The UK pound plunged to its lowest level against the U.S. dollar since the British currency went decimal in 1971.

In early Asia-Pacific trade on Monday, the sterling fell by more than 4% to $1.0327 before it regained some ground to about $1.05, extending Friday’s 3.61% drop.

Media reports said:

Chris Weston, head of research at the brokerage firm Pepperstone, was cited by the Daily Mail as saying that “sterling is getting absolutely hammered” and that “investors are searching out a response from the Bank of England.”

According to him, “they are saying this is not sustainable, when you’ve got deteriorating growth and a twin deficit.”

He was echoed by Marc Chandler, chief market strategist at Bannockburn Global Forex, who described the pound’s record plunge as “incredible”, suggesting that the Bank of England may hold an emergency meeting to deal with the issue.

The developments come after UK Chancellor Kwasi Kwarteng on Friday announced the government’s mini-budget, aimed at resolving the cost of living crisis and boosting economic growth.

Kwarteng vowed to raise gross domestic product (GDP) growth to 2.5% and proposed more than £411 billion ($446 billion) in extra borrowing over five years.

The package of measures stipulates spending £60 billion ($65 billion) in the six months following October 2022 to reduce energy bills for UK households and businesses. The basic income tax rate will be slashed to 19% from 20%, while a planned corporate tax hike to 25% will be reversed, with businesses continuing to pay a rate of 19%. The 45% income tax rate paid by those earning over £150,000 ($158,000) per year will be reduced to 40%. The cap on bankers’ bonuses will be abolished, and alcohol duties will be frozen. Kwarteng also announced a series of supply-side measures, and a reform of planning rules with the creation of low-tax investment zones on top of this.

The chancellor’s announcement of the mini-budget was followed by a turmoil in UK financial markets, with sterling plummeting more than three percent against the greenback to $1.085 – a level last seen 37 years ago.

This came as Shadow Chancellor Rachel Reeves dubbed the mini-budget a “plan to reward the already wealthy”, arguing that UK Prime Minister Liz Truss and Chancellor Kwarteng “are like two desperate gamblers in a casino chasing a losing run.”

“The argument peddled by the Chancellor isn’t a great new idea or a gamechanger, as the minister said, as much as they’d like us to think so. What this plan adds up to is to keep corporation tax where it is today, and take national insurance contributions back to where they were in March. Some new plan,” Reeves told the House of the Commons late last week.

In the Commons, only a few Conservative MPs gave Kwarteng full support, while some voiced alarm over aspects of the new economic plan.

They included Julian Smith, a former Tory chief whip, who claimed that “the huge tax cut for the very rich at a time of national crisis and real fear and anxiety amongst low-income workers and citizens is wrong.”

In a separate development last week, The Telegraph reported that Tory backbenchers are ready to rebel against Truss if the pound falls below the dollar. They reportedly said that they will “hit the nuclear button” and vote against the PM’s tax cuts if the pound continues to plummet.

The Telegraph cited an unnamed Tory MP as saying that “my biggest anxiety is that I’m going to wake up on Monday and it’s going to be Black Monday”.

Another unnamed source told the newspaper that Kwarteng’s budget was “much more expansive than what people were expecting” and they were concerned about the markets being sent into a “tailspin” on Friday.

Pound crashes to all-time low

The British pound sterling plunged nearly 5% to an all-time low against the US dollar on Monday. The currency lost as much as 4.85%, dropping to an unprecedented $1.0327 and extending a 3.61% plunge recorded on Friday.

Market analysts say the drop has been brought about by the announcement of a ‘mini-budget’ last week by finance minister Kwasi Kwarteng, which entails historic tax cuts and the biggest increase in borrowing in over 50 years.

“Sterling is in the firing line as traders are turning backs on all things British. There is a creeping feeling the extra government borrowing that is in the pipeline will severely weigh on the UK economy,” David Madden, a market analyst at Equiti Capital, told The Guardian.

The announcement, which came a day after the Bank of England hiked interest rates to rein in inflation, is viewed as jeopardizing the financial credibility of the government. A weaker pound pushes up the cost of imports, which in turn adds to medium-term inflationary pressures. Many analysts claim that, for the majority of British people, much of the help from tax cuts will be swallowed up by higher energy bills, as well as higher mortgage and borrowing costs.

Some economists predict that the pound’s plunge could force the Bank of England to raise interest rates to support the currency. They expect a doubling of UK interest rates to more than 5% by next summer.

UK Dailies’ Front Pages As Pound Sinks To All-time Low Against U.S. dollar

Tuesday’s newspaper front pages reflected the jitters sparked by Kwasi Kwarteng’s mini-budget plans. Composite: Mirror / The Guardian / Metro / The Daily Telegraph / The Times / Financial Times / i / Daily Express

Turmoil in financial markets which saw the pound fall to a record low against the dollar dominated UK’s front pages.

A report by The Guardian said:

The Guardian leads with “Sterling crisis deepens as Truss’s strategy unravels,” reporting that the government was struggling to prevent a full-scale loss of financial market confidence in its economic strategy.

The Financial Times has “Bank of England and Treasury fail to calm market nerves over UK finances”. The paper says a statement from the Bank “dashed market hopes of an emergency interest rate rise to prop up the pound”.

The Times leads on the central bank’s pledge to act after the fall of the pound with its headline “Bank vows to step in after day of turmoil”.

The Telegraph has “Spooked lenders ditch new mortgages in pound chaos,” noting Halifax, Virgin Money and Skipton were among the lenders pulling mortgage deals ahead of an anticipated rate rise.

The i newspaper has a similar take with its lead story: “New mortgages blocked amid UK market turmoil” above a picture of PM Liz Truss and a smiling chancellor Kwasi Kwarteng.

