To

Shri G C Murmu

C&AG

Dear Shri Murmu,

I have just come across a news report (https://indianexpress.com/article/india/after-ec-now-cag-works-to-red-flag-freebies-state-largesse-8225594/) that your office would be “exploring how to devise parameters that will ‘red-flag’ the burden of subsidies, off-budget borrowings, discounts and write-offs which may pose challenges to the economy of States“.

While the office of the C&AG has an obligation to audit the States’ finances and red flag trends that could adversely impact their fiscal sustainability, it is equally important that your office similarly audits and red flags the policies and decisions taken by the government at the Centre that adversely affect its own finances and the overall fiscal sustainability at the macro-level.

For example, the Centre, in the guise of promoting business and investment, has been giving “freebies” every year to private corporate entities in terms of tax concessions etc. In this connection, you may look at Table 5 of Annexure 7 of the 2022-23 Union Budget, which shows that tax concessions for private corporate taxpayers added upto Rs 1,03,285 Crores for 2020-21 which, by no stretch of imagination, is insignificant, from the point of view of fiscal balance. For the sake of comparison, the subsidy on fertilisers given to the farmers for the same year, which was imperative for maintaining food security of the country, amounted to Rs 1, 27,922 Crores.

There are several other concessions that both the Centre and the States casually dole out to large business houses. They include land at highly concessional rates, subsidies on electricity and water and so on. In recent times, the Central Ministries have diluted the provisions of the Environment (Protection) Act, the Mines & Minerals (Development & Regulation) Act etc. to promote “ease of doing business“, which in effect would damage the environment to the detriment of public interest. Such corporate freebies are quid pro quos for contributions that the corporates make to fund political parties’ profligate electioneering campaigns. Should not the C&AG audit these and report their adverse consequences to the Parliament and the State legislatures?

More importantly, the present government at the Centre has launched a highly indiscriminate scheme of privatisation of the CPSEs and monetisation of their valuable assets, which in effect amounts to a distress sale in a buyers’ market. By deliberately excluding the other CPSEs from bidding for those on sale, the Centre has minimised competition, thereby choosing to undersell its highly valuable CPSEs, their talented human resources capital and their lands. More often than not, the bidders for these assets raise funds from the public sector financial institutions, which debunks the premise that disinvestment would bring additional resources. In many cases, the successful bidders are not capable of carrying forward the kind of strategic activities in which the privatised CPSEs are involved, as amply demonstrated by the sordid saga of disinvestment of the Central Electronics Ltd. (CEL), which the Centre had to abort in the final stages, when there was a public outcry against it. Should not your office audit the disinvestment approach in all its dimensions, its adverse consequences for the public exchequer, the economy and its impact on national security and so on, and place its findings before the Parliament?

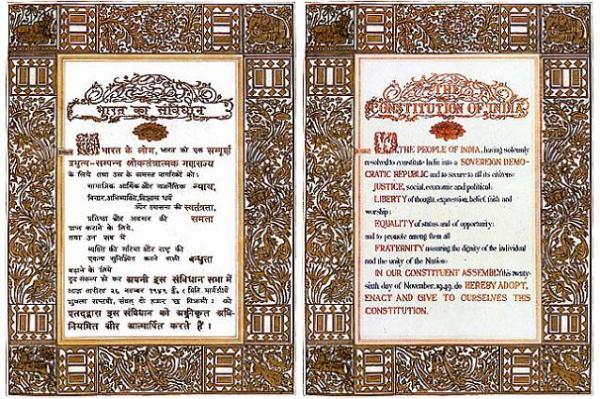

Most of these corporate freebies run counter to the letter and the spirit of the Directive Principles of the Constitution. In specific terms, doling out concessions to profiteering private companies would widen income inequalities and accentuate concentration of wealth in the society, violating Articles 38(2) and 39(c). Statutory amendments that lead to environmental degradation violate Article 48A. In my view, your office should step in and red flag these in your reports to the Parliament and the State legislatures.

I wish your office, instead of being prompted by an isolated observation made by the Prime Minister on “revadi” culture recently (https://www.tribuneindia.com/news/nation/revadi-culture-dangerous-for-development-of-country-says-pm-modi-urges-youth-to-guard-against-it-413011) had acted on its own much earlier, to audit the long-term adverse implications of concessions given by the Centre and the States to business houses, in return for the political ciontributions they receive, both transparently and non-transparently, from those business houses.

I have tried to analyse the Constitutional implications of different kinds of political freebies in my article, “Freebies to the poor: Are they bad? What about freebies to corporates?” (http://eassarma.in/sites/default/files/public/Subsidies-for-poor-Why-object.pdf), which you may like to peruse.

Regards,

Yours sincerely,

E A S Sarma

Former Secretary to Government of India

Visakhapatnam