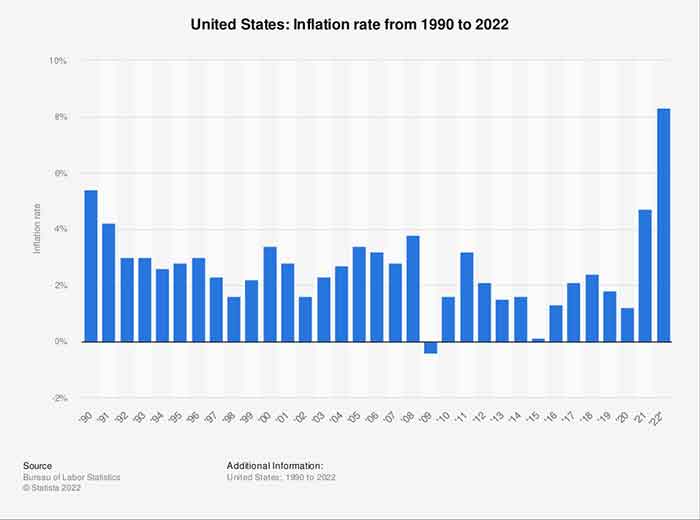

Europe is facing lower-than-expected economic growth as inflation continues to climb, European Central Bank chief Christine Lagarde revealed on Monday, explaining that the ECB had raised interest rates by 75 basis points in an attempt to control soaring prices.

Speaking before the European Parliament’s Committee on Economic and Monetary Affairs on Monday, Lagarde admitted that “inflation remains far too high and is likely to stay above our target for an extended period.”

Media reports said:

The former IMF boss warned that the “economic consequences for the euro area” of “Russia’s unjustified war of aggression on Ukraine” had spiraled further since June, a reference to Western sanctions on Russian oil and gas, which have sent fuel prices skyrocketing.

“The outlook is darkening,” she said.

While the Eurozone economy grew 0.8% in the second quarter, Lagarde said the ECB expected activity to “slow substantially” over the rest of 2022, to a total of 3.1% over the year and a mere 0.9% for all of 2023. Things will improve marginally in 2024, with growth projected at 1.9%, she said.

Much of this quarter’s economic growth was due to “strong consumer spending” driven by the reopening of Covid-shuttered industries like tourism, Lagarde said, while noting a decline in global demand due to what she called the “worsening terms of trade.”

High inflation is being “reinforced by gas supply disruptions,” she said, adding that “uncertainty” and “falling household and business confidence” were also contributing to the bleak predictions.

Inflation hit 9.1% in August, driven by energy and food prices. The ECB has hiked its inflation projections accordingly, setting 8.1% for 2022, 5.5% for 2023, and 2.3% for 2024, with Lagarde pointing the finger again at “major disruptions in energy supply.”

The central bank’s recent 75-point interest increase earlier this month was only the second hike in 11 years, after it added 50 basis points in July. Lagarde said the increase would “dampen demand” but ensure that “inflation expectations remain well anchored.”

Lagarde admitted the situation is expected to “get worse before it gets better” with regard to high energy and food costs — the most important issues for two out of three Europeans right now, according to a Eurobarometer survey.

She urged governments to make sure fiscal support for “the most vulnerable households” was “temporary and targeted” so as not to exacerbate “inflationary pressure.”

Worst Bond Market Crash In Over 70 years Coming, Warns Bloomberg

Global government bonds are on course for their worst performance since 1949 as losses mount in the face of aggressive central banks, Bloomberg reported over the weekend citing Bank of America projections.

According to the report, the escalating losses reflect how far the U.S. Federal Reserve and other central banks have shifted away from the monetary policies of the Covid pandemic, when they held rates near zero to keep their economies going. The reversal has hit everything from stock prices to oil as investors brace for an economic slowdown.

On Friday, the UK’s five-year bonds plummeted by the most since 1992 after the government rolled out a massive tax-cut plan. Two-year U.S. Treasuries are in the middle of the longest losing streak since at least 1976, falling for 12 straight days.

“Bottom line, all those years of central bank interest-rate suppression-proof, gone,” Peter Boockvar, chief investment officer at Bleakley Advisory Group told the media outlet. “These bonds are trading like emerging market bonds, and the biggest financial bubble in the history of bubbles, that of bubbles, that of sovereign bonds, continue to deflate,” he explained.

The Fed raised its policy-rate range to 3.25% on Wednesday, which is its third straight 75-basis-point hike, hinting further increases beyond 4.5%.

