Finance is one field where we have witnessed significant innovations in recent decades, and this has transformed our society in many ways. Earlier, we could hardly visualise social change in rural India as it was mired in caste conflicts and was impervious to the winds of change. Before the 1980s, outsiders rarely visited villages. Those who did were the occasional anthropologist, extension staff, social workers and missionaries of various religions. The gradual change in the profile of visitors was the first sign of the embryonic revolution in development finance, which later bloomed into an era of social banking.

It was during this time that bankers started courting villages in large numbers. Their mission was to find trustworthy villagers for providing soft credit to rescue them from moneylenders. This, it was thought, would help villagers start small businesses, promote local economic activities and empower people to climb out of poverty.

The bankers and missionaries, who shared much of the same client pool, were curiously alike in some ways. Usually outsiders to the local community, they tended to discover their own preconceptions in the villages, rather than being able to grasp the local realities and dynamics. Although the missionaries succeeded, the financial revolution was inevitably aborted by populist politicians and local interests. However, soon it became clear that financial inclusion was not just a powerful economic tool but a critical piece in the development ecosystem, and it could no longer be deferred. The Government, too, was keen to lend its full weight.

Committed development organisations, too, saw an opportunity and space and plunged into the field. Among the early bands of development activists who climbed on board was Chetna Sinha, a trained economist. She set up the Mann Deshi Mahila Sahakari Bank in 1997 at Mhaswad village in Satara district of western Maharashtra. As many as 1,335 women pooled their savings (Rs 7.8 lakh) and set up the first bank for and by rural women in India.

An intrepid lady got an opportunity to join this fledgling institution as an assistant and, with sheer commitment, rose to helm it. She is Rekha Kulkarni who is now the bank’s most visible face. The bank opened at a time when an institution of this type could not have been thought of even by established bankers. Today it has eight branches, 2,00,000 account holders, 30,000 shareholders and has given out loans to the tune of Rs 500 crore. The balance sheet is modest but the model has been applauded by organisations like the Reserve Bank of India (RBI) and the Harvard Business School.

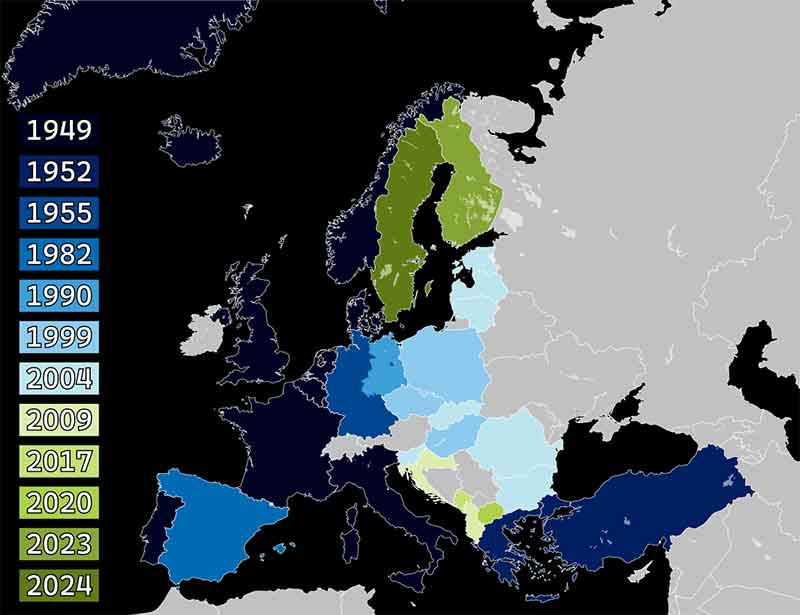

Rekha is the first woman graduate from her village of Shirgaon in Belgaum district in Karnataka. In September 2000, her husband, a retired radar fitter from the Indian Air Force, was struggling to find a stable job. Rekha applied to the Mann Deshi Bank for a job and was hired by Chetna. She turned out to be a great bet. Within six months, she rose to become a branch manager and six years later she became the CEO of the bank. She is part of the faculty at the RBI’s College of Agricultural Banking in Pune. She has travelled to Europe and the US to explain the bank’s model and spoken at Harvard and Yale.

Both Chetna and Rekha knew that without a safe place to save money, it was hard for the poor to take the calculated risks they needed to take to better their lives. While Chetna went about formulating the larger vision, Rekha and the remaining cohort worked on laying the long-term groundwork for the bank.

Both were assailed by several challenges and the bank was expected to address them. However, the benefits of financial inclusion were becoming clear: Affordable credit could help low income populations to build assets and get a business idea off the ground. Appropriately-designed insurance could equip them to buffer their lives against economic shocks such as unemployment, illnesses and disasters.

