Interview with author Wei Ling Chua

The G7 has recently wound up its meeting in Hiroshima, and the participants joined to affirm their fear of the Threat of China. British media reported that prime minister Rishi Sunak said: “China poses the biggest challenge to global security and prosperity of our age with the ‘means and intent to reshape the world order’.” The global septet spoke of “de-risking” rather than “de-coupling” from China. This was prudent because decoupling from the world’s leading manufacturing base would risk plunging all economies into recession. China leads the world in so many facets of production, particularly high technology: high-speed rail, rocket technology, their own space station, lunar and Martian probes and rovers, quantum computing, AI, robotics, bridge building, tunnel construction, chip production, hypersonic missiles, laser weapons, military armaments, nuclear technology, and on and on. Could it be that the Chinese economy is not as sturdy as it seems to be?

I asked Wei Ling Chua, the author of Democracy: What the West can learn from China and Tiananmen Square “Massacre”? The Power of Words vs. Silent Evidence, his forecast for the Chinese economy.

Kim Petersen: In a recent article, “Why China Can’t Pull the World Out of a New Great Depression,” strategic risk consultant F. William Engdahl writes, “… in real physical economic production, China has left the USA and everyone else in the dust. Therefore, the future course of industrial production in China is vital to the future of the world economy.”

He writes that steel production is “the single best indicator of a growing real economy” for which China crushes the competition. China leads in coal production, rare earth mining and processing, motor vehicle production, as supplier of essential cement for construction, aluminum production, and copper consumption. Engdahl adds, “The list goes on.”

Then Engdahl identifies a problem: “A huge problem with China’s economic model over the past two decades has been the fact that it has been a debt-based finance model massively concentrated on real estate speculation beyond what the economy can digest.” He points at the inflated housing market, rising unemployment, the dubiousness of official figures for total state debt, and the lack of transparency for financial information.

It is expected that there would be bumps along the road in the development of what was once, not so long ago, a very poor country compared to the economic colossus that China has become today. In addition to the commodities exported worldwide, China has also garnered much skepticism for its growth and development over the years, and yet China has always managed to steam ahead. China has a planned economy, and assuredly the mandarins have contingency plans for the unexpected.

What is your take on the Engdahl article?

Wei Ling Chua: I think the author lacks an understanding of the CCP series of policies and reforms, and he relies too heavily on the crusader agenda-based line-of-thinking.

Unlike western, Japanese, USSR development that relied heavily on imperialism, expansionism and looting

1) In the first 30 years of the People’s Republic of China (PRC), the sources of finance were mainly from the agricultural sector, and the hard work, delegation and sacrifices of the entire population to rebuild the nation.

The Mao era was the hardest era in the history of the PRC, as the country just managed to hold together the entire nation with virtually nothing (no technology, no money, a 90% illiteracy rate, a divided population, a population hungry and in poor health with a super short average life-expectancy of 36 years, a hostile international environment (Korean war, Sino-India war, USSR border war, plus western sanctions, and in the 1960s USSR sanctions as well).

However, Mao managed to win the Korean war with mainly foot soldiers armed with rifles and hand grenades, helped Vietnam to chase away the US occupier, and defeated India and the USSR in skirmishes. China worked herself into the UN to replace the nationalist government as the only legitimate government of China. It also completed the first stage of the Chinese industrial revolution with all types of light industry (self-made household appliances, processed food), an active agriculture sector, fisheries, etc, and heavy industry such as producing trucks, cars, buses, trains, atomic bombs, satellite, missiles, and all type of other military weapons, construction technology…

2) over the next 30 years, China financed her economic reform via opening up with massive foreign investment plus massive land mortgage financing to fund all types of infrastructure across the country.

But, unlike the rest of the developing countries, China used cheap land and labor to attract foreign investment to build factories, and used her own land allocation as a guarantee to print money and provide loans for building infrastructure, commercial and residential property, and therefore, not incurring too much foreign debt. So, most of China’s debts are domestic and are outside of foreign control.

