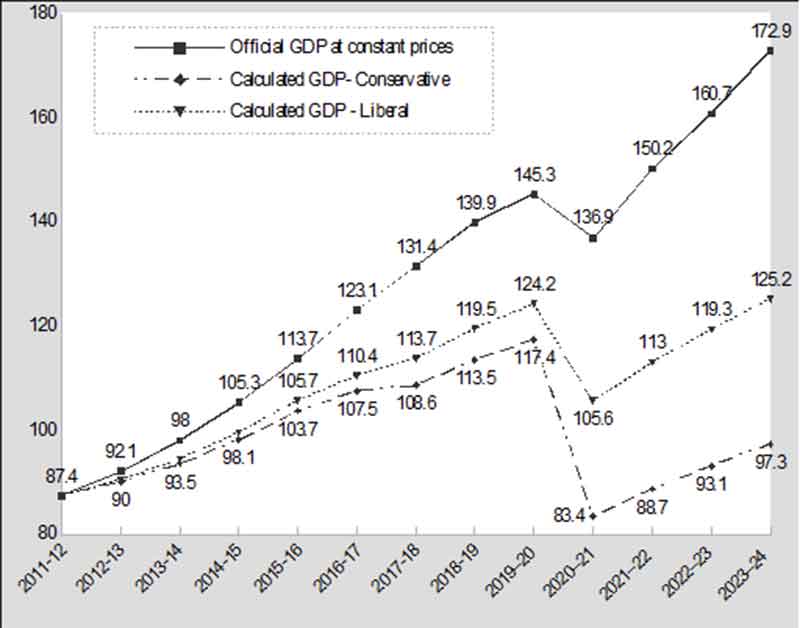

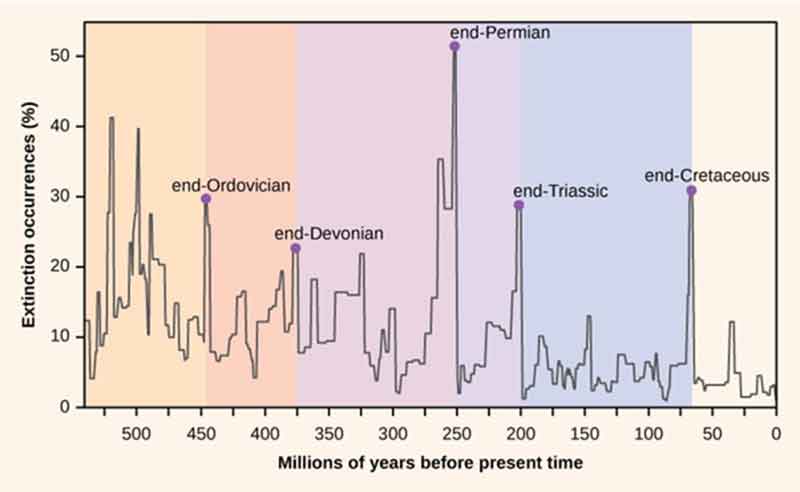

In an interview of Joseph Stiglitz that appeared in Investopedia on 23 April 2020 he said “Covid 19 reminds us that when we have a crisis we turn to collective action and to government.” What became very crucial in countering the pandemic are the collective actions in which civil societies were forced to keep aloof from its internal decay like racism and disparity and the preparedness of government. Any country which was vulnerable to social contradictions and least government interventions were subjected to a greater number of Covid cases and deaths due to covid. In the same interview Stiglitz also predicts that states in USA are about to hit by a revenue shock that is surely greater than in 2008. This can also be applied to other countries as corona has hit the global economy. Similar to the Great Financial Crisis (GFC) it is the governments which can play crucial rule in creating a better world, which means public sector should lead. Talking about public sector is no more a leftist dynamic. A wide range of economists and organization with no leftist leaning has finally admitted the indispensable role of public sector. Here we mean no negation of private sector and enterprises but will be stressing on importance of public sector. The current socio-economic crisis can be compared to GFC 2008 in many ways. Except one or two almost all countries were facing economic problems before the crisis. Even before pandemic the economies of countries including India were facing slowdown. Both GFC 2008 and Covid19 were a very strong blow to economies. Banks collapsed; employments were destructed, people were pushed to severe poverty and difficulties and social mobility ceased. The high task power commission appointed by U.N under the leadership of Stiglitz demanded certain changes in the existing policies. The reading of GFC 2008 is essential during these times. Especially for India a country which was facing slowdown even before pandemic. The problems caused by demonetisation still echoes in our economy. The additional destruction caused by pandemic on the economy can resonate in coming days.