Financial services are analogous to safe water, basic healthcare and primary education. They are essential to enable people to participate in the benefits of a modern, market-based economy. Ideal financial societies are those which provide safe and convenient ways for people to navigate their daily financial lives. It was such a society that Mann Deshi bank envisioned for its clients — one that was equitable, adaptable, sustainable and more resilient. The bank had a clear credo: It was not to be a clone of a stereotyped conventional bank, but a bank for poor women to be run by them; and its entire structure was conceptualised accordingly. Mann Deshi considers women as a distinct segment with unique challenges, concerns and goals. So, instead of disguising male-focussed products as gender neutral, the bank created specific products tailored to their specific needs.

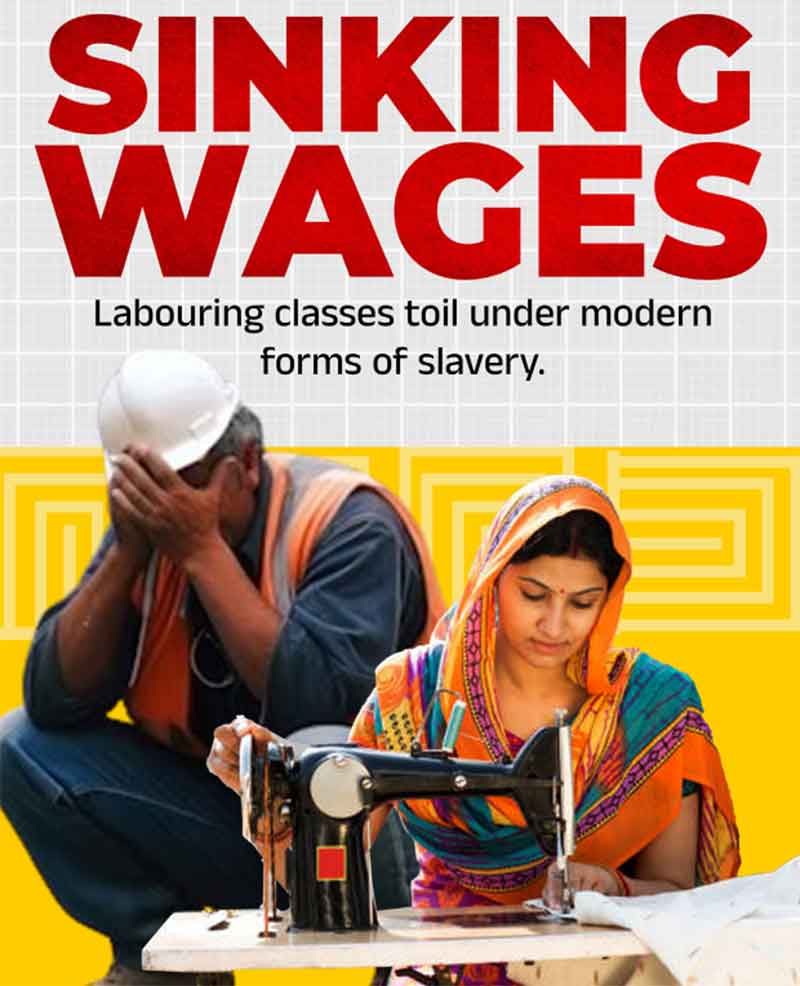

“We need to study the myriad social and behavioural impediments impacting women, and use this knowledge to design customised financial product offerings. In failing to develop client experiences rooted in men and women’s fundamentally-different perspectives on finance, banks are missing a very significant business opportunity,” believes Rekha. Women don’t have a straight financial journey and have more interruptions and life-stages in their financial lives. Low- income women usually need timely and hassle-free credit to increase their financial prospects. “The greatest fracture facing India is women’s inequality”, reiterates Rekha. “A majority of women are doing business on roads in cities and villages, selling products in markets but they do not have access to affordable credit. Regular banks aren’t typically an option. They have several formalities and fees that can be intimidating. Plus it requires an arduous trek to the nearest town, which can compromise a day’s wages. Banks also find this segment unviable because the costs of underwriting and originating these small loans are substantial,” she says.

