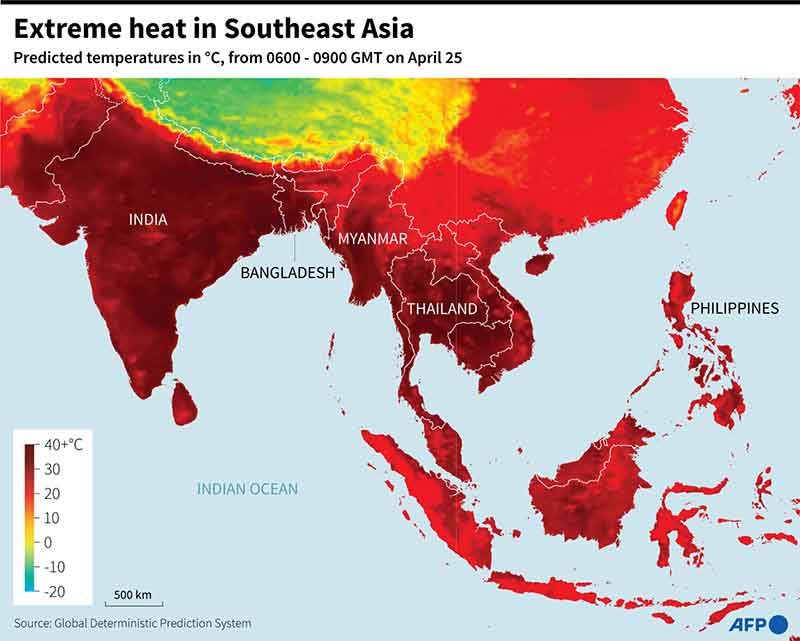

Wheat prices surged to a new record high on Monday after India decided to prohibit exports of the commodity as a heatwave hit production. The price climbed to $453 per ton as the European market opened. Soft red winter wheat for July delivery rose 4.2%.

Media reports said:

India, the world’s second-largest wheat producer, said this weekend it was curbing exports as the country saw its hottest March on record.

Indian authorities have expressed worries about the food security of the nation’s own 1.4 billion people amid lower production and sharply higher global prices.

Export deals agreed before the directive issued on May 13 could still be honored but future shipments will need government approval, New Delhi said.

G7’s Criticism

The Indian export ban decision drew sharp criticism from the Group of Seven (G7) industrialized nations, which said that such measures “would worsen the crisis” of rising food prices.

India, which possesses major buffer stocks, previously said it was ready to help compensate for some of the supply shortages caused by the Russia-Ukraine conflict. The two countries are major suppliers to the international market, accounting for around 30% of global wheat exports. The situation has raised fears that the world could be on the brink of a major food crisis.

EU Issues Dire Economic Forecast

The 27-nation bloc European Union on Monday slashed its forecasts for economic growth in the bloc amid the sanctions imposed on Russia over the conflict in Ukraine and disruptions to energy supplies.

According to the EU’s executive arm, the European Commission (EC), real GDP growth in both the EU and the euro area will be 2.7% in 2022, down from a 4% forecast three months ago.

Growth is expected to slow to 2.3% next year, down from a previous forecast of 2.8% in the EU (and 2.7% in the euro area).

“The outlook for the EU economy before the outbreak of the war was for a prolonged and robust expansion,” said the report.

The report added: “The war is exacerbating pre-existing headwinds to growth, which were previously expected to subside.”

With energy prices having soared this year, inflation is expected to average 6.1% in 2022, and peak at 6.9% in the current quarter, the EC said. Inflation hit 7.5% in April, the highest rate in the history of the monetary union.

That is a “considerable upward revision compared to the Winter 2022 interim Forecast” of 3.5% inflation, the outlook said. Inflation is then projected to fall to 2.7% in 2023, still higher than the European Central Bank’s 2% target.

The EC noted:

“The main hit to the global and EU economies comes through energy commodity prices. Although they had already increased substantially before the war, from the low levels recorded during the pandemic, uncertainty about supply chains has pressured prices upwards, while increasing their volatility.”

