With the wisdom of hindsight, the Root Causes of Sri Lanka’s first ever Sovereign Default, staged three years ago on the eve of 75 years of ‘Independence’ from the British Raj are clear.

When the default happened in March 2021, there was too much Aragalaya protest hype and confusion to discern the deep structures, transnational financial networks, and vested interests (including elite members of the Lankan Diaspora), embedded in Sri Lanka’s debt pile up:

Amid protests at the soaring cost of living, the claim was that Sri Lanka, South Asia’s wealthiest country with the best human and social development indicators in the region was “bankrupt” because it lacked exorbitantly privileged US dollars to buy food and fuel. This was after the shadowy off-shore Hamilton Reserve Bank had filed a case in the New York courts against the country for non-payment of a small amount of interest owned.

The Default in the lush and fertile geostrategic Indian Ocean Island was staged just in time for the International Monetary Fund (IMF) and World Bank’s Spring Meetings in Washington DC where Sri Lanka became the posterchild for 54 other Global South countries, also caught in post-Covid-19 Eurobond debt traps as Cold War tensions escalated between the West and China that is often accused of debt-trapping countries because of its Belt and Road Initiative (BRI).

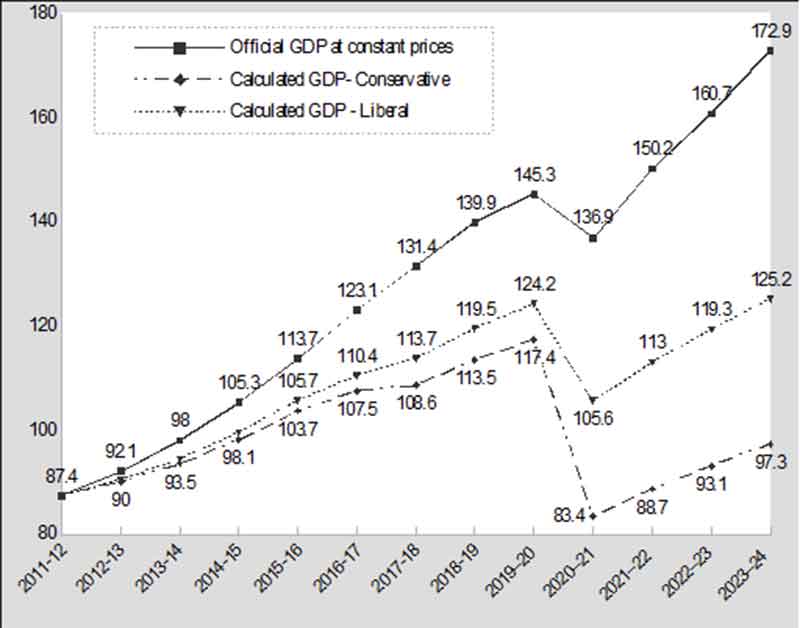

Sri Lanka’s first (and one hopes last Default) after 74 years of “independence” at this time has clearly enabled the Washington Consensus (IMF and World Bank) to take control of the strategic island’s economic sovereignty and policy autonomy, in the name of ‘debt restructuring’. Meanwhile the IMF’s External debt restructuring has rapidly mission-crept into domestic debt, conflating and inflating a debt data numbers game.

The IMF recommends economy-shrinking austerity for citizens in order to pay back sovereign bond holders, along with a fire sale of strategic national assets while de-risking vulture funds like BlackRock and shadowy Hamilton Reserve Bank, even as it claims to be deeply concerned about good governance, democracy and its seems elections in the geostrategic Indian Ocean Island.

Money Politics: Bond Scams for Elections?

