign direct investment, net inflows (BoP, current US$) – Euro area, World, United States, China, Japan”, https://data.worldbank.org/indicator/BX.KLT.DINV.CD.WD?end=2018&locations=CN-XC-US&start=2009&view=chart, accessed on December 15, 2019, cited in the GRR 2020

High debt

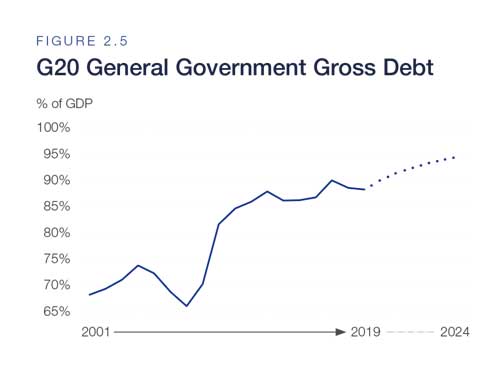

Private and public debt has been accumulating since the crisis. According to the IMF, the global ratio of debt-to-GDP increased by 11 percentage points between 2009 and 2017. Across G20 economies, public debt is expected to reach 90% of GDP in 2019 – the highest level on record – and to grow even more, to 95% in 2024 [the figure 2.5]. Private debt has built up on the basis of lower interest rates – particularly in China and the US, where more than 40% of total private debt is located. In the second quarter of 2019, non-financial corporate debt reached 156% of GDP in China. In the US, non-financial corporate debt reached 47% of GDP in the third quarter – the highest level ever recorded – according to Federal Reserve Bank of St. Louis data. The IMF has listed “rising corporate debt burdens” as a key vulnerability in the global financial system.

Source: WEF estimates with data from IMF DataMapper, https://www.imf.org/external/datamapper/GGXWDG_NGDP@WEO/OEMDC/ADVEC/WEOWORLD, accessed on December 15, 2019, cited in the GRR 2020

Tools unavailable

There’s a risk that the tools previously used to brake economic slides may no longer be available. Financial market stress and strained public finances are creating uncertainty as to whether conventional monetary and fiscal policy instruments could be as effective in the future.

Monetary constraints

Interest rate cuts have fostered higher debt and riskier rent-seeking, which affect financial market stability. In 2019, most central banks persistently cut interest rates to very, sometimes historically, low levels. In the US, the Fed lowered its target interest rate from 2.50% in December 2018 to 1.75% currently. The European Central Bank (ECB) cut its deposit rate to a historic low of -0.50% in September 2019. The Bank of Japan’s deposit rate has remained at -0.10% since February 2016. Such low rates raise concerns about the soundness of banking systems. The ECB has warned that decreasing profits are challenging Europe’s banking sector; in the second quarter of 2019, European banks yielded an average return-to-equity of 7.0%, compared to 12.1% in the US.

The role and reach of monetary policies are also challenged by wider factors such as technological change, climate change and rising inequality.

Fiscal constraints

The margin for fiscal stimulus in most of the world’s main economies has narrowed. Public debt in 15 of the 20 largest economies has increased every year since the 2008–’09 crisis.

Deteriorated business confidence

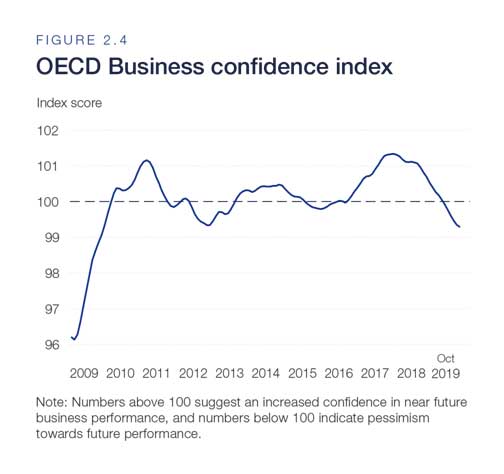

Business confidence has deteriorated during 2019. The Business confidence index – constructed by the Organisation for Economic Co-operation and Development (OECD) using production data and business sentiment to anticipate future performance – signals that the state of the global economy is expected to worsen in the short term. At the time of writing the GRR 2020, the index had declined for 14 consecutive months, dropping below the no-change threshold for the first time since 2016 and reaching a 10-year low in October of last year [the figure 2.4].

Source: OECD Data, Business confidence index, https://data.oecd.org/leadind/ business-confidence-index-bci.htm, accessed on January 3, 2020, cited in the GRR 2020

Note: Numbers above 100 suggest an increased confidence in near future business performance, and numbers below 100 indicate pessimism towards future performance.

Inequality

Concern about inequality underlies recent social unrest on almost every continent. Domestic income inequality has risen in many countries, particularly in advanced economies, and reached historical highs in some. The OECD reports “income inequality in OECD countries is at its highest level for the past half century.” Many of those protesting have long been excluded from their country’s wealth and share frustration that the elite have captured gains at the expense of others.

Inequality hinders growth and damages macroeconomic fundamentals, as the IMF has pointed out: it slows down economic activities and casts doubt on a country’s stability. This damages investor confidence and undermines political capital – both fundamental conditions for prosperity, especially in times of economic volatility. In France, for example, the persistence of the “gilets jaunes” movement had caused businesses more than US$11.4 billion in losses by December 2019. The protests in Chile cost businesses over US$1.4 billion. “[S]ocial incidents dealt [Hong Kong] a very severe blow”.

