To

Smt Nirmala Sitharaman

Union Finance Minister

Dear Smt Sitharaman,

You must have received my letter of 31st January, 2023 (https://countercurrents.org/2023/02/overseas-shell-companies-a-shadow-economy-a-threat-t-national) on the legal vacuum left unfilled over the years (“shell companies” not statutorily defined), deliberately or otherwise, by the Finance and Corporate Affairs Ministries, which has perhaps strengthened the unholy nexus that exists between domestic corporate entities and their overseas shell companies.

As if to compound the problem further, the Department of Economic Affairs in your Ministry relaxed the overseas investment rules in August, 2022, without consulting SEBI and the other regulators, making it legal for domestic corporate entities to make investments overseas, without prohibiting such investments being made in countries where financial regulation is weak.

Apparently, neither your Ministry nor the stock market regulator, has shown any concern whatsoever at the existence of a shadow economy overseas, that seems to enable a few influential corporate groups in India to manipulate the stock markets as they wish, evade taxes on a large scale through money laundering and influence decision making in the government to their benefit.

In this connection, I wish to draw your attention to a news report that appeared yesterday (https://www.ndtv.com/world-news/ex-uk-pm-boris-johnsons-brother-resigns-as-director-of-adani-linked-firm-3748122#pfrom=home-ndtv_topstories) that the younger brother of Boris Johnson, UK’s former Prime Minister, has resigned his “non-executive directorship of a UK-based investment firm (Elara Capital Plc) linked with the now-withdrawn Adani Enterprises Follow-on Public Offer (FPO)”. The younger Johnson seemed to have resigned on the dubious ground that “he has been assured of the company’s ‘good standing’ and has stepped down due to his own lack of ‘domain expertise’ “. He did not realise that he had no “domain expertise” for 7 long months of his tenure and only when the Adani Group unceremoniously withdrew its FPO, such a realisation has suddenly dawned on him! His abrupt exit from Elara certainly points towards a possible nexus between Elara and the Adani Group. What surprises me is that SEBI and the other regulators are yet to see it, despite the stock markets ringing alarm bells more than once.

The Adani group’s share prices plunged last time in mid-2021, when NSDL froze three Mauritius-based GR accounts which invested heavily in Adani companies. In that context, Smt Mahua Moitra raised a question in the Lok Sabha (Question number 72 answered on 19-7-2021) on Adani Group’s beneficial interests in Foreign Portfolio Investors (FPIs) who invested in six listed Adani Group companies, and whether the regulators had initiated any investigation.

In reply, the Minister of State in your Ministry had confirmed that, while SEBI and DRI had undertaken investigations against a few such FPIs, no investigation had yet been undertaken by the Enforcement Directorate. Citing confidentiality, he said that he could not disclose whether the Income Tax Dept had taken up any investigation or not. Further, the Minister provided, “based on information shared by SEBI“, the details of the ultimate beneficial owners of FPIs who invested in the six Adani companies as on June 30, 2021. Among them were many Mauritius-based FPIs.

By way of an example, one of those FPIs mentioned in that reply was Elara India Opportunities Fund (EIOF) and its beneficial owners were indicated to be Rajendra Bhatt, Ajaykumar Amarnath Pandit, giving an impression that the FPI had no link whatsoever with the Adani Group. EIOF seems to be a subsidiary of Elara Capital Plc from whose Board, the brother of Boris Johnson has now resigned. Whatever he may have cited as the reason for his resignation, it appears almost certain that he chose to resign because of the company having a close link with the Adani Group.

The close nexus between the Elara group and the Adani Group was reported widely as early as in April, 2021 (https://themorningcontext.com/business/why-do-these-foreign-funds-love-adani-group-companies), later in July 2021 (https://www.cnbctv18.com/business/four-of-the-largest-adani-investors-have-a-history-of-picking-troubled-companies-report-10149091.htm) and so on. The Finance Ministry’s reply in the Lok Sabha clearly disclosed that Elara had invested in all the six listed Adani companies. The 2021 news reports on Elara ought to have alerted SEBI, RBI, the Ministry of Corporate Affairs and other investigating agencies to launch investigations in 2021 itself, without waiting for external agencies like Hindenburg to point it out.