At the conclusion of the International Monetary Fund (IMF) Staff Visit to Sri Lanka last month, Mission Chief, Peter Breuer noted: Sri Lanka is showing first signs of recovery as it finds itself in an election year, and therefore, what happens before the elections as well as after them will be crucial for the economic recovery”.[1]

As Sri Lanka marks 76 years of purported ‘Independence” amid renewed Eurobond US dollar debt colonization and financial Lawfare, with an IMF Firesale of Strategic national assets ( coastal and highland land, energy, transport and telecom infrastructure), ongoing, some fundamental questions arise about the role of the IMF and its debt restructuring operations: Of particular concern is the lack of transparency regarding the names of Sri Lanka’s Sovereign Bond holders, past and present, particularly in the context of previous Central Bank bond scams in 2015 seemingly also to fund elections and Ranil Wickramasinghe’s United National Party’s electoral campaigns.

Elections are a time of ‘Bread and Circuses” or handouts and religious pageantry for the masses, with bond scams to buy votes for the political and business elites who dish out freebies for votes. With elections scheduled for later this year the “bankrupt” Ranil Rajapakse regime recently asked the United Nations (UN) for help to fund Vesak Celebrations (Buddhist celebrations), in May seemingly taking a cue from Indian Prime Minister Modi’s Ram Temple extravaganza in ahead of election to be held later this year.

During the 2015 Central Bank bond scam members of the ruling United National Party and related political and business elites benefit handsomely from the sovereign bond debt to the county.

Breuer also noted “During our visit, we listened to political parties, their perspectives and angles of their economic policy perspectives. So, of course, what takes place in Sri Lanka in the run up to the elections and afterwards will have an impact on the country’s recovery and growth path and how it extricates itself from the ongoing crisis,” he said.

The strong expectation, Breuer noted, is the Sri Lanka would reach a deal with its commercial Eurobond creditors by the next IMF review on Sri Lanka.

Central Bank Bondscams and Assassinations: Forensic Audits and Cover ups

While the IMF and its advisors have shown great interest in Sri Lanka’s election outcomes governance and corruption reduction, there was no mention of the fact that back in 2015 ahead of Presidential and General Elections two bond scams were conducted at the Central Bank of Sri Lanka (CBSL), which was then headed by Singapore citizen Arjuna Mahendran, a school friend appointed by then Prime Minister Ranil Rajapakse, now President. They were advised and in thrall of the Washington Consensus and related advisors and Economic Hit men on bond trades.

The 2015 CBSL bond scams took place at a time when the U.S. Millennium Challenge Corporation (MCC), Compact was co-incidentally being prepared, along with the Special Operations Forces Agreement (SOFA), while Ranil Wickreamsinghe a.k.a Ranil Rajapakse was in power.

Both agreements were however, later rejected by the people of Sri Lanka and the then President Sirisena, fearful of the possibility of US boots on the ground and military bases in the strategic Indian Ocean island back in 2019. This of course necessitated a regime change operation, and voila, the mysterious hybrid economic war style ISIS claimed Easter Sunday attacks were manifest– to ‘Make the Economy Scream’!

Once the bond scam fraud at the country’s highest financial institution, CBSL was exposed to have been carried out by the Mahendran’s son-in-law of Perpetual Treasurie,s Mahendran was sacked and there were various local investigations and Bondscam Reports written with numerous foot notes by Ministers, including, Dr. Harsha de Silva, now effectively the Opposition Samagi Jana Bala’s (SJB) shadow minister for economy!

However, the Forensic Audit Report by international firms that investigated the bond scams which could have revealed the names of the Bond Holders who benefited from the primary placement scams and ensured accountability, were buried by the new CBSL governor — Dr. Indrajit Coomaraswarmy.

Bond Crimes: A Chilling Killing and the New Messiah

Had the culprits of the 2015 CBSL Bond scam been identified and held accountable though release of the Forensic Audit Reports conducted by international firms, it is likely that Sri Lanka would not have ended up in a Eurobond debt trap and Default in 2021, which has enabled the IMF to effectively dictate economic policy to the hapless and beggared citizens whose currency crashed with the Default.

Ironically, Coomaraswarmy who as CBSL head buried the Forensic Audit Report now provides IMF advice to the Government of Sri Lanka regarding its Debt Servicing, while enabling IMF mission creep into domestic debt restructuring as well. So much for revolving doors and the Independence of the Central Bank of Sri Lanka.