The profound political consequences of inequality can also undermine economic growth by making a country harder to govern – in ways ranging from legislative impasses to complete government paralysis. This risk is accentuated by the decentralized and spontaneous nature of recent demonstrations: with pop-up protests, it is difficult for governments to negotiate with demonstrators and develop concrete measures to meet their demands.

Weak public finances could aggravate already hard-felt social tensions. The European sovereign debt crisis has shown that drastic fiscal corrections and public austerity measures can shrink the welfare state with political and social consequences that many governments would be neither willing nor able to incur.

Failed systems

Systems have failed to promote economic advancement for all. Profound citizen discontent – born of disapproval of the way governments are addressing economic and social challenges – has sparked protests throughout the world. There’s a widespread domestic discontent with current economic systems, perceived to be rigged and unfair.

Polarization and confrontation

The Global Risks Perception Survey finds “economic confrontations” and “domestic political polarization” as the top risks in 2020. “Economic confrontations between major powers” is the most concerning risk for 2020.

According to the survey participants, “recession in a major economy” most likely to increase in 2020.

The survey finds, “protectionism regarding trade and investment” and “populist and nativist agendas” most likely to increase through 2020.

The WEF’s Executive Opinion Survey finds, “fiscal crises” are the top-rated risk for businesses globally over the next 10 years.

The WEF’s expert community perceives, “domestic political polarization” most likely to increase in 2020.

Prolonged slowdown

With this background, the GRR 2020 said:

“Unless the global economic system is reformed to be more socially conscious, the twin risks of prolonged slowdown and stronger defiance towards the current economic model will continue to exacerbate each other.”

- POINTS MISSED

In today’s capitalist world system, there’ll be slowdowns, and these will be prolonged. The factors behind these slowdowns are within the system. The system breeds the factors. The GRR 2020 talks about stagnation, slowing of trade, etc. The point the elite-minds miss is: “mature monopoly capitalist economy as one that is subject to, and indeed dominated by, a basic contradiction: the very growth of its productive potential puts insuperable obstacles in the way of making full use of available human and material resources for the satisfaction of the needs of the great mass of the population. What this means is (1) that in the absence of sufficiently powerful counteracting forces, the normal state of the system in its monopoly capitalist phase is determined by the interaction of the tendency to stagnation and the forces acting counter to this tendency.” (Paul M Sweezy and Harry Magdoff, The Irreversible Crisis, “”Stagnation and the financial explosion”, Monthly Review Press, New York, 1988)

And, the elites aspire for, as the report said, “a prompt and smooth transition to a more cohesive and sustainable model of ‘stakeholder capitalism’.”

The issue of public debt demands a brief observation made more than 150 years ago: “The public debt becomes one of the most powerful levers of primitive accumulation. As with the stroke of an enchanter’s wand, it endows barren money with the power of breeding and thus turns it into capital, without the necessity of its exposing itself to the troubles and risks inseparable from its employment in industry or even in usury.” (Marx, Capital, vol. I, Progress Publishers, Moscow, erstwhile USSR, 1977)

With contradiction within, contradiction with the labor, contradiction with the great masses of people, the capitalist system can never turn cohesive and sustainable. Similarly, its transition will never be smooth as the system itself continues creating hurdles on the path of its transition, which is nothing but the system’s dissolution. Moreover, the term “stakeholder capitalism” needs no elaboration as capitalists and their retinues are its primary stakeholders. Other than this parasitic group, none, the people, the labor has any stake in the system. The latest Oxfam report – Time to care, Unpaid and underpaid care work and the global inequality crisis – narrates a small fragment about the nature of this parasitic group. It’s horrible, it’s shameful, it’s beyond all ethical standards of all ages!

With this “holy” aspiration – “stakeholder capitalism” – the Davos elites are getting engaged with seven key themes that include “Healthy Futures”, “How to Save the Planet”, “Better Business”, “Beyond Geopolitics” and “Tech for Good”. Their discussions include “Averting a Climate Apocalypse” and “How to Turn Protest into Progress”.

With capitalism dominating the planet, there’s no healthy future of this planet. This planet’s only future that looms over the horizon is apocalypse as long as capitalism is the world system as the system’s only survival mode is destroy everything around. The system can’t survive without ever expansion, and it can’t expand without destroying all around. As long as there’s imperialism, there’s imperialism’s never-ending hunger for survival, there’s no scope for going beyond geopolitics. But, the GRR 2020 doesn’t look into that fact. It’s identifying risks partially, but declining to look at roots of the risks – a real dream in a real world. The elites like to dwell within this dream.

Mainstream likes to play with words, and dislikes to dig truths. That’s to hoodwink the commoners. So, one of the foremost tasks is to tear down covers of mystery the mainstream puts on facts concerning life, on issues in economy and politics. Its play with terms like public debt, cohesion, sustainable, interest is to be exposed. The brutal facts with the terms are to be discussed among the commoners. These discussions will help expose hollowness of the mainstream.

Despite use of tricky terms, the GRR 2020 fails to hide the reality as it admits failure to promote economic advancement for all, citizens’ profound discontent with current economic systems perceived to be rigged and unfair. The mainstream-mouth is uttering the facts. That’s the “beauty” of the GRR 2020. The reality doesn’t allow the elites to hide all facts. However, it “beautifies” itself by hiding its ugly class character, notorious class partisanship and political power.

Note: All statements not cited are quoted from the GRR 2020.

Farooque Chowdhury writes from Dhaka.

SIGN UP FOR COUNTERCURRENTS DAILY NEWS LETTER