GFC 2008 And Pandemic: A Comparison

The economic slowdown caused by the virus is more devastating than the crisis that happened in 2008. But there are certain similarities between both historical incidents. The institutions that failed in 2008 and in 2020 are almost the same. This proves that we never learned anything from the past. The solutions for both the crisis also draws similarity.

“The crisis is in part of a result of excessive deregulation of financial markets. Restoring the global economy to health will require restoring to the state the appropriate role of regulator of financial market. In addition, the externalities associated with both the global economic crisis and the global climate crisis can be addressed only by restoring government to its appropriate role in providing collective action at the national and global levels.” (Excerpts from Stiglitz Report)

The above-mentioned sentences still remain a reality. Even before 2020 the financial markets remained deregulated as many countries were governed by right wing governments. The historical role of government in intervention remained forgotten. (Stiglitz Report). The economic crisis caused by corona can be solved only through strong government interventions. The audacity of state to make interventions are necessary to avoid economic crisis in the long term. The adverse effect of GFC 2008 has contributed in worsening the current crisis too. What we fail to understand is that all economic crisis has a long-lasting devastating effect. It is not after the immediate dawn we feel the problems but maybe after months or years.

What are the ways to overcome the pandemic and the crisis?

1.Strong public sector hospitals and institutions

- Strong government intervention in banking sector

- Enhanced Social Security Programmes

- Progressive Reforms

- Poverty Alleviation Programme

- Universal Free Vaccine

- Reducing Inequality

Except from the vaccine all the other solutions resonated during GFC 2008. The problems of the masses remain the same, what changes is the level of intensity.

Strong public sector hospitals and institutions

Why should we strengthen public sector hospitals and institutions? The IMF economists Victor Gaspar,Paulo Medas, and John Ralyea have the answer. “The pandemic has highlighted the role of the public sector in saving lives and livelihoods. State-owned enterprises are part of that effort. They can be public utilities that provide essential services. Or public banks that provide loans to small businesses.” (IMF Blog) IMF Fiscal monitors are also urging the government to function to their maximum. IMF, an organization which demanded shortening government intervention in its past is now advocating for increased government interventions. This reminds us of Kenneth Rogoff ‘s words “The next great battle between socialism and capitalism will be waged over human health.” Even if you negate socialism based on your views you can still remain a Neo Keynesian. The school of Neo Keynesians are almost against market fundamentalism and advocates free health care.

Health care is a basic right in many countries. But in many other countries it is a luxury good. The debate on universal health care is still an ongoing dialect. Different schools of economics have engaged in debate over the past few decades. In the wake of globalizations world expected the Marxian economists to advocate for universal health care but it was Keynesians who came forward for this along with the Left. Kenneth J Arrows, an American economist who was awarded with Nobel Prize has written a paper about medical care in 1963 and it became a focal point of discussion in later decades. In his paper he clarified that health care is a sector where unpredictable phenomenon happens. So, the demand and supply without interventions tend to fail here. Joseph Stiglitz in his book Price of Inequality also focus on making health care free in USA.

As Antonio Gutteres the current Secretary of UN said “Covid – 19 pandemic is a public health emergency – but it is far more.”

During the outbreak of the pandemic different countries had different plans on countering the virus. Spain nationalized all the private hospitals in order to increase medical infrastructure. The same method was followed by Zambia. But the countries which were reluctant to change their neo liberal healthcare policies had harsh experiences. America, Brazil, India were the countries which faced severe problems during the first and second wave. The private sector as such is one component of the failure of either emergency or pandemic planning in many states, and yet another damning verdict on the health systems gaps left in place by the global health security agenda and the policies that have rolled back public health. The pandemic has sharply reminded us once again how health policies and increasing privately-focused health systems fail to meet both national needs and those of the most marginalized and vulnerable. Neoliberalism has seen market-provided healthcare burgeon, and the pandemic has only further exposed what has transpired in health services provision as being inequitable, unstable, and deeply ill-suited to meeting population health needs.

