A triumvirate of high oil prices, a surging dollar and geopolitical instability are set to weigh on India and Indonesia among Asia’s emerging markets, while energy exporter Malaysia may prove a rare beneficiary, said a report by Bloomberg.

The Bloomberg report — India, Indonesia Risk Biggest Fallout From Geopolitical Shocks – said:

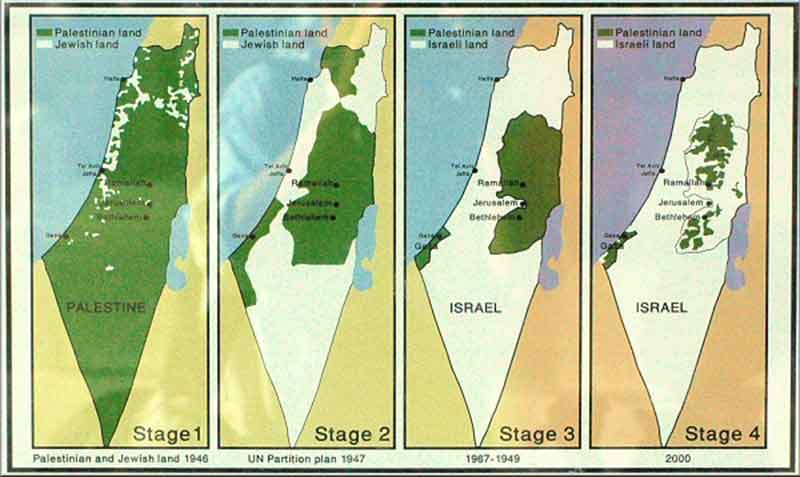

Economists are fretting over the fallout on developing Asia from a widening of the Israel-Hamas war, with policymakers struggling to assess the consequences for oil supply and the scope of the potential impact on growth. The jump in both the dollar and long-term Treasury yields exacerbate the risks for economies running high current-account deficits.

The report said:

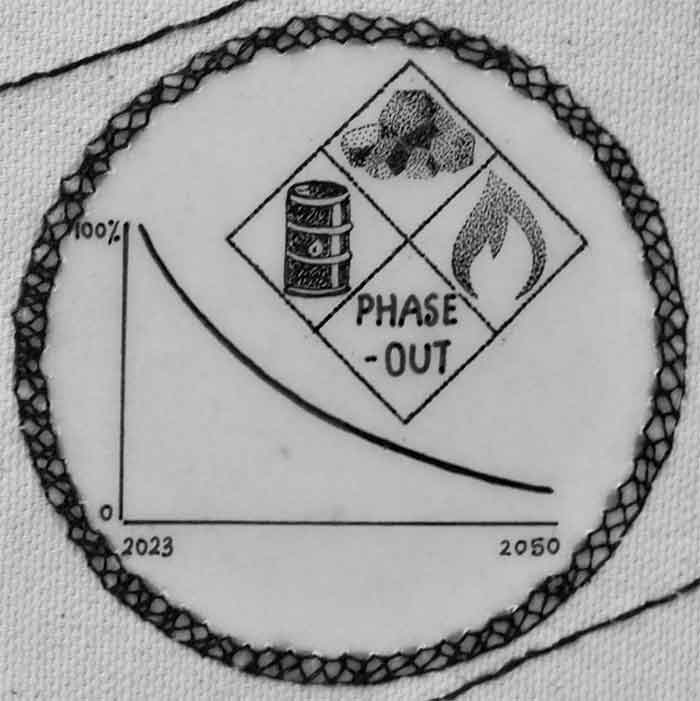

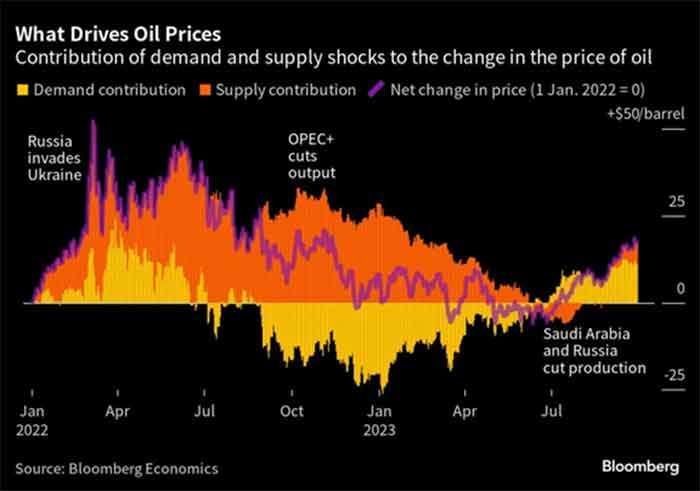

Brent crude prices have jumped almost 20% in the past three months and Bloomberg Economics estimates they could soar to $150 a barrel, from about $90 now, if the Middle East conflict widens to include Iran. The Islamic Republic supplies arms and cash to Hamas, which the US and European Union designate as a terrorist group, and backs the Hezbollah militia in Lebanon.