The final blow to any investigation into the CBSL bond scams of 2015 was the mysterious assassination in December 2022, of the primary witness in the court case, Mr. Dinesh Schaffter in broad daylight in Colombo. That chilling killing effectively buried the court case in which the current President was also an accused.

At this time, the silence of the ‘leftist’ Janatha Vimukthi Peramuna’s (JVP) Anura Kumar Dissanayaka (AKD) regarding the need for accountability and release of the Forensic Audit reports of the CBSL Bond scam and bond holders names to ensure accountability is remarkable.

Ironically, Dissanayake was recently feted in New Delhi and met Indian Foreign Minister S. Jaishankar after a while wind tour of the United States where he wooed Diaspora funding for the National Peoples’ Party, which has been known to advocate enabling voting rights to the Sri Lanka Disapora. AKD has emerged in the increasingly gamed public sphere as the ‘New Messiah’ to lead Sri Lanka on an alternative corruption-free economic development path but has never raised the bar in the public debt on Economic Alternatives to the IMF, such as joining the BRICS and the New Development Bank, de-dollarizing and industrializing Sri Lanka’s marine and mineral sectors to escape the debt trap!

A Ban on GoSL Commercial Borrowing rather than funding elections with Bond scams

While some discerning civil society organizations and academics have called for a ten (10) year moratorium and eventual ban on ALL Government borrowing from private creditors that charge predatory interest rates and debt trap countries, the million-dollar question at this time is: will the bankrupt Ranil Rajapakse regime form a bipartisan pact with the opposition to borrow from the same predatory private market Eurobond traders that caused the Sovereign Default in the first instance — in order to fund elections and election campaign this year as part of its IMF debt restructuring deal with commercial creditors?

In other words, will elections and election campaigns be funded by more Bond scams this year? Would the governing and opposition politicians, jostling for power and positions, turn vice into virtue to borrow from predatory Eurobond lenders in the name of “Democracy” and elections – turning vice into virtue? Some political scientists call such arrangement “money politics” and corruption rackets. Would not such an arrangement amount to bi- or multi-partisan corruption racket in a devil’s bargain to fund electoral ‘democracy’ among the various political parties anxiously jostling for power?

The IMF’s debt restructuring operations are conducted in tandem with the colonial Club de Paris that represents Eurobond traders that charge predatory interest rates, along with selected accounting and legal firms like Lazzaad, Clifford and Chance that have a long history of deal making sans transparency, and debt trapping developing countries through local-global and Diaspora financial networks of corruption and insider trading as happened during the CBSL bondscams.

While, critical civil society groups and academics have suggested Policy Alternatives to the IMF’s austerity and firesale of national assets and called for Sri Lanka to de-dollarize, trade in a basket of currencies and join the emerging economies BRICS Plus and New Development Bank, it is remarkable that none of the political parties have proposed policy alternatives to the IMF bailout of predatory bond holders.

Perhaps, funding elections with bond scams may even legitimate and justify stashing away some derivatives in off-shore banks listed in the Panama Papers! The IMF and its gravy train of advisors and economic hit men are well known for making hard bargains to extract from the people, while de-risking and bailing out predatory bond traders.

Cui Bono or Who benefits from Bond scams and Financial Crime? Default as Hybrid Economic Warfare

Sri Lanka’s first ever sovereign Default in 2021 which triggered rapid rupee depreciation against the exorbitantly privileged US dollar and instantly impoverished the working people, enabled international creditors, Eurobond traders, and related financial networks represented by the colonial Club de Paris and IMF that had already made a killing with predatory interest rates, to effectively take over the peoples’ economic sovereignty and national policy autonomy in the name of “debt restructuring”.

Since the 2021 Default there have been endless talks and numbers games played around the volume and quantum of debt and the “haircuts” to be dished out among various creditors amid talk of parity of treatment, but few outcomes that benefit the people.

With the wisdom of hindsight and the statement of 183 International Economists and development experts released in January 2022 (available at the Debt Justice, UK website), it is now quite clear that Sovereign Bond Commercial creditors that charge predatory interest in partnership with local and Sri Lanka Diaspora networks of elite political, business and financial corruption were the principal beneficiaries and root cause, of and for the country’s first ever Sovereign Debt Default in 2021.