The same is the case with three other overseas accounts, namely, Albula, Crest and APMS, which were frozen for a while by NSDL on suspicion, later cited in Finance Ministry’s Lok Sabha reply in 2021, and also specifically cited by CreditSights (Fitch Group) in August 2022. Once again, they figure in the latest Hindenburg report.

There are several other overseas companies mentioned in the Finance Ministry’s Lok Sabha reply and they all perhaps call for a closer scrutiny.

Should SEBI and the other regulators have waited this long to take up and finalise investigations into the genuineness of such overseas companies, till an overseas research report suddenly appears and creates a mayhem in the domestic stock market? Had the regulators attended to such investigations expeditiously, perhaps the possibility of round-tripping of funds, if any, would have been preempted, the alleged stock market manipulation prevented and the losses incurred by thousands of small retail investors, reposing trust in the capital market regulator, would have been avoided.

The existence of a shadow economy casts serious doubts on the equity share valuations indicated in transactions in the domestic market, espeially acquisitions and mergers. CPSEs are being valued for disinvestment, from the point of view of the stock market, which in itself is vulnerable to manipulation by a few influential corporate oligarchs, as indicated in the Hindenburg report. This raises serious concerns about the credibility of the government’s disinvestment approach itself. It is all the more worrisome that the government chose to acquiesce in overseas shell companies not being brought within the ambit of the domestic laws by leaving the definition of a “shell company” totally vague.

I feel particularly concerned about some of these corporate oligarchs, enjoying immense political patronage, embarking on highly over-leveraged, debt-driven activities, spanning across multiple economic sectors, especially strategic infrastructure sectors, posing a serious threat to the stability of the financial system. I had cautioned the RBI Governor about this more than five months ago (https://countercurrents.org/2022/09/corporate-entities-excessive-dependence-on-psu-banks-financial-stability-implications/?swcfpc=1). I am surprised at reports about RBI trying to find out now from the banks the extent of their exposure to the Adani Group, only after the present slump in the stock markets. Too little, too late!

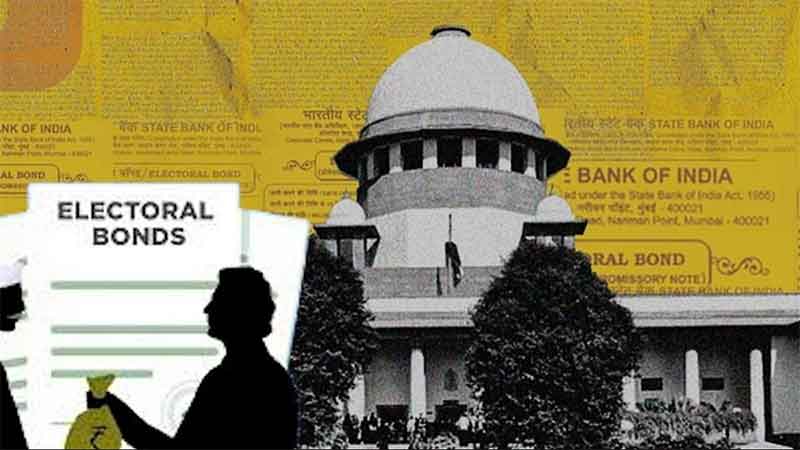

Against this background, I would request the government to ascertain the factors that have come in the way of SEBI and the other regulatory agencies finalising investigations into the antecedents of some of these overseas shell companies and place a comprehensive paper before the Parliament for a discussion.

This is far too important a matter to be allowed to drift aimlessly.

Regards,

E A S Sarma

Former Secretary to Government of India

Visakhapatnam