The Israel-Hamas conflict comes on top of Russia’s protracted war on Ukraine and simmering superpower tensions between the U.S. and China. The following charts show countries more exposed to a higher-for-longer dollar and oil price.

“If higher oil prices persist for a prolonged period, we see India, Thailand, the Philippines, Indonesia more vulnerable to terms of trade deterioration,” said Lavanya Venkateswaran, a senior economist at Oversea-Chinese Banking Corp. Ltd. “Moreover, as ‘twin deficit’ economies — current account and fiscal deficits — they may be more vulnerable to capital outflows.”

Alicia Garcia Herrero at French investment bank Natixis SA said high external debt positions mean Sri Lanka and Pakistan are most at risk. Indonesia and India are also vulnerable “since they tend to run current-account deficits and need external financing for that,” she said.

Compounding the problem, U.S. Treasury yields have soared on concerns that higher oil prices will revive inflation pressures. That is another headwind for nations running high budget deficits as they will likely struggle to raise funds in global markets, Garcia Herrero added.

The chart above shows emerging Asian bonds have become less attractive for investors — the premiums a borrower pays to own Indian or Indonesian bonds against U.S. debt, for example, have hit the lowest level since at least the 2008-09 global financial crisis.

Strategists at HSBC Holdings Plc say they prefer the Chinese renminbi and the Korean won among low-yielding Asian currencies. They highlight Beijing’s tight focus on fine-tuning fiscal policy and recent property market measures and the Bank of Korea’s consistent foreign exchange sales and the country’s potential inclusion in a global bond index next year.

“The other low-yielding currencies not only do not have these supportive factors, they also have certain individual shortcomings,” the HSBC strategists wrote, pointing to election uncertainty for the Taiwanese dollar, deteriorating fiscal metrics for the Thai Baht and overvaluation for the Singapore dollar.

“Among higher-yielding currencies, we have a slight preference for the Philippine peso and the Indian rupee over the Indonesia rupiah,” they said.

One country that stands to benefit from rising oil prices is Malaysia, in terms of both growth and the nation’s fiscal position, economists said.

“We see increased export duties, petroleum income taxes, and dividends from the state-owned Petronas to be adding to the fiscal revenue,” said Bum Ki Son, Singapore-based regional economist at Barclays Plc. “For Indonesia, we think the fiscal position is likely to deteriorate.”

Economists see some positives for India despite the higher dollar and elevated oil prices. Natixis’ Garcia Herrero pointed to strong macroeconomic data that makes the country’s assets attractive despite the headwinds.

“The fact that Indian data has been so strong — latest PMI was the best in Asia — does help India,” said Garcia Herrero.

Stocks Retreat Amid Gaza Risks As Oil Hovers Above $90

A Reuters report said:

Crude oil held above $90 a barrel, equities slid and the safe-haven dollar was firm on Monday amid heightened anxiety over escalating violence in Gaza and the prospect the conflict could spread beyond Israel and Hamas into the wider region.

Israel’s shekel sank to a more than eight-year low after the country’s prime minister, Benjamin Netanyahu, vowed to “demolish Hamas” in retaliation for the rampage on Oct. 7 that killed 1,300 people in the worst attack on civilians in Israel’s history.

The Reuters report said:

Brent crude futures reached a recent high of $91.20 on Monday before trading little changed just below $91, following Friday’s 5.7% surge.

Japan’s Nikkei share average fell as much as 2%, while Hong Kong’s Hang Seng slipped 0.43% and mainland blue chips dropped 0.69%.

Australia’s S&P/ASX 200 index lost 0.35%, New Zealand’s equity benchmark slid about 1%.

It added:

“The situation is dynamic and it is too early to say if the hedges placed on Friday are unwarranted, but there have been pockets of positive news flow,” Chris Weston, head of research at Pepperstone, wrote in a note, citing the resumption of water supplies as one example.

“Risk and energy markets will look for headlines and actions from Iranian officials who have stated they have a duty to come to the aid of the Palestinians.”

Currencies overall retraced some of their moves from the end of the week, with the U.S. dollar index easing slightly to 106.51 from as high as 106.79 on Friday.

The euro rose 0.14% to $1.05255 while the yen was little changed at 149.445 per dollar.

Israel’s shekel weakened to 3.9900 per dollar early in the day for the first time since April 2015, although it has since rebounded about 0.3% to 3.9650.

It said:

“Ultimately, gold and oil prices are the most sensitive expressions of the (Gaza) conflict’s risks,” Kyle Rodda, senior financial market analyst at Capital.com, wrote in a note.

However, “identifying the potential flashpoints and gaming-out scenarios is highly challenging,” Rodda said.