The Express says “Don’t panic! We have got a plan to cut debt”. It says the chancellor “shrugged off yesterday’s financial market jitters” with a vow to set out his strategy to bring down debt.

The Metro has “The pound Kwartanks” alongside a picture of Kwarteng.

The Mirror runs the subheading “Tories economic disaster” above its headline “Out of control”. The paper says millions of households face further financial misery as “Kwarteng’s tax cuts plunge markets into chaos”.

The Mail’s take is “Fury at the city slickers betting against UK Plc.” It cites senior Tories as saying short sellers were “trying to make money out of bad news.”

UK sinks deeper into debt

The British government’s debt interest payable has risen to the highest level on record, the Office for National Statistics (ONS) reported this week.

The interest payable stood at £8.2 billion ($9.25 billion) last month, which is £1.5 billion ($1.7 billion) more than in August 2021, and the highest figure for the month since records began in April 1997, the ONS said, adding that the volatility in interest payable is largely caused by the inflation rates.

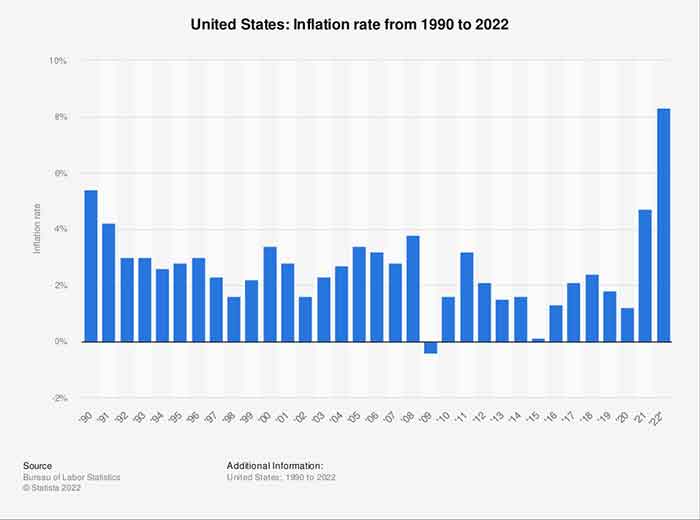

Annual inflation in the UK hit 9.4% in June, the highest rate in 40 years, but retreated to 8.6% in August.

The UK government borrowed nearly twice as much as expected in August, £11.8 billion ($13.3 billion) instead of £6 billion ($6.7 billion) forecast by the Office for Budget Responsibility, as the public sector spent more than it received in taxes and other income, the ONS explained.

Public sector net debt excluding public sector banks represented roughly 96.6% of GDP, which was an increase of 1.9% of GDP compared with the same period last year, according to the ONS.

Markets are concerned that the package of support measures for households and businesses announced by Prime Minister Liz Truss will push borrowing higher, and lead to the Bank of England aggressively raising interest rates.

In September, the British pound reacted to the economic instability in the country by plunging to its lowest level against the US dollar since 1985.

‘Out of control’: what the papers said about government handling of UK’s sterling crisis

UK Super-rich Non-domiciles Avoiding £3.2bn In Tax Each Year

Super-rich overseas people in the UK registered as having non-domicile status are being legally allowed to avoid paying more than £3.2bn of tax on at least £10.9bn of offshore income a year, according to a report.

An analysis by academic economists found that 26,000 people granted non-dom tax status by HM Revenue and Customs (HMRC) collect an average of £420,000 a year in unreported overseas income and capital gains.

The researchers at the University of Warwick and the London School of Economics and Political Science (LSE) calculated that the tax these individuals save by using the “remittance basis” tax break works out at more than £125,000 a year on average.

Scrapping the non-dom scheme and taxing this income could raise more than £3.2bn in additional annual tax revenue, the researchers claimed.

The government insists the non-dom scheme is good for the UK economy as it attracts wealthy overseas people to the country, who pay tax on their UK income and spend a lot of money here. They say that scrapping the scheme would lead to many leaving the country, taking their money with them.

However, the Warwick and LSE research, which is based on HMRC filings, claims that “only 0.3% of those affected would leave the country (fewer than 100 people), most of whom are paying hardly any tax under the current regime”.

Arun Advani, associate professor at Warwick’s economics department and Cage research centre, said: “Historically, arguments against abolition of the non-dom regime rested on uncertainty about whether it would raise any money. It is now plain to see that it does, so supporters of the status quo need to find a new case for its defense.”

Controversy over the non-dom tax loophole went from being a niche issue among tax experts to wider public debate this year after it was revealed that the wife of the then chancellor, Rishi Sunak, was using the status to avoid an estimated £4.5m in tax on dividends she collected from her billionaire father’s IT business.

After widespread outrage, Sunak’s wife, Akshata Murty, said she would pay UK taxes on all income going forward as her tax arrangements were not “compatible with my husband’s [then] job as chancellor”, adding that she appreciated the “British sense of fairness”.

However, Murty has retained her non-dom status, which could in the future allow her family to legally avoid an inheritance tax bill of more than £275m.

The vast majority of non-doms are foreigners living in the UK who use the status so they are only taxed on income and capital gains arising in the country, but not on those generated overseas. Most ordinary people living and working in the UK pay tax on income and capital gains arising here and abroad.

Famous non-doms have included the steel magnate Lakshmi Mittal, the media baron Viscount Rothermere and the oligarch and former owner of Chelsea football club, Roman Abramovich.

Andy Summers, associate professor at LSE Law School, said: “Non-doms receive ten times as much investment income offshore as they report in the UK. By rewarding non-doms for keeping their investments abroad, the current tax rules harm our economy as well as being unfair on ordinary taxpayers who must pay tax on their worldwide income.”