Garkhal is a small settlement which is part of a panchayat area yet has strong orientation towards urban life, being located close to the famous tourist resort of Kasauli. Here about 40 persons have been earning their livelihood from travel related activities, including taxis, pick-ups , private buses etc. There has been very little work in pandemic times for them and none at all in lockdown days. Recent conversations with them revealed mounting worry and tensions due to not just difficulties in meeting essential needs, but also due to the fear of loss of income earning assets.

As they explained they have to make regular payments of permits, fees and taxes etc. irrespective of whether they are getting work or not. Many of them have obtained their vehicles on the basis of loans and installments have to be paid regardless of whether there are earnings or not. In banks or other loan agencies the interest keeps accumulating at compound interest and in addition they keep getting notices which adds to their tensions. Some of the private loan giving agencies can be quite rigid and use strong-arm tactics, which increase tensions of borrowers who had taken loans in the hope of the continuity of normal times.

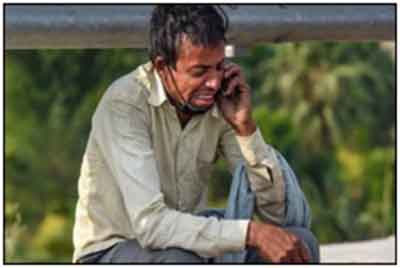

As Ravindra Kumar , a respected person in this profession who helped several younger persons to learn driving and other essentials of this work says. “ Those who were thinking in terms of expansion till about only 15 months back are now on the verge of ruin. Something troubling them all the time is whether they will lose their basic income-earning assets in terms of taxis and vans etc. Our unions have been writing to the authorities again and again for relief but to no avail yet. In other places even suicides have taken place, as published in newspapers also. Then there are others who do not have their own taxis but are in employment with others or in private buses. They too have not earned anything in recent times as private buses are also not operating.”

Such conditions exist in many places. May be the people are affected more in places located close to tourism destinations like Garkhal but a serious decline can be seen even in other places. A significant section of the persons associated with this segment of the transport sector are essentially those who work with loan-financed assets. In Delhi for instance even more numerous than taxi-operators are auto-rickshaw operators. Many of them are from slum areas and from economically weaker sections whose road to upward mobility was to pay back the loan as soon as possible and then their net earning would increase significantly. But the lack of recent work has not only rudely shattered these aspirations of the younger operators but even upset the settled older operators. Recently the biggest addition to this sector was in the form of e-vehicles. Several had taken loans for this and were doing rather well for themselves till about 15 months back when the rapid downswing started. There was a small period of partial recovery in-between but that was short-lived.

Even when the e-vehicles had their short-lived boom time, they actually prospered by displacing cycle-rickshaw pullers who were already at the lowest rung of the transport sector. In most parts of big cities rickshaw pullers had already been reduced to very short routes in the interior colonies but e-rickshaws had started pushing them away from even this marginal role.

A double whammy for the rickshaw pullers, and to some extent from some other low-end workers of this sector, is that the second source of livelihood in their household came from women working as domestic worker and or in some other petty livelihood in the informal sector ( work that could also be done from home), but all this work has been badly disrupted too.

Keeping in view all these factors there is clear need for helping this sector in such a way that at least when the situation eases they are able to get back to work properly and their income earning assets are saved. One way of achieving this would be to provide them some relief in fees and taxes and another would be to extend loan repayment over a longer period of time in affordable ways for them without charging compound interest.

Bharat Dogra is a journalist and author. His recent books include Man Over Machine.

GET COUNTERCURRENTS DAILY NEWSLETTER STRAIGHT TO YOUR INBOX