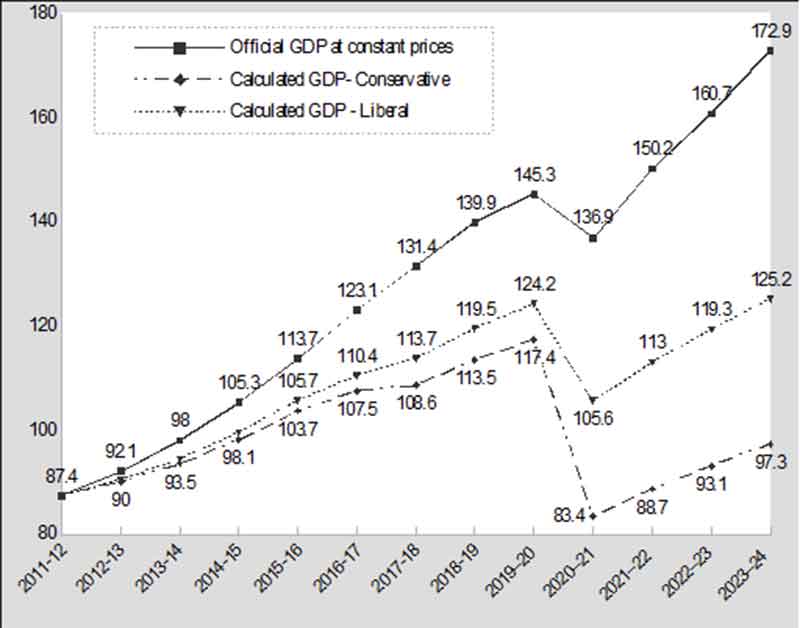

The Reserve Bank of India (RBI) has slashed its growth forecast for this financial year and warned of inflation uncertainties as India’s economy suffers due to the Covid-19, pandemic.

While the country’s GDP growth is set to “remain in the negative territory with some pick up in second half” of the 2020-21 fiscal year, RBI Governor Shaktikanta Das did not give any specific figures, citing difficulties in data collection.

“The end-May 2020 release of NSO (National Statistical Office data) on national income provide greater clarity, enabling more specific projections of GDP growth in terms of both magnitude and direction,” the governor said on Friday.

He added that the inflation outlook is also highly uncertain, but the central bank expects headline inflation to remain firm in the first half of 2020. However, it could stabilize in the second half of the year and fall below the target of four percent.

To counter the fallout of the coronavirus outbreak, which stalled almost all economic activity in the country, India’s central bank decided to cut the repo rate – the rate at which it lends to commercial banks – for the second time this year. The key interest rate was slashed by 40 basis points to four percent, making it the lowest level since 2000. The reverse repo rate, the rate at which the RBI borrows money from commercial banks, was also reduced by a similar amount to 3.35 percent.

The World Bank and the IMF earlier projected disappointing growth for India, saying that the nation’s GDP could fall to between 1.5 percent and 1.9 percent this fiscal year, which began in April and will end in March 2021.

Forecast by Goldman Sachs

Meanwhile, Goldman Sachs has recently worsened its forecast on India and now expects the country’s economy to contract by five percent.

“A forecast of minus 5% for the year as a whole would be as deep as compared to the deepest recession India has witnessed since 1979,” Prachi Mishra, chief India economist at Goldman Sachs, told CNBC on Friday.

India’s unemployment rate remains high despite lifting of lockdown measures

India’s Centre for Monitoring Indian Economy (CMIE) has said the unemployment rate in the country was 24 percent for the week ending May 17, remaining unchanged from the previous week’s figure.

According to its report, however, the labor participation rate rose to 38.8 percent as industries started opening up gradually after the nationwide coronavirus lockdown.

“Halfway into the month of May, it appears that the unemployment rate is around the same level as it was in April, mostly higher by a whisker,” CMIE said, adding that the small relaxations in the lockdown since April 20 have not had any positive impact on the unemployment rate yet.

