To

Smt Nirmala Sitharaman

Union Finance Minister

Dear Smt Sitharaman,

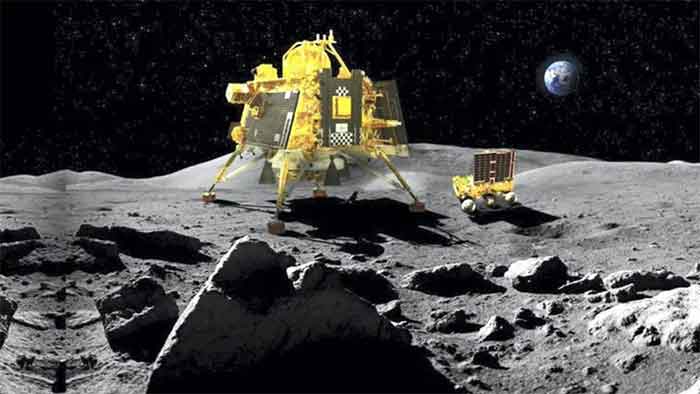

ISRO’s successful high-precision soft landing of its Chandrayaan 3 rover on the south pole of the lunar surface has brought worldwide laurels for India. ISRO’s Chairman, Shri S. Somanath, his highly competent team and all those who have visualised and nurtured ISRO since its inception in 1962 deserve the nation’s accolades and gratitude.

One interesting feature highlighted in several news reports across the country is that the total cost of Chandrayaan-3 is strikingly low, around Rs 615 Crores, a figure that is several times lower in magnitude compared to the cost of a high-tech VVIP aircraft purchased by India recently. Taking a slightly wider perspective, it is less than half the cost of a luxurious mansion owned by an Indian billionaire and less than the cost of a super-yacht owned by yet another billionaire, who have been able to accumulate such vast wealth, largely as a result of a skewed taxation system deliberately budgeted by the government year after year.

Coming to annual sectoral budget allocations, this year’s allocation for the Department of Space (DOS) is Rs 12542.91 crores. This is roughly 1/3rd of the average annual allocation of Rs 40,000 Crores towards subsidies announced by the government to be given to profit-earning private companies under a Production Linked Incentive (PLI) scheme and other PLI-like schemes, without the beneficiary companies having to fulfil prescribed levels of net domestic value addition, generation of employment opportunities, export earnings, meeting domestic market demand at globally competitive prices etc.(https://countercurrents.org/2023/07/pli-scheme-do-subsidies-to-profit-earning-private-manufacturers-yield-commensurate-societal-benefits-2/) Had the government replaced those subsidies with alternate policy instruments such as tax incentives subject to the beneficiaries contributing to domestic value addition, employment etc., the corresponding savings could have been available for investment in sectors such as space, atomic energy, defence research, science & technology, agricultural research and so on, contributing much more to promoting the nation’s self-reliance and the people’s welfare.

The investment made in Chandrayan 3, purely in monetary terms, may be only a little more than Rs 600 Crores but the value of the inputs and the commitment provided to it by ISRO’s scientists, engineers and other employees is immeasurable. In fact, looking back at the way ISRO has evolved over the last six decades, it has not only succeeded in reaching the frontiers of space technology but has also generated a wide range of technologies applicable to several other important sectors of the economy. ISRO transferred over 400 technologies to around 235 industries spanning several crucial sectors such as electronics, computer-based systems, chemicals, special materials, telecommunications, satellite navigation, optical instrumentation and so on which have wide applications in education, health, defence, and several other strategic sectors (https://www.isro.gov.in/media_isro/pdf/ResourcesPdf/technology_transfer_august_2022.pdf).

All this would not have been possible without the cumulative investments consistently made by successive governments over the last more than seven decades in building a vast infrastructure of educational and research institutions across the length and breadth of the country, which helped organisations like ISRO to recruit such highly talented, motivated employees. Indirectly, ISRO worked in harmony with the CPSEs, private companies and MSMEs in developing the required technical inputs.

In other words, investments made by the government in sectors such as space, atomic science research, defence research, other science & technology fields, agricultural research etc. not only promote technology development in those sectors but will also have multifarious spin-off benefits for the economy.

In this connection, I invite your attention to an earlier letter of mine addressed to you (https://countercurrents.org/2023/07/levy-higher-taxes-and-rd-cess-on-profits-of-large-private-companies-to-promote-indigenous-rd-and-self-reliance/) on the abysmally low priority accorded by the government to R&D and indigenous technology development and its likely long-term adverse impact on the inherent strength of the economy. According to the annual R&D statistics (2022-23) published by the Department of Science & Technology (DST), the total R&D expenditure in proportion to GDP in India is very low, declining further from around 0.8% in 2009-10 to 0.65% as at present. Among the BRICS countries, for example, the corresponding indices of R&D spending are 1.3% for Brazil, 1.1% for Russia and 2.4% for China. The

Science & Technology Policy in our case states that the nation’s objective should be to enhance R&D investment to 2% of GDP but it has remained a far cry in the absence of any tangible increases in budgetary allocations for the concerned sectors over the years.

The government recently announced an allocation of Rs 50,000 Crores to be spread over a 5-year timeframe for the newly set up statutory National Research Foundation (NRF), out of which Rs 36,000 Crores is to come from the private sector and Rs 14,000 Crores from the government. In other words, in the name of NRF, the government plans to spend only Rs 2,800 Crores per year on average on R&D, a minuscule allocation by any standard. Private sector spending of Rs 7,200 Crores per year on R&D will be subject to IPR constraints which in turn will lead to the R&D outcomes not being accessible to others. The NRF idea therefore will not address the urgent need to enhance budgetary allocations for R&D in line with DST’s Science & Technology vision.

No doubt that budgetary resources are scarce and it makes it difficult for the government to increase sectoral allocations. However, as already hinted above, the government has ample scope to prune down avoidable expenditure on items such as PLI subsidies to private companies, expenditure on unproductive symbolic items such as luxurious buildings and statues, and diverting the savings to more productive sectors such as education, health, social justice, R&D, space technology and other areas of technology development. In addition, the government is bound by the Directive Principles of the Constitution which require measures to reduce the concentration of wealth [Article 39(c)], for which the State should adopt an appropriate taxation structure, which would also simultaneously generate additional fiscal resources for spending on priority sectors.

Against the above background, I would appeal to the government to revisit the sectoral budget priorities and readjust allocations in favour of sectors such as space, atomic science research, defence research, other science & technology fields, agricultural research etc. Investment in those sectors would yield far higher, more long-term societal returns than infructuous spending on unproductive assets and corporate subsidies.

I hope that the government, while complimenting ISRO as it should will also draw the lessons cited above and translate the same into re-prioritising sectoral budget allocations.

Regards,

Yours sincerely,

E A S Sarma

Former Secretary to the Government of India

Visakhapatnam