After all, the Default was caused by recent borrowing from private markets and bond traders, the largest being BlackRock, with Norway’s Sovereign Wealth fund a close second.

Hybrid Economic Warfare: Was Sri Lanka Pumped and Dumped to ‘Make the Economy Scream’?

Although though out its 75 years of “independence” Sri Lanka had borrowed for development work, the country was able to pay back all its loans, principally, from bilateral and multilateral lenders, taken at concessionary rates, until the default in 2021.

However, in 2019 the World Bank up-graded Sri Lanka an ‘Upper Middle Income Country’ (MIC), compelling borrowing from private Eurobond capital markets that charge predatory interest rates and it was only once the World Bank upgraded the county to an MIC as various exogenous crisis unfolded that debt mounted and the country was cast into an Middle Income trap leading to default.

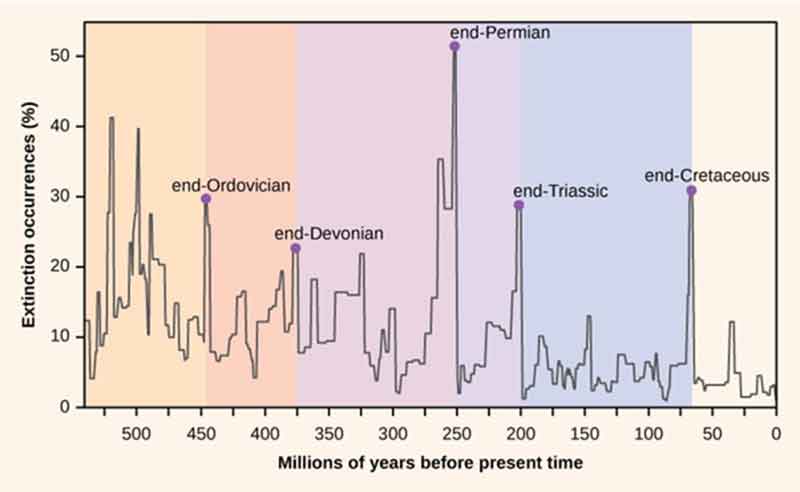

A series of hybrid economic war style exogenous shocks to “make the economy scream”, such as, the mysterious Islamic State (ISIS), claimed terror attacks on tourist hotels, ironically shortly after Lonely Planet has listed the island as the best holiday destination in 2019, followed by another two years of brutal Covid-19 lockdowns and fisheries habour lockdowns sent the tourism-dependent island economy into a tailspin.

Was the strategic island “pumped and dumped” into a ‘Middle Income Trap’ triggering rapid local currency depreciation against an exorbitantly privileged dollar?

At this time, the million-dollar question is: would the IMF’s contribution to debt restructuring, democracy and good governance, entail forcing Sri Lanka to once again borrow from predatory private markets in the name of “democracy” and good governance to hold elections this year despite the history of bond scams at election year? And if so, would these be Green and Pink Washed Environmental, Social and Governance (ESG) Bonds also to fund Asswessuma poverty alleviation handouts to buy votes and also entrench an Aid Dependency culture?

Finally, in an age of Artificial Intelligence (AI), with easily gamed debt data fictions Sri Lanka’s first Default at this time, increasingly looks like a form of ‘hybrid economic warfare’ waged by the Washington Consensus throught networks of Sovereign-wealth-fund-holding-global-elite and the BlackRocks of the world against the systematically impoverished peoples of the Global South.

Indeed, Default as a form of hybrid economic warfare as a new round of Euro-American Debt Colonialism ramps up against the Global South, appears to be just the most recent iteration of Richard Nixon’s instructions to the Central Intelligence Agency (CIA) in 1973 Chile; “Make the Economy Scream” in order to unseat Dr. Salvador Allende, South America’s first Socialist President and head of state at the height of the Cold War.

[1] https://island.lk/imf-what-happens-now-and-after-elections-will-be-crucial-for-sri-lanka/