3) Since Xi came into power, his zero tolerance towards corruption and successful anti-corruption policy very much ensured the country’s continued smooth operation with high efficiency and less waste. This is a most vital element in any nation’s development and future prosperity (whereas all western countries are down down and down at the moment due to legalised corruption in the name of lobbying, political donations, speech bureaus, privatisation, etc)

Xi’s centralised medicine approval strategy has successfully reduced all drug prices by up to more than 90%, and hence china was able to introduce sustainable nationwide medicare coverage. Such a policy freed up people’s savings for domestic consumption. This economic generator is a pillar of any advanced country.

Under Xi, the average wages of the nation basically more than doubled.

Yes, like the rest of the world, the real estate market and tax on property transactions are major sources of government revenue. But Xi knew that if the real-estate market was allowed to continue being controlled by a handful of billionaires to reap speculative profits then the housing prices would keep rising. So, he openly told the nation that housing is for people to live, not for speculative profit. He cracked down on irresponsible real estate giants controlling too much real estate and using them to mortgage and buy more. Finally, this caused some collapse in overheated pricing. But unlike the US, there is no too-big-to-fail company in China; Xi froze these troubled giant companies from issuing dividends to shareholders, and made the owners sell their own assets to repay the interest and loans, sell their overseas companies and assets, and then domestic assets to repay the loans. And when the state bails out a company, all those assets return back to the people; i.e., state control.

The author also failed to take in a lot of things that have taken place in China.

4) Yes, there are debt issues in China, but debts should be distinguished between good debt and bad debt:

Across the west, they keep printing money to give away to political donors in exchange for personal benefits at the expense of the taxpayers, they also give away money to voters to win votes. These are bad debts as they produce no future return for the masses.

But, for China, the debts transform into infrastructure domestically and overseas. The outcome is apparent: more and more regions and countries with Chinese investment enjoy economic prosperity; hence, they help China to continue enjoying prosperity despite western decoupling policies.