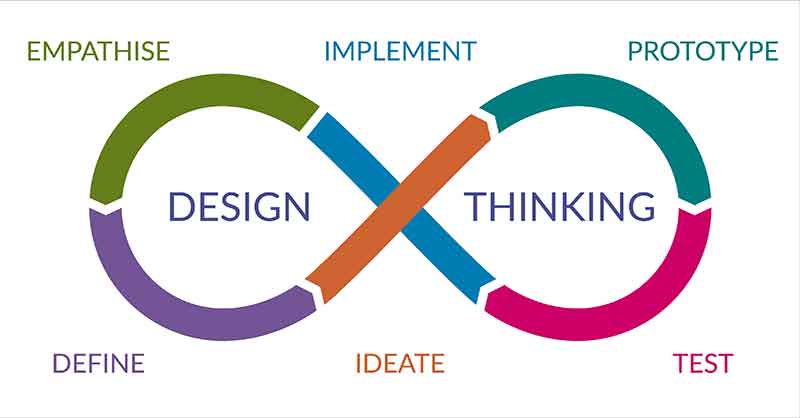

Behaviourally, women customers take more time to develop trust in a new product or service. The same holds good for finance and building confidence and trust in them requires more interaction. Rekha felt that her team needed to address the barriers to financial inclusion of women through behavioural and reformist approaches instead of the usual hardware-based one, so that both demand and supply-side were eliminated.

It’s not that the barriers are necessarily different for rural and urban women, but the same challenges are greater for rural ones. “We need last-mile banking agents to help mitigate barriers that prevent universal inclusion of women in the formal banking system, such as dependency on male family members for travel,” emphasises Rekha. The bank has developed another novel idea that is known as the wealth card, which lists out the client’s assets and can also include cattle or machinery, depending on the business. The wealth card is a barometer of the customer’s net worth.

Chetna, as the bank’s founder, has all along emphasised two very important mantras. The first: Never provide poor solutions to poor people. Second: invest in women. The Mann Deshi Bank was an early embracer of modern financial tools and came up with a slew of sophisticated products and services so that poor women could enjoy the same fruits of financial inclusion as the clients of mainline banks.

As the Mann Deshi team seeks to comprehend the new normal following covid-19, it faces many unknowns. Will the clients regain their businesses? What will recovery look like? Much is still a question mark. But the greatest hope is the tenacity and resilience of the women. Fragilities and vulnerabilities may be woven into their daily lives, yet they have consistently shown they can cope. Both the bank and the clients hope to bounce back from the pandemic’s economic fallout.

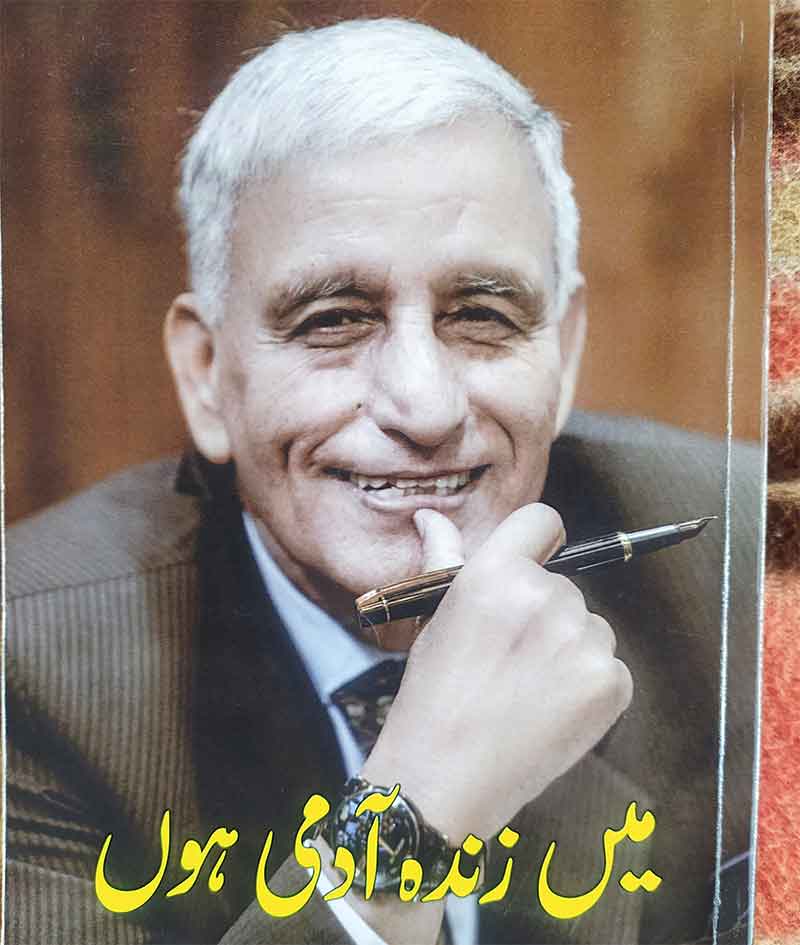

Moin Qazi is the author of the bestselling book, Village Diary of a Heretic Banker .He has worked in the development finance sector for almost four decades .He can be reached at [email protected]

SIGN UP FOR COUNTERCURRENTS DAILY NEWSLETTER