“A persistently high unemployment rate indicates that a large proportion of labor that is willing to work is unable to find jobs,” it said.

Statistics showed that urban India has a higher unemployment rate – 27 percent compared to rural India’s 23 percent – and a lower labor participation rate of 34 percent, compared to 41 percent in rural India.

According to CMIE, “Uncertainty continues to prevail over when the lockdown would be lifted, the nature of economic activity post lockdown, fears of disease, fears of lack of lack of medical facilities, fears of sudden loss of livelihood and the traumatic experience during the lockdown that is likely to keep labor away, within the safety of their homes in their villages or small towns.”

It said that restarting the economy after lifting the lockdown would therefore be a big challenge, as the single biggest proposition in the economic package announced by the government so far – easy credit to MSMEs (Micro, Small and Medium Enterprises) and street hawkers – is unlikely to make a big positive impact.

Last week, India’s Prime Minister Narendra Modi announced a new stimulus package of a combined Rs 20 lakh-crore ($266 billion) – approximately ten percent of the country’s GDP.

Nationwide lockdown could cost Indian economy over $4 billion a day

The 21-day complete shutdown across India will result in a gross domestic product (GDP) loss of almost $98 billion, according to Acuite Ratings & Research.

“While the countrywide shutdown is scheduled to be lifted from April 15, 2020, the risks of prolonged disruption in economic activities exist depending on the intensity of the outbreak,” the credit rating agency said last month, adding that the ongoing disruption will have significant economic consequences across the world as well as in India.

Acuite Ratings has warned there is a risk of a contraction of April-June (2020-21 fiscal) GDP to the extent of between five and six percent, with Q2 (July-September) likely to post modest growth in a best-case scenario.

According to the agency’s estimates, “every single day of the nationwide lockdown will cost the Indian economy almost $4.64 billion,” said Sankar Chakraborti, CEO of Acuite Ratings & Research.

Transport, hotel, restaurant, and real estate activities were named among the most severely impacted sectors.

The rating agency said: “In our opinion, there would be at around 50 percent GVA (gross value added) loss in these sectors, which account for around 22 percent in overall GVA, in Q1 of FY21.”

On the other hand, communications, broadcasting, and healthcare are expected to see boosted activities during the crisis. However, with a 3.5 percent share, their contribution to the overall GVA will be small. The impact of the lockdown is projected to be severe on some industrial activities, while the agricultural sector – which accounts for 15 percent of GVA – is “nonetheless expected to see continuing activity in the lockdown period.”

Acuite estimated that the second quarter may show moderately positive growth of just under three percent on the back of the expected normalization process. It also expects a quick recovery for domestic economic activities in the second half of the fiscal year – which may, in turn, benefit from the increased fiscal and monetary measures, along with lower global oil prices.

BRICS bank provides India with $1bn emergency loan to fight the pandemic

The BRICS’ New Development Bank (NDB) said it has disbursed a billion-dollar emergency assistance loan to India to help the country contain the spread of coronavirus and reduce losses caused by the outbreak.

According to the bank, the “Emergency Assistance Program Loan” was approved by the NDB Board of Directors on April 30.

“The NDB is fully committed to supporting its member countries in the time of calamity. The Emergency Assistance Program Loan to India was approved in quick response to the urgent request and immediate financing needs of the Government of India in fighting Covid-19,” said Xian Zhu, the bank’s vice president and chief operations officer.

The program aims to fund, and thus enhance, India’s critical healthcare system, as well as providing immediate economic assistance to the vulnerable and affected groups.

The Shanghai-based NDB, which was established in 2014, provides funding for infrastructure and sustainable development projects in emerging economies. With capital of up to $100 billion, it aims to continue issuing financial products denominated in the local currencies of its member countries – China, Russia, Brazil, India, and South Africa.

SIGN UP FOR COUNTERCURRENTS DAILY NEWS LETTER