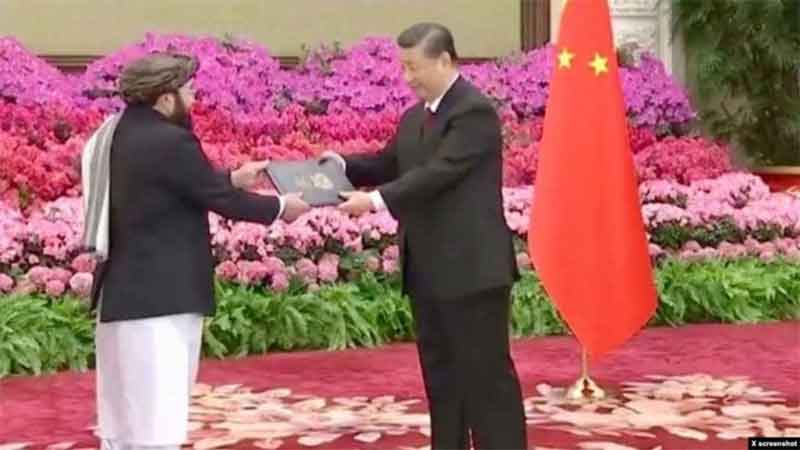

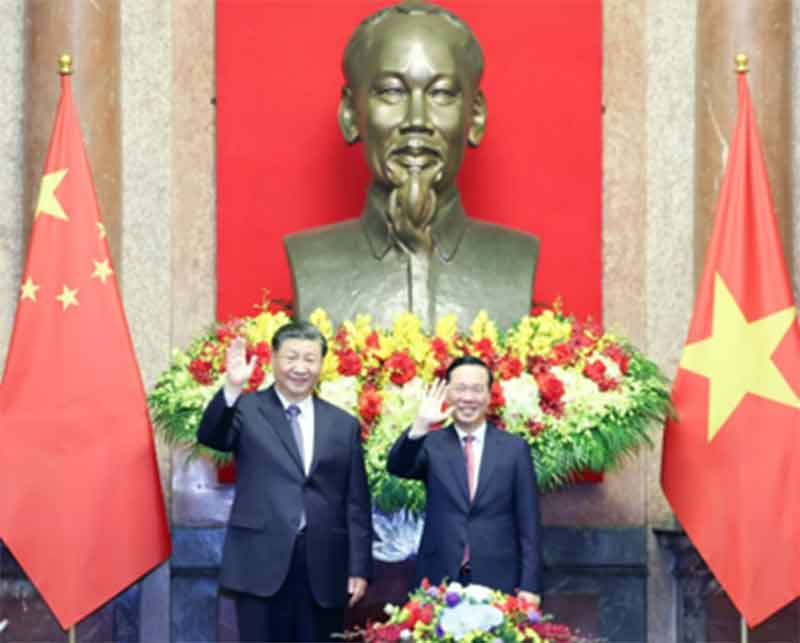

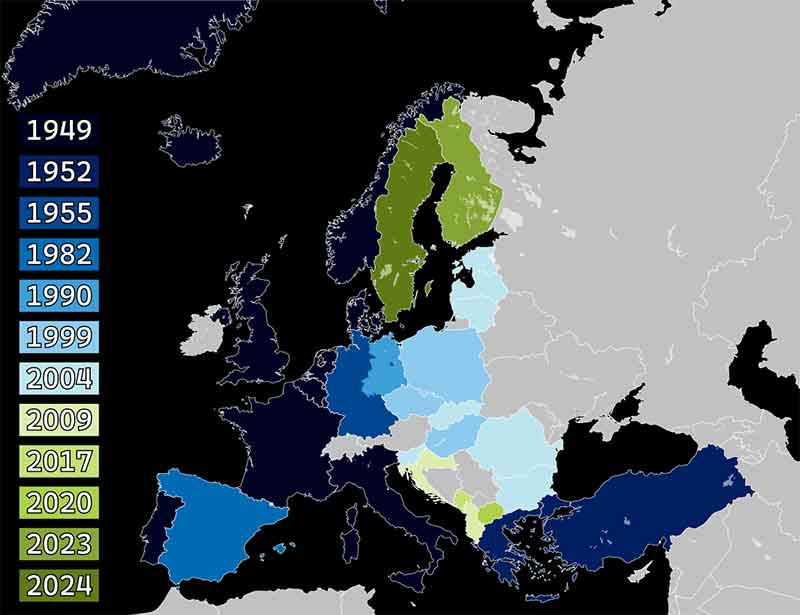

The winning of trust and friends across the world will only pave the way for China’s Belt and Road win-win strategy to ensure mutual prosperity even without the West. We are now witnessing that the BRICS’s GDP is bigger than that of the G7, and the Chinese economy has been bigger than the entire EU (the combined GDP of 27 countries) since 2021.

Besides, the rise of China’s high-tech economy are obvious: due to China’s superiority in EV car technology, China has just replaced Japan as the world’s biggest new car exporter (the world number 1 in EV car exports), solar technology exports as well, infrastructure exports, ship building etc, and lately, overtaking the US in military armament exports to places like the UAE, Saudi Arabia, Malaysia, Thailand… etc. Consider also the growing popularity of the RMB as a reserve currency. It is important to note that China managed to achieve these feats without firing a single shot; it’s all about investment in education, R&D, development of infrastructure, and a policy of win-win.

China’s future is very bright with the coming development, export of chips, nuclear power plants, and reunification with Taiwan. At this moment, the world has seen China managing to finally create a peaceful and Chinese-friendly Central Asia, Russia, Middle East, and ASEAN (excluding the Philippines under Marcos). We also notice that almost all African countries and Latin American countries are also very much preferring China over the West. This peace dividend will help create an entire region surrounding China to move towards the world’s biggest economic block developing in peace and harmony. It will become a magnet for the rest of the world.

Kim Petersen is an independent writer. He can be emailed at: kimohp at gmail.com.