Having gone through Hindenburg research report on Adani Group’s activities, there seems to be much more to it than that which meets the eye. While it is true that the valuations of the Group companies, which are generally reserved for hi tech companies, such as Amazon, Tesla, Google etc. are not justified in case of the companies that are engaged in commodity businesses, the expose has gone far beyond the fundamentals and accused Adani Group management of outright fraud. However, leaving aside emotions one has to dispassionately assess its implications in broader context, considering the promoter’s proximity to the powers that be in the country and its fall out on country’s independence in its external policies.

That it has potential to do immense harm internally to the national economy is not in doubt. That huge investments in these companies by leading Indian banks, LIC and the funds, significantly against collateral of now diminished value of shares of the promoter family, puts these institutions at risk of a great loss is beyond dispute. But there are issues of propriety. The allegations in the report pertain to:

- Transfer pricing (over and under invoicing imports and exports),

- Tax dodging, and

- Violation of SEBI Rules.

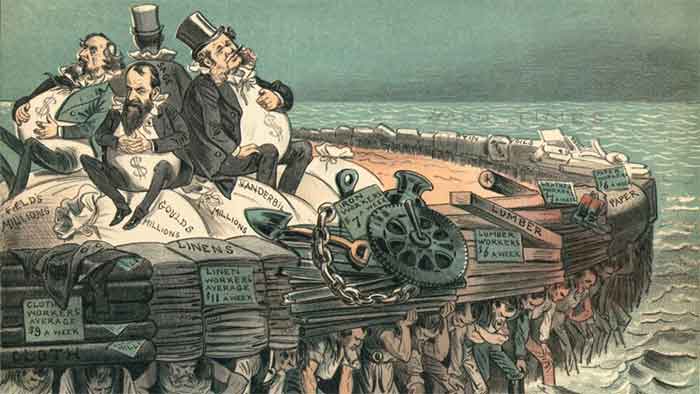

There is nothing new in this. Many companies ignore these and make hey until they are caught by the authorities. These are usual practices where companies are found wanting: for example, one of India’s celebrated industrial group was well known for its stock market manipulations, excise duty evasions and also transfer pricing, and getting away with it. It would not be farfetched to believe that his successors, who run the group companies today, have continued with these traditions set by the patriarch before he passed away. Similarly, the lesser mortals in the league too have been known to be breaking these rules and occasionally getting a rap on the knuckles from authorities, when found guilty. The difference between the large and the small companies is that the authorities are often prone to overlook the misdeeds of the former but not the latter; more so in case of those very close to the powers that be.

What is however significant in the present expose of Adani Group’s activities is a series of allegations related to the money laundering. Here the Hindernburg report has cast a long shadow on the complex network of shell companies run by Vinod Adani, the elder brother of the Group Chairman, Gautam Adani. Given the group’s reputation, this has set the rumor mills rolling about it’s activities.

The offshore shell companies’ network is intricate. This makes it difficult to unravel the sources of billions of dollars transacted through these companies that exist only in name, to the listed entities of Adani Group in India. Apparently, according to the report, it has taken two years to complete this investigation, which overlaps with the emerging global geopolitical environment since 2014. Indeed, an operation of this complexity could not have been completed without the goodwill of an intelligence agency of a power full country having control over the global financial structure. Moreover, the motive behind this investigation couldn’t have been simply pecuniary, to warn investors and engineer the stock market panic, given the extent of financial investments in the group, of leading Indian banks, funds and the entities as large as LIC.

That said it is nobody’s case that what has been revealed is a fiction. Those responsible if found guilty need to be held accountable. Yet the far reaching ramifications of the report on the country’s polity, its economy, and, especially its independence in pursuing its external policies cannot be ignored. Considering the proximity of the promoter family of the group to the political leadership of the country, it is legitimate to ask whether this expose has left the government to arm twisting by the global powers.

It seems no coincidence that some events have unfolded in the past few days in a manner which arouse suspicion about their timings. Indeed, there seems to be more than what meets the eye. These are interesting times. On one hand Prime Minister Modi, has been invited by the US President on a state visit this summer. This when seen against the emerging geopolitical scenario that is not particularly favourable to the US and its allies makes the invitation even more interesting. The news from the Ukrainian battle field is not particularly encouraging for the global hegemon. Nor have economic sanctions against its adversary, Russia, by the US and its allies have succeeded in harming the former; on the contrary they have backfired on them. So where does the Adani figure in this political environment?

By all accounts the US and its allies are desperate to win over the support of important countries in the Southern hemisphere, to strengthen their position against their two main adversaries, China and Russia. India is already on board with respect to China with its membership of Quad. But, on Russia, with whom it has had long standing relationship, it has maintained its independence on its stance and even ignored the sanctions imposed on it.

In fact, India has profitably engaged in imports of oil from Russia at significantly discounted price, with payment facility in rupees. This has enabled Russia to bypass the oil embargo imposed on its oil exports, by the US and its NATO allies. To compound US’ predicament further, it has been actively involved in BRICS, which is undermining the primacy of dollar in international trade and as a global reserve currency.

For these reasons US is cynically engaged in changing this situation in its favour by getting India to jump the ship and weaken both Russia and the BRICS. If one views the Adani episode along with the timing of the release of BBC documentary on Ghodra riots in 2003 and recent statement of Victoria Neuland, the under secretary of state, to the US Congress that “We are working with India to get them to see our point view”, it is apparent that the US is working hard on winning India over to its side, if not willingly then by other means. Evidently it is pressing on nerves, which hurt the most. In this, Adani’s proximity to the political leadership of the country, has become a liability. Especially, given its potential to upset the national economy gravely.

It will be interesting to see how the Indian leadership manages these overtures from the US, against the background of looming threat to its independence in foreign policy making. As things are, it is sandwiched between the devil and deep sea; on one side is the national interest and on the other, is a benefactor who has done utmost to politically support the existing leadership. Indeed, these are the wages of cultivating close associations with the oligarchies.

Shrikant Modak is a senior journalist. He has co-authored five books on the topic of renewable energy economics. He lives in Mumbai.