The private medical sector has failed to deliver the necessary service during the pandemic especially in Low Middle Income Countries (LMIC). It is clear that COVID has created an acute liquidity crisis in the private sector internationally, with the impact most felt by smaller and medium-size practices, clinics and hospitals. Industry bodies have been warning of these private providers facing acute liquidity problems since March 2020, and the financial crisis has forced small- to medium-size clinics and hospitals to close or furlough staff. (Owain David Williams) In India where the government has no business in doing business the public health infrastructure exists as a very thin layer. India spends only 1.25% of its GDP on medical field which even lesser than under developed countries. As per the studies of Lancet 78% of hospitals in urban area and 71% in rural area are under private sector. NSS Data also prove that the greater percentage of masses in both rural and urban area depend on private sector. Most of the private hospitals are reaching the constrain while the whole medical sector is failing in India. Many ASEAN countries responded early and proactively by unilaterally, even aggressively, passing legislation, or simply decreeing limitations on private providers. Malaysia, the Philippines, Thailand and Indonesia all secured COVID treatment by private providers and fixed government subsidized rates. Indian states have moved through their own trajectories of responses to the service and pricing crisis, with even pro-market ruling BJP administrations becoming increasingly aggressive toward private providers. Despite multiple states capping prices for treatment of patients, and despite sequestration of beds and capacities by legal means and emergency powers, the situation has been anarchic, with tensions and real divisions emerging between state governments and private providers. Firms are still routinely breaching price caps and gouging, turning away COVID patients and hoarding beds, with reports of unseemly black markets for beds emerging. The case of Kerala was different from the rest. With its strong public health infrastructure and welfare schemes the state succeeded in resisting the virus. The state has a strong Public Distribution System. While other states failed to take off the ration subsidies due to their tarnished PDS state of Kerala was successful in ensuring that there is no food shortage. While chronic hunger and poverty is still persisting in the country Kerala is performing better in such social and human development indicators. Government hospitals at decentralized levels was one of the key factors which helped Kerala in withstanding the pandemic.

The public health sector in India needs drastic changes in order to move smoothly to a post pandemic era. Abhijit Banerjee, Nobel laureate in economic has said health care is one of the factors which squeezes out the income of people. Covid and post covid issues which the marginalized, low-income people face can only be eradicated with a sound public sector policy.

Even when USA and UK followed universal vaccination policy India abided to a liberal vaccine policy from which the government deviated after strong slashes from the apex court. The liberal vaccine policy was one of the blunders in the vaccination history of India. India has a history of vaccinating 127 million children on one day. In 1998 India set a record of 134 million vaccination in one day under the leadership of Indrajith Gupta the then Home Minister during the United Front government. This was the potential of Indian public infrastructure. From such a strong setup the country was degraded into a liberal vaccine policy which failed to accelerate vaccination and also cause vaccine shortage. The gap between first jab and the second was increased up to 80+ days due to shortage of vaccine. The policy was altered to an extent after the supreme court made an intervention. “From 1978, we had one of the finest distribution policies in the world – the universal immunisation programme. Even for the 45+ people, the previous policy has prevailed. Now we are seeing a change in the policy. But for the 45+ even today the central government will procure and the state government will only administer the vaccine.” Jaydeep Gupta the amicus curiae said this in the court just before urging the government to restore the original policy of universal vaccination. The liberal policy was proved to be a failure by central minister Piyush Goyal. He gave a statement that private sector is lagging in vaccination drive. (Source; The Hindu) He also said that the private sector failed to pick the 25% of vaccine allotted for them. This is how economic crisis weaken private sector and this is why strong public sector should spearhead. At the global level despite the universal vaccine policies and research funding by certain governments, serious problems exist in vaccination. There is no equity in distributing the vaccines. According to Randy Alonso a journalist in People’s World Magazine, the high-income countries which comprises of 16% of world population currently hold 60% of vaccines that have been purchased so far.

Social security and inequalities.

“Social protection is not only an investment of social justice but also major tool of economic stabilization. Well designed social protection systems make the economy more resilient to shocks by increasing the size of automatic stabilizers.” (Stiglitz Report)

Social security is a program with social and economic impact. Increased supply of public good would free part of income that is saved for precautionary purposes and make it available for spending, including investment in both physical infrastructure and human resources. In other words, social spending could crowd in private investment and raise the economy’s current and future growth rates while decreasing its volatility. Abhijit V Banerjee is of the opinion that cash should be distributed at the bottom level of the society i,e to workers and labourers. Former RBI governor Raghuram Rajan was of the opinion that India needed to spend about Rs 65,000 crore to take care of the vulnerable sections such as migrant workers to tide over the pandemic. But such advices were rejected by the government. The government in Kerala focused on spending more on ensuring welfare of the people in the lower strata. Apart from depending on PDS the government took a step forward. As per the studies conducted by Anders Kjelsrud and Rohini Swaminathan which appeared in the book “ Poverty and Income Distribution in India” the transfers through public schooling are more progressive than those through the PDS. Poorer households are larger and have a higher ratio of school aged children. The government of Kerala distributed goods through schools.

Governments of various countries were asked to create a strong social security program in the backdrop of GFC 2008. But it was neglected. But the current catastrophe has forced governments to issue stimulus packages for the needy.