“With more Fed rate hiking coming and quantitative tightening, as well as the possibly more government debt issuance down the road amid less treasury buyers out there now, it all just means higher rates,” managing director at Mischler Financial Glen Capelo said, adding: “The 10-year yield is definitely going to get closer to 4%.”

According to Bloomberg, in the coming week the market may face fresh volatility from the release of inflation data and public speaking engagements by Fed officials. Also, the sale of new two-, five- and seven-year Treasuries will likely spur trading volatility in those benchmarks, it reports.

EU Sanctions Have Backfired, Says Orban

An earlier media report said:

Sanctions imposed by the European Union on Russia over its military offensive in Ukraine have “backfired,” according to Hungarian Prime Minister Viktor Orban, who pointed out that skyrocketing energy prices in Europe were the result of the restrictions.

Speaking to parliament on Monday, the Hungarian leader warned that people should prepare for a “prolonged war” in Ukraine. He also stated that the EU’s response to the conflict was the reason governments across Europe have started falling, referring to Sunday’s elections in Italy where right-wing candidates were expected to take control of the government.

“We can safely say that as a result of the sanctions, European people have become poorer, while Russia has not fallen to its knees,” said Orban, whose country, like many in the EU, currently faces surging inflation, plunging consumer confidence and a possible recession. “This weapon has backfired, with the sanctions Europe has shot itself in the foot.”

“We are waiting for an answer, the entire Europe is waiting for an answer from Brussels on how long we will keep doing this,” he added.

During a meeting with MPs last week, the Hungarian leader reportedly instructed the country’s ruling coalition to work hard to have the EU’s anti-Russian sanctions scrapped by the end of the year, claiming the move would immediately result in gas prices being cut in half, in turn bringing down inflation, Magyar Nemzet daily reported.

Orban, who was re-elected for a fourth term in a landslide victory in April, has been an outspoken critic of the EU leadership and has accused Brussels of causing unnecessary hardships for member states in its efforts to punish Russia for launching a military offensive against Ukraine.

The European Parliament voted earlier this month to no longer consider Hungary a “democracy” and has branded the country an “electoral autocracy,” accusing Orban of failing to follow the EU’s stance on immigration and sanctions. The Parliament’s report on Hungary’s political system has urged the European Commission to make “full use of the tools available” to force Budapest back in line with “European values.”

Hungary slammed the report as being based on “subjective opinions and politically biased statements,” and claimed it was “yet another attempt by the federalist European political parties to attack Hungary and its Christian-democratic, conservative government.”

How Much U.S. Pours Into Ukraine’s budget? Zelensky Reveals

The Ukrainian government is being heavily supported with American money, with Washington contributing $1.5 billion per month to the budget, Ukraine’s President Vladimir Zelensky has revealed.

The sum was mentioned by the Ukrainian leader during an interview with CBS host Margaret Brennan for the ‘Face the Nation’ program, which was aired on Sunday.

Currently Kiev runs “a deficit of $5 billion in our budget,” Zelenksy said, adding that “the United States gives us $1.5 billion every month to support our budget to fight” against Russia.

Zelensky argued that arming and otherwise helping Ukraine militarily is a “win-win” for the U.S. He pledged that once Russia is defeated, the Ukrainian people will return to their home country and start paying taxes there, relieving the burden on American taxpayers.

“For the United States, it will be significant savings, but for us, it will be an opportunity to secure our territory and make it safe for our population,” he stated.

U.S. President Joe Biden has pledged to help Ukraine “for as long as it takes” to secure a strategic defeat of Russia, which he declared Washington’s ultimate goal in the conflict.

Many Americans do not share the president’s view that the situation in Ukraine is crucial. According to the conservative election pollster Rasmussen Reports, it failed to make the top-ten list of issues of concern for likely voters.

Earlier this month, the Biden administration asked Congress to authorize some $12 billion in additional aid for Ukraine, including $4.5 billion to support the Kiev government financially beyond September. It asked for $2 billion on top of that, to help Ukraine offset rising energy prices.

The package is expected to be approved on Friday, but some political analysts question whether the cash flows to Ukraine can be sustained after the midterm elections in November.

“Americans cannot afford to provide a blank checkbook to Ukraine when we have inflation, gas prices, a supply chain crisis, all of the above, going on at home,” a GOP lawmaker told Politico, speaking on the condition of anonymity. “That is what I am haring from my voters.”

The outlet predicted that if the Republican Party wins the House, Biden will face more resistance to his requests for emergency aid to Ukraine.