The report also said that while inflationary pressures intensify, global GDP is now expected to expand by 3.2% in 2022, down from the previously projected 5.7%. U.S. GDP growth projection for this year was also trimmed to 2.9%, with inflation set to move up to 7.3% before retreating to 3.1% in 2023.

Soaring Living Cost Forces Poles To Limit Consumption

Poland’s cost of living crisis is forcing people to cut back on restaurants and driving, with 36% keeping expenses to a minimum to make it through each month, a new survey has revealed.

According to a poll conducted by ARC Rynek i Opinia, 38% of respondents who could previously afford “luxuries” have given up on them. A researcher for the polling group, Dr. Adam Czarnecki, said people are “limiting consumption,” piling pressure on the economy at a time of “stagflation” – i.e. high inflation accompanied by subdued economic output.

The survey also found that 38% of Poles are saving far less than before and spending more due to the price hikes, with 13% saying they are no longer able to save anything.

The report said:

“More than 1/3 of Poles (36%) admit that they had to limit their daily expenses in order to have enough money for the entire month, and every fourth (24%) admits that due to higher prices they cannot afford basic expenses.”

In addition, 35 percent of Polish car users say they are cutting back on driving due to rising fuel costs.

The study found that people are taking a cautious approach to financial risk: 18% of Poles have decided not to go ahead with a planned loan and 26% hope to repay existing ones as soon as possible, due to concerns over a future hike in interest rates.

The report added:

“Every fifth Pole (21%) admits opting to buy something rather than keeping money in an account, because its value decreases.”

Dr. Czarnecki described it as a “very dynamic situation in the area of personal finance, in which consumers may feel insecure.”

The online survey was carried out from 4 to 11 May, with respondents aged 18-65.

Poland’s inflation in April hit 12.4% compared to the same month last year

According to a Statistics Poland report released on May 13, housing prices have risen by 17%, food by 13.2% and transport by more than 21%. Restaurants and hotels have hiked prices by more than 14%.

Compared to March this year, food costs have increased by 4.4%.

Aside from struggling with the global cost of living crisis, exacerbated by the conflict in Ukraine, Poland is also a primary destination for Ukrainian refugees. According to the latest figures from the UN High Commissioner for Refugees, almost 3.4 million Ukrainians have crossed into Poland since the start of the conflict.

Draconian Measures Will Be Taken To Support Crashing Economy, Warns Ukraine

The Ukrainian government will take “painful” measures if the military conflict in the country lasts another three or four months, according to the country’s Finance Minister Serhiy Marchenko. He said that the drastic steps may include a sharp increase of taxes, spending cuts as well as nationalization.

“What in recent years has become a fairly market-driven and free-wheeling economy could face a wave of nationalization that will undo years of hard progress,” Marchenko said in an interview with The Economist.

The minister cited the latest forecast revealed by the World Bank that expects the Ukrainian economy to shrink by 45% in 2022.

According to Marchenko, customs revenue fell by about a quarter due to a reduction in imports and the dropping of many duties.

He highlighted that the salaries of the military is “a huge burden,” adding the country’s monthly losses amount up to $5 billion due to the current situation.

The conflict also poses significant challenges for exporting wheat, barley, sunflower seeds, Marchenko said, warning that the EU may face food shortages as a result of the bureaucratic hurdles Ukrainian lorries are running against as the country is not a member of the bloc.

In March, the finance minister said that the damage caused to the Ukrainian economy because of the war could amount to about $500 billion. He added that revenue from customs duties decreased by 85%, while Odessa, Ukraine’s last remaining sea port, which accounted for 20% of all custom revenue, had halted operations.

Soaring Prices Ahead, Predicts Ryanair CEO

The European flying public should expect higher prices this summer when it comes to booking flights, Ryanair CEO Michael O’Leary has warned.

The cost of flying this summer will reach a “single-digit percent” high above pre-pandemic levels, the low-cost airline chief told BBC Radio 4’s Today program on Monday.