End of ideology: the need to kill zombie ideas

“Talking to Zombies” is the latest book written by Paul Krugman a famous economist. Even before him social scientists like Slavoj Zizek and Noam Chomsky warned the world about how ideologies can pause a hurdle in shaping the pandemic and post pandemic economies. The ideology of market fundamentalism is the greatest blockade of change. Even so-called progressive capitalism is opposed by market fundamentalism. The market fundamentalist myths were debunked by Stiglitz in his book “The Price of Inequality”.

Myth: Free market gives equal opportunity to all

Reality: Decline of opportunity happens when corporate welfare rules prevail. The statistics have exposed the fact that poor kids who succeed academically are less likely to graduate from college than rich people.

Myth: When the taxes are lowered one would actually raise more money because savings and work increase

Reality: Tax revenues fall, deficit increase

Myth: Investing in public sector and goods leads to lack of

productivity

Reality: Under investing in public good leads to lack of economic mobility.

The former Vice President of USA Mike Pence just after 5 days of Spain nationalizing all the private hospitals tweeted that “We cannot let the cure be worse than the problem itself.” Mike Pence meant that the government was not ready to alter its policy even if the things get worse. But in order to increase the overall immunity even America switched their gear. The interaction between state and people should be more powerful to counter the virus at every stage. It is time we dispose the old Regan quote “Government is the problem.”.

Public bank was established in California through legislation in the month of July 2020. The aim was to help with a more equitable economic recovery from the Covid-19 crisis. One can draw very much similarities between the 2008 global crisis and the current pandemic.

Paul Krugman in his latest book is making a successful counter against conservative market fundamentalist arguments on health care, social security and inequality. The statement of Mike Pence depicts the danger of market fundamentalism. Even while making cultural menace of “socialist scare” the trickle-down theory believers failed to hide how their government made interventions in not only markets but also in companies. When it comes to the matter of public finance during the pandemic, countries are recapitalizing the public banks and also saving the private companies from the shock. The government of USA brought the corporate bonds of Boeing while the aviation industry was falling down. When it comes to India LIC backed the government and prevented the fall. States like Kerala with ample public health institutions won applause at global level while states like U.P and Gujarat trailed a lot behind.

Why and how the government

Whenever the country is in trouble it is the public sector which comes to the rescue. It is because the aim of public sector is service rather than profit. The government or the state is the largest power apparatus in the world. It has the capacity to withstand man made crisis. Viral Acharya, former deputy governor of RBI in his interview which was taken by Maneka Desai pointed out that there was a increase in the number of people who moved their savings and transactions to public banks from private banks during GFC 2008. This shows the capability of public sector. According to bank analyst Bryan Johnson after GFC world saw the transfer of risk from the private sector banks to the public sector. Economist Gerard Minack agrees the banks will be safe, because the Government won’t let them fail. Government cannot stand aloof from the market. Leading economists are urging for federal aid packages to states. Quoting Stiglitz again “the first priority is to provide more funding for the public sector, especially for those parts of it that are designed to protect against the multitude of risks that a complex society faces and to fund the advances in science and higher quality of education on which our future prosperity depends.”

The Great Reset Report, Global Risk Report published by World Economic Forum is also highlighting the need for a strong government and public sector. One must think what forces IMF, WEF, World Bank to critically think about trickle-down theory and look forward for government. These organizations were once the vocals of diminishing government but now they are deeply thinking on government and inequalities. While other countries are expanding their public spending India is following market fundamentalism. Even after witnessing that privatization of railway was a bad idea in Britain, India is following the same path. The current epidemic the Indian public bank face is the increased NPAs (Non-Performing Assets).

Indian government is interfering in favour of a few and non-interfering in disinterest of the majority. In a contradictory position the NDA government favours slimming the governance while making interventions for the few. India is a large economy consisting of MSMEs. Preventing the collapse of this informal sector is crucial to save the economy. A special MSME economic relief package should be announced. Public sector infrastructure should be developed. One of the analyses of IMF is very relevant. The State-Owned Enterprises of many countries are the leading companies in the world. Reforms which can facilitate a conversion of SEOs into dominant market players should also be implemented by India. India just spends 1.6% of its GDP on health. The rate of spending on government is decreasing in various spheres including health. Rapid disinvesting is shrinking the public sector which can adversely affect the country in future. India should learn from the banking lessons of USA which lead to a bubble burst. Instead of abusive lending and risky loans banks should focus on lending to MSMEs and curb excessive risk-taking investments.

Alan Paul Varghese is a final year undergraduate student of Zakir Hussain Delhi College under Delhi University and fellow of Smithu Kothari Fellowship awarded by Centre For Financial Accountability