Oil Prices Flat As Investors Assess Risks Of Israel-Hamas War

Another Reuters report said:

Oil traded mostly flat on Monday after surging last week as investors wait to see if the Israel-Hamas conflict draws in other countries – a development that would potentially drive up prices further and deal a fresh blow to the global economy.

Brent futures were last flat at $90.89 per barrel at 0419 GMT. U.S. West Texas Intermediate (WTI) crude was down 2 cents to $87.67 a barrel.

Both benchmarks climbed nearly 6% on Friday, posting their highest daily percentage gains since April, as investors priced in the possibility of a wider Middle East conflict.

For the week, Brent advanced 7.5% while WTI climbed 5.9%.

“Investors are trying to figure out the impact of the conflict while a large-scale ground assault has not begun after the 24-hour deadline that Israel first notified residents of the northern half of Gaza to flee to the south,” said Hiroyuki Kikukawa, president of NS Trading, a unit of Nissan Securities.

“The impact that may involve oil-producing countries has been factored into the prices to some extent, but if an actual ground invasion were to occur and have an impact on oil supply, the prices could easily exceed $100 a barrel,” he said.

The conflict in the Middle East has had little impact on global oil and gas supplies, and Israel is not a big producer.

The report said the war between Islamist group Hamas and Israel poses one of the most significant geopolitical risks to oil markets since Russia-Ukraine war last year, amid concerns about any potential escalation involving Iran.

Market participants are assessing what a wider conflict might imply for supplies from countries in the world’s top oil producing region, including Saudi Arabia, Iran and the United Arab Emirates.

If Tehran is found to be directly involved in the Hamas attack, it would likely result in the U.S. fully enforcing its sanctions on Iran’s oil exports, Commonwealth Bank of Australia analyst Vivek Dhar said in a note on Monday.

“The U.S. has turned a blind eye on its sanctions on Iran’s oil exports this year as it looked to improve diplomatic ties with Iran,” he said.

“The 0.5-1 million barrels per day increase in Iran’s oil exports this year – equivalent to 0.5-1% of global oil supply – is at risk of being sidelined if U.S. sanctions are enforced in full.”

Israel’s Prime Minister Benjamin Netanyahu vowed on Sunday to “demolish Hamas” as his troops prepared to move into the Gaza Strip in pursuit of Hamas militants whose deadly rampage through Israeli border towns shocked the world.

Iran warned on Saturday that if Israel’s “war crimes and genocide” are not stopped then the situation could spiral out of control with “far-reaching consequences.”

The U.S. last week imposed the first sanctions on owners of tankers carrying Russian oil priced above the G7’s price cap of $60 a barrel, an effort to close loopholes in the mechanism designed to punish Moscow for its invasion of Ukraine.

Russia is one of the world’s top crude exporters, and the tighter U.S. scrutiny of its shipments could curtail supply.

Loss Of $1 Trillion in Global GDP – Economic Cost Of Iran-Israel Conflict, Estimates Bloomberg

The global economy would fall into recession with oil prices skyrocketing if Iran were to get involved in the Israel-Palestine conflict, Bloomberg reported this week.

According to Bloomberg Economics, analysts are viewing the impact on global growth and inflation under three potential scenarios: with hostilities largely confined to Israel and the Palestinian territories; with the conflict spreading to Lebanon and Syria; and with a direct confrontation between Israel and Iran.

While all the three scenarios are likely to cause a surge in oil prices, higher inflation and slower global economic growth, a full-blown war between Iran and Israel would cause the most damage, analysts say.

“The wider the conflict spreads, the more its impact becomes global rather than regional. Conflict in the Middle East can send tremors through the world because the region is a crucial supplier of energy and a key shipping passageway,” they wrote.

In that event, oil prices could spike to $150 a barrel. Global inflation would be likely to surge to 6.7% from the current IMF 2024 forecast of 5.8%. Global growth would be likely to shrink by 1% from the current projections for next year, to 1.7%. This would be the worst figure since 1982, and, in monetary terms, would cost the global economy roughly $1 trillion.

“The spare production capacity in Saudi Arabia and the UAE may not save the day if Iran decides to close the Strait of Hormuz, through which one-fifth of the world’s daily oil supplies pass. There would also be a more extreme risk-off shift in financial markets,” analysts warn.

The effects would be felt quickly, analysts claim, because many countries are still battling inflation caused by the West’s Ukraine-related sanctions on Russia, which have reoriented global trade, including oil and gas flows. They warn that another war in an energy-producing region could push the global economy into a recession.

Bloomberg notes that a direct conflict between Iran and Israel is still “a low probability scenario.”

This month’s hostilities between Palestinian militant group Hamas and the Israel Defense Forces has already caused a surge in global oil prices. International benchmark Brent crude futures for December delivery closed at $90.8 per barrel on Friday, up from roughly $84 per barrel a week before.