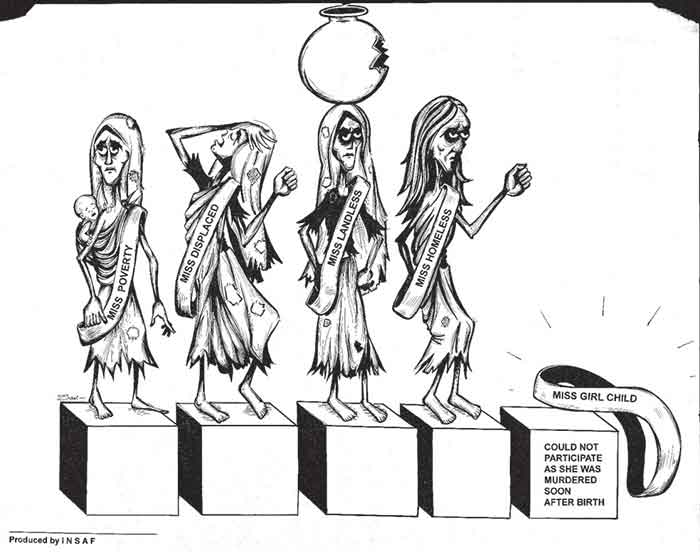

The massive bank charges introduced in past few years have greatly affected the financial state of marginalised working class. This was better understood when the team of FanIndia has talked to some people of working class who belong to the indigent sections of the society such as farmers, construction labours, aanganwadi workers, domestic workers, Cycle Rickshaw pullers, etc. As their average monthly income is usually quite less, we got to know that their everyday’s living expenses leave them with very minute or zero savings in their bank accounts. Despite no savings, the hefty charges imposed by the banks on such account holders are converting their balances into negative and making their condition more worsen and poorer.

Most of them have their bank accounts in major public sector banks such as SBI, PNB, Canara banks who have set different rules to levy penalties and charges for different services and maintaining minimum balance in the saving accounts. So to know the impact of bank charges better on them, we have determined their average monthly income and expenditure (which includes majorly their cost of living (rent), goods, electricity, food, clothing, energy, healthcare and childcare) and the rest savings left in their account.

Here we are trying to explain by giving an example of Auto Rickshaw pullers whose average monthly income in metropolitan cities lies from Rs. 12000-15000 per month whereas in other urban cities it is Rs. 8000-10000 per month.

Now if in metro city like Delhi, Cycle Rickshaw pullers who get the average monthly salary of Rs. 15000 in which they spent monthly Rs. 3000-4000 in rent and electricity, Rs. 4000 for food and groceries, Rs. 2000 for healthcare and other miscellaneous expenses, the remaining amount (Rs. 4k – 5k) they send to their family members. This comes to Rs. 15,000 per month expenses. Now most of them have their accounts in government banks. In case if they will have their bank account in Canara bank which deducts Rs. 40 for not maintaining the minimum balance of Rs.1000 per month, plus Rs.15 for SMS alerts per quarter, and Rs. 120 for annual debit card charges. All these charges will deduct at least Rs. 660 from their accounts in a year (excluding withdrawal transaction and other services charges) who usually have zero balance or a balance which is always less than Rs. 500. And so every month’s deduction of these charges changes their accounts into negative balances and gradually declines the total income of each individual.

Similarly the cycle rickshaw pullers of States like Bihar and Uttar Pradesh have monthly salary of around Rs.8000-10000 per month and their monthly expenses includes Rs. 2000-3000 for rent, Rs. 6000 for food (if they live with their family), Rs. 1000 for healthcare. So the total expense comes to Rs. 10,000 per month. The different bank charges imposed on them by different banks, for example: Punjab National Bank (PNB) which charges with the penalty of Rs.250 quarterly for not maintaining Rs. 2000 as minimum balance and this comes to Rs.1000 in a year, plus quarterly SMS alert charge of Rs. 15 and annual charges of Rs. 100 for debit card issuance by PNB. So in such a little or zero savings, just all these three charges will deduct at least Rs. 1160 from their accounts in a year and apart from these three compulsory charges, there are several other charges on transactions and for availing other services of banks.

Due to insufficient savings, these people cannot afford to keep minimum balance in their accounts. For this reason government has even encouraged them to open their accounts under Jan Dhan Yojana with zero balance. But later when people have opened accounts in large numbers to avoid maintaining minimum balance, subsequently banks have started converting them into regular saving accounts and ultimately started charging them in the name of different services and penalties.

Hence, these charges leave no money into their account and convert their balances into negative which immediately deducts money as penalty from their next month salary (whenever it credits into account). These charges are not only exhausting their savings but adversely putting them completely into the condition of financial distress.

Therefore, through the campaign of ‘No Bank Charges’, we demand that RBI and Banks must remove all the charges levied on savings accounts as these are hurting mostly the unorganized and economically weaker sections. They must not be punished for any fault or crime for which they aren’t responsible at all. They must not be charged for just having and keeping money into their banks accounts.

Please support the campaign and to demand the removal of bank charges from saving account holders, send email to your bank from www.fanindia.net.

For more details, visit: www.fanindia.net.

SIGN UP FOR COUNTERCURRENTS DAILY NEWS LETTER