To

Shri I Srinivas

Secretary

Ministry of Corporate Affairs

Govt of India

Dear Shri Srinivas,

I have come across a news report today (https://thewire.in/business/corporate-affairst-ministry-csr-pm-cares-cm-relief-fund) that your Ministry has issued a “clarification” to the effect that corporate contributions under Section 135 of the Companies Act to the State Chief Minister’s Relief Fund shall not qualify for benefits applicable to Corporate Social Responsibility (CSR) benefits.

In the same breath, I have come across another news report (https://www.livemint.com/news/india/coronavirus-crisis-govt-says-donations-to-pm-s-fund-covered-under-csr-spending-11585457109577.html) that your Ministry had earlier issued a notification that similar corporate contributions made to the recently instituted PM CARES Fund would attract CSR benefits under the same Section of the Companies Act.

If your Ministry has interpreted Section 135 and Schedule VII of the Companies Act in that manner, I feel it is patently incorrect and it also gives one the impression that the interpretation provided by your Ministry amounts to a discriminatory treatment meted out to the States.

The purposes that come within the ambit of “Corporate Social Responsibility” are unambiguously listed in Schedule VII of the Companies Act, which is extracted below.

SCHEDULE VII

(See section 135) Activities which may be included by companies in their Corporate Social Responsibility Policies

Activities relating to:—

(i) eradicating extreme hunger and poverty;

(ii) promotion of education;

(iii) promoting gender equality and empowering women;

(iv) reducing child mortality and improving maternal health;

(v) combating human immunodeficiency virus, acquired immune deficiency syndrome, malaria and other diseases;

(vi) ensuring environmental sustainability; (vii) employment enhancing vocational skills; (viii) social business projects;

contribution to the Prime Minister’s National Relief Fund or any other fund set up by the Central Government or the State Governments for socio-economic development and relief and funds for the welfare of the Scheduled Castes, the Scheduled Tribes, other backward classes, minorities and women; and such other matters as may be prescribed.

The States are presently engaged in combating COVID19 spread as actively as, if not more, the Central government. Item (v) above specifically refers to “combating ….other diseases” which would evidently include COVID19. Therefore, it is incorrect for anyone to say that the COVID19 campaign undertaken by the States, funded partly by Chief Minister’s Relief Fund, does not qualify to attract the CSR benefits.

It is surprising that your Ministry should say that corporate contributions made to PM CARES Fund come within the ambit of Schedule VII but, at the same time, deny those benefits in the case of corporate donations made to Chief Minister’s Relief Fund. By no stretch of imagination can such a highly discriminatory interpretation be accepted.

More than the legal infirmity in such a bizarre interpretation of Schedule VII, there is also a serious concern about the federal structure that is provided in the Constitution and a Ministry of the Union trying to upset the balance between the Union and the States in the sourcing of resources.

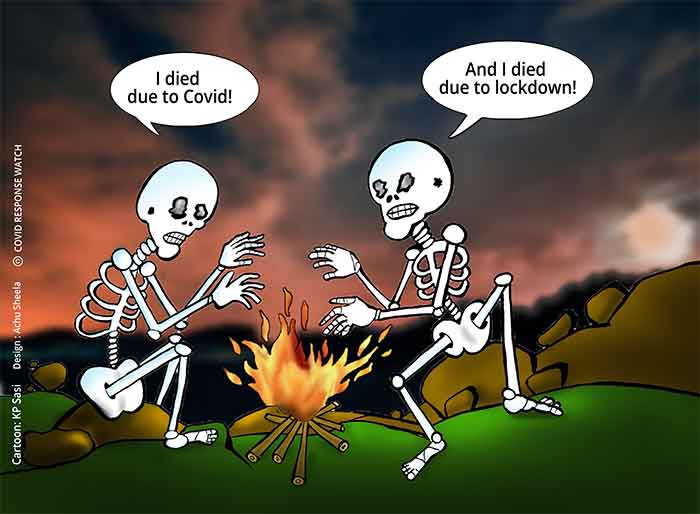

In the ongoing battle against COVID19, it is the States that have borne the brunt of the burden. It is they that have assumed responsibility for tracing, tracking, quarantining and providing medical treatment for the virus affected persons. It is they who are facing severe shortages of medical equipment, which the Centre is responsible for providing. When the Centre announced a lockdown abruptly, it is the States that were “directed” to assume responsibility for rehabilitating lakhs of migrant workers thrown out of employment overnight. On the side of the funds required, it is once again the States that have been at the receiving end, struggling to get what is legitimately due to them. There is no doubt that the States are battling COVID19 in the midst of adverse circumstances.

It is therefore surprising that a Ministry like yours which has a quasi-judicial role, should tilt even the legal interpretations like this one against the States. By your interpretation, you have at once paved the way for corporate contributions drying up for the States and getting diverted to PM CARES Fund. In my view, more funds in the hands of the States is the need of the hour.

I would strongly urge upon you to revisit the interpretation of Schedule VII of the Act vis-a-vis the Chief Minister’s Relief Fund and issue a clear notification that is consistent with the letter and the spirit of the Act and which does adequate justice to the States.

Regards,

Yours sincerely,

E A S Sarma

Former Secretary to GOI

Visakhapatnam

SIGN UP FOR COUNTERCURRENTS DAILY NEWS LETTER