He cited “demand for the beaches of Europe” during the summer vacation months as behind the anticipated price hike. He also pointed to the conflict in Ukraine and its impact on the price of fuel. Bookings are around 10% behind pre-pandemic levels, he told CNBC’s Europe Squawk Box on Monday.

O’Leary said an expected economic downturn, an inflexible post-Brexit labor market in the UK and “continuing uncertainty” about the energy supply would lead to “inevitable fuel surcharges” in all competing airlines, whereas a very strong hedging position on jet fuel, 80%, allowed the airline to continue to offer lower prices to its customers.

Ryanair, Ireland’s largest airline and the premier low-budget carrier in Europe, managed to weather the pandemic due to high passenger demand, a result of its ultra-low cost model.

O’Leary said that this high demand had caused “exuberant optimism” in recent years, which had since been tempered by the emergence of the Omicron variant of Covid-19. He said the specter of a resurgent pandemic and “negative newsflows” surrounding the Ukraine conflict could compromise the company’s strong recovery.

The Ryanair chief said he expects the company to be “modestly profitable” in the coming fiscal year, and aims to serve 165 million passengers by the end of this fiscal year, beating its pre-pandemic record of 149 million in the summer of 2019. The intervening period saw the advent of Covid-19, with its catastrophic impact on the air travel sector.

Ryanair reported annual losses of $370.11 million on Monday, a significant improvement over last year’s reported loss of $1.06 billion.

Russian Economy To Stabilize, Predicts EC

Russia’s real GDP is projected to decline by 10.4% this year after a growth of 4.7% recorded in 2021, according to the latest outlook revealed by the EC.

The country’s export earnings are expected to surge thanks to high prices and strong demand for commodities.

The report said:

“This will enable the government to support the ruble, vulnerable groups and the economy, limiting the decline in real GDP to 10.4% in 2022.”

The EC predicts the Russian economy to stabilize as soon as in 2023, as the country is expected to adjust to the new reality. At the same time, GDP growth is projected to remain restrained next year, amounting to 1.5%, since the ongoing import substitution evoked by the departure of foreign businesses will not be effective enough.

The prediction said:

“Uncertainty regarding the nature of future economic ties with the rest of the world will continue to hamper investor confidence and seriously limit the growth potential of the economy.”

The report projects inflation to exceed 20% this year due to supply side bottlenecks and rising import prices. In 2023, inflation will subside to 10% as purchasing power declines and consumption patterns change, the report adds.

According to the outlook, Russia’s export of goods and services will drop 16.1% this year with 2023 exports expected to see a slight growth of 3.9%. Imports are expected to fall by 25.8% in 2022, and will show an increase of 5.4% next year.

The unemployment rate in the country will reportedly increase by 5.9% in 2022, and is predicted to demonstrate further growth by 5.6% next year.

Private investment is predicted to fall by more than 20% in 2022, given the extremely low appetite for new investment in the current environment amid the withdrawal of foreign companies.

A projected small budget deficit of 0.5% of GDP in 2022 is set to widen to 1.5% of GDP in 2023, as easing commodity prices and limited Russian ability to export them curtails revenues.

Ruble Nears Five-Year High Against Euro

The Russian ruble is edging towards a five-year high against the euro on Monday, demonstrating unprecedented resilience amid the most drastic sanctions ever imposed on Moscow by the West. The ruble was named the world’s best-performing currency by Bloomberg last week.

The ruble strengthened by over 1% to trade just above 65 rubles to the euro, getting close to its strongest position since June 2017.

The Russian currency made similar gains against the US dollar, trading above 63 rubles per dollar, hovering near its strongest exchange rate against the greenback since February 2020.

The ruble dropped to historic lows of over 120 to the dollar and 130 to the euro amid the first wave of Ukraine-related sanctions in early March, but has since nearly doubled in value.

The latest appreciation comes amid a series of support measures for the currency introduced by the Russian government. In addition to temporary capital controls, the Russian Ministry of Finance has obliged Russian exporters to sell 80% of their foreign exchange earnings.

The introduction of a ruble-based mechanism for gas export payments also helped to stabilize the ruble, increasing the supply of the currency on the market and boosting demand.